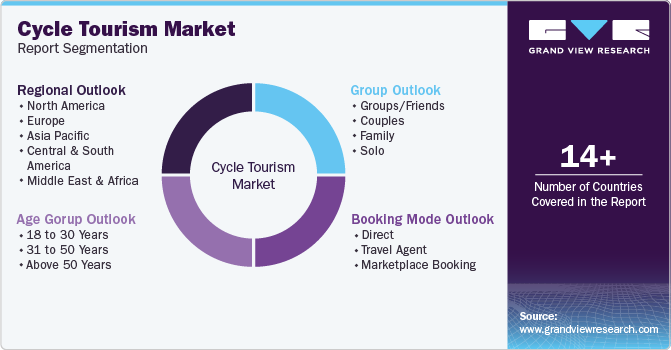

Cycle Tourism Market Size, Share & Trends Analysis Report By Group (Groups/Friends, Couples, Family, Solo), By Booking Mode (Direct, Travel Agent, Marketplace Booking), By Age Group, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-025-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Cycle Tourism Market Size & Trends

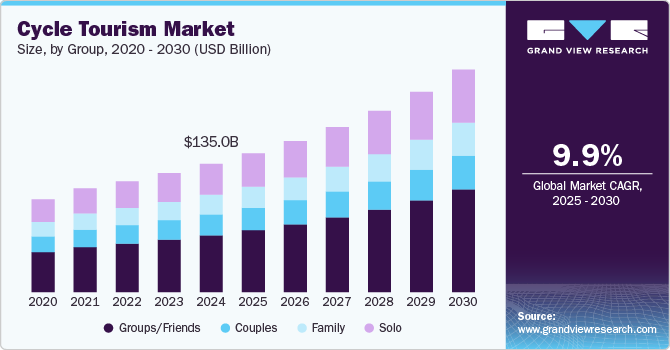

The global cycle tourism market size was valued at USD 135.04 billion in 2024 and is projected to grow at a CAGR of 9.9% from 2025 to 2030. As travelers increasingly seek sustainable and immersive travel experiences, the demand for cycle tourism is increasing. With growing awareness of environmental issues and a shift toward eco-friendly tourism, cycling offers a low-carbon way to explore destinations without the environmental impact associated with traditional vehicles. Many travelers are prioritizing modes of transport that align with their commitment to sustainability, and cycle tourism presents an ideal option. By reducing dependency on cars and public transport, cycle tourism supports local environments and minimizes pollution, making it a favored choice among environmentally conscious tourists.

Health and wellness trends further fuel the popularity of cycle tourism. People are more focused on maintaining active lifestyles and choosing travel experiences that integrate physical activity. Cycling is not only a low-impact form of exercise suitable for a broad range of fitness levels but also offers a more intimate experience with nature, as tourists can cover large areas while remaining connected to their surroundings. Whether exploring city landscapes or rural trails, cycle tourism allows travelers to enjoy physical exercise while immersing themselves in their destinations.

Moreover, the infrastructure supporting cycle tourism has significantly improved worldwide. Many destinations now have dedicated cycling trails, bike-sharing programs, and rental services that make cycling more accessible and enjoyable for tourists. Governments and tourism boards are investing in cyclist-friendly paths, especially in areas with natural or cultural significance, to attract tourists seeking an active way to explore. These enhancements make cycle tourism safer, easier, and more appealing, encouraging travelers to choose cycling as a core part of their travel plans.

Additionally, the increased demand for authentic and slow travel experiences also contributes to the growth of cycle tourism. Cycling allows tourists to explore places at their own pace, interact with locals, and discover hidden gems off the typical tourist paths. This sense of exploration and freedom resonates with travelers looking for more meaningful connections with their destinations. As a result, cycle tourism is flourishing as a global trend that satisfies the desire for sustainable, health-oriented, and deeply engaging travel experiences.

Group Insights

The group/friends segment captured around 44.13% market share in 2024. Cycling as a group allows travelers to explore destinations in a fun, social setting, enhancing camaraderie and creating shared memories. Group cycling also provides a sense of safety and support, as members can encourage and motivate one another throughout the journey, especially on challenging routes. Furthermore, the rise of social media has popularized group adventure trips, inspiring people to organize cycling tours with friends as a way to bond and document their experiences together. This trend is also supported by tour operators who offer tailored group packages, accommodating diverse group sizes and skill levels, which further drives interest in group-based cycle tourism.

The solo segment is expected to grow at a CAGR of 9.6% from 2024 to 2030. Cycling solo allows tourists to set their own pace, explore destinations based on personal interests, and enjoy a deeper, more reflective travel experience. Many solo travelers are drawn to the freedom of navigating their paths, away from the pressures of group schedules, allowing them to connect more authentically with the environment and local culture. Additionally, the rise of digital connectivity and mobile technology has made solo travel safer and more accessible, as cyclists can rely on GPS navigation, mobile booking options, and online communities for support.

Booking Mode Insights

Direct booking mode accounted for a share of around 62% in 2024. By booking directly with tour providers, accommodation, and equipment rental services, cyclists can tailor their itineraries to better suit their personal preferences, choosing specific routes, accommodations, and experiences that fit their skill levels and interests. Direct booking often allows travelers to communicate directly with service providers, gaining insights, recommendations, and even exclusive offers that are not available through third-party platforms. Additionally, the convenience of online direct booking systems, combined with the rising trend of personalized and independent travel, makes it easier for cycle tourists to arrange seamless, flexible plans.

The marketplace booking segment is expected to grow at a CAGR of 10.7% from 2025 to 2030. Marketplace booking platforms aggregate various cycling tours, accommodations, and services, allowing tourists to browse and compare options all in one place. This setup streamlines the booking process, saving time for travelers who can review itineraries, pricing, and customer reviews to make informed decisions. Additionally, many marketplace platforms offer secure payment methods, customer support, and flexible cancellation policies, giving travelers peace of mind when booking.

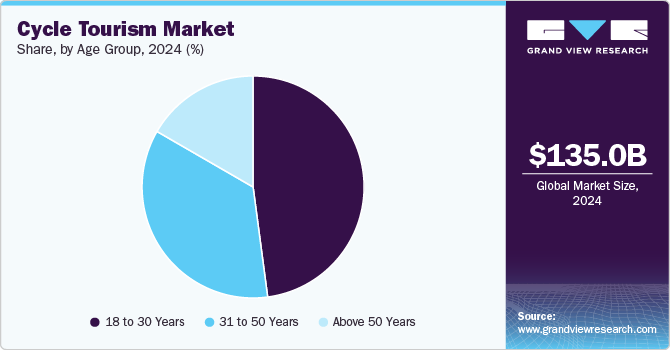

Age group Insights

The 31 to 50 age group segment accounted for a share of around 47.90% in 2024. People in this age group are often at a life stage where they seek active leisure options that align with their fitness goals, and cycling offers both physical exercise and adventure. Many in this age range have the financial stability to invest in travel. They are inclined toward experiential tourism, which allows them to explore new destinations in a fulfilling and active way. Additionally, cycling offers a sustainable and eco-friendly form of travel, which resonates well with the values of this age group.

The demand for cycle tourism among the 18 to 30 years age group is expected to grow at a CAGR of 10.6% from 2025 to 2030. This age group values experiential travel that offers authenticity and a chance to connect with nature, and cycling provides an ideal way to achieve both. Additionally, many young travelers are driven by environmental awareness, preferring eco-friendly travel options like cycling to minimize their carbon footprint. The flexibility and affordability of cycling trips appeal to younger tourists, who often prioritize budget-conscious travel while desiring unique, memorable experiences. Social media also plays a role, as sharing cycling adventures through platforms like Instagram and TikTok has popularized cycle tourism among young people looking to combine exploration with social engagement.

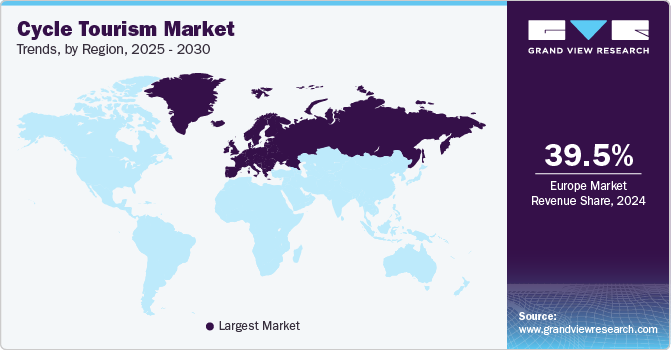

Regional Insights

North America cycle tourism market accounted for a market share of 27.53% in 2024 in the global market. North America’s diverse geography, from scenic coastlines and mountain trails to national parks and rural landscapes, offers cyclists a variety of unique and visually stunning routes. Many cities and regions have invested in improved cycling infrastructure, creating bike lanes, trails, and safety measures that make cycling more accessible and enjoyable for tourists. Additionally, there is a rising trend of environmental awareness and wellness-focused travel, which cycling fulfills by providing an eco-friendly way to explore while supporting active lifestyles. North American destinations also appeal to both novice and seasoned cyclists, with tour operators offering customized packages and rentals that accommodate all skill levels, enhancing the continent’s attractiveness as a cycle tourism destination.

U.S. Cycle Tourism Market Trends

The U.S. cycle tourism market held a share of 77.67% in 2024. The U.S. offers a wide variety of scenic cycling routes, from coastal highways and national park trails to historic countryside paths, appealing to both recreational and adventure cyclists. Many cities and states are investing in cycling infrastructure, such as dedicated bike lanes and safe trails, which enhances the appeal of cycling for tourists. Additionally, the growth of bike-sharing programs and easily accessible rental services makes it convenient for tourists to incorporate cycling into their travel plans, driving the popularity of cycle tourism across the U.S.

Europe Cycle Tourism Market Trends

The Europe cycle tourism market accounted for a share of around 39.47% in 2024. Europe boasts extensive cycling infrastructure, including dedicated bike lanes, scenic routes, and well-marked trails across cities and countryside, making it a highly accessible and attractive destination for cycle tourists. Many European regions promote sustainable tourism, encouraging travelers to choose low-impact travel options, and cycling aligns perfectly with this focus on environmental responsibility. Additionally, Europe’s rich history, diverse landscapes, and charming towns make cycling an ideal way to experience the continent at a leisurely pace, allowing tourists to connect with local cultures in an authentic, interactive way.

The UK cycle tourism market accounted for a significant share of the European market in 2024. The UK offers an expanding network of cycling routes, including popular paths like the National Cycle Network and scenic trails through the countryside, making it easier for cyclists to access and enjoy diverse terrains. Additionally, many travelers are drawn to the UK’s unique cycling experiences, such as coastal rides, countryside trails, and routes that pass through cultural landmarks. With growing environmental awareness, more tourists are choosing cycling as an eco-friendly alternative to driving while also benefiting from the health and wellness aspects of this form of travel. Supportive infrastructure, including bike rental stations, cycling-friendly accommodations, and local tour operators, further enhances the cycle tourism experience, making the UK an increasingly attractive destination for cyclists of all levels.

Asia Pacific Cycle Tourism Market Trends:

The cycle tourism market in Asia Pacific is expected to grow at a CAGR of 10.9% from 2025 to 2030. Many Asia Pacific countries, including Japan, Thailand, and New Zealand, offer dedicated cycling routes that showcase historic sites, natural wonders, and vibrant local communities, making it possible for tourists to experience these destinations in an engaging, active way. The region’s strong emphasis on sustainability has further fueled interest in cycling as an eco-friendly travel option. Additionally, governments and tourism boards in the region have made efforts to promote cycle tourism by improving infrastructure, creating safe cycling trails, and offering rental and guided tour services that cater to all experience levels.

Japan cycle tourism market accounted for a significant share regionally in 2024. Japan’s cycling paths, such as the popular Shimanami Kaido and picturesque routes in Hokkaido, provide unique access to coastal views, mountainous landscapes, and traditional villages, allowing tourists to explore Japan’s natural beauty and local culture in an immersive way. The Japanese government has also invested in cyclist-friendly amenities, including designated bike lanes, rental services, and signage, making cycling safe and accessible for both locals and international visitors. Furthermore, cycle tourism aligns with Japan’s emphasis on sustainable tourism, appealing to environmentally conscious travelers who prefer low-impact travel options.

Key Cycle Tourism Company Insights

Some of the major companies operating in the global market are SpiceRoads Cycling, World Expeditions, Travel + Leisure Holdco, LLC, Exodus Travels Limited., Intrepid Travel, G Adventures, Himalayan Glacier Adventure and Travel Company, Sarracini Travel, Arbutus Routes, and Austin Adventures. These key companies are focusing on taking major initiatives to strengthen their market position and offer authentic and immersive travel experiences to travelers across the world.

Key Cycle Tourism Companies:

The following are the leading companies in the cycle tourism market. These companies collectively hold the largest market share and dictate industry trends.

- SpiceRoads Cycling

- World Expeditions

- Travel + Leisure Holdco, LLC

- Exodus Travels Limited.

- Intrepid Travel

- G Adventures

- Himalayan Glacier Adventure and Travel Company

- Sarracini Travel

- Arbutus Routes

- Austin Adventures

View a comprehensive list of companies in the Cycle Tourism Market

Recent Developments

-

In September 2021, Cycling UK announced the launch of the West Kernow Way, a new 150-mile cycling route in Cornwall designed as an off-road loop starting from Penzance. Created to showcase Cornwall's landscapes and cultural heritage, the route uses quiet roads, bridleways, and trails and is estimated to take three to four days to complete. As part of an initiative to promote off-season tourism, Cycling UK has worked with local authorities to ensure long-term access to certain paths.

Cycle Tourism Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 146.19 billion |

|

Revenue forecast in 2030 |

USD 234.30 billion |

|

Growth rate (Revenue) |

CAGR of 9.9% from 2025 to 2030 |

|

Actuals |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Group, booking mode, age group, region. |

|

Regional Scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; South Africa; Saudi Arabia; Brazil; Argentina |

|

Key companies profiled |

SpiceRoads Cycling; World Expeditions; Travel + Leisure Holdco, LLC; Exodus Travels Limited.; Intrepid Travel; G Adventures; Himalayan Glacier Adventure and Travel Company; Sarracini Travel; Arbutus Routes; Austin Adventures |

|

Customization |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cycle Tourism Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cycle tourism market report on the basis of group, booking mode, age group, and region.

-

Group Outlook (Revenue, USD Billion, 2018 - 2030)

-

Groups/Friends

-

Couples

-

Family

-

Solo

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct

-

Travel Agent

-

Marketplace Booking

-

-

Age Group Outlook (Revenue, USD Billion, 2018 - 2030)

-

18 to 30 Years

-

31 to 50 Years

-

Above 50 Years

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global cycle tourism market was estimated at USD 135.04 billion in 2024 and is expected to reach USD 146.19 billion in 2025.

b. The cycle tourism market is expected to grow at a compound annual growth rate of 9.9% from 2025 to 2030 to reach USD 234.30 billion by 2030.

b. Europe dominated the cycle tourism market with a share of 39.47% in 2024. This is owing to increased demand for cycle tourism as a form of physical activity, the rise in bicycle lanes, car-free city centers, and greater bike storage facilities.

b. Some of the key players operating in the cycle tourism market include SpiceRoads Cycling; World Expeditions; Travel + Leisure Holdco, LLC; Exodus Travels Limited.; Intrepid Travel; G Adventures; Himalayan Glacier Adventure and Travel Company; Sarracini Travel; Arbutus Routes; and Austin Adventures.

b. Key factors that are driving the cycle tourism market growth include a significant rise in the number of cycling participants traveling a long distance, increasing penetration of adventure camping and adventure sports among millennials, and government initiatives to develop domestic and international tourism across the economies, growing awareness of environmental issues and a shift toward eco-friendly tourism.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."