- Home

- »

- Network Security

- »

-

Cyber Warfare Market Size, Share And Growth Report, 2030GVR Report cover

![Cyber Warfare Market Size, Share & Trends Report]()

Cyber Warfare Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Defense, Government, Aerospace, Homeland, Corporate), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-307-2

- Number of Report Pages: 99

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

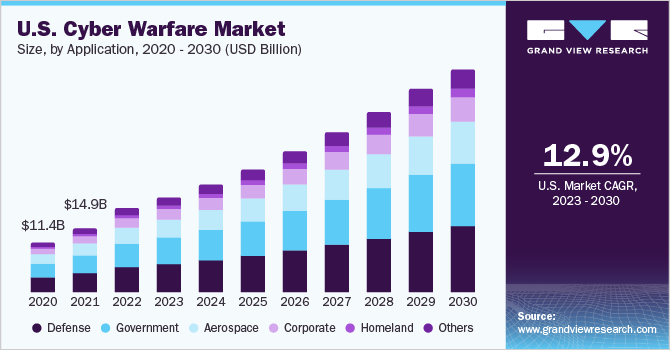

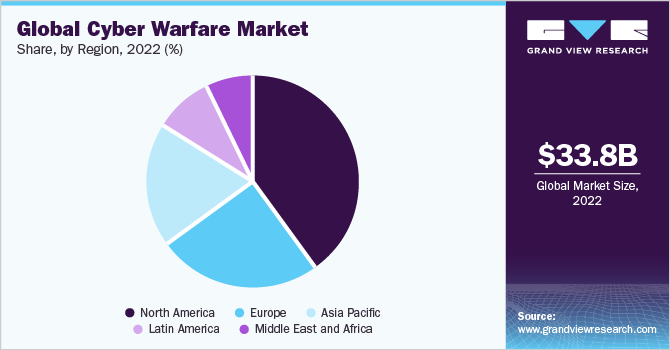

The global cyber warfare market size was valued at USD 33.81 billion in 2022 and projected to grow at a compound annual growth rate (CAGR) of 14.9% from 2023 to 2030. Recently, government and international organizations have become focused on cybersecurity owing to increased security challenges posed by or within cyberspace. It has raised several concerns about national security, thus alarming the need for a robust cybersecurity posture. Thus, the government, military, and other agencies are protecting their digital infrastructure and devices connected to the internet to deter cyber-attacks.

An increase in defense spending for improving the government’s effectiveness, efficiency, and cybersecurity capability is anticipated to be the key factor driving the implementation of cyber warfare systems across all geographic regions. The agenda such as modernizing government IT infrastructure, improving deteriorated facilities, and curbing cyber vulnerabilities, are further anticipated to drive the market over the forecast period.

The growing technological advancement in IT and the capabilities of cyber weapons leading to disruption to national security are constantly reshaping the threat landscape. Thus, cyber-related threats are identified as one of the highest occurring global risks. Moreover, cyber warfare is emerged as a significant threat to the nation, outstripping terrorism. The mitigation of losses arising from increasing cyber-attacks on countries, leading to economic disruption, has become a significant concern.

As emerging nations soar towards digitization, cyber warfare emerges as a major growth constraint. Different nations have increased their spending on cybersecurity and established units to overcome cybersecurity challenges to deter cyber espionage and data breaches in the military and defense sectors. Thus, increasing demand for cybersecurity is anticipated to drive the market over the forecast period.

Over the past few years, various industries have witnessed a steady increase in the number of security breaches related to cyber espionage. The sophistication of cyber-attacks has increased the resulting national or state hackers to abuse network security and gain privileged access to sensitive data. For instance, in June 2023, a global cyberattack was carried out by Russian cybercriminals, targeting multiple U.S. federal government agencies. As reported by one of the U.S. cybersecurity agencies, the attack exploited a vulnerability found in agencies' widely used software named MOVEit applications. Additionally, it is anticipated that this widespread hacking incident may have impacted numerous companies and organizations within the U.S.

The U.S. Federal Government has taken several initiatives against cyber-attacks and constantly demonstrates its cyber warfare capabilities to help deter sophisticated attacks from potential adversaries. The government is building its cyber army and proposed 133 teams for its "cyber mission force" by 2018 - 2027. Moreover, it engages in proactive training and development for military personnel in the U.S. Army Cyber Center of Excellence (CCoE), the U.S. Army's force modernization proponent for cyberspace operations, signal/communications networks, and information services. Increased defense budget to safeguard cyberspace, protect Federal networks, and critical infrastructure from cyber-attacks is further anticipated to propel the market growth over the forecast period.

Application Insights

The defense segment held the largest revenue share of 30.0% in 2022. Dependency on communication & information technology in the military & defense has led to exposure to cyber risks. The defense sector is allocating increased funding to cybersecurity units to mitigate & deter the potential threat from national and state hackers. The emergence of new technologies & Internet of Things (IoT) in defense is anticipated to be the driving factor for applying the cyber warfare system in the defense sector. Furthermore, developing the existing cybersecurity posture and technologies is expected to fuel the application of cyber warfare systems in the defense sector.

The government has taken significant steps to curb cyber vulnerabilities recently. The government application segment was valued at USD 15.9 billion in 2022, growing at a CAGR of 15.4% over the forecast period. A significant increase in the sophistication and intensity of cyber-attacks has recently led developed countries to build resilience and adopt national cybersecurity strategies.

The corporate segment is expected to grow at the fastest CAGR of 16.1% during the forecast period. This sector is a prime target for cyber-attacks due to potential financial gain, intellectual property theft, and disruption of business operations. As a result, corporations are actively seeking comprehensive cyber warfare solutions to defend against a wide range of threats, including malware, ransomware, phishing attacks, and advanced persistent threats.

Regional Insights

The North American region in the cyber warfare market accounted for the largest revenue share of 40.5% in 2022 and is expected to continue its dominance by 2030. Increasing cyber defense budget, government efforts to protect its digital infrastructure, and focus on strengthening cybersecurity approaches are the key driving factor impacting the regional demand. Moreover, establishing cybersecurity units and deploying robust cybersecurity frameworks within government agencies, the military, and the defense sector further drives the market growth.

Asia Pacific is estimated to grow at the fastest growth rate of 17.4% from 2023 to 2030. The Asia Pacific offers potential growth opportunities for cyber warfare applications mainly due to key factors such as government regulatory reforms to ensure cyber defense posture, rapid economic growth in developing countries, and the increasing pace of technological advancements in cyberspace. Moreover, increasing cyber-attacks have emerged as a vital factor considered for the defense budget allocation by various nations’ governments, thereby driving the market over the forecast period.

Key Companies & Market Share Insights

The industry players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in April 2023, Thales, a French IT company, collaborated with 11 French organizations and companies specializing in cybersecurity to introduce a cyber intelligence and threat detection platform. The objective was to establish a unified platform offering cyber threat intelligence services to companies and government entities. Some of the major participants in the global cyber warfare market:

-

AIRBUS

-

BAE Systems

-

Booz Allen Hamilton Inc.

-

DXC Technology Company

-

General Dynamics Corporation

-

Intel Corporation

-

IBM Corporation

-

Leonardo S.p.A.

-

Lockheed Martin Corporation.

-

Northrop Grumman

-

Raytheon Technologies Corporation

-

L3Harris Technologies, Inc.

Recent Developments

-

In May 2023, Mosaic, an agricultural company, collaborated with U.S.-based Safe Security, a cybersecurity platform provider, to introduce a new form of cyber coverage. This collaboration involves integrating real-time cyber-risk data into Mosaic's underwriting process. By utilizing Safe Security's acclaimed cyber-risk platform, Mosaic's primary product thoroughly assesses organizations' cybersecurity from within while offering incentives in the form of premium-rate rewards for investing in security solutions.

-

In August 2022, SynSaber, an asset monitoring and cybersecurity company, secured a Series A funding round of USD 13 million. This investment fueled the ongoing advancement of SynSaber's industrial asset and network monitoring solution, supported the expansion of the company's global presence, drove growth in sales, marketing, and development activities, and enhanced customer momentum and industry research efforts.

-

In February 2022, IBM invested multi-million dollars in its resources across the Asia Pacific region. As a part of this investment, the company opened its new Security Operations Center (SOC), a cybersecurity hub, to create cyber resiliency for organizations.

-

In July 2021, Leonardo, an aerospace company, partnered with Italy-based utility company A2A to test its advanced technologies by integrating them into A2A plants and networks. Leonardo’s cyber security research center develops these cutting-edge technologies. This agreement also aims to enhance the security of digital transformation processes and generate new products tailored to safeguard energy infrastructures against cyber threats.

Cyber Warfare Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 67.26 billion

Revenue forecast in 2030

USD 177.41 billion

Growth rate

CAGR of 14.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

AIRBUS; BAE Systems; Booz Allen Hamilton Inc.; DXC Technology Company; General Dynamics Corporation; Intel Corporation; IBM Corporation; Leonardo S.p.A.; Lockheed Martin Corporation. Northrop Grumman; Raytheon Technologies Corporation; L3Harris Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cyber Warfare Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global cyber warfare market on the basis of application and region:

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Defense

-

Government

-

Aerospace

-

Homeland

-

Corporate

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global cyber warfare market size was estimated at USD 33.81 billion in 2022 and is expected to reach USD 67.26 billion in 2023.

b. The global cyber warfare market is expected to grow at a compound annual growth rate of 14.9% from 2023 to 2030 to reach USD 177.41 billion by 2030.

b. North America dominated the cyber warfare market with a share of 40.5% in 2022. This is attributable to increasing cyber defense budget, government efforts to protect its digital infrastructure and focus on strengthening cybersecurity approaches.

b. Some key players operating in the cyber warfare market include BAE System Plc, Boeing, General Dynamic Corporation, Lockheed Martin Corporation, and Raytheon Company.

b. Key factors that are driving the market growth include modernizing government IT infrastructure, the indulgence of government, military, and other agencies, and increased investment by the government to protect its digital infrastructure and devices connected to the internet.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.