Cyber Security Training Market Size, Share & Trends Analysis Report By Type, By Delivery Method, By Training Content, By Certification, By Target Audience, By Industry, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-222-5

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Cyber Security Training Market Size & Trends

The global cyber security training market size was estimated at USD 4.53 billion in 2023 and is anticipated to grow at a CAGR of 17.4% from 2024 to 2030. Due to the significant use of unsecured networks, human factors, and technology gaps, a series of cyber security challenges are surfacing in the market, including cyber infrastructure damage, data theft, device compromise, and security breaches that pose serious threats to organizational security, national security, and economic stability; thus, leading towards great concerns in the global society. Cybersecurity training is becoming a greater tool among organizations, it helps build greater security capabilities among individuals for protecting and responding to cybersecurity incidents.

Cybersecurity training helps managers, IT professionals, and cybersecurity stakeholders identify potential cybersecurity threats such as ransomware, phishing scams, malware, and social engineering attacks. With the help of cyber security training, employees can detect potential vulnerabilities, suspicious emails, hacking links, and attachments. The significance of cyber security training is rapidly growing among small businesses owing to the limited availability of high-tech security tools and technologies. Thus, cyber security training reduces the likelihood of employees falling victim to cyber-attacks, and it also prevents employees from sharing sensitive information with unauthorized parties and accidentally downloading malware files.

Safeguarding data breaches is a costly and time-consuming process. The costs associated with data breaches include reputation damage, legal fees, and lost revenue. For instance, according to IBM Data Breach Report 2023, the average cost of a data breach in the U.S. was USD 9.48 million; in Germany, it was 4.67 million; in India, it was 2.18 million; in the Middle East, it was 8.07 million; and in Latin America, it was 3.69 million. Furthermore, based on industries, the average cost of a data breach was highest in healthcare, i.e., USD 10.93 million; in financial, it was 5.90 million; and in technology, it was USD 4.66 million. Cyber security training is the process of educating and providing real-time simulation training to employees and IT staff, helping them effectively identify, analyze, and report potential security risks. Thus, it can help prevent data breaches, reduce costs associated with such incidents, and minimize potential losses.

The demand for skilled cybersecurity professionals is rapidly growing among organizations. Based on the estimate, there will be more than 3.5 million unfilled positions in the cybersecurity industry. Organizations are looking for cyber security employees with a greater understanding of cloud computing security, AI and ML, and Zero Trust security implementation in the organization. Furthermore, cyber security certifications are gaining higher popularity among fresh graduates and mid-level employees with limited knowledge in the field of cyber security. Also, students and professionals are looking for short-term cyber security certification courses compared to long-term degrees, as they offer greater project knowledge, require limited fees, and time, and provide greater job opportunities.

The current environment is crucial for cyber security professionals owing to factors such as the fast-paced development of AI technology, significant shift towards digital technologies, higher skill gap among professionals, and rapid growth in security breaches and cyber-attacks across industries. Organizations are continuously in search of talented and skilled workforce who can demonstrate effective results within stipulated time and resources.These factors would create lucrative growth opportunity for the market during the forecast period.

Key companies in the market are introducing intermediate, professional, and high-end cyber security training courses to support the market demand for trained and skilled security professionals. For instance, in May 2023, Google LLC. announced a new certification program for entry-level cybersecurity professionals. The Google Cybersecurity Certification program was designed to help individuals and students with no prior experience and graduation degrees in a similar field get their first job in the cybersecurity field. These factors would further drive the cyber security training market during the forecast period.

Market Concentration & Characteristics

The technology environment in the cyber security market is rapidly evolving, criminals are exploring highly sophisticated techniques and methods to breach an organization’s security environment. Thus, businesses are continuously investing in training and skill-building activities for their employees to make them ready for future challenges. For instance, in February 2024, BlackBerry, a technology and security solution company, and the SANS Institute, a globally recognized cybersecurity training and curriculum provider, announced a strategic collaboration to provide advanced technology and cyber security courses to upskill and train cyber security workforce in Malaysia along with Indo-Pacific region.

There is a significant surge in demand for cloud security certificates, AI and ML cyber security certificates, ethical hacking certificates, network security certificates, incident response certificates, and risk management, among other cyber security certification and training courses. Thus, market companies are introducing advanced cyber security courses for professionals. For instance, in May 2023, ThriveDX, a cyber security technology company, announced the launch of the ThriveDX Awareness Administration Certificate Program consists of interactive online training constructed to give participants a mix of both practical knowledge and hands-on experience.

Regulatory frameworks such as the EU Cybersecurity Act (EUCA) and the Cybersecurity Maturity Model Certification (CMMC) in the US establish clear standards for cybersecurity practices and certifications. This creates a common ground for market companies and increases trust in certification programs.

In cyber security training, the threat of substitutes can be termed as moderate, as online tutorials and self-learning courses offer alternative avenues for learning. These substitutes provide convenience and flexibility and pose a challenge to traditional classroom-based training models. However, key companies in the market are launching advanced courses based on emerging cybersecurity threats and compliance requirements to meet the evolving needs of learners and industry standards.

Cyber security training is playing a crucial role, as it is becoming the first line of defense against potential cyber-attacks. Cyber security training covers essential areas like phishing scams, strong passwords, device security, and safe online habits. With regular engaging sessions reinforced with simulation training and clear reporting mechanisms, organizations can build a robust culture of security awareness, minimize risks, and protect valuable data.

Furthermore, cyber security training and certification programs are providing greater opportunities to individuals and professionals looking for cyber security jobs. These programs provide practical, hands-on experience through simulation training, engaging discussions, and regular assessments. As a result, the cybersecurity training market is expected to surge considerably in the coming future.

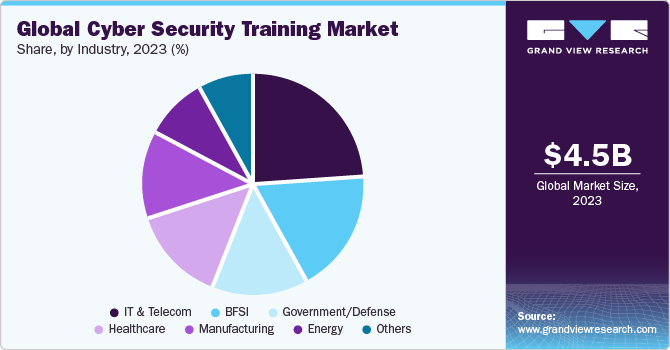

Industry Insights

The IT & telecom segment accounted for the largest market share of over 24% in 2023. The demand for cybersecurity training programs within the IT & telecom sectors is experiencing a significant surge owing to rapid digitization and growing reliance on interconnected networks. IT & telecom companies have been facing heightened cybersecurity threats, from data breaches to ransomware attacks, making robust cybersecurity measures a top priority within the industry. Thus, the demand for cyber security training courses is growing among IT & telecom professionals seeking to continuously update their skills and knowledge to effectively mitigate these threats and safeguard sensitive information in their organizations.

The hospitality segment is anticipated to grow at a CAGR of 19.6% during the forecast period. Healthcare organizations are becoming prime targets for cyberattacks due to the vast amount of valuable personal and medical information. As a result, there's a heightened awareness among healthcare professionals about the importance of cybersecurity measures to protect patient privacy, ensure regulatory compliance, and maintain the integrity of healthcare systems and infrastructure. Consequently, there is a growing demand for specialized cybersecurity training programs tailored to the unique challenges and regulatory requirements of the healthcare sector.

Type Insights

The online training segment accounted for the largest market share of over 47% in 2023. The rapid increase in cyber-attacks and security breaches has intensified the need for advanced training and certification programs among professionals that offer practical knowledge, simulation training, and hands-on experience in security incidents. Additionally, the global shortage of cybersecurity talent is also creating a positive outlook for the market, as it offers a flexible and cost-effective way to upskill and fill the gaps in cybersecurity expertise.

The boot camps segment is anticipated to grow at a CAGR of 16.7% during the forecast period. Cybersecurity boot camp programs offer intensive and immersive learning experiences. These programs typically feature accelerated curriculums that cover a wide range of cybersecurity topics, including threat detection, incident response, ethical hacking, secure coding, and compliance frameworks. Participants engage in hands-on exercises, simulations, and real-world scenarios facilitated by industry experts. It helps individuals and organizations in enhancing their cyber security skills and knowledge in a short period.

Delivery Method Insights

The self-paced Training segment accounted for the largest market share of over 45% in 2023. Self-paced training has emerged as a significant trend in the cybersecurity training market, catering to the diverse needs and schedules of learners. These programs offer flexible learning modules covering a wide range of cybersecurity topics, including but not limited to threat analysis, network security, encryption techniques, and risk management. Learners can progress through the material at their own speed, accessing resources such as video tutorials, interactive exercises, and online forums for support and clarification.

The blended training segment is anticipated to grow at a CAGR of 18.3% during the forecast period. Blended training typically involves self-paced modules to cover foundational knowledge and hands-on exercises, followed by instructor-led sessions for deeper dives, interactive discussions, and real-time Q&A. This combination allows professionals to grasp concepts at their own pace while benefiting from peer collaboration and expert guidance. Additionally, simulation training and hands-on lab experience offered within these programs help individuals gain practical knowledge of learned skills, boost knowledge retention, and prepare them for real-world scenarios.

Training Content Insights

The foundational cybersecurity segment accounted for the largest market share of over 24% in 2023. Foundational cybersecurity training programs are witnessing a surge in demand among young professionals and fresh graduates, fueling significant growth in the cybersecurity training market. This trend is driven by several factors, including increased awareness of cyber threats, the growing integration of technology across industries, and the rising inclination of students towards cybersecurity modules to equip themselves for a competitive and expanding job market.

The emerging technologies training segment is anticipated to grow at a CAGR of 19.4% during the forecast period. Emerging technologies training programs are witnessing a surge in demand among both industry professionals and recent graduates. With rapid advancements in areas such as artificial intelligence (AI), blockchain, cloud computing, and the Internet of Things (IoT), the need to acquire specialized skills to remain competitive in the cyber security job market is rapidly growing among individuals. Thus, professionals across various industries recognize the importance of these emerging technologies, and therefore, the need for emerging technologies training courses is growing significantly.

Certifications Insights

The industry standard certifications segment accounted for the largest revenue share of over 57% in 2023. Industry-standard certification training programs are experiencing a significant surge in demand among professionals seeking to validate their expertise and advance their careers in various fields. Certifications such as CompTIA Security+, Certified Information Systems Security Professional (CISSP), Project Management Professional (PMP), and Cisco Certified Network Associate (CCNA) are regarded highly by employers across the world as a benchmark of proficiency and competency.

The vendor-specific certifications segment is anticipated to grow at a CAGR of 18.0% during the forecast period. Vendor-specific certification programs are experiencing a notable surge in demand among professionals seeking to validate their expertise and enhance their career prospects in specific technology domains. Recognized industry leaders such as Fortinet and Google LLC offer a range of certifications tailored to their respective products and services, covering areas like networking, cloud computing, cybersecurity, and data analytics. These certifications provide a structured learning path and assessment mechanism, equipping individuals with the knowledge and skills needed to effectively deploy, manage, and optimize vendor-specific technologies within organizations.

Target Audience Insights

The enterprises segment accounted for the largest market share of over 54% in 2023. The demand for cybersecurity training programs among organizations is at an all-time high, driven by the escalating frequency and sophistication of cyber threats targeting businesses worldwide. Organizations across industries recognize the critical importance of cybersecurity in safeguarding sensitive data, protecting intellectual property, and maintaining operational resilience.

The individuals segment is anticipated to grow at a CAGR of 16.5% during the forecast period. The demand for cybersecurity training programs among individuals is experiencing a remarkable surge in the market, driven by heightened awareness of cyber threats, higher job opportunities, andhigh-paying job opportunities in the cybersecurity market. Individuals from diverse backgrounds, including IT professionals, students, and entrepreneurs, are increasingly seeking cybersecurity training to enhance their knowledge and skills in safeguarding digital assets, organizational networks, and endpoints.

Regional Insights

North America held the major market revenue share of over 35% in 2023. The escalating cyber threat landscape, with its increasingly sophisticated attacks, drives demand for skilled professionals in the North America cyber security job market. Thus, organizations recognize the need for talent and a skilled workforce in the cybersecurity field, and therefore, businesses are readily investing in training their workforce.

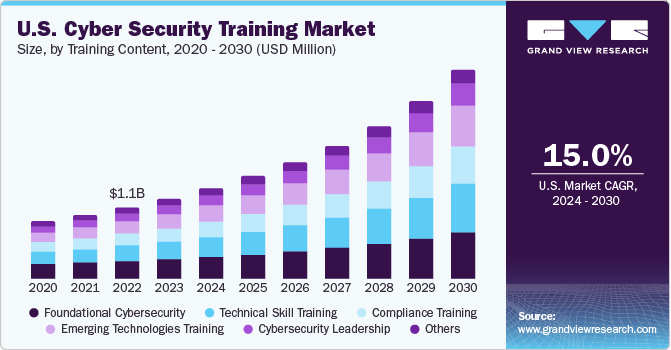

U.S. Cyber Security Training Market Trends

The cyber security training market in the U.S. is growing significantly at a CAGR of 15.0% from 2024 to 2030. The increasing adoption of digital technologies and cloud-based solutions in the U.S. across sectors, including healthcare, BFSI, and IT & Telecom, has fueled the need for enhanced cyber security capabilities among professionals. Thus, the demand for skill development cyber security training courses is expected to drive market growth.

Europe Cyber Security Training Market Trends

The cyber security training market in Europe is growing significantly at a CAGR of 17.1% from 2024 to 2030. The growing investments in AI and digital technologies, rising awareness towards cyber security, and expanding investments in cyber security initiatives by businesses and government entities are among the key factors positively driving the market growth.

The cyber security training market in the UK is growing significantly at a CAGR of 14.2% from 2024 to 2030. The cyber security landscape is rapidly evolving in the UK, fueled by fast paced adoption of digital technologies, endpoint devices, and connected infrastructure, providing a greater opportunity for the market. This rapid growth in the cyber security industry has created a big talent vacuum, with demands for skilled professionals and talented staff in the market.

The Germany cyber security training market is growing significantly at a CAGR of 16.8% from 2024 to 2030. Germany faces a growing number of cyberattacks, with sophisticated tactics targeting businesses, government agencies, and individuals. This fuels the need for a skilled workforce capable of identifying, mitigating, and responding to these threats, driving demand for cyber security training.

The cyber security training market in France is growing significantly at a CAGR of 20.2% from 2024 to 2030. The rapid digitalization in France across industries and increasing reliance on connected devices are attracting potential cyber criminals to the country, necessitating routine training and development activities among the workforce. Further, compliance with EU regulations, including GDPR and NIS Directive, emphasizes data protection and cyber security training for businesses are the primary drivers of the cyber security training industry.

Asia Pacific Cyber Security Training Market Trends

The cyber security training market in Asia Pacific is growing significantly at a CAGR of 19.7% from 2024 to 2030. Asia Pacific, the convergence of rapid digitization, young tech-savvy populations, and rising cyber threats are creating a positive ground for the market. Students and young professionals are continuously exploring advanced training and certification courses, seeking higher growth and career opportunities in the cybersecurity field. Furthermore, the rapid growth of digital infrastructure across the region demands a large pool of talent and working professionals to support the growing demand for cybersecurity experts. The primary factors mentioned above are driving the regional market growth.

The China cyber security training market is growing significantly at a CAGR of 16.5% from 2024 to 2030. The Chinese government has been actively promoting cybersecurity education and training programs. Initiatives such as the National Cybersecurity Talent Base Construction Plan and the Cybersecurity Law have emphasized the need for skilled professionals in the field.

The cyber security training market in Japan is growing significantly at a CAGR of 21.7% from 2024 to 2030. Rapid digitalization in Japan across industries, from healthcare and finance to manufacturing and critical infrastructure, is creating a vast surface for cybercriminals. Further, the country faces a significant shortage of qualified cybersecurity professionals, which necessitates upskilling and reskilling initiatives through cybersecurity training courses.

The India cyber security training market is growing significantly at a CAGR of 22.5% from 2024 to 2030. The rapid digitization in India, fueled by significant government initiatives towards digital payments, digital infrastructure, and smart manufacturing, has created a vast attack surface for cybercriminals. This has amplified the need for a skilled workforce to combat these threats, driving demand for cyber security training courses in India.

Middle East & Africa Cyber Security Training Market Trends

The cyber security training market in Middle East & Africa is growing significantly at a CAGR of 19.0% from 2024 to 2030. The Middle East region presents significant growth opportunities in the field of cybersecurity training due to factors such as the increasing digitization across industries in the region has heightened the importance of cybersecurity measures to protect sensitive data and critical infrastructure. This heightened awareness has created a demand for skilled cybersecurity professionals capable of implementing and managing robust security frameworks.

The Saudi Arabia cyber security training market is growing significantly at a CAGR of 21.5% from 2024 to 2030. Saudi Arabia’s ambitious Vision 2030 initiative surge in foreign investment in emerging technologies, including IoT, AI, and cloud computing, supported by Saudi Arabia's ambitious Vision 2030 initiative, is also driving the need for cyber security training and certification programs among professional.

Key Cyber Security Training Company Insights

Some of the key companies operating in the market include Google LLC, NINJIO, and SANS Institute.

-

Google LLC, a global technology solution and service provider, plays a significant role in the cybersecurity training landscape. They offer various resources and initiatives to equip individuals and organizations with the necessary skills to navigate the ever-evolving cyber threat landscape. It includes Google Cybersecurity Certificate, Google Cybersecurity Professional Certificate on Coursera,Google Cloud Training, and Google Cybersecurity Action Team (GCAT) services for organizations.

-

NINJIO is a leading provider of cybersecurity awareness training solutions, aiming to empower individuals and organizations to become active defenders against cyber threats. The training courses offered by the company include NINVO Aware, NINGO Phish3D, NINJO Sense, and NINJO Alert. The company offers these training programs by offering engaging micro-learning sessions, utilizing behavioral science techniques to explain technical terminologies, and offering personalized learning experiences to users.

Inspired eLearning, Webroot, and PhishingBox are some of the emerging market participants.

- Inspired eLearning is a leading provider of eLearning solutions, specializing in security awareness and compliance training for organizations worldwide. With over a decade of experience, they empower employees to become active defenders against cyber threats, ultimately improving organizational security posture.

Webroot University is a leading provider of cybersecurity training and education, offering a comprehensive range of courses designed to meet the needs of individuals and organizations of all sizes. Industry experts teach their training and certification courses and cover a wide range of cyber security topics.

Key Cyber Security Training Companies:

The following are the leading companies in the cyber security training market. These companies collectively hold the largest market share and dictate industry trends.

- CanIPhish

- Cofense

- Digital Defense Incorporated (DDI)

- Fortinet

- Google LLC

- Infosec IQ

- Inspired eLearning

- KnowBe4

- Kaspersky

- NINJIO

- PhishingBox

- Thoma Bravo (Proofpoint)

- SANS Institute

- TitanHQ (SafeTitan)

- Webroot

Recent Developments

-

In April 2023, Fortinet, a leading global cybersecurity solutions provider, has unveiled enhancements to its flagship Network Security Expert (NSE) Certification program aimed at bolstering cybersecurity skill sets and tackling the industry's talent shortage more effectively.

-

In May 2023, SANS Institute, a globally recognized cybersecurity training and certifications institute, announced the opening of a third cohort of its Cyber Reskilling Program in Bahrain, with a strategic partnership with (Tamkeen). This Cyber Reskilling Program is aimed at identifying, educating, and conducting rapid reskilling programs for individuals within a span period of eight weeks, with comprehensive training from global industry experts in the cyber security field.

-

In June 2023, NINJIO, a cyber security certification and training provider, announced the launch of a comprehensive and new approach to cyber security awareness training, with the launch of the advanced personalization engine NINJIO Risk Algorithm, which provides IT security experts with the ability to trailer cyber security training courses according to the specific needs of individuals.

Cyber Security Training Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.23 billion |

|

Revenue forecast in 2030 |

USD 13.70 billion |

|

Growth rate |

CAGR of 17.4% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, delivery method, training content, certification, target audience, industry, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; Mexico; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

CanIPhish; Cofense; Digital Defense Incorporated (DDI); Google LLC; Infosec IQ; Inspired eLearning; KnowBe4; Kaspersky; Fortinet; NINJIO; PhishingBox; Thoma Bravo (Proofpoint); SANS Institute; TitanHQ (SafeTitan); Webroot |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cyber Security Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cyber security training market report based on type, delivery method, training content, certification, target audience, industry, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online Training

-

Classroom Training

-

Bootcamps

-

-

Delivery Method Outlook (Revenue, USD Billion, 2018 - 2030)

-

Self-pace Training

-

Instructor-Led Training

-

Blended Training

-

-

Training Content Outlook (Revenue, USD Billion, 2018 - 2030)

-

Foundational Cybersecurity

-

Technical Skill Training

-

Compliance Training

-

Emerging Technologies Training

-

Cybersecurity Leadership

-

Others

-

-

Certification Outlook (Revenue, USD Billion, 2018 - 2030)

-

Vendor Specific Certifications

-

Industry Standard Certifications

-

-

Target Audience Outlook (Revenue, USD Billion, 2018 - 2030)

-

Enterprises

-

Individuals

-

-

Industry Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT & Telecom

-

Healthcare

-

Government/Defense

-

Manufacturing

-

Energy

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cyber security training market size was estimated at USD 4.53 billion in 2023 and is expected to reach USD 5.23 billion by 2024.

b. The global cyber security training market is expected to grow at a compound annual growth rate of 17.4% from 2024 to 2030 to reach USD 13.70 billion by 2030.

b. The online training segment accounted for the largest market share of over 47% in 2023 in the cyber security training market. The rapid increase in cyber-attacks and security breaches has intensified the need for advanced training and certification programs among professionals that offer practical knowledge, simulation training, and hands-on experience in security incidents.

b. Some key players operating in the cyber security training market are CanIPhish; Cofense; Digital Defense Incorporated (DDI); Google LLC; Infosec IQ; Inspired eLearning; KnowBe4; Kaspersky; Fortinet; NINJIO; PhishingBox; Thoma Bravo (Proofpoint); SANS Institute; TitanHQ (SafeTitan); and Webroot.

b. Due to the significant use of unsecured networks, human factors, and technology gaps, a series of cyber security challenges are surfacing in the market, including cyber infrastructure damage, data theft, device compromise, and security breaches that pose a serious threat to organizational security, national security, and economic stability. Thus, leading towards great concerns in the global society. Cybersecurity training is becoming a greater tool among organizations, highly effective for protecting and responding to cybersecurity incidents.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."