Customer Intelligence Platform Market Size, Share & Trends Analysis Report By Component (Platform, Services), By Data Channel (Web, Social Media), By Application, By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-362-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

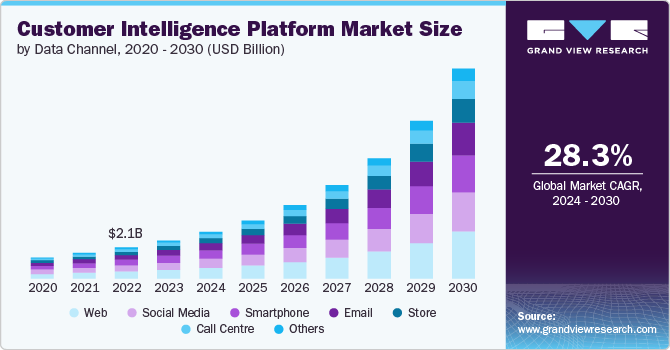

The global customer intelligence platform market size was estimated at USD 2.51 billion in 2023 and is expected to grow at a CAGR of 28.3% from 2024 to 2030. The market has been experiencing significant growth, driven by the increasing importance of customer data in formulating business strategies. CIPs aggregate and analyze data from various customer touchpoints, enabling companies to gain deeper insights into customer behavior, preferences, and trends. This holistic view helps businesses enhance customer engagement, personalize marketing efforts, and ultimately drive growth and loyalty.

Companies are increasingly recognizing that understanding and improving customer experience is crucial for differentiation in a highly competitive market. This need has been amplified by the digital transformation wave, where businesses are leveraging technology to meet the evolving expectations of digital-savvy customers. Additionally, advancements in artificial intelligence (AI) and machine learning (ML) have significantly enhanced the capabilities of customer intelligence platforms, allowing for more sophisticated data analysis and actionable insights.

Further, the rising adoption of omnichannel strategies. Customers today interact with brands across multiple channels, including social media, mobile apps, websites, and physical stores. Customer intelligence platforms enable businesses to consolidate data from these diverse sources, providing a unified view of the customer journey. This comprehensive perspective is essential for delivering consistent and personalized experiences across all touchpoints.

As AI and ML technologies continue to evolve, customer intelligence platforms can offer more accurate predictions of customer behavior and trends, allowing businesses to proactively address customer needs and preferences. Furthermore, the increasing adoption of Internet of Things (IoT) devices presents a new frontier for customer intelligence, as these devices generate vast amounts of data that can be leveraged to gain deeper insights into customer habits and preferences.

Businesses in regions including Asia-Pacific and Latin America continue to digitalize, there is a growing demand for sophisticated customer intelligence solutions. These markets offer substantial growth potential for customer intelligence platform providers, particularly as local businesses seek to compete on a global scale by enhancing their customer engagement strategies.

Component Insights

The platform segment accounted for the largest market share of over 67% in 2023. The increasing need for personalized customer experiences is a primary driver of the customer intelligence platform market. As businesses recognize the value of customer-centric strategies, the demand for sophisticated platforms that can analyze vast amounts of data to provide actionable insights grows. Customer intelligence platforms enable companies to aggregate data from various sources, analyze customer behavior, and predict future trends. This capability is crucial in tailoring marketing efforts, improving customer service, and fostering customer loyalty. As a result, businesses across various sectors, including retail, finance, and healthcare, are investing heavily in customer intelligence platforms to gain a competitive edge by understanding and anticipating customer needs more effectively.

The service segment is expected to grow at a significant rate during the forecast period. The growing complexity of data management and the need for expert insights are key factors driving the growth of the customer intelligence services market. As businesses accumulate vast amounts of customer data from various touchpoints, managing and extracting valuable insights from this data becomes increasingly challenging. Customer intelligence services, which include consulting, implementation, and managed services, provide the necessary expertise and support to help organizations effectively utilize their customer intelligence services. These services ensure that businesses can maximize the potential of their customer intelligence data, leading to more informed decision-making and strategic planning.

Data Channel Insights

The web segment accounted for the largest market share of over 23% in 2023. The growth of the web segment in the market is driven by the increasing digitization of consumer interactions and the proliferation of online platforms. With the widespread use of the internet, businesses are capturing vast amounts of data from websites, social media, e-commerce platforms, and online forums. This data provides valuable insights into customer behavior, preferences, and trends, enabling companies to tailor their marketing strategies and improve customer engagement.

The call center segment is expected to grow at a significant rate during the forecast period. The call center segment of the market is experiencing growth driven by the increasing importance of customer service in differentiating brands. Call centers remain a crucial touchpoint for customer interactions, handling a wide range of inquiries, complaints, and support requests. The data generated from these interactions is invaluable for understanding customer pain points, preferences, and satisfaction levels.

Application Insights

The customer experience management segment accounted for the largest market share of over 22% in 2023. The increasing importance of customer-centric strategies in businesses across various sectors is driving the demand for customer experience management applications. Companies are recognizing that delivering exceptional customer experiences is a crucial differentiator in a competitive market. This shift is driven by several key factors, including the rising expectations of consumers for personalized and seamless interactions with brands. Customers today demand a high level of service and engagement, expecting businesses to understand their preferences and respond to their needs promptly. As a result, organizations are investing heavily in CEM solutions to analyze customer feedback, monitor interactions, and tailor services to enhance satisfaction and loyalty.

The personalized recommendation segment is expected to grow at a significant rate during the forecast period. The market for personalized recommendations is booming as businesses increasingly recognize the value of offering tailored suggestions to enhance customer engagement and drive sales. Personalized recommendation systems leverage data analytics and AI to analyze customer behavior, preferences, and purchase history, enabling companies to deliver highly relevant and individualized product or service recommendations. This personalized approach not only improves the customer experience by making interactions more meaningful but also significantly boosts conversion rates and revenue for businesses.

Deployment Insights

The cloud segment accounted for the largest market share of over 50% in 2023. The growth of the cloud segment in the Customer Intelligence Platform (CIP) market is primarily driven by the increasing adoption of cloud computing across industries. Businesses are increasingly recognizing the benefits of cloud-based solutions, such as scalability, cost-effectiveness, and ease of deployment. Cloud-based CIP platforms enable organizations to access and analyze vast amounts of customer data in real time, allowing for more accurate and timely insights. This real-time data processing capability is crucial for businesses looking to enhance customer experiences, personalize marketing efforts, and optimize operational efficiencies.

The on-premise segment is expected to grow at a significant rate during the forecast period. The on-premise segment is driven by the need for greater control and security over customer data. Many organizations, particularly those in highly regulated industries such as finance, healthcare, and government, prefer on-premise solutions due to concerns about data privacy and compliance. On-premise CIPs allow these organizations to maintain direct oversight of their data, ensuring that it is stored and managed in accordance with internal policies and regulatory requirements. This level of control is crucial for businesses that handle sensitive customer information and need to adhere to strict data protection standards.

Enterprise size Insights

The large enterprise segment accounted for the largest market share of over 57% in 2023. In large enterprises, the adoption of customer intelligence platforms is driven by the need for advanced data analytics and comprehensive customer insights to maintain a competitive edge in a rapidly evolving market. Large organizations typically have vast amounts of customer data collected from various touchpoints, including online interactions, in-store visits, and customer service engagements. CIP solutions help these enterprises to consolidate and analyze this data to gain a 360-degree view of their customers. This holistic understanding enables large enterprises to personalize marketing efforts, optimize product offerings, and improve customer service, ultimately driving higher customer satisfaction and loyalty.

The SMEs segment is expected to grow at a significant rate over the forecast period. The Customer Intelligence Platform (CIP) market growth within SMEs is primarily driven by the increasing need for data-driven decision-making and enhanced customer engagement. SMEs are recognizing the value of leveraging customer data to gain insights into customer behavior, preferences, and purchasing patterns. With the rise of digital transformation, even small businesses are now able to access and utilize advanced analytics tools that were once reserved for larger enterprises.

End-use Insights

The BFSI segment accounted for the largest market share of over 18% in 2023. The banking and financial institutes are leveraging customer experience platforms to gather and analyze customer data, enabling them to offer tailored products and services that meet the specific needs and preferences of their clients. This personalized approach not only enhances customer satisfaction and loyalty but also boosts cross-selling and up-selling opportunities. Additionally, the regulatory environment in the BFSI sector is becoming increasingly stringent, necessitating robust data management and analysis capabilities. CIP solutions help financial institutions comply with regulations by providing comprehensive insights into customer behavior, transactions, and potential risks, thereby enhancing their ability to detect and prevent fraud.

The media and entertainment segment are expected to grow at a significant rate during the forecast period. In the media and entertainment industry, the adoption of customer intelligence platforms is being driven by the need for enhanced audience engagement and personalized content delivery. The proliferation of digital content and the increasing competition among media providers necessitate a deeper understanding of audience preferences and consumption patterns. CIP solutions enable media companies to collect and analyze data from various sources, such as social media, streaming platforms, and online surveys, to gain comprehensive insights into audience behavior.

Regional Insights

North America held a market share of over 36% in 2023. The Customer Intelligence Platform (CIP) market in North America is witnessing significant growth driven by the rapid adoption of advanced technologies and data analytics. Businesses in the region are increasingly recognizing the value of customer data in enhancing customer experiences and driving business strategies. Additionally, the high internet penetration and the proliferation of connected devices generate vast amounts of customer data, further propelling the demand for CIP solutions in the region.

U.S. Customer Intelligence Platform Market Trends

The market in the U.S. is projected to grow significantly at a CAGR of 26% from 2024 to 2030. The presence of major tech giants and a well-established digital infrastructure in the U.S. supports the widespread implementation of CIP solutions. Furthermore, the competitive business environment encourages companies to leverage customer intelligence to gain a competitive edge, optimize marketing efforts, and improve customer retention.

Asia Pacific Customer Intelligence Platform Market Trends

The market in Asia Pacific is expected to grow significantly at a CAGR of 30% from 2024 to 2030. In the Asia Pacific region, the Customer Intelligence Platform (CIP) market is experiencing rapid growth due to the increasing digital transformation across various industries. Countries such as China, India, and Japan are at the forefront of adopting advanced analytics and artificial intelligence technologies to harness customer data for strategic decision-making. The burgeoning e-commerce sector in the region generates a massive amount of customer data, which necessitates the use of CIP solutions to analyze and utilize this data effectively.

Europe Customer Intelligence Platform Market Trends

The market in Europe is expected to grow at a CAGR of 27.9% from 2024 to 2030. In Europe, the market is being driven by a combination of regulatory frameworks and technological advancements. The General Data Protection Regulation (GDPR) has heightened the focus on data privacy and protection, prompting businesses to adopt CIP solutions that ensure compliance while still enabling them to gather and analyze customer data efficiently. This regulatory environment is encouraging companies to invest in secure and transparent data management practices, which is, in turn, boosting the adoption of CIP technologies.

Key Customer Intelligence Platform Company Insights

Some of the key players operating in the market include Acxiom LLC; Adobe; Google LLC; Informatica; IBM Corporation; iManage; Microsoft Corporation; Oracle Corporation; Proxima; SAP SE; SAS Institute Inc.; Salesforce.com, inc.; and Teradata among others. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2024, Acxiom LLC, a global customer intelligence company, announced a strategic partnership with ActionIQ, a customer data platform provider. This collaboration leverages the strengths of both companies to revolutionize the way brands and marketers collect, analyze, and utilize customer data. By combining their expertise, Acxiom and ActionIQ aim to enhance data-driven marketing strategies and deliver seamless, personalized customer experiences.

-

In May 2024, iManage, an AI-powered knowledge work platform provider and vLex, a legal intelligence platform company announced a strategic partnership to integrate their platforms. This collaboration aimed at enhancing access to comprehensive legal insights, streamlining legal research and workflow for users. This move signifies a major advancement in customer intelligence, empowering legal professionals with more efficient and effective tools for knowledge management and decision-making.

-

In December 2023, Proxima, a predictive data intelligence platform introduced an innovative AI-driven business health check tool that provides in-depth insights into profitable unit economics, capital efficiency, profitability, and overall performance. By eliminating the need for a dedicated data team, it empowers brands to thoroughly analyze their data, optimize efficiency, reduce customer acquisition costs, and maximize customer lifetime value.

Key Customer Intelligence Platform Companies:

The following are the leading companies in the customer intelligence platform market. These companies collectively hold the largest market share and dictate industry trends.

- Acxiom LLC

- Adobe

- Google LLC

- IBM Corporation

- iManage

- Informatica

- Microsoft Corporation

- Oracle Corporation

- Proxima

- Salesforce.com, inc.

- SAP SE

- SAS Institute Inc.

- Teradata

Customer Intelligence Platform Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.09 billion |

|

Revenue forecast in 2030 |

USD 13.81 billion |

|

Growth rate |

CAGR of 28.3% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, enterprise size, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, Australia, South Korea, Australia, Brazil, UAE, Saudi Arabia, South Africa. |

|

Key companies profiled |

Acxiom LLC; Adobe; Google LLC; Informatica; IBM Corporation; iManage; Microsoft Corporation; Oracle Corporation; Proxima; SAP SE; SAS Institute Inc.; Salesforce.com, inc.; Teradata |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Customer Intelligence Platform Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global customer intelligence platform market report based on component, data channel, application, deployment, enterprise size, end-use, and region:

-

Customer Intelligence Platform Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Platform

-

Services

-

-

Customer Intelligence Platform Data Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Web

-

Social Media

-

Smartphone

-

Email

-

Store

-

Call Centre

-

Others

-

-

Customer Intelligence Platform Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Customer Data Collection and Management

-

Customer Segmentation and Targeting

-

Customer Experience Management

-

Customer Behaviour Analytics

-

Omnichannel Marketing

-

Personalized Recommendation

-

Others

-

-

Customer Intelligence Platform Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Customer Intelligence Platform Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Customer Intelligence Platform End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Banking, Financial Services, and Insurance (BFSI)

-

Retail and e-commerce

-

Telecommunications and IT

-

Manufacturing

-

Transportation and Logistics

-

Government and Defense

-

Healthcare and Life Sciences

-

Media and Entertainment

-

Travel and Hospitality

-

Others

-

-

Customer Intelligence Platform Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global customer intelligence platform market size was estimated at USD 2.51 billion in 2023 and is expected to reach USD 3.09 billion in 2024.

b. The global customer intelligence platform market is expected to grow at a compound annual growth rate of 28.3% from 2024 to 2030 to reach USD 13.81 billion by 2030.

b. The customer experience management segment accounted for the largest market share of over 22% in 2023. The increasing importance of customer-centric strategies in businesses across various sectors is driving the demand for customer experience management applications. Companies are recognizing that delivering exceptional customer experiences is a crucial differentiator in a competitive market.

b. Key players in the customer intelligence platform market include Acxiom LLC; Adobe; Google LLC; Informatica; IBM Corporation; iManage; Microsoft Corporation; Oracle Corporation; Proxima; SAP SE; SAS Institute Inc.; Salesforce.com, inc.; and Teradata

b. The customer intelligence platform market has been experiencing significant growth, driven by the increasing importance of customer data in formulating business strategies. CIPs aggregate and analyze data from various customer touchpoints, enabling companies to gain deeper insights into customer behavior, preferences, and trends. This holistic view helps businesses enhance customer engagement, personalize marketing efforts, and ultimately drive growth and loyalty.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."