Customer Identity And Access Management Market Size, Share & Trends Analysis Report By Component, By Deployment, By Authentication Method, By Industry Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-383-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

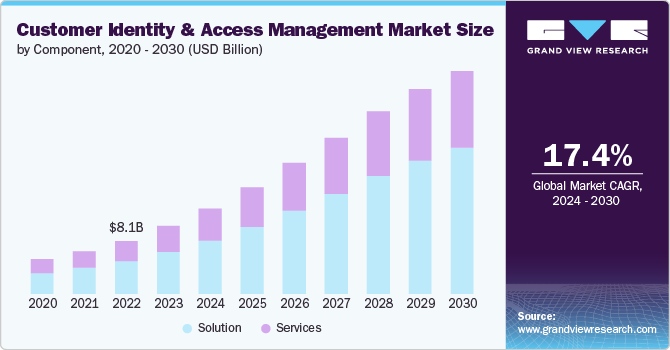

The global customer identity and access management market size was estimated at USD 8.12 billion in 2023 and is projected to grow at a CAGR of 17.4% from 2024 to 2030. This surge in demand can be attributed to the rising awareness of data protection laws, the growing digitalization of businesses, and the necessity for enhanced user experiences.

Security solutions are pivotal in managing and securing customer identities, providing businesses with the tools to streamline registration processes, authenticate users, and manage profiles while maintaining compliance with privacy regulations. As online transactions and digital interactions continue to rise, the importance of implementing robust solutions becomes ever more critical. Moreover, the advent of technologies such as artificial intelligence and machine learning is introducing advanced functionalities in solutions, Component more personalized and secure user experiences.

The market is fueled by the growing need to secure customer access to services and data amidst rising data protection awareness and digital business transformations. This burgeoning demand underscores the crucial role of solutions in managing and safeguarding customer identities. These solutions are essential for streamlining registration, authenticating users, and managing profiles while adhering to privacy laws. The increasing trend of online transactions and digital interactions elevates the importance of deploying robust systems. In addition, the integration of cutting-edge technologies such as artificial intelligence and machine learning is enhancing functionalities, enabling more personalized and secure customer experiences. This growth trajectory is set to continue as industries across the board begin to appreciate the significant value it brings in building customer trust and loyalty, along with ensuring stringent data security.

Strategic partnerships enhance its capabilities and reach. These collaborations between customer identity and access management (CIAM) providers and technology firms are driven by the need to offer more comprehensive and advanced solutions that cater to the escalating demands for secure and seamless customer experiences. By joining forces, companies can leverage each other's strengths, such as integrating artificial intelligence and machine learning for improved personalization and security. Such partnerships are crucial for staying competitive, expanding market presence, and meeting the diverse needs of businesses across various industries, ultimately fostering stronger customer trust and loyalty.

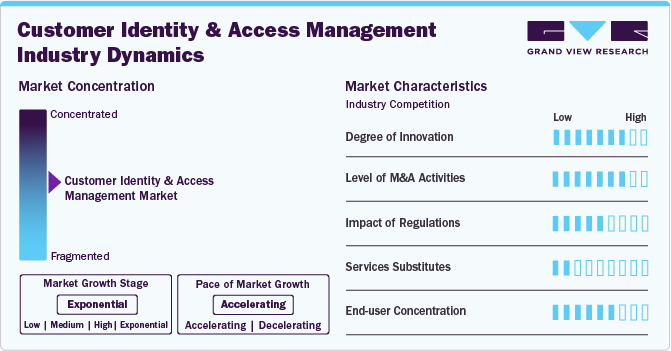

Market Concentration & Characteristics

The market growth stage is exponential, and the pace of the market growth is accelerating. This rapid development phase is marked by an increase in merger and acquisition (M&A) activities, indicating not only the sector's vitality but also a growing interest from key players and investors. This interest is driven by the desire to leverage the opportunities presented by the evolving digital landscape, aiming to deliver more innovative and secure solutions to end-users.

The customer identity and access management (CIAM) market is seeing an increasing number of merger and acquisition (M&A) activities, underscoring its exponential growth stage and ever-expanding potential. This surge in M&A activities highlights the sector's dynamism and the heightened interest from both strategic players and investment communities looking to capitalize on the evolving digital landscape. Such movements not only consolidate the market, making it more competitive, but also enhance the technological capabilities and service Components of the entities involved, ultimately benefiting the end-users with more innovative and secure solutions.

The customer identity and access management (CIAM) market is also subject to moderate regulatory scrutiny and is impacted by its operations and strategic decisions. This scrutiny impacts its operations and strategic decisions, as providers must navigate a complex web of global and local regulations, including GDPR, CCPA, and others. These regulations aim to protect user data and privacy, requiring solutions to be both robust and adaptable.

Customer identity and access management face minimal competition from product substitutes in the market. This minimal competition can be attributed to the specialized nature of the solutions, which are intricately designed to address complex security, privacy, and user experience demands that generic substitutes cannot adequately meet. The market’s unique capabilities in managing vast amounts of identities and ensuring secure, seamless access for users across various platforms set it apart. Consequently, the scarcity of viable alternatives reinforces its indispensable role in enhancing digital experiences, thereby securing its dominant position in the market.

End-user concentration is a significant factor in the customer identity and access management (CIAM) market. This approach emphasizes the critical role that understanding and catering to the specific needs of the end-users plays in defining the success of CIAM solutions. By prioritizing end-user requirements, companies can ensure their Components are not only secure and compliant but also user-friendly, thereby enhancing overall customer satisfaction. This focus is essential for businesses aiming to secure a competitive edge by providing superior customer experiences.

Component Insights

Solution accounted for the largest market revenue share in 2023. The market is driven by the increasing need for comprehensive identity management platforms that can handle complex customer interactions across multiple channels. Organizations are seeking integrated solutions that combine authentication, authorization, user management, and analytics in a single package. The demand for scalable and flexible solutions that can adapt to evolving security threats and regulatory requirements fuels market growth. Advanced features such as risk-based authentication, fraud detection, and consent management are becoming essential components.

Services are expected to register the fastest CAGR from 2024 to 2030 due to the complexity of implementing and maintaining robust identity management systems. Organizations are increasingly relying on professional services for strategy development, solution design, and implementation to ensure optimal deployment of solutions. Managed services are gaining popularity as businesses seek to offload the day-to-day management of their identity infrastructure to experts. Consulting services are in demand for compliance assessments, security audits, and optimization of existing deployments.

Deployment Insights

On-premises accounted for the largest market revenue share of 62.0% in 2023. This Deploymentl appeals to businesses seeking complete control over their identity infrastructure and data storage. Large enterprises with existing on-premises IT investments often prefer this approach for seamless integration with legacy systems. Industries handling sensitive data, such as government, healthcare, and finance, may choose on-premises solutions to comply with specific regulatory requirements. The ability to customize and fine-tune solutions to meet unique organizational needs is another key driver. In addition, concerns about cloud security and data privacy in some regions contribute to the continued demand for on-premises deployments.

The cloud segment is expected to register the fastest CAGR of 38.0%% from 2024 to 2030. Organizations are increasingly adopting cloud solutions to support digital transformation initiatives and enable remote work capabilities. Cloud deployment offers faster implementation times and easier upgrades, allowing businesses to stay current with the latest security features. The ability to rapidly scale resources to meet fluctuating demand is particularly attractive for e-commerce and other consumer-facing services. Cloud solutions often provide better integration with other cloud-based services and APIs, facilitating a more connected ecosystem. The shift towards OpEx models and the reduction in IT infrastructure management overhead further drive cloud adoption across various industries.

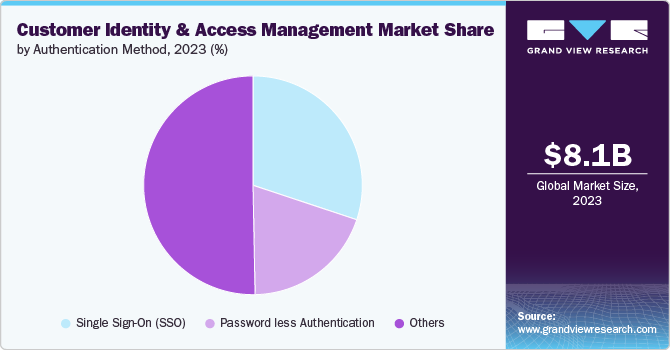

Authentication Method Insights

Single Sign-On (SSO) accounted for the largest market revenue share in 2023. Organizations are adopting SSO to reduce password fatigue and enhance security by minimizing the number of credentials users need to manage. The rise of cloud-based services and SaaS applications increases the demand for SSO solutions that can integrate seamlessly across diverse environments. SSO also helps businesses improve productivity by reducing time spent on password resets and login issues. Compliance requirements for stronger access controls and the need for centralized identity management further fuel SSO adoption. In addition, SSO's ability to provide detailed user activity logs aids in security audits and threat detection.

Password less authentication is expected to register the fastest CAGR from 2024 to 2030. This rapid growth is due to increasing recognition of password-related security vulnerabilities and user frustration with complex password policies. This approach enhances security by eliminating password-based attacks like phishing and credential stuffing. The rising adoption of biometric technologies in smartphones and other devices facilitates the implementation of password less solutions. Organizations are drawn to password less authentication for its potential to reduce IT support costs associated with password resets. The push for frictionless user experiences in e-commerce and digital services drives demand for seamless authentication methods. In addition, regulatory compliance requirements for strong authentication methods in sectors such as finance and healthcare contribute to the growth of password less solutions in market.

Industry Vertical Insights

The BFSI segment accounted for the largest market revenue share in 2023. Open banking initiatives and the rise of fintech companies necessitate robust identity verification and access management solutions. The shift towards omnichannel banking experiences requires seamless and secure customer authentication across multiple platforms. Growing cyber threats and fraud attempts in financial transactions fuel demand for advanced technologies. The adoption of AI and machine learning for fraud detection and risk assessment further enhances solutions. In addition, the need for personalized customer experiences while maintaining data privacy pushes financial institutions to invest in sophisticated systems that balance security and user convenience.

The healthcare segment is expected to grow at a CAGR from 2024 to 2030. Stringent regulations such as HIPAA in the US drive the adoption of robust identity management solutions to ensure patient data privacy. The rise of telemedicine and remote patient monitoring creates demand for secure, user-friendly authentication methods. Integration of IoT devices in healthcare necessitates advanced identity and access management for both patients and healthcare providers. The growing trend of personalized medicine and patient engagement platforms requires solutions that can manage consent and preferences effectively. In addition, the need for interoperability between different healthcare systems while maintaining data security further boosts adoption in this sector.

Regional Insights

North America accounted for the highest market revenue share in 2023, driven by increasing adoption of cloud-based services, stringent data protection regulations, and the growing need for enhanced customer experiences. The region's advanced IT infrastructure and high digital literacy rates facilitate the adoption. Rising cybersecurity concerns, coupled with the proliferation of IoT devices, further fuel market growth. The demand for seamless omnichannel experiences and personalized customer interactions is pushing businesses to invest in robust solutions.

U.S. Customer Identity and Access Management Market Trends

The customer identity and access management (CIAM) market in the U.S. is expected to have a notable CAGR from 2024 to 2030, propelled by the presence of major technology companies and a thriving startup ecosystem. Stricter regulations such as CCPA and GDPR compliance requirements for US companies operating globally drive adoption. The country's focus on digital transformation across sectors, including finance, healthcare, and retail, boosts demand for advanced identity management solutions. Increasing cyber threats and data breaches have heightened awareness of the importance of robust identity protection. The trend towards password less authentication and biometric technologies is gaining traction, further stimulating market growth.

Asia Pacific Customer Identity and Access Management Market Trends

The customer identity and access management (CIAM) market in Asia Pacific accounted for a significant revenue share in 2023. The region's large and young population, coupled with rising smartphone adoption, creates a vast potential for digital identity management. Governments' initiatives to implement national digital identity programs boost the public sector market. The increasing frequency of cyber-attacks and data breaches raises awareness about the importance of robust identity protection. The region's diverse regulatory landscape and the need for cross-border compliance drive multinational companies to adopt comprehensive solutions.

The Japan customer identity and access management market is estimated to grow significantly from 2024 to 2030. The government's Society 5.0 initiative, aimed at creating a super-smart society, stimulates demand for advanced identity management solutions. Japan's aging population and the need for accessible digital services fuel adoption across various sectors, particularly healthcare and finance. The country's strict data protection regulations and emphasis on cybersecurity push businesses to implement robust systems.

The customer identity and access management market in India is estimated to record a notable CAGR from 2024 to 2030. The increasing adoption of cloud services and the proliferation of smartphones create a conducive environment for implementation. India's booming e-commerce and fintech sectors fuel demand for secure and seamless customer authentication solutions. The government's focus on digital identity projects, such as Aadhaar, stimulates adoption in both public and private sectors. Rising cybersecurity concerns and the need for compliance with data protection regulations drive market growth.

The China customer identity and access management market had the largest revenue share in 2023. The country's focus on digital transformation and smart city initiatives creates significant opportunities for providers. China's emphasis on cybersecurity and data protection, exemplified by laws such as the Cybersecurity Law and Personal Information Protection Law, drives adoption. The integration of emerging technologies such as AI and blockchain in identity management solutions fuels market growth.

Europe Customer Identity And Access Management Market Trends

The customer identity and access management (CIAM) market in Europe is anticipated to grow at a moderate CAGR from 2024 to 2030. The need for compliance and enhanced data security across industries fuels adoption. The region's focus on digital identity initiatives, such as eIDAS, promotes the integration of solutions. Increasing cyber threats and the need for seamless customer experiences across multiple channels contribute to market expansion. The growing trend of open banking in the financial sector necessitates robust identity management solutions. In addition, the rise of IoT and smart city initiatives creates new opportunities for providers.

The France customer identity and access management market accounted for a significant revenue share in 2023. The government's focus on cybersecurity and digital identity projects, such as France Connect, stimulates adoption in the public sector. France's robust retail and e-commerce sectors create demand for seamless and secure customer authentication solutions. The country's emphasis on innovation and startup ecosystem fosters the development of advanced technologies. Increasing awareness of data privacy rights among consumers pushes businesses to invest in comprehensive identity management systems.

The customer identity and access management market in the UK is estimated to grow at the highest CAGR from 2024 to 2030. Post-Brexit data protection regulations and the need for compliance with both UK and EU standards fuel adoption. The country's strong financial services sector, embracing open banking and fintech innovations, creates significant demand for advanced identity management solutions. The UK government's digital transformation initiatives and focus on secure citizen services boost the public sector market.

The Germany customer identity and access management market is estimated to grow at a moderate CAGR from 2024 to 2030. The country's strict adherence to GDPR and other regulations propels businesses to adopt robust solutions. Germany's advanced manufacturing sector, undergoing digital transformation, creates significant demand for identity management systems. The country's focus on Industry 4.0 initiatives and IoT integration in various sectors fuels adoption. Germany's thriving e-commerce market and the need for enhanced customer experiences across digital platforms contribute to market growth.

Middle East & Africa Customer Identity And Access Management Market Trends

The customer identity and access management (CIAM) market in the Middle East and Africa (MEA) region is estimated to grow significantly from 2024 to 2030. Governments' initiatives to implement national digital identity programs, such as the UAE's UAE Pass, stimulate adoption. The region's young and tech-savvy population fuels demand for seamless digital experiences and mobile-first solutions. Increasing cybersecurity threats and the need for compliance with evolving data protection regulations drive market growth. The MEA region's focus on smart city projects and the growing e-commerce sector create significant opportunities for providers.

The customer identity and access management (CIAM) market in Saudi Arabia accounted for a considerable revenue share in 2023. The government's push for e-government services and digital citizen engagement drives adoption in the public sector. Saudi Arabia's growing fintech industry and the trend towards open banking create demand for advanced identity management solutions. The country's emphasis on cybersecurity and data protection, in line with the National Cybersecurity Authority's efforts, fuels market growth. The rapid development of smart cities and the increasing adoption of IoT technologies present new opportunities for providers.

Key Customer Identity And Access Management Company Insights

Some of the key players operating in the market include Microsoft Corporation, IBM Corporation, and SAP.

-

SAP's growth is driven by its robust integration capabilities within the SAP ecosystem, enabling seamless management of customer identities across enterprise applications. SAP's CIAM solutions offer scalability and flexibility to meet diverse business requirements, ensuring efficient customer identity management. This strategic approach enhances operational efficiency and customer satisfaction by providing secure and integrated identity management solutions tailored to the needs of enterprises across different industries.

-

IBM’s growth is bolstered by its comprehensive portfolio of security solutions and expertise in enterprise-grade identity management. Leveraging AI and cloud technologies, IBM offers scalable CIAM solutions that enhance security while improving user experience. Integration with IBM's broader ecosystem of services further strengthens its market position, catering to diverse industry needs. IBM's commitment to innovation and cybersecurity helps organizations mitigate risks associated with identity management, driving its growth in the CIAM market.

ForgeRock, and Okta are some of the emerging market participants in the customer identity and access management (CIAM) market.

-

ForgeRock’s robust platform emphasizes security, scalability, and flexibility. Key drivers of ForgeRock's growth include its ability to provide comprehensive identity solutions across various channels and devices, enabling organizations to deliver seamless and personalized customer experiences. ForgeRock's focus on open standards and integration capabilities supports its position as a preferred choice for enterprises seeking advanced CIAM functionalities. In addition, ForgeRock's innovation in areas such as consent management and identity analytics further propels its growth in the CIAM market.

-

Okta growth is driven by its cloud-first approach, Component scalable and reliable identity management solutions. Emphasizing strong security measures like adaptive authentication and MFA enhances customer data protection. Okta's user-centric focus ensures seamless and personalized user experiences across multiple devices and applications. Its ability to integrate with a wide range of systems and provide advanced analytics further solidifies its position as a leader in CIAM, catering to diverse enterprise needs effectively.

Key Customer Identity And Access Management Companies:

The following are the leading companies in the customer identity and access management market. These companies collectively hold the largest market share and dictate industry trends.

- IBM Corporation

- Microsoft Corporation

- Salesforce

- SAP

- Broadcom

- Okta

- Akamai Technologies

- Ping Identity

- ForgeRock

- LoginRadius

- HID Global

Recent Developments

-

In June 2024, Akamai Technologies, Inc. completed acquisition of Noname Security, a leading API security company, for approximately USD 450 million. This acquisition aimed to enhance Akamai’s capabilities in meeting rising API security demands. Noname's expertise allowed Akamai to extend protection across all API traffic locations and leverage its sales and marketing resources. The acquisition was expected to bolster Akamai's market position and strengthen its customer Components.

-

In June 2024, LoginRadius, launched passkeys on its CIAM platform, utilizing the FIDO2 open standard. In response to the friction introduced by multi-factor authentication (MFA), LoginRadius introduces passkeys to advance towards a passwordless future. By integrating FIDO2, Passkeys aims to address security challenges associated with traditional passwords, Component enterprises a secure and seamless alternative that enhances user experience and protects user data.

Customer Identity And Access Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 10.23 billion |

|

Revenue forecast in 2030 |

USD 26.72 billion |

|

Growth rate |

CAGR of 17.4% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, authentication method, industry vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

IBM; Microsoft; Salesforce; SAP; Broadcom; Okta; Akamai Technologies; Ping Identity; ForgeRock; LoginRadius; HID Global |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Customer Identity And Access Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global customer identity and access management (CIAM) market report based on component, deployment, authentication method, industry vertical, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Identity Governance

-

Identity Analytics

-

Identity Administration and Authentication

-

Identity Proofing Services

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Authentication Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Sign-On (SSO)

-

Password less Authentication

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Hospitality & Travel

-

Healthcare

-

Retail & E-Commerce

-

Education

-

Government & Public Sector

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global customer identity and access management market size was estimated at USD 8.12 billion in 2023 and is expected to reach USD 10.23 billion in 2024.

b. The global customer identity and access management (CIAM) market is expected to grow at a compound annual growth rate of 17.4% from 2024 to 2030 to reach USD 26.72 billion by 2030.

b. North America accounted for the highest market revenue share in 2023, driven by increasing adoption of cloud-based services, stringent data protection regulations, and the growing need for enhanced customer experiences. The region's advanced IT infrastructure and high digital literacy rates facilitate the adoption.

b. Some key players operating in the customer identity and access management (CIAM) market include Microsoft Corporation, IBM Corporation, SAP, ForgeRock, Okta, and among others

b. Security solutions are pivotal in managing and securing customer identities, providing businesses with the tools to streamline registration processes, authenticate users, and manage profiles while maintaining compliance with privacy regulations.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."