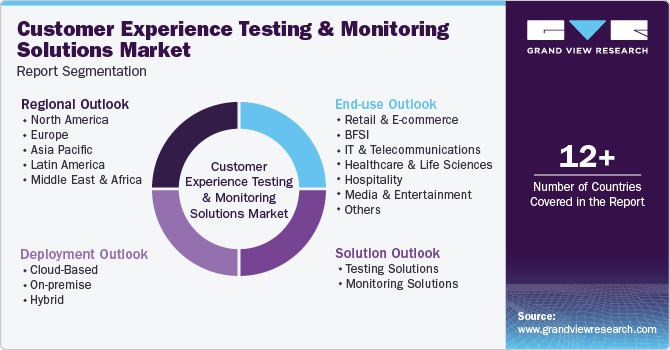

Customer Experience Testing And Monitoring Solutions Market Size, Share, & Trends Analysis Report By Solution (Testing Solutions, Monitoring Solutions), By Deployment (Cloud-Based, On-premise), By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-535-1

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

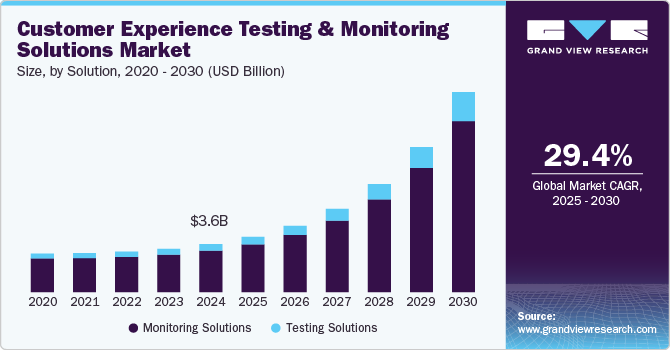

The global customer experience testing and monitoring solutions market size was estimated at USD 3.58 billion in 2024 and is projected to grow at a CAGR of 29.4% from 2025 to 2030. Several key factors drive the growth of the market. Increasing digital transformation across industries has heightened the need for businesses to ensure seamless and consistent customer experiences across multiple channels, including web, mobile, and contact centers. As customer expectations continue to rise, organizations prioritize proactive monitoring and testing of their digital platforms to identify performance bottlenecks, ensure service reliability, and enhance user satisfaction.

In addition, the growing adoption of advanced technologies such as artificial intelligence (AI) and automation enables businesses to conduct real-time monitoring and predictive analysis, further improving their ability to detect and resolve issues before they impact customers. Regulatory requirements for ensuring accessibility, data privacy, and service quality also contribute to the demand for comprehensive testing and monitoring solutions. Overall, the increasing emphasis on delivering superior customer experiences to drive customer retention and competitive differentiation is a primary factor propelling the expansion of this market.

The rapid pace of digital transformation across industries has significantly increased the need for robust customer experience testing and monitoring solutions. Organizations increasingly rely on digital platforms, including websites, mobile applications, and contact centers, to engage with customers, deliver services, and facilitate transactions. This shift has created a complex, omnichannel environment where customers expect consistent, seamless, and responsive experiences across all touchpoints. Ensuring such experiences requires continuous testing of digital platforms to identify potential functionality issues, performance bottlenecks, and inconsistencies in user experience. Consequently, businesses invest in advanced solutions that enable them to monitor customer journeys across channels, ensuring that every interaction meets the desired quality standards.

Customers' expectations for seamless, intuitive, and personalized interactions continue to rise as they become more digitally savvy. Customers are less tolerant of service disruptions, slow response times, or poorly designed interfaces, placing considerable pressure on organizations to deliver high-quality experiences at all times. This has driven increased demand for proactive monitoring and testing solutions that allow businesses to detect performance issues, predict potential failures, and resolve problems before they negatively affect customer experience. By leveraging these solutions, organizations can move from reactive to proactive service assurance, strengthening customer satisfaction, reducing churn, and enhancing their brand reputation in an increasingly competitive market.

Incorporating artificial intelligence (AI), machine learning (ML), and automation technologies significantly enhances the capabilities of customer experience testing and monitoring solutions. AI-powered tools can continuously analyze large volumes of data generated from customer interactions to detect anomalies, identify patterns, and provide predictive insights. Automation further streamlines testing processes by enabling repetitive tasks such as regression testing, load testing, and user journey simulations to be conducted with minimal manual intervention. The combined application of AI and automation allows organizations to identify potential issues faster, improve the accuracy of their testing processes, and accelerate their ability to adapt to changing customer needs and technological advancements.

In an increasingly saturated and competitive business environment, delivering superior customer experiences has become a key differentiator for organizations across sectors. Companies increasingly recognize that customer experience influences customer satisfaction, brand loyalty, and long-term retention. Businesses that can identify and address friction points, optimize user journeys, and deliver consistently high-quality experiences are better positioned to differentiate themselves from competitors. As a result, investments in customer experience testing and monitoring solutions are seen not only as a technical necessity but also as a strategic enabler for sustained business growth and competitive advantage.

Solution Insights

Monitoring solutions held the largest market share at over 86% in 2024. Monitoring solutions dominate the market because they provide real-time visibility into customer interactions, system performance, and service quality across digital platforms. Organizations increasingly rely on continuous monitoring to proactively detect performance degradation, service interruptions, or customer journey disruptions before they escalate into larger issues that impact end users. The ability to collect and analyze real-time data from various channels, including web, mobile, and contact centers, allows businesses to maintain service consistency and swiftly address emerging problems. In addition, the growing adoption of cloud-based services, complex digital ecosystems, and the need for omnichannel consistency have amplified the demand for comprehensive monitoring solutions that offer centralized control, rapid issue resolution, and predictive insights.

The testing solutions segment is expected to grow at a significant rate during the forecast period as businesses recognize the importance of preemptively evaluating their customer experience infrastructure to ensure reliability, performance, and scalability. With the growing complexity of customer engagement platforms, including mobile apps, contact centers, websites, and digital self-service tools, businesses are increasingly investing in testing solutions to identify potential issues before they impact end users. Testing solutions allow companies to simulate real-world customer interactions, assess system responsiveness under varying loads, and validate the performance of new features and updates. The rapid adoption of cloud platforms, AI-powered solutions, and digital transformation initiatives across industries further accelerates the demand for comprehensive customer experience testing solutions, driving significant growth in this segment.

Deployment Insights

The cloud-based deployment segment held the largest market share of over 44% in 2024. Cloud-based solutions currently dominate the market due to their scalability, flexibility, and cost-effectiveness, aligning with modern businesses' evolving needs. Organizations across industries are increasingly adopting cloud-based platforms to support their digital transformation initiatives, enabling them to rapidly deploy, update, and scale customer experience testing and monitoring capabilities without the need for significant infrastructure investments. The ability to access these solutions from anywhere, combined with seamless integration with cloud-hosted applications and services, further enhances their appeal. Moreover, cloud-based solutions facilitate real-time data collection, analysis, and reporting across multiple customer touchpoints, empowering businesses to gain comprehensive visibility into customer journeys and service performance.

The hybrid deployment segment is expected to grow at a significant rate during the forecast period, driven by the increasing need for organizations to balance flexibility with data security, compliance, and operational control. Businesses operating in highly regulated industries, such as healthcare, finance, and government, often face strict data sovereignty, privacy, and system reliability requirements, making fully cloud-based solutions less feasible. Hybrid solutions enable these organizations to retain sensitive data and critical testing environments on-premises while leveraging the cloud's scalability and advanced analytical capabilities for less sensitive workloads. In addition, hybrid solutions offer greater customization options, allowing businesses to tailor their testing and monitoring frameworks to meet specific operational requirements and technology environments. As organizations seek to modernize their IT ecosystems while maintaining control over core processes and data, adopting hybrid solutions is expected to continue rising, particularly among large enterprises with complex infrastructures.

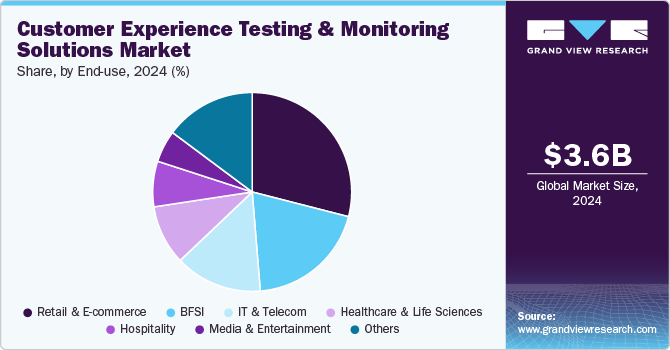

End Use Insights

The retail & e-commerce segment held the largest market share in 2024 due to its heavy reliance on digital platforms to drive customer engagement, sales, and loyalty. With consumers increasingly preferring online shopping and omnichannel experiences, retailers must ensure seamless performance across websites, mobile applications, social commerce platforms, and physical store integrations. Any disruptions, slow load times, or inconsistencies in user experience can directly impact customer satisfaction, sales conversions, and brand reputation. To meet these high customer expectations, retail and e-commerce businesses invest heavily in both real-time monitoring solutions to detect and resolve issues as they arise and in comprehensive testing tools to validate functionality, performance, and user experience across devices, geographies, and network conditions.

The hospitality segment is expected to grow at a significant CAGR during the forecast period, driven by the industry’s increasing focus on delivering personalized and seamless guest experiences across both digital and physical touchpoints. Hospitality businesses, including hotels, resorts, and travel service providers, are expanding their digital presence through websites, mobile apps, self-service kiosks, and online booking platforms, all requiring rigorous testing and continuous performance monitoring to ensure smooth and intuitive customer interactions. As guest expectations for frictionless digital experiences-from booking and check-in to personalized services during their stay-continue to rise, hospitality companies invest in technologies that proactively identify service gaps and optimize user experiences. In addition, the growing use of smart technologies, loyalty apps, and contactless services in the hospitality sector further amplifies the need for robust testing and monitoring solutions, contributing to the segment’s rapid growth.

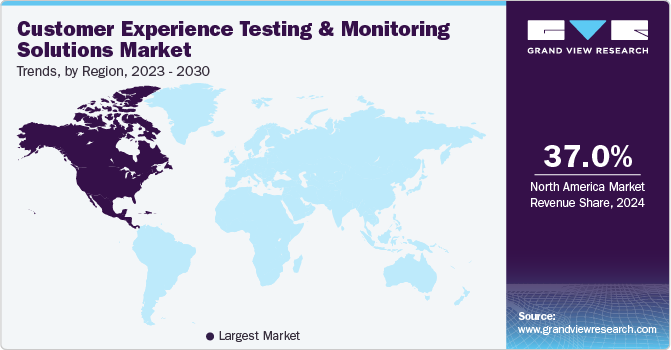

Regional Insights

North America customer experience testing and monitoring solutions industry held the major share globally of over 37% in 2024. The North American market is witnessing strong adoption of customer experience testing and monitoring solutions, driven by rapid digital transformation across industries such as retail, banking, healthcare, and telecommunications. Businesses in the region are increasingly focusing on omnichannel experience optimization and leveraging advanced technologies, including AI and predictive analytics, to proactively enhance service quality and user satisfaction.

U.S. Customer Experience Testing And Monitoring Solutions Market Trends

The customer experience testing and monitoring solutions industry in the U.S. is expected to grow significantly from 2025 to 2030. In the U.S., rising customer expectations, particularly in e-commerce, financial services, and media sectors, are driving demand for comprehensive testing and monitoring solutions. Organizations are emphasizing real-time customer journey monitoring, with a growing focus on integrating customer feedback into continuous experience improvement initiatives.

Europe Customer Experience Testing And Monitoring Solutions Market Trends

Europe's customer experience testing and monitoring solutions industry is growing significantly at a CAGR of over 29% from 2025 to 2030. In Europe, the market is driven by the increasing adoption of digital services across retail, travel, and public sectors, coupled with stringent regulatory requirements around service quality, accessibility, and data privacy. Businesses are prioritizing proactive experience management to comply with evolving standards and improve customer loyalty.

The UK customer experience testing and monitoring solutions industry is expected to grow rapidly in the coming years. The UK is seeing rising demand for customer experience testing and monitoring solutions as businesses accelerate their digital transformation strategies. Retailers, financial institutions, and telecommunications providers are investing in end-to-end experience monitoring, with a focus on optimizing mobile and e-commerce platforms to enhance customer retention and conversion rates.

The Germany customer experience testing and monitoring solutions industry held a substantial market share in 2024. In Germany, the market is influenced by the strong presence of technology-driven industries and the growing emphasis on delivering seamless digital experiences across manufacturing, automotive, and banking sectors. German businesses are adopting advanced testing frameworks and real-time monitoring tools to ensure service reliability and customer satisfaction, particularly in multi-channel environments.

Asia Pacific Customer Experience Testing And Monitoring Solutions Market Trends

The Asia Pacific's customer experience testing and monitoring solutions industry is growing significantly at a CAGR of over 30% from 2025 to 2030. The Asia Pacific region is experiencing rapid growth in customer experience testing and monitoring solutions due to the expanding digital economy, increasing mobile penetration, and growing demand for high-quality digital services. Organizations across sectors, including retail, telecom, and financial services, are actively investing in AI-powered solutions to monitor and enhance customer experiences in real time.

The China customer experience testing and monitoring solutions industry held a substantial share in 2024. In China, the market is driven by the massive growth of e-commerce, social commerce, and digital banking platforms, which has intensified competition and heightened the need for superior customer experiences. Companies are adopting AI and big data analytics to continuously monitor customer interactions and predict service issues to maintain high levels of satisfaction.

The Japan customer experience testing and monitoring solutions industry held a substantial share in 2024. In Japan, customer experience testing and monitoring solutions are gaining traction as businesses focus on enhancing customer satisfaction in highly service-oriented sectors such as retail, hospitality, and banking. There is growing interest in integrating advanced analytics, automation, and voice-of-customer data into experience management processes to align services with customer expectations.

India's customer experience testing and monitoring solutions industry is expanding rapidly. In India, the market is growing rapidly due to the proliferation of digital services, particularly in the e-commerce, fintech, and telecommunications sectors. Indian companies are increasingly adopting cloud-based testing and monitoring solutions to manage large-scale digital operations and ensure consistent experiences across diverse customer segments and regional markets.

Key Customer Experience Testing And Monitoring Solutions Company Insights

Key players operating in the market include Adobe, Genesys, HubSpot, IBM, Salesforce, SAP, SAS, and Verint Systems Inc. The key players focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In June 2024, Verint quietly acquired four AI-focused companies to strengthen its technology stack. These acquisitions include AI-powered analytics, cloud-based callback solutions, and data analytics technologies. While Verint has not publicly disclosed the names of these companies, these strategic moves aim to enhance its CX automation solutions.

-

In February 2024, Medallia introduced a new Generative AI Virtual Assistant designed to enhance customer service capabilities by enabling service agents to deliver faster and more personalized responses. The virtual assistant leverages Medallia’s vast customer experience data, combined with real-time interaction insights, to generate tailored responses that align with both the customer’s history and the organization’s preferred communication style. The solution aims to improve agent efficiency by reducing the time spent drafting responses, allowing agents to focus on higher-value interactions. By integrating customer feedback, behavioral data, and historical context, the virtual assistant supports more accurate and contextually relevant communication, ultimately contributing to enhanced customer satisfaction. This launch highlights Medallia’s ongoing commitment to leveraging advanced AI technologies to help organizations deliver superior customer experiences across all touchpoints.

Key Customer Experience Testing And Monitoring Solutions Companies:

The following are the leading companies in the customer experience testing and monitoring solutions market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- Genesys

- HubSpot

- IBM

- InMoment

- Medallia

- NICE Ltd.

- Oracle

- Qualtrics

- Salesforce

- SAP

- SAS

- StellaService

- Verint Systems Inc.

- Zendesk

Customer Experience Testing And Monitoring Solutions Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 4.12 billion |

|

Revenue forecast in 2030 |

USD 14.95 billion |

|

Growth Rate |

CAGR of 29.4% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Base Year |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Solution, deployment, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, UAE, Saudi Arabia, and South Africa |

|

Key companies profiled |

Adobe; Genesys; HubSpot; IBM; InMoment; Medallia; NICE Ltd.; Oracle; Qualtrics; Salesforce; SAP; SAS; StellaService; Verint Systems Inc.; and Zendesk |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Customer Experience Testing And Monitoring Solutions Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global customer experience testing and monitoring solutions market report based on solution, deployment, end use, and region.

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Testing Solutions

-

Usability Testing

-

Functional Testing

-

Performance Testing

-

Regression Testing

-

Others

-

-

Monitoring Solutions

-

Feedback Management

-

Customer Analytics

-

Customer Journey Analytics

-

Sentiment Analysis

-

Real-time Monitoring

-

Others

-

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud-Based

-

On-premise

-

Hybrid

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail & E-commerce

-

BFSI

-

IT & Telecommunications

-

Healthcare & Life Sciences

-

Hospitality

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global customer experience testing and monitoring solutions market size was estimated at USD 3.58 billion in 2024 and is expected to reach USD 4.12 billion by 2025.

b. The global customer experience testing and monitoring solutions market is expected to grow at a compound annual growth rate of 29.4% from 2025 to 2030 to reach USD 14.95 billion by 2030.

b. The monitoring solutions segment accounted for the largest revenue share of over 86% in 2024. Monitoring solutions dominate the customer experience testing and monitoring solutions market because they provide real-time visibility into customer interactions, system performance, and service quality across digital platforms.

b. The key players operating in the customer experience testing and monitoring solutions market include Adobe, Genesys, HubSpot, IBM, InMoment, Medallia, NICE Ltd., Oracle, Qualtrics, Salesforce, SAP, SAS, StellaService, Verint Systems Inc., and Zendesk.

b. The market growth is driven by the iIncreasing digital transformation across industries and the rising complexity of IT environments and the growing adoption of advanced technologies such as artificial intelligence (AI) and automation enables businesses to conduct real-time monitoring and predictive analysis.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."