- Home

- »

- Next Generation Technologies

- »

-

Customer Experience BPO Market, Industry Report, 2033GVR Report cover

![Customer Experience Business Process Outsourcing Market Size, Share & Trends Report]()

Customer Experience Business Process Outsourcing Market (2025 - 2033) Size, Share & Trends Analysis Report By Service Type (Inbound, Outbound), By Outsourcing Type (Onshore, Offshore, Nearshore), By Support Channel, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-191-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Customer Experience BPO Market Summary

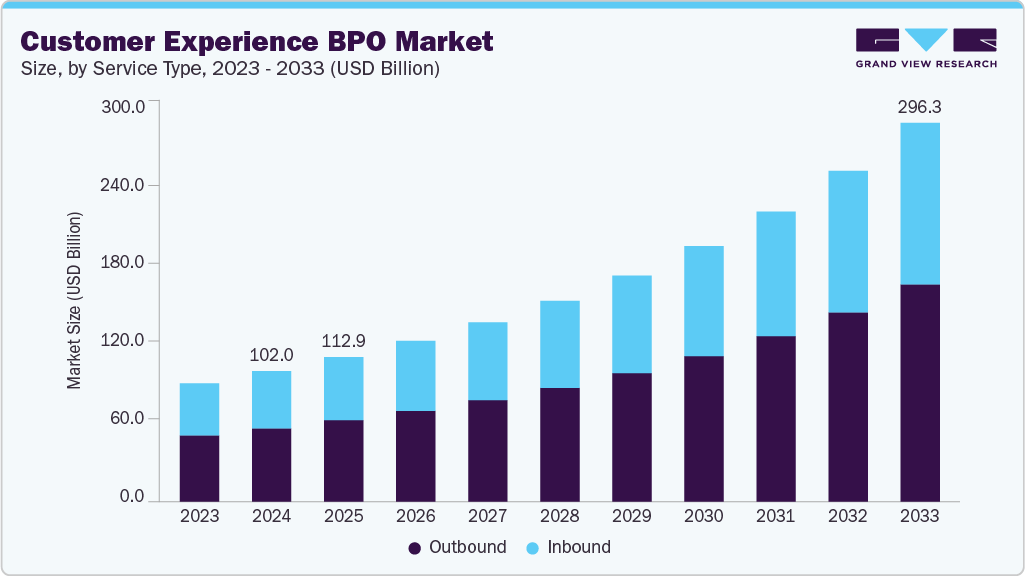

The global customer experience business process outsourcing market size was estimated at USD 102.03 billion in 2024 and is projected to reach USD 296.29 billion by 2033, growing at a CAGR of 12.8% from 2025 to 2033. The adoption of cost-effective, cloud-based customer experience (CX) BPO services has seen substantial growth worldwide.

Key Market Trends & Insights

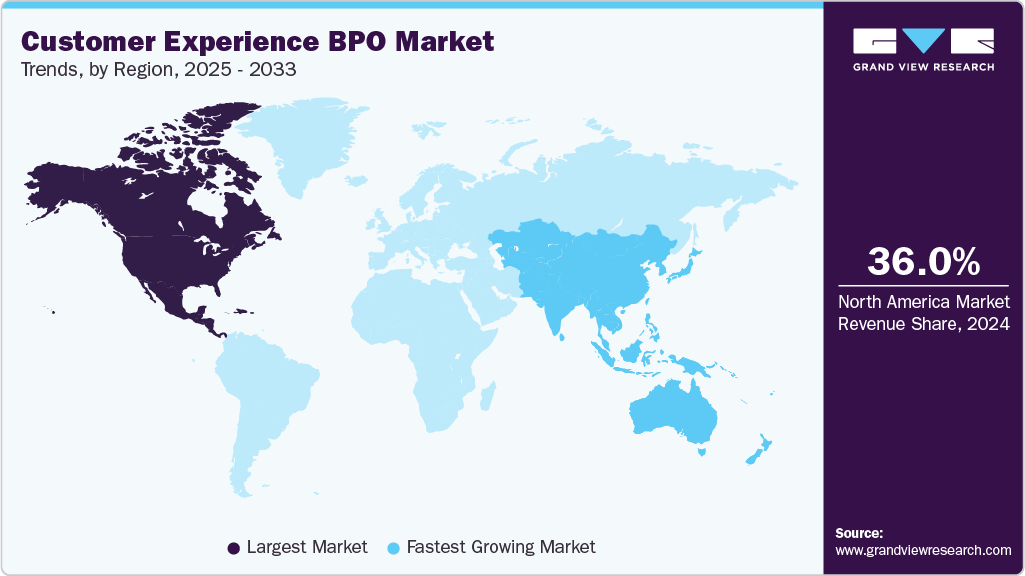

- North America customer experience BPO market dominated the global industry with the largest revenue share of 36.0% in 2024.

- The customer experience BPO market in U.S. is expected to grow significantly over the forecast period.

- By service type, outbound segment led the market and held the largest revenue share of 56.1% in 2024.

- By outsourcing type, the offshore segment held the dominant position in the market and accounted for the largest revenue share in 2024.

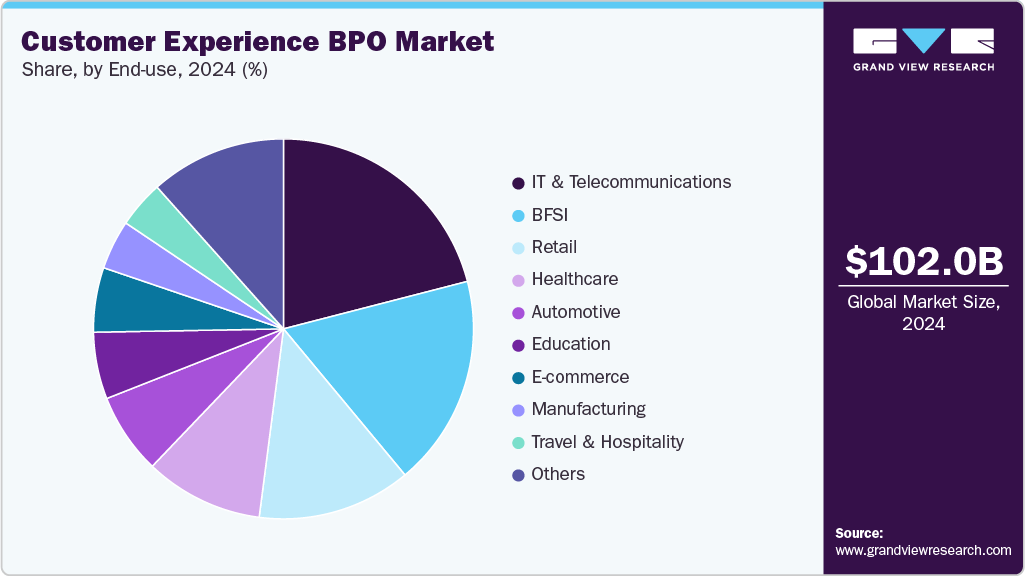

- By end use, the e-commerce segment is expected to grow at the fastest CAGR from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 102.03 Billion

- 2033 Projected Market Size: USD 296.29 Billion

- CAGR (2025-2033): 12.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

These services help organizations avoid the high capital costs usually linked to on-premises infrastructure such as hardware, software, and physical systems. Cloud-based CX BPO providers offer dependable, flexible, and on-demand resource management, helping companies reduce operational expenses, minimize capital investments, and enhance financial agility. These advantages are key contributors to the expanding market for cloud-based CX solutions.In addition, there is a rising demand for automated customer service solutions as businesses look to reduce human involvement and operational costs while still enhancing the customer experience. The integration of technologies such as artificial intelligence (AI), machine learning (ML), and cloud computing is enabling companies to deliver more personalized and efficient customer support. For example, AI-powered chatbots connected to social media platforms allow users to resolve common issues independently. This growing need for automation is further fueling the global demand for AI-enhanced CX BPO services.

Advancements in technology are reshaping how businesses interact with customers. Tools such as real-time self-service and AI-driven support are delivering considerable value to organizations. Moreover, shifting consumer expectations-particularly the preference for live chat and mobile messaging-are accelerating the automation of customer service processes. For instance, in October 2024, ibex, a U.S.-based company in business process outsourcing (BPO) and AI-powered customer experience solutions, has entered into a strategic partnership with Parloa, a provider of generative AI automation technologies. This collaboration aims to strengthen ibex’s customer engagement offerings by integrating Parloa’s advanced AI capabilities, enabling more efficient and intelligent automation across client interactions. The partnership reflects both companies’ commitment to leveraging cutting-edge technology to transform customer service operations.

Service Type Insights

The outbound segment dominated the market and accounted for the revenue share of 56.1% in 2024, driven by the increasing demand for proactive customer engagement strategies. Businesses are leveraging outbound CX BPO services to conduct lead generation, sales outreach, market surveys, appointment scheduling, and customer retention campaigns. The shift from traditional telemarketing to more personalized and data-driven outreach, powered by predictive analytics and CRM integrations, is enhancing the effectiveness of outbound interactions.

The inbound segment is anticipated to grow at a significant CAGR during the forecast period. The increasing use of digital platforms for purchasing and service inquiries has led to a surge in incoming customer interactions, particularly in sectors such as e-commerce, BFSI, telecommunications, and travel. Inbound CX BPO services are being enhanced with technologies like AI-powered IVR systems, natural language processing (NLP), and live chat support to deliver seamless, faster, and more context-aware responses.

Outsourcing Type Insights

The offshore segment dominated the market and accounted for the largest revenue share in 2024 due to the significant cost advantages it offers to businesses in developed economies. By outsourcing CX operations to countries with lower labor costs, companies can achieve substantial savings without compromising service quality. Additionally, offshore destinations like India, the Philippines, and South Africa boast large pools of skilled, English-speaking professionals and well-established BPO infrastructures.

The nearshore segment is expected to grow at the fastest CAGR during the forecast period. Businesses based in North America and Western Europe often choose nearshore partners in Latin America and Eastern Europe, respectively, to benefit from easier collaboration, reduced language barriers, and quicker issue resolution. Proximity also enables more frequent site visits and better oversight, which helps maintain quality control and compliance with regulations.

Support Channel Insights

The voice segment dominated the market and accounted for the largest revenue share in 2024. The advancement of voice analytics, speech recognition, and sentiment analysis is enhancing the quality of interactions and enabling real-time performance monitoring. Additionally, investments in accent neutralization, multilingual support, and training for empathetic communication are helping BPO providers deliver high-quality voice services across global markets. The ability of voice support to build trust and foster customer loyalty remains a core driver of its sustained demand.

The non-voice segment is expected to grow at a highest CAGR during the forecast period. As consumers increasingly use chat, email, social media, and self-service portals, companies are investing in non-voice CX BPO solutions to manage these channels efficiently. Technologies like AI-powered chatbots, automated ticketing systems, and machine learning-based response generation are improving speed and accuracy in query resolution.

End-use Insights

The IT & telecommunications segment dominated the market and accounted for the largest revenue share in 2024, driven by the high service complexity and demand for continuous customer support. Telecom operators and IT service providers often deal with large customer bases requiring assistance with technical issues, billing queries, service activations, and network outages. This drives the need for both inbound and outbound BPO services to ensure seamless service delivery and minimize churn.

The e-commerce segment is expected to grow at a significant CAGR over the forecast period due to the high volume and velocity of customer interactions it generates. As online retail expands, especially in emerging markets, businesses face increasing pressure to provide real-time support for order inquiries, delivery updates, returns, refunds, and product recommendations. E-commerce players are relying heavily on CX BPO providers to manage omnichannel customer support across platforms like live chat, mobile apps, social media, and email.

Regional Insights

North America customer experience business process outsourcing market dominated the global market with the largest revenue share of 36.0% in 2024 driven by widespread digital transformation and the increasing adoption of omnichannel engagement strategies. Businesses across sectors are integrating advanced analytics, AI-based automation, and cloud CX platforms to enhance responsiveness and customer satisfaction. Additionally, the growing focus on customer retention and experience personalization is encouraging companies to outsource complex CX functions to specialized BPO providers, boosting demand for high-end, tech-integrated outsourcing solutions

U.S. Customer Experience Business Process Outsourcing Market Trends

The customer experience BPO market in the U.S. is expected to grow significantly at a CAGR of 11.7% from 2025 to 2033. The proliferation of high-touch industries such as banking, insurance, and healthcare, with strict service-level expectations-drives outsourcing for quality, compliance, and cost efficiency. Furthermore, BPO firms offering value-added services like advanced CRM integration, agent performance analytics, and compliance monitoring are gaining significant traction in the U.S. market.

Europe Customer Experience Business Process Outsourcing Market Trends

The customer experience BPO market in Europe is anticipated to register considerable growth from 2025 to 2033 due to the increasing regulatory complexities, multilingual customer bases, and the need for localized customer engagement. Companies operating across multiple EU countries seek CX BPO providers that can deliver standardized services while complying with data privacy regulations like GDPR.

The UK customer experience business process outsourcing market is expected to grow rapidly in the coming years, owing to post-Brexit market adjustments and a strong fintech and e-commerce ecosystem. Companies are outsourcing CX functions to remain agile amid labor shortages and cost pressures while ensuring seamless service delivery to domestic and international customers. Additionally, the push for customer-centric digital transformation in sectors like retail, public services, and telecom is accelerating the demand for AI-enabled and cloud-based CX solutions.

The customer experience business process outsourcing market in Germany held a substantial market share in 2024 driven by its strong manufacturing and industrial base, where B2B and B2C firms require technical support and multilingual services. The German emphasis on quality, efficiency, and precision has encouraged BPO providers to develop high-skill CX centers offering tech support, warranty services, and product-related assistance.

Asia Pacific Customer Experience Business Process Outsourcing Market Trends

Asia Pacific held a significant share in the global market in 2024, driven by, due to a large, cost-effective workforce, rapid urbanization, and increasing internet and mobile penetration. Emerging economies like India, the Philippines, and Vietnam are key outsourcing hubs, offering multilingual and 24/7 service capabilities.

The Japan customer experience business process outsourcing market is expected to grow rapidly in the coming years due to its aging population and the growing need for personalized and tech-supported customer engagement in sectors like insurance, healthcare, and consumer electronics. Japanese companies are increasingly outsourcing CX tasks to handle rising service complexity while overcoming domestic labor shortages.

The customer experience business process outsourcing market in China held a substantial market share in 2024, due to the growing digital economy and the rise of large-scale domestic tech and e-commerce companies. These enterprises demand agile and scalable customer support operations to manage massive user bases and real-time service needs. The government's emphasis on AI and smart infrastructure is also encouraging domestic BPO providers to develop AI-driven contact center solutions.

Key Customer Experience Business Process Outsourcing Company Insights

Key players operating in the customer experience business process outsourcing industry are Teleperformance, Concentrix Corporation, Accenture, IBM Corporation, and WNS (Holdings) Ltd. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2025, Concentrix Corporation introduced iX Hero, a new agentic AI-powered application designed to enhance customer experience by working alongside human agents. The solution addresses key challenges in customer service, enabling faster resolutions and support for both simple and complex inquiries. iX Hero aims to improve efficiency and elevate service quality through seamless collaboration between AI and human expertise.

-

In February 2025, Teleperformance entered into a strategic partnership with Sanas, a U.S.-based company in real-time speech understanding technology. As part of the collaboration, TP will serve as the exclusive reseller of Sanas' solutions to major global brands across diverse industries. The two companies aim to also work jointly to develop and refine Sanas’ speech understanding model. This alliance aligns with TP’s broader strategy to enhance its AI capabilities through proprietary innovation and strategic partnerships.

Key Customer Experience Business Process Outsourcing Companies:

The following are the leading companies in the customer experience BPO market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Automatic Data Processing, Inc.

- Cognizant

- Concentrix Corporation

- Firstsource

- Fusion CX

- Genpact

- Infosys

- IBM Corporation

- TATA Consultancy Services Limited

- Teleperformance

- TELUS Digital

- Unity Communications

- Wipro

- WNS (Holdings) Ltd.

Customer Experience Business Process Outsourcing Market Report Scope

Report Attribute

Details

Market size in 2025

USD 112.97 billion

Revenue forecast in 2033

USD 296.29 billion

Growth rate

CAGR of 12.8% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Service type, outsourcing type, support channel, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Singapore; Malaysia; Indonesia; Philippines; Thailand; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Accenture; Automatic Data Processing, Inc.; Cognizant; Concentrix Corporation; Firstsource; Fusion CX; Genpact; Infosys; IBM Corporation; TATA Consultancy Services Limited; Teleperformance; TELUS Digital; Unity Communications; Wipro; WNS (Holdings) Ltd.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Customer Experience BPO Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the customer experience business process outsourcing market report based on service type, outsourcing type, support channel, end-use, and region.

-

Service Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Inbound

-

Outbound

-

-

Outsourcing Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Onshore

-

Offshore

-

Nearshore

-

-

Support Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Voice

-

Non-voice

-

Chats

-

Email

-

Others

-

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Automotive

-

BFSI

-

Healthcare

-

Manufacturing

-

Media & Entertainment

-

IT & Telecommunications

-

Education

-

Retail

-

Travel & Hospitality

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Singapore

-

Malaysia

-

Indonesia

-

Philippines

-

Thailand

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global customer experience business process outsourcing market size was estimated at USD 102.03 billion in 2024 and is expected to reach USD 112.97 billion by 2024.

b. The global customer experience business process outsourcing market is expected to grow at a compound annual growth rate of 12.8% from 202 to 2033 to reach USD 296.29 billion by 2033.

b. The outbound segment dominated the market and accounted for the revenue share of 56.1% in 2024, driven by the increasing demand for proactive customer engagement strategies. Businesses are leveraging outbound CX BPO services to conduct lead generation, sales outreach, market surveys, appointment scheduling, and customer retention campaigns.

b. Key players operating in the customer experience BPO market are Accenture, Automatic Data Processing, Inc., Cognizant, Concentrix Corporation, Firstsource, Fusion CX, Genpact, Infosys, IBM Corporation, TATA Consultancy Services Limited, Teleperformance, TELUS Digital, Unity Communications, Wipro, WNS (Holdings) Ltd.

b. Customer experience business process outsourcing is experiencing significant growth, owing to the adoption of cost-effective, cloud-based customer experience (CX) BPO services. These services allow organizations to avoid the high capital costs typically associated with on-premises infrastructure, such as hardware, software, and physical systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.