Customer Data Platform Market Size, Share & Trends Analysis Report By Component, By Enterprise Size, By Deployment, By Type (Analytics, Campaign, Access), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-594-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Customer Data Platform Market Trends

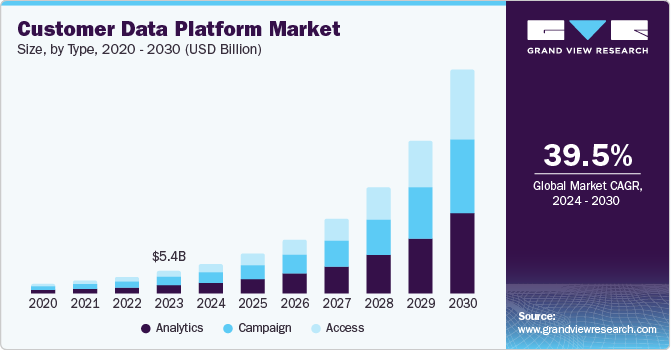

The global customer data platform market size was valued at USD 5.37 billion in 2023 and is projected to grow at a CAGR of 39.5% from 2024 to 2030. The increasing demand for effective analytics to determine consumer behavioral trends is the primary factor driving market growth. The growing inclination towards Al-driven unified and personalized data management solutions and services has also contributed to the development of this industry in recent years.

The market is driven by the activities included in the primary focus of CDP platforms, such as collecting data, resolving unified customer profiles, pulling insights from gathered data, and facilitating the management of complex data. The increased customer engagement using several tools such as blogs, social media platforms, promotional websites, and e-commerce websites has also enabled companies to gain valuable insights related to consumer behavior.

These observations assist the major market participants in understanding evolving customer preferences to cope with the market's competitive environment. Organizations actively establish better connections with consumers and offer personalized products. It encourages organizations to invest in customer data platforms that enable continuous customer engagement and provide unified consumer profiles.

Furthermore, rising digital engagement and various digital platforms are considered key points of contact, and they generate vast amounts of data, encouraging businesses to adopt CDP solutions. CDPs offer access to extensive data assets by utilizing data management features such as identity resolution and unification. Moreover, CDP solutions also help adhere to compliance standards and manage data governance, mainly through strict regulations such as the Central Consumer Protection Authority (CCPA) and the General Data Protection Regulation (GDPR).

These solutions provide customer data that can be used for strategic marketing and decision-making. Growing dependence on data, increasing demand for reliable and actionable data assets, and unceasing opportunities developed in multiple industries with increasing digitization and technology use are expected to generate greater demand for the customer data platform market.

Component Insights

Based on components, CDP solutions segment dominated the industry and accounted for the largest revenue share of 63.3% in 2023. This growth is attributed to increasing demand for data management solutions. The benefits of CDP solutions, such as customer data unification, predictive scoring, segmentation to identify and target audiences, and others, are helpful for marketers to know the customers' buying patterns, which are the key factors driving the demand for CDP solutions. Also, CDP provides insightful customer analytics to organizations, facilitating decision-making processes related to product development, marketing, sales, and more, encouraging companies to adopt CDP solutions.

CDP services segment is expected to experience the fastest CAGR during the forecast period. Some of the CDP services include integration & deployment, support & maintenance, and training & consulting. CDPs are essential in merging various kinds of customer data and forming a precise single-customer perspective with the help of automated data integration & deployment, which develops high data clarity while enhancing marketing efficiencies of the organizations. Therefore, CDP's abilities to enhance customer experience, facilitate the elevation of marketing strategies, improve data privacy, and assist in accomplishing measurable business growth are contributing to the rising demand for CDP services.

Enterprise Size Insights

The large enterprise segment accounted for the largest revenue share in 2023. These businesses are often equipped with the capacity to expand multiple functions and segments by leveraging the benefits of customer data platforms. With machine learning and artificial intelligence (AI) integration, large enterprises are developing expertise in customer behavior predictions, enhanced personalization of products & services, and increased customer engagements driven by well-determined marketing campaigns. Moreover, CDP also helps maintain data privacy regulations and provides a framework for compliance.

Small and medium-sized enterprises (SMEs) are projected to grow at the fastest CAGR during 2024 to 2030. The market is driven by the increasing digitization of operations and SMEs' growing adoption of cloud CDP services. Cloud-based CDP solutions that provide scalable data management services without requiring significant upfront investments in infrastructure are particularly generating greater engagement among SMEs. The competitive advantage offered by the CDP solutions and services enables SMEs to develop enhanced abilities to thrive while new entrants and existing companies use their respective positioning. CDPs' improved insights regarding consumer behavioral patterns empower SMEs to generate well-targeted marketing campaigns.

Deployment Insights

The cloud deployment segment dominated the global industry in 2023. Cloud-based CDPs offer built-in connectors to Customer Relationship Management (CRM) systems, databases, marketing automation platforms, and personalization engines, offering leverage to marketing teams to react rapidly according to changes in customer behavior. The cloud environment allows organizations without sophisticated infrastructure and expertise to implement robust data management systems without heavy investments. Moreover, rising technological advancements encourage vendors to integrate machine learning (ML) and software as a service (SAAS) with cloud CDP to design new software. For instance, Cloudera, a company specializing in hybrid data solutions, introduced the Cloudera Data Platform (CDP) One, an all-in-one data lakehouse software as a service (SaaS) that provides quick and straightforward self-service analytics and exploration of various data types.

The on-premise deployment segment is anticipated to experience a significant CAGR over the forecast period. The increasing inclination towards maximum customization to fulfill evolving customer demands contributes to the rising adoption of on-premises CDP solutions. Moreover, unlike cloud CDPs, CDPs that are deployed on-premise store data in an organization's data centers or servers and do not need a third-party provider. Companies that prefer complete data control and minimized data theft risks tend to adopt on-premise CDP deployment.

Type Insights

The analytics segment accounted for the largest revenue share in 2023. The demand for analytics platforms is attributed to benefits such as the automation of consumer profiles depending on the customer life cycle journey. Furthermore, this platform helps automatically generate profiles using personalized modeling and machine learning technology, depending on segregation parameters, for customized marketing. Rising dependency on data-driven decision-making capabilities of business and growing complexities in customer engagement through multiple channels are primarily influencing the demand for this segment.

The access segment is anticipated to experience the fastest CAGR over the forecast period. This growth is attributed to the rising importance of collecting data through various channels such as customer feedback forms and surveys, email newsletters, blog subscriptions, and others to develop detailed customer profiles, enhance message timing and targeting, and examine customer behavior at individual levels across time. Moreover, some companies introduce omnichannel customer engagement platforms to access large amounts of data.

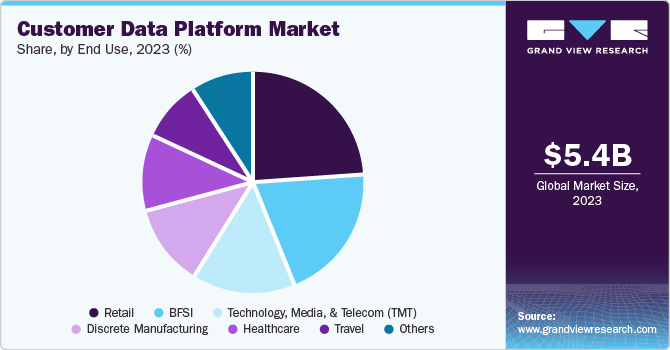

End Use Insights

The retail segment accounted for the largest market revenue share in 2023. The growing need for businesses to engage a more extensive customer base and enhance shopping experiences drives the growth of this segment. CDP solutions assist retailers with implementing personalized follow-up strategies such as re-engaging customers via rewards and email reminders, enhancing average order value, retaining customers, ensuring loyalty, and attaining marketing efficiency by delivering relevant ad campaigns. These aspects are expected to generate greater demand for CDPs in the retail domain.

The travel segment is anticipated to register the fastest CAGR over the forecast period. The increasing inclination towards rising digital interactions and cutting-edge competition for long-term customer loyalty is expected to drive market expansion during the forecast period. The exclusive abilities of CDP solutions to unlock a unified customer view, encourage organizations to customize their offerings, contribute to increased customer engagement, and boost revenue growth are preferred over other data management software, resulting in the continuous development of the travel and tourism industry.

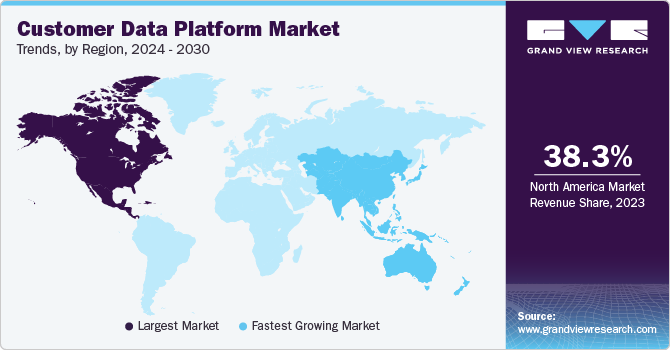

Regional Insights

North America customer data platform market dominated the global industry with a revenue share of 38.3% in 2023. The growth of the region is attributed to the presence of prominent vendors and providers of CDP as a sub-product. Furthermore, the marketers and brands in the region have been some of the early adopters of CDPs. The e-commerce industry in North America is growing quickly, and CDPs assist e-commerce companies in analyzing online customer behavior, customizing product recommendations, and improving the buying experience. The rapid adoption of innovative technology, such as cloud computing and marketing automation, is fueling the growth of the CDP market in the region.

U.S. Customer Data Platform Market Trends

The U.S. customer data platform market dominated the regional industry in 2023. This is attributed to presence of significant market players with higher market shares and increasing investments in CDP. The growing adoption of CDPs is driven by the increasing customer base gathered by the e-commerce industry in the country. According to The Census Bureau of U.S. Department of Commerce, retail e-commerce sales estimate for the first quarter of 2024 in the U.S. was USD 289.2 billion, which accounted for 2.1% of increase since fourth quarter of year 2023. Advantages offered by CDPs such as enhanced consumer insight offerings and effective assistance in developing efficient market strategies have developed greater demand for this market in recent years.

Europe Customer Data Platform Market Trends

Europe customer data platform market was identified as a lucrative region in 2023. Countries in Europe such as France, Germany, and the UK, are experiencing substantial expansion in the CDP market. Stringent data privacy regulations such as GDPR have significant effects on the European market. European businesses are inclined towards adoption of CDPs that offer robust data governance and client consent management features.

The UK customer data platform market is expected to grow rapidly in the approaching years. This market is primarily driven by the increasing adoption of CDP solutions due to its numerous benefits in expanding businesses with access to large amounts of customer data, enabling them to customize their offerings. Also, the CDP solution ensures compliance with GDPR mandates and helps organizations in prevention of the related complications. The entry of multiple e-commerce businesses, growing expansions of domestic businesses, availability of vast data, and increasing dependence on data driven decision making capabilities of organizations is expected to fuel growth for this market during forecast period.

Asia Pacific Customer Data Platform Market Trends

Asia Pacific customer data platform market is anticipated to witness the fastest growth during the forecast period. Emergence of this region as one of the key market for online business industry has driven the growth for CDPs solutions and services market in the region. Entry multiple global businesses, growing use of smartphones, enhanced accessibility & availability of internet, unceasing growth in population, rising disposable income levels and few more demographic factors have influenced consumer behavioral patterns in the region. This is expected to develop growing demand for advanced CDP solutions during forecast period.

China customer data platforms market held a substantial market share in 2023. As numerous Chinese enterprises embraced digital transformation, vast amounts of data has been generated in recent years. This has led to growing need of efficient data management tools and technologies such as CDPs. Continuously evolving consumer behavior and trends in customer inclination and preferences are generating the need for the adoption of CDP solutions by organizations.

Key Customer Data Platform Company Insights

Some of the key companies in the customer data platform market include Oracle, Salesforce, Inc., ActionIQ., Adobe, Acquia, Inc., Ascent360, and others. The presence of multiple CDP vendors in the market, leads to fragmentation, as they work to utilize various advanced technologies for a competitive advantage. Established CDP vendors are forming strategic partnerships with technology and service providers to enhance their current platform.

-

Oracle, a prominent company in the information technology and data industry, specializes in developing and commercializing well-known Oracle database software and database management systems. The company also offers the Oracle Unity Customer Data Platform to enhance customer experiences across sales, services, marketing, and commerce.

-

Salesforce, Inc., a major market participant in technology industry, specializes in cloud-based software services, including Salesforce Data Cloud, a customer data platform that allows marketing organizations to have complete access to customer data. The company focuses on enhancing the user experience by providing cloud solutions to assist other organizations' marketing, sales, and services departments.

Key Customer Data Platform Companies:

The following are the leading companies in the customer data platform market. These companies collectively hold the largest market share and dictate industry trends.

- ActionIQ.

- Adobe

- Acquia, Inc.

- Ascent360

- BlueConic

- CHEQ AI Technologies Ltd. (Ensighten)

- Lytics, Inc.

- mParticle, Inc.

- NGDATA N.V.

- Oracle

- Salesforce, Inc.

- SAP

- Twilio Inc. (Segment)

- TEALIUM

Recent Developments

-

In July 2024, Tealium, signed a worldwide multi-year Strategic Collaboration Agreement (SCA) with Amazon Web Services (AWS), aiming to speed up customer data and artificial intelligence (AI) advancement, particularly in its specific vertical offerings for highly-regulated industries. This collaboration is anticipated to accelerate the customer data solutions offered by Tealium, leveraged by AWS’ scalable and secure cloud infrastructure.

Customer Data Platform Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 7.06 billion |

|

Revenue forecast in 2030 |

USD 51.95 billion |

|

Growth Rate |

CAGR of 39.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

October 2024 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, enterprise size, deployment, type, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, South Arabia, UAE, South Africa |

|

Key companies profiled |

ActionIQ; Adobe; Acquia, Inc.; Ascent360; BlueConic; CHEQ AI Technologies Ltd. (Ensighten); Lytics, Inc.; mParticle, Inc.; NGDATA N.V.; Oracle; Salesforce, Inc.;SAP; Twilio Inc. (Segment);TEALIUM |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Customer Data Platform Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the customer data platform market report based on component, enterprise size, deployment, type, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

Integration & Deployment

-

Support & Maintenance

-

Training & Consulting

-

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premises

-

Cloud

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Analytics

-

Campaign

-

Access

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

BFSI

-

Technology, Media, & Telecom (TMT)

-

Travel

-

Healthcare

-

Discrete Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Arabia

-

UAE

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."