- Home

- »

- Healthcare IT

- »

-

Customer Communication Management Software In Healthcare Market Report, 2030GVR Report cover

![Customer Communication Management Software In Healthcare Market Size, Share & Trends Report]()

Customer Communication Management Software In Healthcare Market Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-338-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

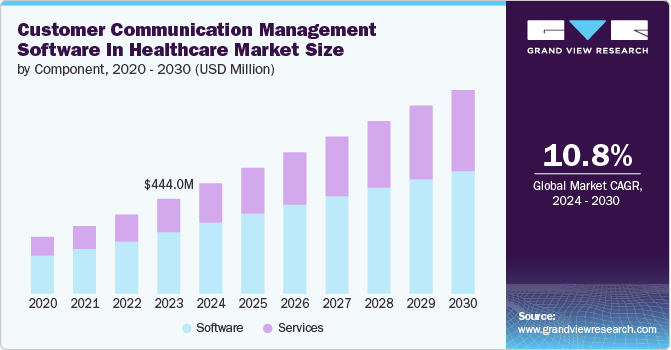

The global customer communication management software in healthcare market size was estimated at USD 444.0 million in 2023 and is projected to grow at a CAGR of 10.8% from 2024 to 2030. This is driven by the increasing emphasis on patient engagement and satisfaction has prompted healthcare providers to adopt CCM solutions to enhance communication with patients.

For instance, in September 2022, Smart CommunicationsTM announced enhanced integration with Duck Creek, an insurance platform. These additional connectors will assist insurance companies in meeting the digital preferences of their policyholders by facilitating personalized, interactive conversations and scalable digital experiences. These software systems facilitate personalized interactions through various channels, improving patient experience and loyalty. In addition, advancements in AI and machine learning are enabling customer communication management (CCM) software to offer predictive analytics and personalized communication strategies, further fueling market growth.

CCM software plays a crucial role in enhancing patient engagement and satisfaction by enabling personalized and timely communication. Healthcare organizations utilize these platforms to send appointment reminders, deliver lab results securely, and provide educational content tailored to individual patient needs. By fostering proactive communication and addressing patient queries promptly, CCM software helps improve patient outcomes and overall satisfaction levels. Furthermore, the ability of these platforms to integrate with electronic health records (EHR) systems ensures seamless information exchange, enhancing care coordination and patient-provider relationships.

In addition,advancements in AI, machine learning, and natural language processing are transforming CCM software capabilities, making them more intelligent and adaptive. AI-powered features enable predictive analytics to anticipate patient needs, automate responses, and personalize communication strategies based on behavioral patterns and preferences. Moreover, innovations such as chatbots and virtual assistants integrated into CCM platforms enhance patient interaction by providing real-time assistance and support. For instance, in June 2024, Heygent Dental AI introduced its new Conversational Dental AI Receptionist software. This patient engagement and communication platform utilizes advanced AI technology, developed entirely with state-of-the-art software capabilities. As technology continues to evolve, CCM software in healthcare is poised to become increasingly sophisticated, driving improved patient engagement, operational efficiency, and overall healthcare delivery outcomes.

Furthermore, the ongoing digital transformation in healthcare is driving the adoption of CCM software to streamline operational processes and improve efficiency. These software solutions automate routine communication tasks, such as appointment scheduling and billing notifications, reducing administrative burdens and freeing up staff to focus on patient care. Integrated CCM platforms enable seamless communication across multiple channels, including email, SMS, and patient portals, enhancing communication effectiveness and operational agility. By centralizing communication workflows and leveraging analytics-driven insights, healthcare organizations can achieve cost savings, optimize resource allocation, and deliver more personalized care experiences.

Component Insights

The software segment held the largest revenue share of 65.0% in 2023, driven by continuous innovation and the introduction of new products tailored to enhance patient engagement and operational efficiency. Innovations include AI-driven CCM platforms that offer predictive analytics to personalize patient communications and automate workflows.

Recent advancements have seen the integration of chatbots and virtual assistants into CCM software, improving responsiveness and enhancing patient interactions. For instance, in July 2022, Brightree introduced Brightree Digital Experience, a suite of new software tools designed to enhance and streamline the patient experience. These tools enable providers to automate and coordinate text and email outreach to keep patients informed, facilitate electronic documentation and signature collection, and offer video chat capabilities for virtual patient support. These innovations not only streamline administrative tasks such as appointment scheduling and billing but also ensure that healthcare providers deliver timely and personalized communication to improve overall patient care and satisfaction.

The services segment is projected to grow at the fastest CAGR from 2024 to 2030, driven by the demand for user-friendly and cost-effective solutions. For instance, in October 2023, Newgen Software, a global provider of digital transformation solutions, collaborated with Duck Creek Technologies, a leader in property and casualty insurance solutions. Together, they launched a platform aimed at insurers, facilitating seamless information flow across front-office, middle-office, and back-office operations. This partnership accelerates application development and enhances the end-to-end customer journey within the insurance sector. These services offer intuitive interfaces and simplified workflows, making them accessible even for non-technical users.

Additionally, the economic benefits of CCM services are significant, as they reduce administrative costs and improve operational efficiency. By automating patient communications and streamlining processes such as appointment reminders and billing notifications, healthcare providers can focus more on patient care, ultimately enhancing patient satisfaction and outcomes while maintaining budget-friendly operations.

Deployment Insights

The cloud-based segment held the largest share of 65.5% in 2023, driven by the need for flexible, scalable, and accessible solutions. Recent launches highlight this trend by offering healthcare providers enhanced features, including real-time updates and secure data storage. For instance, In October 2022, Smart Communications, a tech company and Premier Guidewire PartnerConnect Solution partner, showcased cloud strategies for insurers with AWS.

As cloud adoption accelerates, insurers benefit from integrated, scalable, and adaptable ecosystems, enhancing competitive advantage through advanced applications like Guidewire and Smart Communications. These cloud-based platforms enable seamless integration with existing systems, ensuring that patient interactions are managed efficiently and effectively. The ease of access and robust security measures make cloud-based CCM an attractive option for healthcare providers looking to improve patient engagement and care coordination.

The hybrid segment is projected to grow at fastest CAGR from 2024 to 2030.Key factors driving this expansion include the need for seamless integration of on-premise and cloud-based systems, ensuring flexibility and data security. Hybrid solutions offer healthcare providers the ability to manage patient communications efficiently while maintaining compliance with stringent data protection regulations. Additionally, the scalability and cost-effectiveness of hybrid CCM make it an attractive choice for healthcare organizations aiming to enhance patient engagement and operational efficiency.

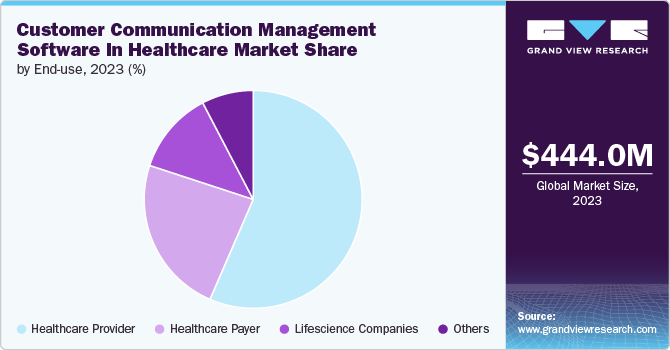

End Use Insights

The healthcare provider segment held the largest share of 56.5% in 2023. This expansion is driven by the increasing demand for efficient patient communication and engagement tools. CCM software helps healthcare providers streamline administrative tasks, such as appointment scheduling, reminders, and follow-up communications, thereby improving operational efficiency and patient satisfaction. The integration of advanced features like automated workflows, secure messaging, and real-time analytics further enhances the appeal of CCM solutions. Additionally, the push towards digital transformation in healthcare and the necessity for compliance with regulatory standards like HIPAA contribute to the growing adoption of CCM software among healthcare providers.

The lifescience companies segment is expected to grow at a significant CAGR from 2024 to 2030. The increasing complexity of regulatory requirements and the need for compliance with standards like HIPAA and GDPR necessitate the adoption of robust communication management solutions, driving the segmental growth. Life sciences companies are investing heavily in CCM software to enhance communication with stakeholders, streamline clinical trial processes, and ensure efficient patient recruitment and retention. Moreover, the integration of advanced technologies such as AI and machine learning into CCM platforms provides predictive analytics and personalized communication strategies, further fueling market growth. Significant investments in research and development and strategic partnerships are also contributing to the expansion of CCM software adoption in the life sciences sector.

Regional Insights

The customer communication management software in healthcare market in North Americadominated the overall global market and accounted for the 46.3% revenue share in 2023, with key players are focusing on strategic developments such as expanding product capabilities and enhancing customer experience.

Companies are investing in advanced technologies like AI and cloud integration to improve scalability and efficiency in managing customer communications. For instance, in May 2023, Precisely introduced EngageOne RapidCX, transforming Customer Communications Management (CCM) for industries with stringent regulations. This innovative solution enhances customer experiences by delivering personalized communications driven by data insights. It addresses critical needs in sectors like financial services, health insurance, and telecommunications, where compliance and personalized communication are essential for maintaining customer trust and satisfaction. Strategic partnerships and acquisitions are also prominent, aimed at broadening market reach and integrating complementary technologies. These efforts are geared towards offering robust solutions that meet evolving customer needs in the competitive CCM software landscape.

U.S. Customer Communication Management Software In Healthcare Market Trends

The customer communication management software in healthcare market in the U.S. plays a vital role in enhancing patient engagement and operational efficiency. Providers are adopting CCM solutions to streamline communication processes, ensure compliance with healthcare regulations, and deliver personalized patient communications across various channels.

Europe Customer Communication Management Software In Healthcare Market Trends

The Europe customer communication management software in healthcare market is experiencing significant growth, driven by technological advancements and the entry of new market players. Innovations such as AI-driven personalization and cloud-based solutions are enhancing patient communication and operational efficiency. New entrants are introducing competitive solutions, fostering market expansion and offering healthcare providers more choices to improve patient engagement and compliance with regulatory standards.

Asia Pacific Customer Communication Management Software In Healthcare Market Trends

The customer communication management software in healthcare market in Asia Pacific is experiencing the fastest growthwith frequent new product launches. For instance, in April 2022, Newgen Software, an India-based company specializing in low-code digital transformation platforms, released OmniOMS 10.0, an enhanced iteration of its Omnichannel Customer Engagement Platform (CCM). Companies are introducing innovative solutions to enhance patient engagement, streamline communication processes, and ensure compliance with healthcare regulations, driving market growth and meeting the evolving needs of healthcare providers in the region.

Latin America Customer Communication Management Software in Healthcare Market Trends

The Latin Americacustomer communication management software in healthcare market is experiencing growing demand. This software simplifies patient communication, ensuring timely and personalized interactions across various channels. With increasing adoption, healthcare providers benefit from improved operational efficiency and enhanced patient satisfaction. The market's growth reflects the region's commitment to leveraging technology to elevate healthcare delivery and patient care standards.

Middle East & Africa (MEA) Customer Communication Management Software in Healthcare Market Trends

The customer communication management software in healthcare market in MEA is experiencing growth. Companies are increasing their presence through strategic expansions and participating in regional conferences to showcase innovations. For instance, in September 2022, Smart CommunicationsTM, a technology company specializing in facilitating meaningful customer conversations for businesses, hosted its annual conference, INNOVATE EMEA 2022. These initiatives aim to cater to growing healthcare communication needs and enhance service delivery across the Middle East and Africa.

Key Customer Communication Management Software In Healthcare Company Insights

The market is witnessing a highly competitive scenario due to the presence of key players such as Smart Communications; Newgen Software Technologies Limited.; Oracle; Cincom; DataOceans LLC.; Doxim; Hyland Software, Inc.; Conduent, Inc.; and Avaali Solutions Pvt Ltd. These players are undertaking various strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Customer Communication Management Software In Healthcare Companies:

The following are the leading companies in the customer communication management software in healthcare market. These companies collectively hold the largest market share and dictate industry trends.

- Smart Communications

- Newgen Software Technologies Limited.

- Oracle

- Cincom

- DataOceans LLC.

- Flexsin Inc.

- Doxim

- CAL-SIERRA TECHNOLOGIES, INC.

- Hyland Software, Inc.

- Conduent, Inc.

- Avaali Solutions Pvt Ltd.

Recent Developments

-

In September 2023, Cincom Systems, a provider in Customer Communications Management (CCM) solutions, announced a partnership with Socotra Inc. The collaboration aims to expedite insurers' digital transformation by optimizing customer communication processes throughout the entire customer lifecycle.

-

In August 2023, Newgen Software, known for its digital transformation platform NewgenONE, unveiled OmniOMS 11.0. This latest iteration of their Omnichannel Customer Engagement Platform (CCM) addresses operational challenges in enterprise-wide communication management, offering businesses effective solutions to streamline their operations.

-

In April 2023, Smart Communications, a technology company dedicated to enhancing customer engagement, announced a strategic partnership to integrate its customer communication management platform, SmartCOMM, with CGI's credit management platform, CGI Credit Studio. This collaboration aims to support lenders' digital initiatives, making them more agile, flexible, and customer-focused.

Customer Communication Management Software In Healthcare Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 517.0 million

Revenue forecast in 2030

USD 955.0 million

Growth rate

CAGR of 10.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Smart Communications; Newgen Software Technologies Limited.; Oracle; Cincom; DataOceans LLC.; Flexsin Inc. ; Doxim; CAL-SIERRA TECHNOLOGIES, INC.; Hyland Software, Inc.; Conduent, Inc.; Avaali Solutions Pvt Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Customer Communication Management Software In Healthcare Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global customer communication management software in healthcare market report based component, deployment, end use and region.

-

Component Outlook (Revenue, USD Million, 2018 -2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 -2030)

-

On-premise

-

Cloud-based

-

Hybrid

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare Provider

-

Healthcare Payer

-

Lifescience Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global customer communication management software in healthcare market size was estimated at USD 444.0 million in 2023 and is expected to reach USD 517.0 million in 2024.

b. The global customer communication management software in healthcare market is expected to grow at a compound annual growth rate of 10.8% from 2024 to 2030 to reach USD 955.0 million by 2030.

b. The customer communication management software in healthcare market in North America dominated the overall global market and accounted for the 46.3% revenue share in 2023, with key players are focusing on strategic developments such as expanding product capabilities and enhancing customer experience.

b. Some key players operating in the customer communication management software in healthcare market include Smart Communications; Newgen Software Technologies Limited.; Oracle; Cincom; DataOceans LLC.; Flexsin Inc. ; Doxim; CAL-SIERRA TECHNOLOGIES, INC.; Hyland Software, Inc.; Conduent, Inc.; Avaali Solutions Pvt Ltd.

b. The increasing emphasis on patient engagement and satisfaction has prompted healthcare providers to adopt Chronic Care Management (CCM) solutions to enhance patient communication. Furthermore, increasing technological developments, such as the integration of advanced technologies like AI and machine learning into CCM platforms, provide predictive analytics and personalized communication strategies, further fueling market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."