- Home

- »

- IT Services & Applications

- »

-

Customer Analytics Market Size And Share Report, 2030GVR Report cover

![Customer Analytics Market Size, Share & Trends Report]()

Customer Analytics Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Data Source (Web, Store), By Application, By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-348-5

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Customer Analytics Market Summary

The global customer analytics market size was estimated at USD 14.57 billion in 2023 and is projected to reach USD 48.63 billion by 2030, growing at a CAGR of 19.2% from 2024 to 2030. The proliferation of digital platforms has transformed the landscape of data generation and availability, fueling market growth.

Key Market Trends & Insights

- North America held the largest market share of 36.01% in the customer analytics market in 2023.

- The customer analytics market in the U.S. is anticipated to grow at a significant CAGR during the forecast period.

- By application, the campaign management segment held a market share of 23.96% in 2023.

- By component, the solutions segment accounted for the largest market share of 66.67% in 2023.

- By data source, the web analytical tools segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 14.57 Billion

- 2030 Projected Market Size: USD 48.63 Billion

- CAGR (2024-2030): 19.2%

- North America: Largest market in 2023

In the digital age, consumers interact with businesses through many channels, generating significant data. These channels include social media platforms, e-commerce websites, mobile applications, customer service interactions, and the Internet of Things (IoT) devices. Each interaction leaves a digital footprint, contributing to a vast pool of structured and unstructured data. Social media platforms are a prime example of data explosion. Users generate massive amounts of data through posts, likes, comments, shares, and interactions. This data offers deep insights into consumer preferences, opinions, and behaviors. Similarly, e-commerce websites collect data on browsing patterns, purchase histories, and transaction details, providing a wealth of information about consumer buying behaviors and preferences.

Social media platforms are a prime example of data explosion. Users generate massive amounts of data through posts, likes, comments, shares, and interactions. This data offers deep insights into consumer preferences, opinions, and behaviors. Similarly, e-commerce websites collect data on browsing patterns, purchase histories, and transaction details, providing a wealth of information about consumer buying behaviors and preferences.This abundance of data presents both an opportunity and a challenge for businesses. The opportunity lies in the potential to derive meaningful insights to drive strategic decisions, enhance customer experiences, and improve operational efficiencies. However, the sheer volume and complexity of the data require advanced analytical tools and techniques to process, analyze, and extract actionable insights effectively.

Customer analytics leverages this data to understand customer behavior, preferences, and trends comprehensively. Advanced analytics tools, powered by big data technologies, enable businesses to analyze vast datasets in real-time, uncover hidden patterns, and predict future behaviors. This capability allows companies to personalize their offerings, optimize marketing efforts, and enhance customer engagement.

Moreover, increased data availability facilitates the development of more accurate and robust predictive models. These models can forecast customer needs, identify potential churn risks, and suggest proactive measures to retain customers. The insights from such analyses enable businesses to stay ahead of market trends, respond quickly to changes, and maintain a competitive edge.

Application Insights

The campaign management segment held a market share of 23.96% in 2023 and is expected to dominate the market by 2030.Modern consumers interact with brands across multiple channels, including social media, email, mobile apps, and websites. Campaign management applications facilitate the implementation of omnichannel marketing strategies by allowing businesses to coordinate and manage campaigns across different channels. These applications provide a unified view of customer interactions, ensuring consistent messaging and a seamless experience regardless of the platform. The need to execute effective marketing strategies across various touchpoints significantly drives the growth of campaign management applications.

Product management is expected to grow at a CAGR of 21.0% over the forecast period. Delivering a superior customer experience is crucial for retaining customers and driving business growth. Product management applications utilize customer analytics to understand how customers interact with products, identifying pain points and areas for improvement. This insight allows product managers to make informed decisions about product modifications, enhancements, and user experience improvements. As businesses prioritize customer satisfaction, the demand for product management applications that facilitate these enhancements is growing.

Component Insights

The solutions segment accounted for the largest market share of 66.67% in 2023. The solutions segment consists of social media analytical tools, web analytical tools, dashboard & reporting tools, voice of customer (VOC), ETL (extract, transform, and load), and analytical modules/tools. The increasing demand for personalized experiences from brands drives the segment's growth. Customer analytics solutions help businesses analyze vast amounts of customer data to understand individual preferences and behaviors. This enables companies to create personalized marketing campaigns, product recommendations, and customer interactions. The ability to deliver such tailored experiences enhances customer satisfaction and loyalty, driving the demand for advanced customer analytics solutions.

The services segment is expected to grow at a CAGR of 21.4% during the forecast period. The sheer volume and complexity of data generated by modern businesses require specialized skills and expertise to manage and analyze effectively. Many organizations lack the in-house capabilities to handle big data, perform advanced analytics, and extract actionable insights. This gap has increased demand for external services, including data integration, cleaning, and advanced analytics services. Service providers offer the expertise and tools to manage large datasets, ensure data quality and consistency, and apply sophisticated analytical techniques that businesses may not be equipped to perform internally.

Data Source Insights

The web analytical tools segment accounted for the largest market share in 2023. The rise of e-commerce and the growing trend of online activities have led to an explosion of web traffic data. Businesses are increasingly operating online, and as a result, they generate vast amounts of data related to customer behavior, preferences, and interactions. Web analytical tools help companies capture, measure, and analyze this data to gain insights into customer journeys, optimize website performance, and improve user experiences. The shift towards digital commerce has made web analytics essential for understanding and engaging with customers online.

The analytical modules/tools segment is expected to grow at a CAGR of 19.8% during the forecast period. Analytical modules are increasingly integrated with various business systems such as CRM, ERP, and marketing automation platforms. This integration allows for a more comprehensive customer data analysis across different functions and departments. The seamless flow of data between systems enhances the accuracy and efficiency of analytics, providing a holistic view of customer interactions and behaviors. The ability to integrate analytical modules with existing business systems drives their growth as businesses seek to maximize the value of their data.

Deployment Insights

The cloud-based segment held a market share in 2023 and is expected to dominate the market by 2030. Cloud-based customer analytics solutions are often more cost-effective compared to traditional on-premises systems. By leveraging cloud infrastructure, businesses can avoid the substantial capital expenditures of purchasing and maintaining physical servers and data centers. Instead, they can opt for a pay-as-you-go model, paying only for the resources they use. This operational expenditure model helps businesses manage their budgets more effectively and allocate resources to other strategic areas, driving the growth of cloud-based solutions.

On-premise is expected to grow at a CAGR of 16.3% over the forecast period. Many organizations, particularly large enterprises, invest significantly in systems and infrastructure. Transitioning to cloud-based analytics solutions can be challenging and costly due to compatibility issues and the need for extensive system integration. On-premise customer analytics solutions seamlessly integrate with existing systems, allowing organizations to leverage their current investments while enhancing their analytics capabilities.

Enterprise Size Insights

The large enterprises segment accounted for the largest market share of 57.92% in 2023. Large enterprises often operate complex IT infrastructures with multiple integrated systems, including CRM, ERP, and marketing automation platforms. Customer analytics solutions seamlessly integrate with these enterprise systems to provide a unified view of customer data across departments and functions. This integration facilitates cross-functional collaboration, enhances data consistency and accuracy, and enables more comprehensive analysis and reporting capabilities. Leveraging integrated data sets strengthens decision-making processes and supports strategic initiatives across the organization.

The SMEs segment is expected to grow at a CAGR of 20.3% over the forecast period. Marketing budgets are typically limited for SMEs, making it essential to maximize the effectiveness of marketing campaigns. Customer analytics enables SMEs to optimize marketing strategies by identifying the most profitable customer segments, determining the best channels for customer acquisition, and measuring marketing activities' return on investment. By targeting the right audience with personalized messages and offers, SMEs can achieve higher conversion rates and customer retention, driving revenue growth and profitability.

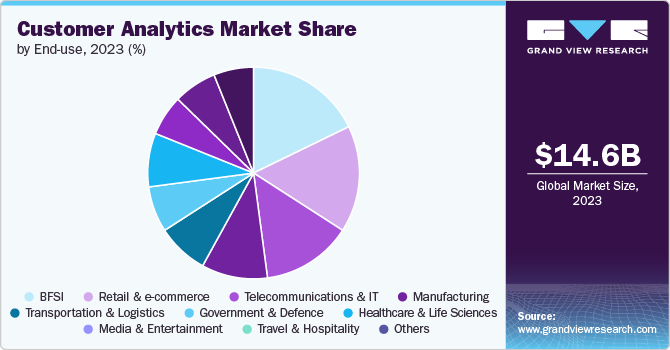

End-use Insights

The Banking, Financial Services, and Insurance (BFSI) segment accounted for the largest market share of 17.83% in 2023. Customer analytics are crucial in risk management and fraud detection within the BFSI sector. Advanced analytics techniques, such as predictive modeling and anomaly detection, help identify potential risks and fraudulent activities in real time. Financial institutions can detect suspicious activities and proactively mitigate risks by analyzing transaction patterns, customer behaviors, and external data sources. Customer analytics enhances security, reduces financial losses, and protects the institution's reputation.

The media and entertainment segment is expected to grow at a CAGR of 21.7% during the forecast period. Analytics tools in the media and entertainment sector enhance operational efficiency by optimizing content production, distribution, and marketing efforts. By analyzing audience feedback and performance metrics, companies can make data-driven decisions that streamline production workflows, reduce content waste, and optimize marketing spend. Predictive analytics can forecast audience demand, allowing companies to allocate resources more effectively and minimize costs associated with underperforming content or inefficient distribution strategies.

Regional Insights

North America held the largest market share of 36.01% in the customer analytics market in 2023. The increasing investment in advanced technologies such as artificial intelligence and machine learning drives the growth of the market in the region. Artificial intelligence (AI) and machine learning (ML) algorithms enable predictive analytics, anomaly detection, and automated decision-making, empowering businesses to extract deeper insights from complex datasets. Integrating AI and ML technologies with customer analytics drives innovation, improves analytical accuracy, and enables businesses to stay at the forefront of technological advancements in data analytics.

U.S. Customer Analytics Market Trends

The customer analytics market in the U.S. is growing significantly at a CAGR of 17.2% from 2024 to 2030. Businesses in the region are increasingly focusing on achieving measurable ROI from their investments in customer analytics. Analytics tools help companies optimize marketing spending, improve customer acquisition and retention rates, and increase profitability. By quantifying the impact of analytics initiatives on business outcomes, organizations can justify their investments and allocate resources strategically.

Asia Pacific Customer Analytics Market Trends

The customer analytics market in Asia Pacific is growing significantly at a CAGR of 21.1% from 2024 to 2030. The growth of e-commerce and digital marketing in the Asia Pacific has accelerated the adoption of customer analytics. Online retailers, digital platforms, and marketers use analytics tools to track consumer behavior throughout the customer journey—from browsing products to completing purchases. Analytics insights help optimize website design, enhance product recommendations, optimize pricing strategies, and improve conversion rates.

Europe Customer Analytics Market Trends

The customer analytics market in Europe is growing significantly at a CAGR of 18.8% from 2024 to 2030. The increasing need for enhanced business insights among European organizations drives the market's growth. Customer analytics solutions offer predictive modeling, trend analysis, and real-time reporting capabilities that enable businesses to anticipate market trends, forecast customer behavior, and identify growth opportunities.

Key Customer Analytics Company Insights

Key players operating in the market include Google, Microsoft, Adobe, among others. To gain a competitive advantage over their rivals, the companies are focusing on various strategic initiatives, including new product development, partnerships and collaborations, and agreements.

Key Customer Analytics Companies:

The following are the leading companies in the customer analytics market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft

- Adobe

- Dell Inc.

- SAP SE

- SAS Institute Inc.

- Teradata

- Oracle

- Salesforce.com, inc.

- Manthan

Recent Developments

-

In May 2024, AnalyticsIQ, a provider of predictive people-based data, launched a predictive solution called ChannelIQ to unlock consumer marketing preferences. This innovation leverages advanced predictive modeling techniques to analyze vast datasets and identify key indicators of consumer behavior, enabling marketers to launch effective campaigns, build better models, and grow their businesses.

-

In February 2024, Accenture agreed to acquire GemSeek, a customer experience analytics provider, to expand its customer analytics services. The acquisition highlights Accenture's continuous investment in AI and data capabilities to assist clients in expanding their business and maintaining relevance with customers.

Customer Analytics Market Scope

Report Attribute

Details

Market size value in 2024

USD 16.98 billion

Revenue forecast in 2030

USD 48.63 billion

Growth rate

CAGR of 19.2% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, data source, enterprise size, deployment, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Google; Microsoft; Adobe; Dell Inc.; SAP SE; SAS Institute Inc.; Teradata; Oracle; Salesforce.com, inc.; Manthan

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Customer Analytics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global customer analytics market report based on component, data source, enterprise size, deployment, application, end-use, and region:

-

Customer Analytics Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Social media analytical tools

-

Web analytical tools

-

Dashboard and reporting tools

-

Voice of customer (VOC)

-

ETL (extract, transform, and load)

-

Analytical modules/tools

-

Services

-

System Integration & Deployment

-

Training & Consulting

-

Support & Maintenance

-

-

Customer Analytics Data Source Outlook (Revenue, USD Billion, 2018 - 2030)

-

Web

-

Social Media

-

Smartphone

-

Email

-

Store

-

Call Centre

-

Others

-

-

Customer Analytics Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Brand Management

-

Campaign Management

-

Churn Management

-

Customer Behavioral Analysis

-

Product Management

-

Others

-

-

Customer Analytics Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud-based

-

-

Customer Analytics Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium Enterprises (SMEs)

-

Large Enterprises

-

-

Customer Analytics End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Retail and e-commerce

-

Telecommunications and IT

-

Manufacturing

-

Transportation and Logistics

-

Government and Defence

-

Healthcare and Life Sciences

-

Media and Entertainment

-

Travel and Hospitality

-

Others

-

-

Customer Analytics Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global customer analytics market size was estimated at USD 14.57 billion in 2023 and is expected to reach USD 16.98 billion in 2024.

b. The global customer analytics market is expected to grow at a compound annual growth rate of 19.2% from 2024 to 2030 to reach USD 48.63 billion by 2030.

b. Solution segment dominated the market in 2023 with a market share of over 66%. The increasing demand for personalized experiences from brands drives the segment's growth.

b. Some key players operating in the customer analytics market include Google; Microsoft; Adobe; Dell Inc.; SAP SE; SAS Institute Inc.; Teradata; Oracle; Salesforce.com, inc.; and Manthan.

b. The proliferation of digital platforms has transformed the landscape of data generation and availability, fueling the growth of the customer analytics market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.