Current Sensor Market Size, Share & Trends Analysis Report By Current Sensing Method (Direct Current Sensing, In-direct Current Sensing), By Loop, By Technology, By Output, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-378-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Current Sensor Market Size & Trends

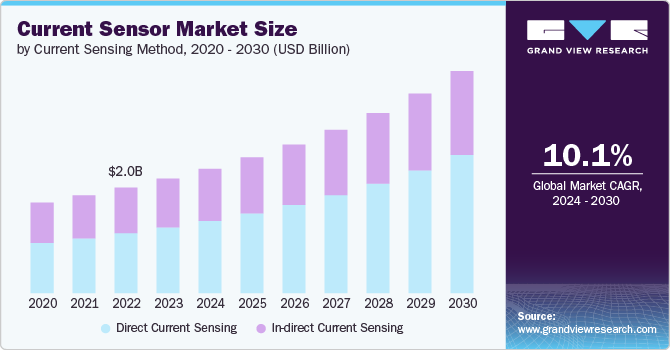

The global current sensor market size was valued at USD 2.18 billion in 2023 and is expected to grow at a CAGR of 10.1% from 2024 to 2030.The rise of electric vehicles (EVs) is a significant driver of the market. As the automotive industry shifts toward electrification, the demand for precise current measurement in battery management systems and motor control units has surged. Current sensors play a crucial role in monitoring the state of charge and health of EV batteries, ensuring optimal performance and longevity. Additionally, accurate current measurement helps in the efficient operation of electric motors, which are fundamental components of EVs. This growing adoption of EVs globally is expected to continue fueling the demand for advanced current sensors.

The expansion of renewable energy sources is also contributing to the growth of the market. Solar and wind power systems require efficient energy conversion and management, which depend heavily on accurate current measurement. Current sensors are essential in monitoring the output of solar inverters and wind turbines, optimizing their performance, and ensuring energy is harnessed efficiently. Furthermore, energy storage systems, which are critical for balancing supply and demand in renewable energy setups, also rely on current sensors for effective operation. As the world moves towards greener energy solutions, the demand for current sensors in this sector is expected to rise significantly.

Industrial automation is also driving the growth of the market. Modern manufacturing processes increasingly rely on automation and robotics, necessitating precise current measurements for motor control and machinery operation. Current sensors help in monitoring and controlling the electrical currents that power various industrial equipment, ensuring smooth and efficient functioning. This not only enhances productivity but also reduces the risk of equipment failure and downtime. With industries continuously seeking ways to improve operational efficiency, the integration of current sensors in automated systems is becoming more prevalent.

The advent of smart grid technology is another key driver for the market. Smart grids require real-time monitoring and management of electricity distribution to improve efficiency, reliability, and sustainability. Current sensors are integral to these systems, providing critical data on current flow, load conditions, and fault detection. This information enables utilities to optimize power distribution, reduce energy losses, and respond swiftly to any anomalies or disruptions. As investments in smart grid infrastructure increase globally, the need for reliable current sensors is expected to grow accordingly.

Advancements in sensor technology are further boosting the market for current sensors. Innovations such as miniaturization, enhanced accuracy, and digital integration are making current sensors more versatile and efficient. These improvements enable the deployment of current sensors in a wider range of applications, from consumer electronics to healthcare devices. Enhanced features such as real-time data processing and wireless connectivity are also expanding the scope of current sensor usage. As technological advancements continue to evolve, they are likely to open new opportunities and drive further growth in the market.

Current Sensing Method Insights

Based on the current sensing method, the direct current sensing segment led the market and accounted for 57.5% of the global revenue in 2023. The growth of the segment can be attributed to its high accuracy and reliability in precise current measurement applications. This method, often using shunt resistors, is highly valued in electric vehicle battery management systems, where accurate monitoring of battery health and charge state is essential. Its simplicity and cost-effectiveness make direct current sensing appealing to a broad range of uses, especially in low to medium-current applications. Industrial automation also relies heavily on this method to ensure machinery and motor controls operate efficiently. As the need for precise, economical current measurement solutions grows, the adoption of direct current sensing methods is set to increase significantly.

The in-direct current sensing segment is expected to register significant growth from 2024 to 2030. In-direct current sensing is gaining traction due to its non-intrusive nature and ability to handle higher current levels. Technologies such as Hall effect sensors and Rogowski coils are central to this method, offering the advantage of isolation and enhanced safety, which are critical in high-power applications. This method is increasingly favored in renewable energy systems, where it is essential to monitor and manage the output of solar inverters and wind turbines efficiently. Additionally, in-direct current sensing is becoming more prevalent in high-power industrial equipment, where maintaining isolation and preventing direct electrical contact is paramount.

Loop Insights

The closed loop segment accounted for the largest market revenue share in 2023. Closed loop current sensing is driven by its high accuracy, linearity, and ability to handle high current levels. This method, which employs a feedback loop to maintain measurement precision, is essential in applications requiring exact current monitoring, such as industrial automation and power supply systems. Its superior performance in terms of accuracy and bandwidth makes it suitable for demanding environments like aerospace, defense, and medical devices. Additionally, the increasing need for precise current control in electric vehicles and renewable energy systems is boosting the adoption of closed loop current sensors. As the demand for high-performance and reliable current measurement solutions grows, the closed loop current sensing segment is expected to see significant expansion.

The open loop segment is expected to grow significantly from 2024 to 2030. Open loop current sensing is becoming increasingly popular due to its simplicity, cost-effectiveness, and ease of integration. This method, which uses devices like Hall effect sensors to measure current without direct contact, is particularly attractive in applications where cost and space constraints are critical. Its ability to provide fast response times and low power consumption makes it ideal for consumer electronics, automotive, and renewable energy applications. Additionally, advancements in sensor technology are enhancing the accuracy and reliability of open loop systems, further driving their adoption.

Technology Insights

The hall effect segment accounted for the largest market revenue share in 2023. The hall effect is experiencing robust growth driven by its non-contact operation, high accuracy, and versatility across diverse applications. These sensors are widely adopted in automotive, industrial automation, and consumer electronics sectors due to their ability to precisely measure a wide range of currents. The rise of electric vehicles and renewable energy systems further fuels demand, as Hall Effect sensors play a critical role in ensuring efficient power management and safety. As technology continues to advance, Hall Effect sensors are expected to maintain their prominence by offering compact, reliable solutions for current measurement.

The flux gate segment is expected to grow significantly from 2024 to 2030. These sensors find application in navigation systems, satellite communications, and other high-precision environments where accurate current sensing is essential. Flux Gate sensors excel in scenarios requiring stable magnetic field measurement, making them indispensable in the aerospace, defense, and scientific research sectors. As demand grows for precise current measurement capabilities, Flux Gate technology is poised to expand its footprint by delivering reliable, compact solutions that meet stringent performance requirements.

Output Insights

The analog segment accounted for the largest market revenue share in 2023. These sensors offer real-time responsiveness, and reliability within existing analog infrastructures. Analog sensors deliver continuous, proportionate signals critical for accurate current measurement in applications where immediate data feedback is essential. Additionally, analog sensors are advancing to offer improved precision, reduced power consumption, and enhanced compatibility with advanced control systems, ensuring their continued relevance in critical operational environments, and thereby contributing to the growth of the market.

The growth of the digital segment can be attributed to technological advancements and increasing demand for IoT-enabled devices. Digital output sensors offer distinct advantages such as immunity to noise, digital signal processing capabilities, and the ability to transmit data over long distances without signal degradation. These sensors are increasingly deployed in IoT applications, smart grids, and battery management systems where rapid, accurate data acquisition and communication are crucial. Digital sensors are poised for rapid expansion, providing robust solutions that support advanced data analytics, remote monitoring, and seamless integration with digital control systems.

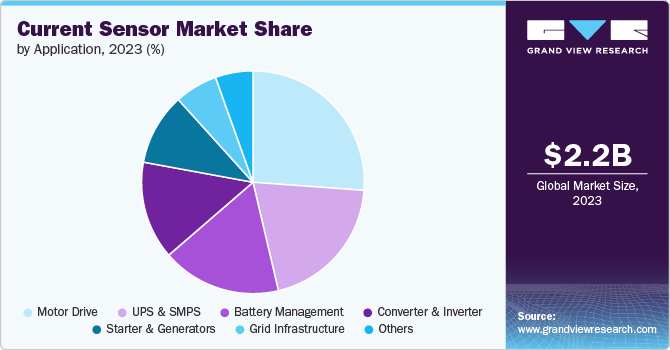

Application Insights

The motor drive segment accounted for the largest market revenue share in 2023. The growth of the segment is driven by the rapid adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs). As automotive manufacturers prioritize efficiency and performance, precise current sensing technologies are becoming essential for enhancing motor control and managing battery systems effectively. This demand is further amplified by the shift towards industrial automation, where current sensors play a critical role in variable frequency drives (VFDs) and servo motors, supporting the evolution towards smart factories and IoT-integrated machinery.

The starter & generators segment is expected to grow significantly from 2024 to 2030 as there is a strong focus on improving energy efficiency and reducing emissions in automotive and aerospace applications. Current sensors play a crucial role in ensuring the optimal performance and safety of starter motors and generators. This trend aligns with global sustainability initiatives and regulatory requirements, driving the development and adoption of advanced current sensing technologies that can meet stringent performance standards while supporting the integration of cleaner and more efficient power systems.

Regional Insights

North America current sensor market is anticipated to register significant growth from 2024 to 2030. There is a growing demand for current sensors across various sectors such as renewable energy, automotive electronics, and consumer electronics. The region's focus on advancing electric vehicle infrastructure and enhancing energy efficiency drives the adoption of current sensing technologies. With increasing investments in sustainable energy solutions and stringent regulatory standards, current sensors play a crucial role in optimizing power management and supporting the transition towards cleaner and more integrated power systems.

U.S. Current Sensor Market Trends

The current sensor market in the U.S.is anticipated to register significant growth from 2024 to 2030. The established industrial automation infrastructure that requires efficient current sensors and continued focus on technological advancements is a significant factor contributing to the growth of the current sensor market across the U.S.

Asia Pacific Current Sensor Market Trends

The current sensor market in Asia Pacific dominated the global market and accounted for 32.30% in 2023. Expansion in automotive sales and advancements in consumer electronics are poised to drive significant growth in the Asia Pacific current sensor market. The region is witnessing a burgeoning demand for smartphones, tablets, PCs, and smartwatches, fueled by increasing urbanization and digitalization efforts across economies such as China, Japan, and South Korea. As countries in the region accelerate their digital transformation agendas, there is a heightened need for enhanced process automation, error detection, and predictive maintenance capabilities, driving the adoption of advanced current sensor technologies.

Europe Current Sensor Market Trends

The current sensor market in Europe is poised for significant growth from 2024 to 2030. Stringent emission norms and the shift toward sustainable energy solutions are key drivers shaping the current sensor market. Industries in countries such as Germany, France, and the U.K. are increasingly integrating current sensing technologies to comply with environmental regulations and improve energy efficiency. The region's emphasis on innovation in the automotive and industrial sectors, coupled with the rising adoption of electric vehicles, fuels the demand for advanced current sensors. This trend underscores Europe's commitment to fostering technological innovation and achieving sustainability goals through reliable and efficient power management solutions.

Key Current Sensor Company Insights

Key players operating in the market include Honeywell International Inc, Allegro MicroSystems, Inc., TDK Corporation., STMicroelectronics, TAMURA Corporation, Infineon Technologies AG, LEM International SA, ROHM CO., LTD, Melexis, and Omron Corporation. These companies leverage advancements in Hall effect, shunt, and magnetic sensing technologies to cater to diverse applications in automotive, industrial automation, renewable energy, and consumer electronics sectors. The market is witnessing increased demand for precise and efficient current measurement solutions, driven by trends such as the rapid electrification of vehicles, expansion of renewable energy installations, and the integration of IoT devices across industries.

Key Current Sensor Companies:

The following are the leading companies in the current sensor market. These companies collectively hold the largest market share and dictate industry trends.

- Honeywell International Inc.

- Allegro MicroSystems, Inc.

- TDK Corporation

- STMicroelectronics

- TAMURA Corporation

- Infineon Technologies AG

- LEM International SA

- ROHM CO. LTD

- Melexis

- Omron Corporation

Recent Developments

-

In June 2023, NOVOSENSE launched the NSM2019, a current sensor known for its high isolation and low impedance. This sensor chip provided a fully integrated and highly isolated solution with exceptionally low internal primary conductor resistance. It enabled accurate current measurement without the need for external isolation components, making it suitable for a wide range of AC or DC current measurement applications in industrial and automotive systems.

Current Sensor Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.37 billion |

|

Revenue forecast in 2030 |

USD 4.24 billion |

|

Growth rate |

CAGR of 10.1% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Current sensing method, loop, technology, output, application, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; and MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Honeywell International Inc.; Allegro MicroSystems, Inc.; TDK Corporation.; STMicroelectronics; TAMURA Corporation; Infineon Technologies AG; LEM International SA; ROHM CO. LTD, Melexis; and Omron Corporation. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Current Sensor Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global current sensor market based on the current sensing method, loop, technology, output, application, and region.

-

Current Sensing Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct Current Sensing

-

In-direct Current Sensing

-

-

Loop Outlook (Revenue, USD Million, 2018 - 2030)

-

Open Loop

-

Closed Loop

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Hall Effect

-

Shunt

-

Flux Gate

-

Magneto-resistive

-

-

Output Outlook (Revenue, USD Million, 2018 - 2030)

-

Analog

-

Digital

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Motor Drive

-

Converter Inverter

-

Battery Management

-

UPS & SMPS

-

Starter & Generators

-

Grid Infrastructure

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global current sensor market size was estimated at USD 2.18 billion in 2023 and is expected to reach USD 2.37 billion in 2024.

b. The global current sensor market is expected to grow at a compound annual growth rate of 10.1% from 2024 to 2030 to reach USD 4.24 billion by 2030.

b. Asia Pacific dominated the current sensor market with a share of 32.3% in 2023. Expansion in automotive sales and advancements in consumer electronics are poised to drive significant growth in the Asia Pacific current sensor market.

b. Some key players operating in the current sensor market include Honeywell International Inc.; Allegro MicroSystems, Inc.; TDK Corporation.; STMicroelectronics; TAMURA Corporation; Infineon Technologies AG; LEM International SA; ROHM CO. LTD, Melexis; and Omron Corporation.

b. Key factors that are driving the market growth include the rise of electric vehicles (EVs) and the advent of smart grid technology.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."