- Home

- »

- Plastics, Polymers & Resins

- »

-

Curing Agent Market Size, Share & Growth Report, 2030GVR Report cover

![Curing Agent Market Size, Share & Trends Report]()

Curing Agent Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Epoxy, Polyurethane, Rubber, Acrylic), By End Use (Paints & Coatings, Electrical & Electronics, Wind Energy), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-410-1

- Number of Report Pages: 98

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Curing Agent Market Size & Trends

The global curing agent market size was estimated at USD 6.62 billion in 2023 growing at a CAGR of 6.3% from 2024 to 2030 owing to the continuous rise in manufacturing across various sectors, including construction and automotive, significantly boosts the demand for curing agents. As these industries expand, they require more materials that utilize the market for enhanced performance.

The continuous growth in manufacturing sectors, particularly construction and automotive, is a major driver of demand for curing agents. As these industries expand, they require more advanced materials that utilize curing agents to improve performance and longevity. Innovations in curing agent formulations, such as developing epoxy curing agents, create new opportunities in various applications. For instance, the construction sector increasingly uses epoxy curing agents for industrial flooring and protective coatings, which are essential for durability and resistance to wear.

The robust growth in key industries such as construction and automotive primarily drives the demand for curing agents. As these sectors expand, they increasingly rely on advanced materials that utilize products to enhance performance and durability. For instance, the construction industry has seen a significant surge in activity, with China's construction output peaking at approximately USD 4.11 trillion in 2022, directly correlating with the rising demand for products used in paints, coatings, and adhesives.

In addition, the coatings sector is experiencing growth due to economic advancements and increased industrial activity, particularly in emerging economies across the Asia-Pacific region. This trend is further supported by technological innovations, such as introducing new epoxy systems and products that cater to the evolving needs of various applications. Overall, industrial expansion, technological advancements, and regional growth significantly propel the demand for curing agents in the global market.

Type Insights

Epoxy dominated the market with a revenue share of 40.43% in 2023. Epoxy resins are known for their excellent adhesion, chemical resistance, and mechanical properties. The market for epoxy systems can be amines, anhydrides, or phenolic compounds. The choice of curing agent affects the final properties of the epoxy, such as flexibility, heat resistance, and curing time. For instance, amine-based curing agents typically provide faster curing times and improved toughness, making them suitable for applications in coatings, adhesives, and composite materials.

Polyurethanes are versatile materials that can be tailored for a wide range of applications, from flexible foams to rigid plastics. The curing agents used in polyurethane systems often include isocyanates, which react with polyols to form a durable polymer. The properties of polyurethane can be adjusted by varying the ratio of hard to soft segments, allowing for materials that range from soft elastomers to hard plastics. This adaptability makes polyurethanes ideal for applications in automotive parts, footwear, and coatings. Rubber curing agents, often referred to as vulcanizing agents, enhance the properties of rubber materials. Common curing agents include sulfur and peroxides, which create cross-links between polymer chains, improving elasticity, strength, and heat resistance. The vulcanization process is crucial in producing tires, seals, and gaskets, where durability and performance under stress are essential.

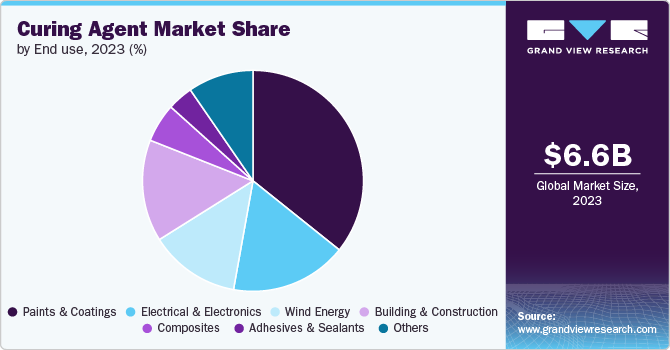

End Use Insights

Paints & coatings end use dominated the market with a revenue share of 35.74% in 2023.The paints and coatings industry is one of the largest consumers of curing agents, particularly epoxy and polyurethane systems. Curing agents enhance coatings' durability, adhesion, and chemical resistance, making them suitable for diverse applications, including architectural, automotive, and industrial coatings. The demand for high-performance coatings is driven by the need for protective finishes that can withstand environmental factors such as moisture, UV radiation, and corrosion. The market for UV-cured coatings is also expanding, as these products offer fast curing times and superior durability, appealing to manufacturers looking for efficient production processes. In the electrical and electronics sector, curing agents are essential for producing high-quality insulating materials and coatings. Epoxy resins, often cured with amine or anhydride agents, are widely used in potting and encapsulation applications to protect sensitive electronic components from moisture and mechanical stress. The growth of this sector is closely linked to advancements in technology and the increasing demand for consumer electronics, which require reliable and durable materials to ensure performance and longevity.

The building and construction industry relies heavily on curing agents for various applications, including adhesives, sealants, and flooring systems. This market improves construction materials' mechanical properties and longevity, making them more resilient to wear and environmental conditions. As global construction activities surge, particularly in emerging markets, the demand for high-performance materials that utilize curing agents is expected to rise. This trend is further supported by the increasing focus on sustainable building practices, where advanced materials can contribute to energy efficiency and reduce environmental impact.

Region Insights

Asia Pacific dominated the market segment with a revenue share of 35.84% in 2023. Asia Pacific is a key region in textile production; thus, it holds the highest share of the global market. Factors such as robust demand, policy support, increasing investments, and competitive advantage are driving the textile industry, especially in Asian countries, such as China, which is further positively affecting the product market in the region.

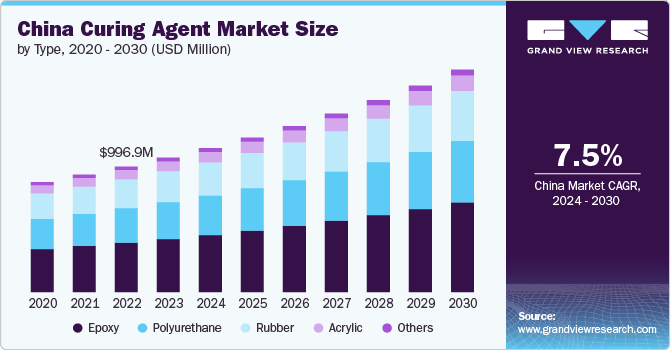

China Curing Agent Market Trends

The curing agents market in China is experiencing a significant increase in construction activities fueled by government investments in infrastructure development. This growth is expected to drive the demand for curing agents, particularly in producing paints, coatings, and adhesives used in construction applications.

North America Curing Agent Market Trends

The curing agent market in North America is expected to grow significantly during the forecast period. The construction sector in North America is witnessing a resurgence, with significant investments in infrastructure and residential projects. This growth is boosting the demand for curing agents, particularly in paints and coatings, essential for enhancing durability and performance.

Europe Curing Agent Market Trends

The curing agent market in Europe is increasingly emphasizing eco-friendly and sustainable products. Manufacturers are developing bio-based and low-VOC (volatile organic compounds) curing agents to comply with stringent environmental regulations and meet consumer demand for greener alternatives. This trend is expected to influence product development and market dynamics significantly.

Key Curing Agent Company Insights

Some of the key players operating in the market include

-

Alfa Chemicals Ltd. is a specialty chemical distributor that provides a wide range of chemicals for various industries, including the industrial, pharmaceutical, and personal care sectors. The company is recognized for its commitment to quality and customer service and ensures that it meets the diverse needs of its clientele.

-

BASF SE, founded in 1865 and headquartered in Ludwigshafen, Germany, is the largest chemical company in the world. The company operates across diverse sectors, providing a wide array of products, from basic chemicals to specialized solutions. BASF's commitment to innovation and sustainability has positioned it as a leader in the global chemical industry.

-

DIC operates globally, with 176 subsidiaries and affiliates in 62 countries. Its headquarters is in Chuo-ku, Tokyo, Japan. The company has a significant operational footprint, including 10 production plants in Japan and various facilities worldwide, which support its diverse product offerings.

Key Curing Agent Companies:

The following are the leading companies in the curing agent market. These companies collectively hold the largest market share and dictate industry trends.

- Alfa Chemicals

- BASF SE

- Cardolite Corporation

- DIC Corporation

- Evonik Industries

- Hexion

- Hunstman International LLC

- Mitsubishi Chemical Corporation

- Olin Corporation

- Supreme Polytech Pvt. Ltd.

- Westlake Epoxy

Recent Developments

-

In March 2024, Evonik Industries introduced a new epoxy curing agent named Ancamine 2880. This innovative product is designed to meet the growing demands of the coatings market by providing a fast-curing and UV-resistant solution that enhances the performance of epoxy coatings.

-

In August 2022, Hexion Inc. launched a new epoxy system and curing agent to address the increasing demand for epoxy resins and curing agents in various applications. This initiative reflects Hexion's commitment to innovation and sustainability in the coatings industry.

Curing Agent Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.02 billion

Revenue forecast in 2030

USD 10.13 billion

Growth rate

CAGR of 6.3% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan; South Korea; Thailand; Australia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Alfa Chemicals; BASF SE; Cardolite Corporation; DIC. Corporation; Evonik Industries; Hexion; Hunstman International LLC; Mitsubishi Chemical Corporation; Olin Corporation; Supreme Polytech Pvt. Ltd.; Westlake Epoxy

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Curing Agent Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global curing agent market report based on type, end use, and region;

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Epoxy

-

Polyurethane

-

Rubber

-

Acrylic

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paints & coatings

-

Electrical & electronics

-

Wind energy

-

Building & construction

-

Composites

-

Adhesives & sealants

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global curing agent market was valued at USD 6.62 billion in 2023 and is expected to reach USD 7.02 billion in 2024.

b. The global curing agent market is expected to grow at a compound annual growth rate of 6.3 % from 2024 to 2030, reaching USD 10.13 billion by 2030.

b. Asia Pacific dominated the market segment with a revenue share of 35.84% in 2023. Asia Pacific is a key region in terms of textile production, and thus, it held the highest share in the global product market.

b. Some key players operating in the curimg agent market include Alfa Chemicals, BASF SE, Cardolite Corporation, DIC. Corporation, Evonik Industries, Hexion, Hunstman International LLC, Mitsubishi, Chemical Corporation, Olin Corporation, Supreme Polytech Pvt. Ltd., Westlake Epoxy

b. Key factors that are driving the market growth include the continuous rise in manufacturing across various sectors, including construction and automotive, significantly boosts the demand for curing agents.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.