- Home

- »

- Homecare & Decor

- »

-

Culinary Tourism Market Size, Share & Growth Report, 2030GVR Report cover

![Culinary Tourism Market Size, Share & Trends Report]()

Culinary Tourism Market (2024 - 2030) Size, Share & Trends Analysis Report By Activity (Culinary Trails, Cooking Classes), By Booking Mode (Tour Operators, Direct Travel), By Tourist Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-179-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Culinary Tourism Market Summary

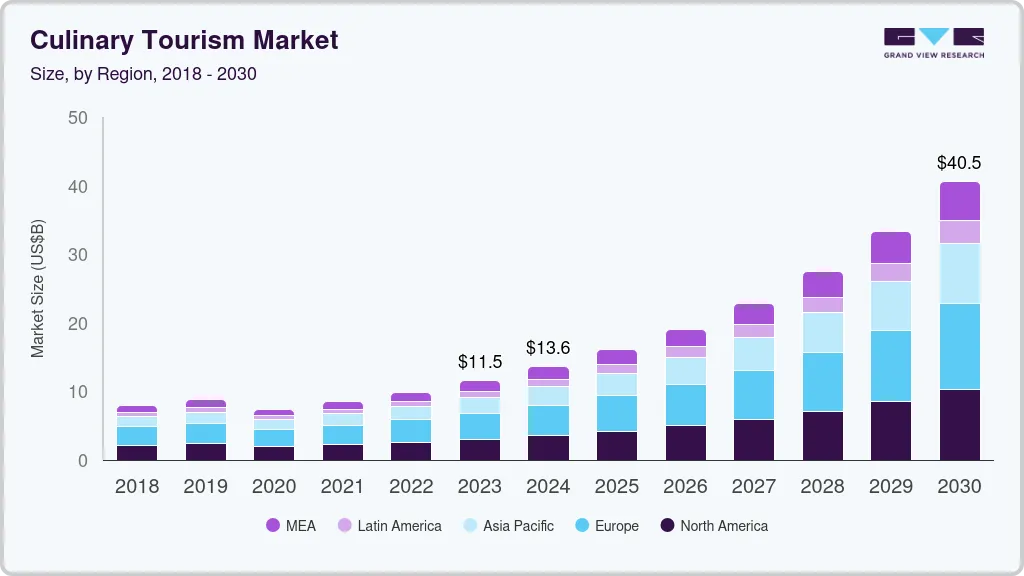

The global culinary tourism market size was estimated at USD 11.5 billion in 2023 and is projected to reach USD 40.53 billion by 2030, growing at a CAGR of 19.9% from 2024 to 2030. The market growth can be attributed to the increasing consumer spending on travel & tourism, tourists’ desire to try food products made of locally sourced ingredients, and increasing food travelers who explore new cultures through food worldwide.

Key Market Trends & Insights

- Europe dominated the global market with a revenue share of more than 30.0% in 2023.

- Based on activity, the food festival segment dominated the market with a revenue share of over 30.0% in 2023

- Based on booking mode, booking culinary tourism packages segment through direct travel dominated the market with a revenue share of over 60.0% in 2023.

- Based on tourist type, the existential tourist type segment dominated the market in 2023, with a revenue share of over 40.0%.

- Based on tourist type, the diversionary tourist segment is projected to grow at the fastest CAGR during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 11.5 Billion

- 2030 Projected Market Size: USD 40.53 Billion

- CAGR (2024-2030): 19.9%

- Europe: Largest market in 2023

The primary driver of market growth is the rise in desire to explore local dishes as a way to connect with the locals and gain more insight into the destination, history, and culture. According to the World Travel Association (WTFA) 2022 Report, 34% of the tourists visit places that attract them in terms of cuisine. In addition, it is stated in the 2023 report that culinary culture exposes tourists to various ways of life, which are essential to understand in terms of socio & political awareness.

UNESCO included 27 food and drink traditions in its Representative List of the Intangible Cultural Heritage of Humanity in January 2022. For instance, tourists travel to various countries such as Ukraine to taste Ukrainian Borsht, Haiti for Joumou Soup (made with squash), and Italy for Truffle, Senegal for Ceebu Jën (a dish made of rice, vegetables, and fish).

Another driving factor of the market is the initiative taken by the government and associations to promote culinary tourism. For instance, in 2020, the Indigenous Tourism Association of Canada (ITAC) launched Destination Indigenous. This initiative promotes the best Indigenous tourism experiences across Canada. One of its projects is the ITAC Culinary Directory, featuring 27 restaurants and wineries, with 14 catering operations, conference centers, and breweries. The main aim of Destination Indigenous is to give people a glimpse into the vibrant cultures of Canada's Indigenous peoples. They focus on nature and wildlife tours, cultural sharing, accommodation, relaxation, culinary experiences, and handicrafts.

According to a blog by World Expeditions, various locations are famous for food items having blend of a local ingredient with an internationally preferred food. For instance, traditional Peruvian cuisine mainly relied on staples like corn, chilies, and potatoes (with over 3000 types). However, the staple dishes in Peru evolved into a rich blend of local and international influences and attracted various tourist to the country. The fusion includes elements from Spanish, African, French, Asian, Italian, and British cuisines. This unique mix of flavors, cultures, and traditions has turned Peru, especially Lima and Cusco, into emerging global culinary hubs.

Market Concentration & Characteristics

Market growth stage is high, and market growth pace is accelerating. The market is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors such as NFC technology used to provide travelers with important information about the destination, local foods popular at the place, and many other personalized information for the traveler.

The market is characterized by moderate level merger and acquisition (M&A) activities by the leading players. It is due to several factors, including increasing revenue, increased market presence, geographical expansion, and enhanced brand portfolio.

Culinary tours and events may be subject to regulations governing the tourism industry. It is also subject to health and safety regulations to ensure the quality and safety of the food they serve. Some countries have regulatory frameworks aimed at promoting sustainable practices in the culinary industry, such as waste reduction, sourcing local ingredients, and energy efficiency.

There are a limited number of direct service substitutes for culinary tourism owing to virtual cooking classes and workshops that allow individuals to explore and learn various ways to cook and learn different cuisines.

Companies in the market are focusing on offering special-edition tours, customized packages, and novel and adventurous experiences to attract new tourists and gain a competitive edge over other players. For instance, in November 2023, Abercrombie & Kent (A&K) launched a new package that focuses majorly on exploring the culture and heritage of Italy and the Palio. The tour package includes a visit to Michelin-starred restaurant named; Oseleta, a special dinner in Verona, cooking lesson at Nonna Antonia, and various other cooking demonstrations by top-class chefs.

Activity Insights

Based on activity, the food festival segment dominated the market with a revenue share of over 30.0% in 2023. Events, food festivals, and tours are crucial factors in culinary tourism that attract tourists to different locations. Food festivals provide the assurance of variety and an all-round food experience. For instance, according to an article by Scripps Media, Inc., nearly 98,920 people attended the 2023 Asian Food Fest held from April 29 to 30, mainly with the goal of tasting Asian food items and learning about the culture of Asia. Moreover , countries like Ireland conduct food festivals, such as “Taste of Dublin” and “Burren Slow Food Festival” in May and June.

The culinary trails segment is projected to grow at the fastest CAGR during the forecast period. Culinary trails pull together the best of a region’s food and drink offerings, whether to showcase a specific food item or cuisine or highlight the diversity of local producers. In November 2023, the West Virginia Department of Tourism launched culinary trail to promote the must-visit restaurants and the best cuisine to consume. Such initiatives aid in culinary tourism promotion driving segment growth.

Booking Mode Insights

Booking culinary tourism packages through direct travel dominated the market with a revenue share of over 60.0% in 2023. Sales channel that provide optimal deals on flights, hotels, and rental cars aid travelers to explore online options. Airlines websites are one of the most convenient one-stop shops that offer bundled vacation packages. Offering tour packages directly through their websites and booking engines becomes a viable and efficient strategy for airlines leveraging existing resources to enhance their travel offerings.

Booking culinary tourism packages through online travel agencies is expected to grow at the fastest CAGR during the forecast period. Online travel agencies (OTAs) offer convenience for tourists by providing critical information and comparison options and ensuring transparency and the convenience of instant bookings and confirmation.The rising internet and smartphone penetration and shifting consumer preferences accelerate market growth. According to GSMA, at the end of 2021, the number of mobile internet users in the Asia Pacific region exceeded 1.2 billion, and mobile broadband networks covered around 96% of the region’s population. Rising digital dependency among all generations across the globe is expected to accelerate the market growth over the forecast period.

Tourist Type Insights

The existential tourist type segment dominated the market in 2023, with a revenue share of over 40.0%. Travelers actively seek local and regional culinary experiences, opting for eateries popular among the locals. The existentialist demographic displays a relaxed and laid-back disposition preferring for simple and rustic dining venues over gourmet and 5-star restaurants. Furthermore, the tourists express interest in engaging activities such as cooking schools, cooking classes, fishing trips, vineyard tours, and attendance at food festivals.

The diversionary tourist segment is projected to grow at the fastest CAGR during the forecast period. Diversionary tourists enjoy socializing and involving in food festivities, prioritizing the experience over ambiance. They prefer streamlined access to dining information, favoring recommendations and curated top-10 lists over engaging in extensive research.

Regional Insights

Europe dominated the global market with a revenue share of more than 30.0% in 2023. This region dominates the culinary tourism sector owing to its outbound tourism, which is around half of the worldwide outbound tourism. According to the CBI Ministry of Foreign Affairs, 3% to 5% of European tourists are majorly culinary tourists. Tourist spend around 25% of their budget on food and beverages, which may be as high as 35% for expensive destinations and 15% for budget-friendly destinations.

Culinary tourism in Asia Pacific is projected to grow substantially during the forecast period. South Korea, Malaysia, Japan, Thailand, Vietnam, India, and many other countries offer a blend of historical and cultural heritage with modern culture. Preserving this local identity also allows tourists to explore and enjoy the local culture, natural environment, and unique food, fostering market growth. For instance, Thailand is also home to numerous world-class gourmet restaurants, Michelin-rated restaurants, award-winning bars, and innovative cafes in large cities such as Bangkok and Chiang Mai.

Key Companies & Market Share Insights

The market is characterized by the significant presence of domestic and international players accounting for a substantial market share in the respective regions.

Key players operating in the market are focusing on strategic measures to drive company growth and solidify their positions in the global market. For instance, TUI Group (TUI AG) is focusing on the continuous customer base expansion and increasing bookings of its tours and travel activities through its destination management and digital platform. The company also aims to expand the distribution of its products via third parties. The company is ready to incur additional expenses and develop its digital platform to achieve the same.

Key Culinary Tourism Companies:

- Abercrombie & Kent USA, LLC

- Greaves Travel Ltd

- India Food Tour

- Classic Journeys, LLC

- The FTC4Lobe Group

- The Travel Corporation

- Gourmet on Tour

- Culinary Adventures International

- Culinary Tours

- Butterfield & Robinson Inc.

Recent Developments

-

In December 2022, A&K Travel Group Ltd.- the company that owns Abercrombie & Kent, Crystal Cruises, and Cox & Kings-announced its equity partnership with Ecoventura, a sustainable travel company of the Galapagos Islands. This partnership foresees an equity investment in Ecoventura and the creation of a joint venture.

-

In October 2022, Abercrombie & Kent (A&K) announced the opening of four new Destination Management Companies in Canada, Colombia, Namibia, and Saudi Arabia. The company has over 55 offices in 30 countries, making it the largest network of destination management companies.

-

In August 2020,Butterfield & Robinson Inc. announced the new Singular Stays program, where friends and families can have private trips and include various activities and events to immerse themselves. Guests are offered a stay in villas, castles, and lodges.

Culinary Tourism Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.58 billion

Revenue forecast in 2030

USD 40.53 billion

Growth Rate

CAGR of 19.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Activity, booking mode, tourist type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; Japan; India; South Korea; Vietnam; Brazil; UAE

Key companies profiled

Abercrombie & Kent USA, LLC; Greaves Travel Ltd.; India Food Tour; Classic Journeys, LLC; The FTC4Lobe Group; The Travel Corporation; Gourmet on Tour; Culinary Adventures International; Culinary Tours; Butterfield & Robinson Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Culinary Tourism Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global culinary tourism market report based on activity, booking mode, tourist type, and region:

-

Activity Outlook (Revenue, USD Million, 2018 - 2030)

-

Culinary Trails

-

Cooking Classes

-

Restaurants

-

Food Festivals

-

Others

-

-

Booking Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Online Travel Agencies (OTA)

-

Tour Operators

-

Direct Travel

-

-

Tourist Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Recreational

-

Diversionary

-

Existential

-

Experimental

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

-

Middle East & Africa

-

UAE

-

-

Central & South America

-

Brazil

-

-

Frequently Asked Questions About This Report

b. The global culinary tourism market was estimated at USD 11.5 billion in 2023 and is expected to reach USD 13.58 billion in 2024.

b. The global culinary tourism market is expected to grow at a compound annual growth rate of 19.9% from 2024 to 2030 to reach USD 40.53 billion by 2030.

b. Europe dominated the culinary tourism market with a share of 32.7% in 2023. This region is dominating the culinary tourism market owing to its outbound tourism which is around half of the worldwide outbound tourism.

b. Some of the key players operating in the culinary tourism market include Abercrombie & Kent USA, LLC, Greaves Travel Ltd, India Food Tour, Classic Journeys, LLC, The FTC4Lobe Group, The Travel Corporation, Gourmet on Tour, Culinary Adventures International, Culinary Tours, Butterfield & Robinson Inc.

b. Key factors that are driving the culinary tourism market growth include increasing consumer spending on travel & tourism, coupled with tourists’ desire to try food products made of locally sourced ingredients have resulted in increased food travelers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.