Cryptocurrency Exchange Platform Market Size, Share & Trends Analysis Report By End-use (Commercial, Personal), By Cryptocurrency Type (Bitcoin, Ethereum), By Region (EU, APAC, North America), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-971-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2022 - 2030

- Industry: Technology

Report Overview

The global cryptocurrency exchange platform market size was valued at USD 30.18 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 27.8% from 2022 to 2030. The growing popularity of digital assets, such as cryptocurrencies and Non-Fungible Tokens (NFTs), is anticipated to increase the demand for cryptocurrency exchange platforms. People in developed countries, such as the U.S. and Canada, are rapidly adopting digital currency owing to its flexibility and ease of transaction. In addition, the rising acceptance of mobile-based trading platforms is expected to create opportunities for the industry. Furthermore, cryptocurrencies use blockchain technology for decentralization and efficient transactions.

Blockchain technology offers fast, secure, decentralized, transparent, and reliable transactions; hence, the companies are investing in blockchain and collaborating to deliver quality services to the consumers. For instance, in July 2022, KuCoin, one of the prominent cryptocurrency exchange platforms, announced its partnership with Coinrule Ltd., a trading bot for cryptocurrency platforms, to provide automated trading to its customers. In addition, traders using Kucoin’s platform are able to trade margin options, cryptocurrency futures, and perpetual swaps through Coinrule API. The growing popularity of cryptocurrencies as a medium of exchange for products and services led the central banks to support and accept digital currencies across the globe.

Furthermore, various prominent players are introducing innovative products, such as NFTs and Exchange Traded Funds (ETFs), which are expected to support the growth of the industry. For instance, in August 2022, an NFT ETF trading zone was introduced by KuCoin, a worldwide cryptocurrency exchange for more than 20 million users. The product seeks to lower the investment threshold for blue-chip NFTs and increase the liquidity of NFT assets. Prolonged crises with increasing inflation and the rising cost of living adversely affected nations, such as Iran, Venezuela, and El Salvador. Consequently, residents of these countries are shifting toward cryptocurrencies as a medium of exchange for basic utilities and a form of value storage.

It is anticipated to act as a substitute for fiat currencies, such as the Rial, the Bolivar, and other government-issued fiats in such regions. As a result, the growing demand for cryptocurrencies from these countries is expected to create a positive outlook for the industry. Although cryptocurrency is a new-age financial technology, the absence of laws and a uniform standard for exchange platforms & digital money is projected to limit its expansion. Regulators across the globe are concerned over the exploitation of such platforms for illegal activities, which is a major obstruction to the market’s growth. On the other hand, the advantages offered by blockchain and cryptocurrencies outweigh the increasing illegal activities. In addition, the government authorities have the potential to prevent such activities and regulate the exchanges in a manner that they can monitor suspicious activities.

COVID-19 Impact Analysis

During the COVID-19 pandemic, the majority of individuals started investing in cryptocurrencies to enhance their Return-on-Investment (RoI). Surprisingly, more traders and investors turned to safer and more dependable digital currencies, as most financial markets were struck by the impact of the outbreak across the globe. People chose to invest in cryptocurrencies to protect their interests and ensure at least a basic return on their investment. Thus, the COVID-19 outbreak caused a surge in demand for cryptocurrency exchange platforms and created opportunities for industry growth.

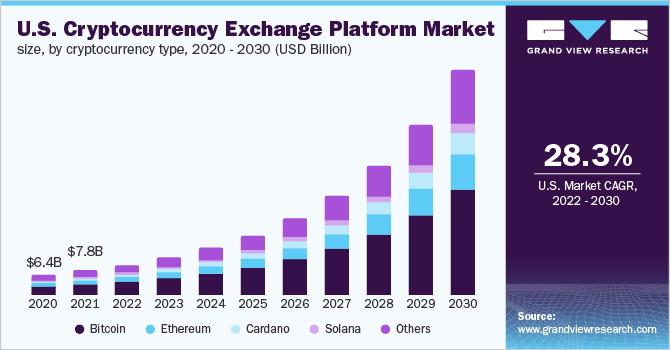

Cryptocurrency Type Insights

The Bitcoin segment dominated the global industry in 2021 and accounted for the largest share of more than 45.00% of the overall revenue. The dominance of Bitcoin is attributed to the fact that it is the origin of cryptocurrencies and laid the foundation for the cryptocurrency market. Hence, Bitcoin can influence the entire cryptocurrency industry. In addition, the proliferation of several altcoins, such as Litecoin, Bitcoin Cash, and Bitcoin Diamond, is expected to boost the segment’s growth in the coming years. Moreover, Bitcoin is considered the most reliable and secure network, thus, raising the demand for Bitcoin exchange platforms.

The Ethereum segment is anticipated to witness the second-fastest growth rate over the forecast period. Ethereum’s popularity is growing in parallel with the emergence of digital assets, such as NFTs and Decentralized Finance (DeFi) projects. They are majorly built on Ethereum, owing to their extremely secure network and architecture. In addition, the application and utilization of the Ethereum network in the development of the Metaverse are expected to create new growth opportunities for the Ethereum exchange platforms.

End-use Insights

On the basis of end-uses, the industry has been further categorized into commercial and personal. The commercial segment dominated the global industry in 2021 and accounted for the maximum share of more than 68.20% of the overall revenue. The growing commercial acceptance of cryptocurrencies as the banks started capitalizing on the prevalence of cryptocurrencies to provide related services to customers is expected to boost the segment’s growth. For instance, in February 2021, The Bank of New York Mellon Corp. (BNY Mellon) stated that it would allow the transfer, issue, and storage of Bitcoin for asset management clients.

The two biggest cryptocurrencies, Ether and Bitcoin, are available for customers to hold in crypto wallets of the Bank of New York Mellon Corporation, which was developed in collaboration with the crypto infrastructure firm, Fireblocks. The personal end-use segment is anticipated to record the fastest CAGR over the forecast period. The growing awareness about cryptocurrencies among millennials in developing countries, such as India and Nigeria, is expected to drive the segment’s growth over the forecast period. People are looking for alternative investment options as they do not want to restrict themselves to traditional investment vehicles, which are expected to aid the industry growth. As a result, the growing number of cryptocurrency traders and investors in developing countries is expected to bolster the segment growth.

Regional Insights

North America dominated the global industry in 2021 and accounted for the maximum share of more than 29.35% of the overall revenue. The growing popularity of cryptocurrency as a value store and the utilization of cryptocurrencies in NFTs in the region is driving the need for cryptocurrency exchange platforms. In addition, the dominance is attributed to the presence of several prominent players in the region, such as Gemini, Kraken, and others, and the steps taken by various organizations to meet customer demands. For instance, in June 2021, NCR Corp. and NYDIG partnered to provide cryptocurrencies for credit unions and 650 banks.

This effort has been made in response to NCR banking customers buying digital currency through third-party exchanges. Asia Pacific is expected to register the highest CAGR over the forecast period. The acceptance of cryptocurrencies in emerging countries, such as China and India, is driving the growth of the region. Moreover, strategic collaborations and partnered ventures by key players contribute to the region’s growth. For instance, TaoTao, a crypto exchange platform, and Z Corporation, Inc., an investment company, entered into a strategic collaboration with Binance Holding Ltd. in January 2020. The partnership was aimed at providing trading services for consumers across Japan.

Key Companies & Market Share Insights

The industry is characterized by the presence of several key market players. Market players are pursuing various strategies, such as new product launches, strategic partnerships, geographic expansions, and others, to enhance their offerings. For instance, in June 2022, FTX, a cryptocurrency exchange, announced the acquisition of Bitvio, Inc., a cryptocurrency trading platform based in Canada. FTX intended to expand its global footprint with this acquisition; the deal is said to be closed by the third quarter of the fiscal year 2022. Several fintech companies are investing aggressively in the cryptocurrency market recognizing the potential of cryptocurrencies. In July 2022, PicPay, a fintech company based in Brazil, announced the launch of a cryptocurrency exchange platform to provide its customers access to Ether, Bitcoin, and Paxos’ USDP stablecoin. Some of the prominent players in the global cryptocurrency exchange platform market include:

-

BlockFi International Ltd.

-

Coinmama

-

eToro

-

Coinbase

-

Binance

-

Kraken

-

Bitstamp

-

Coincheck, Inc.

-

FTX Trading Ltd.

-

AirSwap

Cryptocurrency Exchange Platform Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2022 |

USD 37.07 billion |

|

Revenue forecast in 2030 |

USD 264.32 billion |

|

Growth rate |

CAGR of 27.8% from 2022 to 2030 |

|

Base year of estimation |

2021 |

|

Historical data |

2017 - 2021 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Cryptocurrency type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Germany; U.K.; China; South Korea; Japan; Brazil |

|

Key companies profiled |

BlockFi International Ltd.; Coinmama; eToro; Coinbase; Binance; Kraken; Bitstamp; Coincheck, Inc. FTX Trading Ltd.; AirSwap |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cryptocurrency Exchange Platform Market Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global cryptocurrency exchange platformmarket report based on cryptocurrency type, end-use, and region:

-

Cryptocurrency Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Bitcoin

-

Ethereum

-

Cardano

-

Solana

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial

-

Banks

-

Fintech Companies

-

Credit Unions

-

Others

-

-

Personal

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

South Korea

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global cryptocurrency exchange platform market size was estimated at USD 30.18 billion in 2021 and is expected to reach USD 37.07 billion in 2022.

b. The global cryptocurrency exchange platform market is expected to grow at a compound annual growth rate of 27.8% from 2022 to 2030 to reach USD 264.32 billion by 2030

b. North America dominated the cryptocurrency exchange platform market with a share of 29.39% in 2021. The growing popularity of cryptocurrency as a value store and the utilization of cryptocurrencies in NFTs in the region is driving the need for cryptocurrency exchange platforms.

b. Some key players operating in the cryptocurrency exchange platform market include BlockFi International Ltd., Coinmama, eToro, Coinbase, Binance, Kraken, Bitstamp, Coincheck, Inc., FTX Trading Ltd., and AirSwap.

b. Key factors that are driving the cryptocurrency exchange platform market growth include the growing popularity of mobile-based trading platforms and rising awareness of blockchain technology.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."