- Home

- »

- Medical Devices

- »

-

Cryostat Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![Cryostat Market Size, Share & Trends Report]()

Cryostat Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Closed-Cycle Cryostats, Bath Cryostats), By System Components (Dewars, Transfer Tubes), By Cryogen, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-369-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cryostat Market Summary

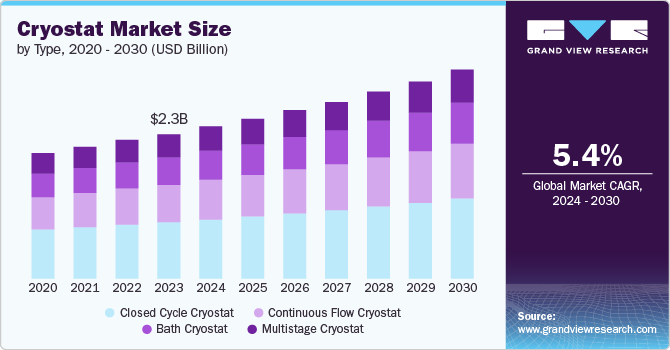

The global cryostat market size was estimated at USD 2.33 billion in 2023 and is projected to reach USD 3.35 billion by 2030, growing at a CAGR of 5.4% from 2024 to 2030. The market growth can be attributed to the increasing demand for advanced medical devices and cryogenic preservation techniques in healthcare & medical research.

Key Market Trends & Insights

- The North America cryostat market held a significant share of 41.3% in 2023.

- The Asia Pacific cryostat market is expected to witness the fastest growth at a CAGR of 6.4% over the forecast period.

- Based on type, the bath cryostat segment is expected to register the fastest growth at a CAGR of 5.9% from 2024 to 2030.

- In terms of system components, the dewars segment held the largest market share of 25.0% in 2023.

- Based on cryogen, the nitrogen segment is expected to register the fastest growth at a CAGR of 5.8% from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 2.33 Billion

- 2030 Projected Market Size: USD 3.35 Billion

- CAGR (2024-2030): 5.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Innovations in cryogenic technology and rising investments in healthcare infrastructure are expected to propel market growth. Moreover, the growing demand for cryostats for aerospace applications and the rising need for reliable & efficient cryostat systems are anticipated to fuel market growth over the forecast period.

Case Study Insights: A Comparative Overview of Different Types of Cryostats

Cryostat Type

Achievable Temperatures

Advantages

Applications

Products by Key Manufacturers

Closed-Cycle Cryostats

2.8K to 800K

No liquid helium required, continuous operation, low vibrations

Applied research, quantum computing, optical spectroscopy

Cryostation s200 by Montana Instruments

Continuous-Flow Cryostats

65K to 800K

Wide temperature range, efficient cooling

Scientific research, materials science

SuperTran ST-100 Series by Lake Shore Cryotronics

Bath Cryostats

65K to 800K

Stable temperature control, easy setup

Forensic science, materials science, medical applications

VarioxBL and OptistatDN-V

Multistage Cryostats

2.8K to 300K

Achieve very low temperatures, high cooling power

Astrophysics, low-temperature experiments, materials science

OTF7000 Cryostat by Bright Instruments

Cryostats offer high efficiency and accurate results, making them increasingly sought after across various industries. Medical institutions and research laboratories are increasingly adopting cryostats to ensure the preservation of biological samples at ultra-low temperatures. Cryostats equipped with microtome blades offer high precision. For instance, the Epredia microtome blade range of MX35 Premier ensures consistent and reliable sample preparation. This precision enhances the quality of research & diagnostic outcomes and reduces the need for additional cutting devices, thereby lowering operational costs.

Moreover, the ability of cryostats to maintain the integrity of biological specimens is crucial for accurate diagnostics and research outcomes. The growth of personalized medicine, which requires precise sample preparation and storage, is another key factor expected to drive the demand for cryostats. In addition, ongoing research in oncology, neurology, & regenerative medicine relies heavily on cryogenic technology to preserve & study cellular and molecular structures, thereby propelling market growth. Cryostats are used extensively in aerospace applications for material testing, superconducting devices, and developing advanced propulsion systems. The need for precise temperature control and the ability to maintain extremely low temperatures are critical in these applications, making cryostats indispensable. Companies such as Lake Shore Cryotronics provide specialized cryostat solutions that cater to the stringent requirements of the aerospace sector. The expansion of space exploration activities and the development of new aerospace technologies are expected to fuel the demand for advanced cryostat systems, contributing to market growth.

Furthermore, technological advancements in cryogenics have opened new avenues for the market. Innovations in cryostats, such as the use of improved insulation materials & optimized cryogen reservoirs to extend the hold time between cryogen refills, automated temperature control, enhanced insulation materials, and the integration of digital monitoring systems, have significantly improved the efficiency & reliability of cryostats. Companies like Advanced Research Systems and Cryomech Inc. are at the forefront of developing cutting-edge cryogenic solutions that cater to diverse industrial and research applications. These advancements enhance the performance of cryostats and reduce operational costs & maintenance requirements. As technology continues to evolve, the industry is expected to benefit from increased adoption and new application possibilities.

Governments & private sector entities across the globe are investing heavily in modernizing healthcare facilities and equipping them with state-of-the-art medical devices. This trend is particularly evident in emerging economies where healthcare systems are undergoing significant transformation. Investments in advanced medical equipment, including cryostats, are essential to support the growing demand for quality healthcare services. Moreover, initiatives to enhance healthcare research capabilities are anticipated to drive the demand for cryogenic technology, enabling institutions to conduct high-quality research and clinical trials.

Type Insights

The closed-cycle cryostats segment held the largest market share in 2023.

Closed-cycle cryostats are favored for their versatility, efficiency, and cost-effectiveness. Utilizing closed-cycle refrigeration systems eliminates the need for cryogenic liquids and minimizes maintenance requirements. This type of cryostat is ideal for diverse applications, including materials research, medical diagnostics, and superconducting technology. Their user-friendly operation and reduced operational costs make them a preferred choice across various industries, contributing to their strong market position. Moreover, the increasing technological advancements in closed-cycle cryostats are propelling segment growth. For instance, in February 2021, Montana Instruments Corporation launched CryoCor. This closed-cycle optical cryostat system is tailored for researchers who require high-throughput electrical and optical materials characterization; however, it lacks extensive cryogenic expertise or large budgets. CryoCor offers several features to facilitate its use, including an integrated vacuum system, automated temperature control, and push-button cooling, allowing users to achieve cryogenic temperatures with minimal setup time, ranging from 4.9 K to 350 K. Hence, the introduction of advanced closed-cycle cryostats by several manufacturers to cater to various scientific research needs is predicted to drive segment growth over the forecast period.

The bath cryostat segment is expected to register the fastest growth at a CAGR of 5.9% from 2024 to 2030. These cryostats immerse samples in a cryogenic liquid bath, providing uniform cooling essential for maintaining sample integrity. They are particularly useful in histopathology and histology for preparing thin tissue sections for microscopic examination, ensuring high-quality sample preservation and preparation. The primary advantage of bath cryostats is their ability to maintain a consistent temperature environment, making them ideal for applications requiring stable and precise temperature control. In medical diagnostics, bath cryostats are employed to prepare biological samples for detailed analysis, contributing to more accurate diagnoses. In addition to medical applications, bath cryostats are used in cryoelectron microscopy to preserve biological samples at cryogenic temperatures. This enables researchers to visualize biomolecular structures in their native states with high resolution, which is crucial for advancing research in molecular biology and biochemistry. The ability of bath cryostats to provide precise & stable temperature control makes them indispensable for various scientific and medical applications, driving segment growth significantly over the forecast period.

System Components Insights

The dewars segment held the largest market share of 25.0% in 2023. This can be attributed to dewars being essential components of cryostat systems, used for storing cryogenic fluids. Dewars, with their specialized components, are integral to the functionality of cryostats in various applications, including scientific research, medical diagnostics, and industrial processes. Manufacturers are developing dewars with increased liquid cryogen storage capacities ranging from 5 liters up to 200 liters to cater to diverse application needs. For instance, the Gamma Gage II dewar from ORTEC, with features such as a standard preamplifier and high voltage filter, ensures comprehensive compatibility with High-Purity Germanium (HPGe) radiation detectors, making it an efficient & versatile option for users requiring reliable cryogenic storage and transportation solutions. Another notable example is Chart Industries, which offers a wide range of dewar products with capacities from 20 liters to 180 liters to meet the requirements of various industries. In addition, each component, from the Dewar flask to the temperature sensors, plays a vital role in ensuring the efficient and safe handling of cryogenic liquids. The continuous advancement and integration of these components are expected to contribute to the overall segment growth.

The gas flow pumps segment is expected to witness the fastest growth at a CAGR of 7.5% over the forecast period. These pumps are integral to the operation of cryostat systems, facilitating the efficient circulation of cryogenic gases like helium and nitrogen to maintain the desired low temperatures. The demand for gas flow pumps is driven by their essential role in applications requiring precise temperature control, including medical diagnostics, materials research, and industrial processes. Companies like Cryomech Inc. are at the forefront of developing advanced gas flow pump technologies that enhance the performance and reliability of cryostat systems. The increasing adoption of cryogenic technologies across various sectors underscores the significance of gas flow pumps, as they enable continuous and stable cooling, thereby supporting the growing need for high-precision and efficient cryogenic solutions.

Cryogen Insights

The helium segment accounted for the largest market share in 2023 due to its unique properties that make it ideal for achieving and maintaining extremely low temperatures. Abundant and chemically inert, helium drives efficient heat transfer capabilities, making it the preferred cryogen across various industries. It plays a critical role in medical imaging, quantum computing, & scientific research due to its reliability, cost-effectiveness, and widespread availability. Manufacturers are incorporating helium cryogen into their cryostat products to achieve & sustain the ultra-low temperatures essential for precise scientific measurements and industrial applications. For instance, in April 2023, INOXCVA, an Indian cryogenic equipment manufacturer, announced the production of a 4K helium cryostat for Magnetic Resonance Imaging (MRI) magnet systems. This cryostat is designed to support whole-body 1.5T MRI machines, showcasing INOXCVA’s capability to meet high-precision requirements in medical imaging. The development highlights India’s growing expertise in advanced cryogenic solutions for healthcare applications, aligning with the increasing demand for reliable and efficient MRI systems globally.

The nitrogen segment is expected to register the fastest growth at a CAGR of 5.8% from 2024 to 2030. Nitrogen cryogens are increasingly being adopted across diverse applications, such as biological sample preservation, medical diagnostics, and semiconductor manufacturing. Nitrogen’s inert properties and cost-effectiveness make it an appealing option for achieving cryogenic temperatures, often serving as an alternative to helium. In industrial & research settings, nitrogen is widely utilized as a cryogen. SLEE Medical GmbH offers cryostats utilizing nitrogen cryogen, delivering efficient & economical cooling solutions for healthcare and industrial applications. Furthermore, with a growing emphasis on sustainability, the use of nitrogen cryogens aligns with environmental priorities, contributing to their market expansion, particularly in applications where ultra-low temperatures are not essential.

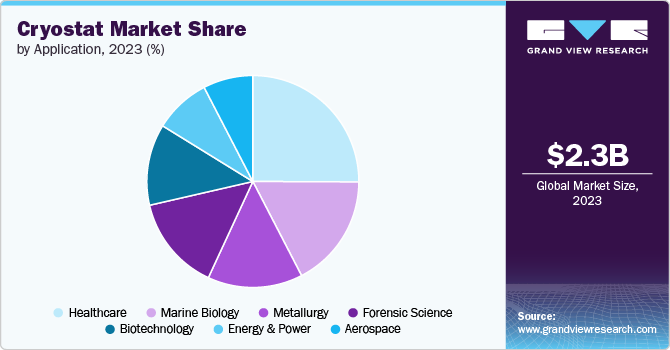

Application Insights

On the basis of application, the healthcare segment held the largest market share in 2023. The growing prevalence of chronic diseases and increasing demand for early & precise diagnostics are expected to drive the adoption of cryostats. Advancements in cryostat technology, such as improved temperature control and automation, enhance their efficiency in healthcare applications, solidifying their market position. Cryostats are extensively used in medical research and diagnostics to store tissues, cells, & biomolecules without compromising their integrity. This capability is vital for conducting accurate experiments, developing new therapies, and storing biological materials for future studies.

Advancements in precision medicine and personalized healthcare require sophisticated cryostat technologies to ensure the reliability and reproducibility of experimental results. As healthcare institutions and research facilities continue to expand their capabilities in molecular biology & genomics, the demand for cryostats is expected to grow. This growth can be attributed to the need for reliable temperature control and sample preservation solutions, which are crucial for advancing research and improving patient outcomes.

Regional Insights

The North America cryostat market held a significant share of 41.3% in 2023. The presence of advanced healthcare and research infrastructure, including medical diagnostics & life sciences laboratories, is expected to drive the demand for cryostats in applications like histology and tissue analysis. North America is home to key players in the semiconductor and electronics industries, where cryostats are used for materials research and testing. Robust investments in Research & Development (R&D), coupled with government funding for scientific projects, are anticipated to fuel the adoption of advanced cryostat technologies. For instance, NASA uses cryogenics, which supports the development of advanced satellite technologies and space exploration missions. Stringent quality standards and regulatory requirements in the region ensure the reliability and safety of cryostat systems, bolstering their market presence in North America.

U.S. Cryostat Market Trends

The cryostat market in the U.S. is expected to grow at a CAGR of 4.5% over the forecast period. Growth in the country can be attributed to the increasing demand for advanced medical equipment, rising investments in the aerospace industry, the presence of key cryostat companies, and supportive government initiatives. The U.S. Department of Energy (DOE) is investing in cryogenic research to support the development of advanced materials, such as superconductors and magnets, for energy applications. Furthermore, NASA’s Cryogenic Fluid Management (CFM) technology, which utilizes cryostats, is an integral part of exploration systems for manned missions and planetary exploration.

Europe Cryostat Market Trends

The cryostat market in Europe is expected to grow at a substantial rate over the forecast period. Europe’s well-developed healthcare system creates a strong demand for cryostats in medical applications, particularly in histopathology and clinical diagnostics. Furthermore, the region’s robust R&D ecosystem, especially in life sciences and materials science, fuels the need for cryostats in laboratories and research institutions.

Asia Pacific Cryostat Market Trends

The Asia Pacific cryostat market is expected to witness the fastest growth at a CAGR of 6.4% over the forecast period, driven by government-led healthcare schemes. The flourishing semiconductor and electronics industries in the region have led to increased utilization of cryostats for materials testing and research. In addition, the growing investments in scientific research and an expanding biotechnology sector are expected to contribute to the rising demand. Furthermore, initiatives promoting R&D in countries like China and India are propelling the adoption of advanced cryostat technologies, resulting in the highest CAGR in the Asia Pacific region.

Key Cryostat Company Insights

Rising competition in the market, driven by innovative product offerings from key players, various regulatory norms, and favorable government initiatives aimed at boosting digital health, is significantly impacting the competitive landscape. Moreover, leading companies in the market are employing diverse strategies, such as mergers & acquisitions, collaborations, and partnerships, to strengthen their geographical presence and expand their customer base.

Key Cryostat Companies:

The following are the leading companies in the cryostat market. These companies collectively hold the largest market share and dictate industry trends.

- Leica Biosystems

- Cryomech Inc.

- Amos Scientific

- MEDITE

- Bright Instruments

- Dakewe Medical

- Jinhua YIDI Medical Appliance Co., Ltd.

- SLEE Medical GmbH

- Advanced Research Systems

- Lake Shore Cryotronics

Recent Developments

-

In April 2024, Equigas acquired Correct Cryogenics, expanding its portfolio in the industrial gas sector. This acquisition is expected to bolster Equigas’ presence in the cryogenics market, offering enhanced services and solutions to customers in various industries

-

In September 2023, Bluefors completed the acquisition of Cryomech, a move aimed at strengthening its position in the cryogenics market. This acquisition allows Bluefors to enhance its capabilities in providing advanced cryogenic solutions, particularly in quantum computing and scientific research.

-

Nation Composite Centre, UK developed a new cryostat device and testing method for cryogenic composites, aiming to improve the performance & reliability of materials used in extremely low-temperature environments. This innovation is set to advance the capabilities of cryogenic composite materials in aerospace, automotive, and other high-performance industries.

-

In September 2021, sureCore developed a specialized CMOS IP library designed specifically for operation in extremely low-temperature environments, a crucial requirement for quantum computing applications. This innovation enables the creation of cryogenic CMOS control chips that can be co-located alongside qubits in a cryostat, paving the way for the development of advanced quantum computing systems.

Cryostat Market Report Scope

Report Attribute

Details

The market size value in 2024

USD 2.44 billion

The revenue forecast in 2030

USD 3.35 billion

Growth rate

CAGR of 7.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, system components, cryogen, application, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Spain; Italy; Norway; Sweden; Denmark; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Leica Biosystems; Cryomech Inc.; Amos Scientific; MEDITE; Bright Instruments; Dakewe Medical; Jinhua YIDI Medical Appliance Co., Ltd.; SLEE Medical GmbH; Advanced Research Systems; Lake Shore Cryotronics; Epredia.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country or regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cryostat Market Report Segmentation

This report forecasts revenue growth at the global, regional, & country level and provides an analysis of the latest trends and opportunities in each of the subsegments from 2018 to 2030. For this study, Grand View Research has segmented the cryostat market report based on type, system components, cryogen, application, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Closed Cycle Cryostat

-

Continuous flow cryostat

-

Bath Cryostat

-

Multistage cryostat

-

-

System Components Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dewars

-

Transfer Tube

-

Gas Flow Pumps

-

Temperature Controller

-

High Vacuum Pumps

-

Microtome Blades

-

-

Cryogen Outlook (Revenue, USD Billion, 2018 - 2030)

-

Helium

-

Nitrogen

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Healthcare

-

Energy & Power

-

Aerospace

-

Metallurgy

-

Biotechnology

-

Forensic Science

-

Marine Biology

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cryostat market size was estimated at USD 2.33 billion in 2023 and is expected to reach USD 2.44 billion in 2024.

b. The global cryostat market is expected to grow at a compound annual growth rate of 7.7% from 2024 to 2030 to reach USD 3.35 billion by 2030.

b. North America dominated the cryostat market with a share of 41.3% in 2023. The presence of advanced healthcare and research infrastructure, including medical diagnostics and life sciences laboratories, drives substantial demand for cryostats in applications like histology and tissue analysis.

b. Some key players operating in the cryostat market include Leica Biosystems, Cryomech Inc., Amos Scientific, MEDITE, Bright Instruments, Dakewe Medical, Jinhua YIDI Medical Appliance Co., Ltd., SLEE Medical GmbH, Advanced Research Systems, Lake Shore Cryotronics, and Epredia.

b. Key factors that are driving the market growth include the increasing demand for advanced medical devices and cryogenic preservation techniques in healthcare and medical research. Innovations in cryogenic technology and rising investments in healthcare infrastructure further propel market expansion. Moreover, the growing demand for cryostats for aerospace applications and the rising need for reliable and efficient cryostat systems are anticipated to fuel market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.