- Home

- »

- Beauty & Personal Care

- »

-

Cruelty-free Cosmetics Market - Global Cruelty-free Cosmetics Industry Size, Share, Analysis And Research ReportGVR Report cover

![Cruelty-free Cosmetics Market Size, Share & Trends Report]()

Cruelty-free Cosmetics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Skincare, Haircare, Makeup, Fragrance), By End Use (Women, Men, Unisex, Children), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-397-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cruelty-free Cosmetics Market Summary

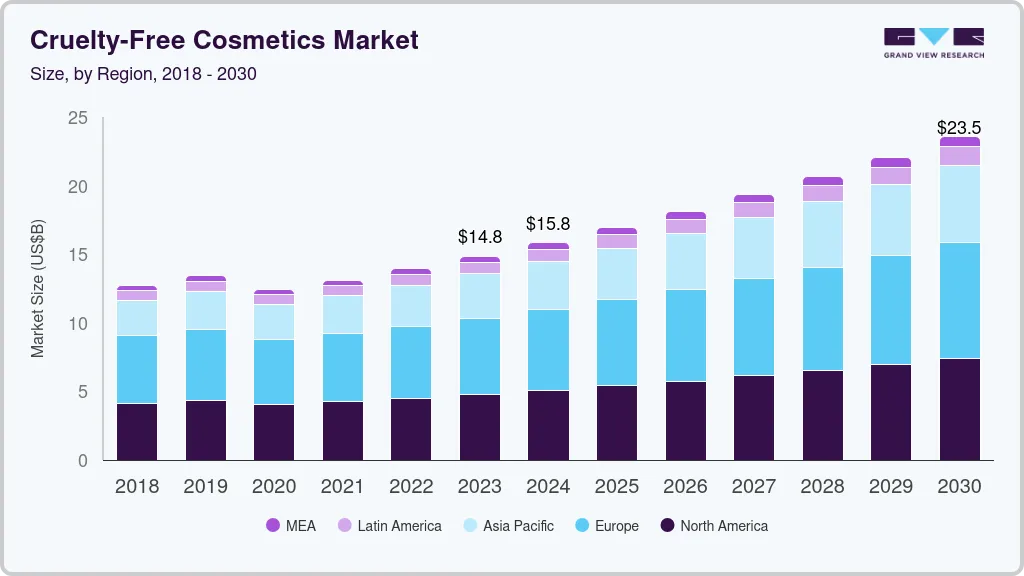

The cruelty-free cosmetics market size was valued at USD 14.84 billion in 2023 and is projected to reach USD 23.54 billion by 2030, growing at a CAGR of 6.8% from 2024 to 2030. This growth is attributed to increasing consumer awareness and demand for ethical and sustainable beauty products, stringent regulations against animal testing, and innovations in alternative testing methods.

Key Market Trends & Insights

- The cruelty-free cosmetics market in Europe accounted for a share of over 37% of the global market revenue in 2023.

- The cruelty-free cosmetics market in the U.S. is expected to grow at a CAGR of 7.0% from 2024 to 2030.

- By product, the skincare segment accounted for a revenue share of 44.2% in 2023.

- By distribution channel, the sales of cruelty-free cosmetics through hypermarkets & supermarkets segment accounted for a revenue share of 33.7% in 2023.

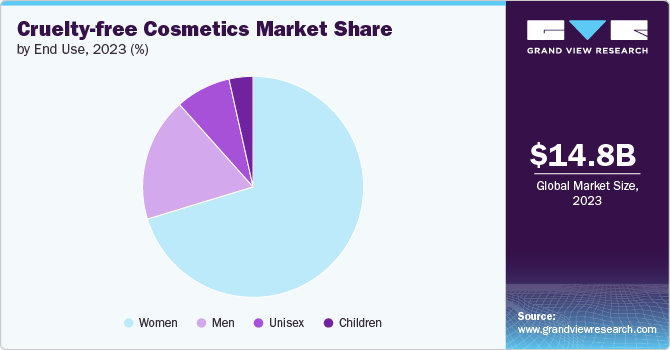

- By end-use, the demand for cruelty-free cosmetics among women segment accounted for over 70% of the global market revenue in 2023.

Market Size & Forecast

- 2023 Market Size: USD 14.84 Billion

- 2030 Projected Market Size: USD 23.54 Billion

- CAGR (2024-2030): 6.8%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

Additionally, the rise in vegan and clean beauty trends is driving further market growth. In March 2021, China, one of the key cosmetics markets, updated its animal testing policies, permitting imported "general cosmetics" like shampoo and makeup to be sold without animal testing, a significant shift from previous requirements that mandated animal testing. This change follows PETA's revelations and advocacy, which exposed that many companies were secretly funding animal tests despite banning them publicly. Through partnerships with the Institute for In Vitro Sciences, PETA has facilitated the establishment of animal-free testing methods in China. However, this new policy does not extend to "special" cosmetics such as hair dye or products for infants and children, which will still require animal testing.

Following this update in regulations in the Chinese market, as of 2023, the potential ban on animal testing in China for all cosmetic products, both domestically produced and imported; marks a significant advancement for the cruelty-free cosmetics market. This shift not only aligns with global animal welfare trends but also sets a precedent that could inspire other countries to adopt similar measures. This regulatory change is expected to boost market growth by reinforcing ethical standards and expanding consumer choices in cruelty-free cosmetics.

On the downside, the lack of standardized definitions for "Cruelty-Free" can undermine consumer trust and create challenges regarding product transparency. The use of claims like "Cruelty-Free" or "Not Tested on Animals" on cosmetic labels can be misleading due to the lack of legal definitions for these terms. While some companies use these claims to promote their products, they may still rely on animal testing conducted by raw material suppliers or contract laboratories. Others may use non-animal testing methods or scientific literature to substantiate safety.

Technological advancements in alternative testing methods have facilitated the shift toward cruelty-free cosmetics. Innovations such as in vitro testing, computer modeling, and human cell cultures are increasingly adopted, reducing the reliance on animal testing. Many cruelty-free brands focus on using established, safe ingredients, aligning with consumer preferences for natural products and minimizing the need for new testing. This trend reflects a broader industry movement toward more ethical and sustainable practices.

Many established brands are reformulating their products and obtaining cruelty-free certifications to meet consumer demand. Meanwhile, newer brands, such as Organically Epic, are built around cruelty-free principles from their inception, using this commitment as a key differentiator in a competitive market.

Retailers are also supporting the movement by dedicating sections to cruelty-free products and clearly labeling them, as seen in partnerships like the one between Organically Epic and Superdrug. This retailer support is crucial for promoting and expanding the availability of cruelty-free products.

Product Insights

The skincare segment accounted for a revenue share of 44.2% in 2023. This is attributed to the high consumer demand for ethical skincare products, increased awareness of animal testing issues, and the popularity of natural and vegan ingredients in skincare formulations.

The makeup segment is expected to grow at a CAGR of 7.7% from 2024 to 2030. This growth is attributed to rising consumer awareness and demand for ethical beauty products, the influence of social media and beauty influencers promoting cruelty-free brands, and the increasing availability of high-quality, vegan makeup options.

Key market participants are expanding their cosmetic lines with a wide variety of makeup and skincare products. Tarte Cosmetics launched Sugar Rush in February 2019, a vegan-friendly line targeting budget-conscious Gen Z shoppers, featuring 17 cruelty-free products, including makeup, skincare, and bodycare, all priced under USD 30. The collection quickly gained popularity, reflecting the growing demand for ethical beauty products.

Distribution Channel Insights

The sales of cruelty-free cosmetics through hypermarkets & supermarkets accounted for a revenue share of 33.7% in 2023, attributed to the wide availability and convenience of purchasing these products in large retail chains, the growing trend of dedicated cruelty-free sections, and effective in-store promotions. Additionally, these stores offer a diverse range of products, making it easier for consumers to access and choose cruelty-free options.

Online sales are expected to grow at a CAGR of 8.3% from 2024 to 2030. This growth is attributed to the increasing preference for online shopping due to convenience, the availability of a wider range of products, and the ease of accessing detailed product information and reviews. Additionally, digital marketing strategies, influencer endorsements, and exclusive online discounts are driving more consumers to purchase cruelty-free cosmetics online.

End Use Insights

The demand for cruelty-free cosmetics among women accounted for over 70% of the global market revenue in 2023. According to data from virtual beauty app Perfect365, 36% of women show a strong preference for cruelty-free cosmetics brands. Women are motivated by ethical concerns regarding animal welfare. The desire to avoid supporting practices that cause harm to animals drives a preference for cruelty-free products.

Women often seek transparency in the products they use. Cruelty-free certifications from reputable organizations like PETA or Leaping Bunny offer assurance that the products they purchase do not involve animal testing, fostering trust and loyalty to brands that prioritize ethical practices.

The demand for cruelty-free cosmetics among men is expected to grow at a CAGR of 7.9% from 2024 to 2030. This growth is attributed to increasing awareness of ethical consumption, the rising popularity of men's grooming products, and the broader acceptance of skincare and cosmetic routines among men.

Regional Insights

North America cruelty-free cosmetics market accounted for a revenue share of 32.1% of the global market in 2023. This prominence is driven by strong consumer demand for ethical and sustainable beauty products, with major brands like Too Faced, Tarte Cosmetics, and Fenty Beauty leading the charge. The region's market growth is also supported by stringent regulations and increased consumer awareness about animal testing, prompting many companies to adopt cruelty-free practices. Furthermore, partnerships with organizations like PETA and innovations in non-animal testing methods are contributing to a shift toward more ethical and responsible beauty products.

U.S. Cruelty-free Cosmetics Market Trends

The cruelty-free cosmetics market in the U.S. is expected to grow at a CAGR of 7.0% from 2024 to 2030. The push for the Humane Cosmetics Act and state-level bans on animal-tested cosmetics reflect a significant shift toward cruelty-free standards. Additionally, partnerships with major multinational companies and educational initiatives are advancing non-animal testing methods and increasing consumer awareness. This regulatory and advocacy momentum, combined with a strong public preference for cruelty-free options, is driving the growth of the U.S. cruelty-free makeup market.

Europe Cruelty-free Cosmetics Market Trends

The cruelty-free cosmetics market in Europe accounted for a share of over 37% of the global market revenue in 2023. The cruelty-free cosmetics market in Europe is driven by stringent regulatory frameworks and strong consumer advocacy for ethical products. The European Union has comprehensive bans on animal testing for cosmetics, which supports market growth by ensuring cruelty-free standards are met. Additionally, widespread public awareness and support for animal welfare have heightened demand for cruelty-free cosmetics.

Asia Pacific Cruelty-free Cosmetics Market Trends

The cruelty-free cosmetics market in Asia Pacific is expected to grow at a CAGR of 8.3% from 2024 to 2030. The cruelty-free cosmetics market in Asia Pacific is driven by increasing regulatory support and consumer demand for ethical products. Several countries in the region, such as Australia, India, New Zealand, Taiwan, and South Korea, have enacted legislation to ban cosmetics animal testing, aligning with global trends and enhancing market growth.

Key Cruelty-free Cosmetics Company Insights

The market is relatively fragmented due to the presence of numerous companies offering diverse products. e.l.f Cosmetics, Inc., The Body Shop International Limited, Too Faced, Tarte Cosmetics, Urban Decay, and Fenty Beauty are some of the key market participants. These companies leverage their ethical stances, transparency, and innovations in formulation and packaging to differentiate themselves in a growing market. These companies have been at the forefront of advocating for animal rights in the cosmetics industry, with a strong focus on maintaining ethical practices across its product range.

Key Cruelty-free Cosmetics Companies:

The following are the leading companies in the cruelty-free cosmetics market. These companies collectively hold the largest market share and dictate industry trends.

- e.l.f. Cosmetics, Inc.

- The Body Shop International Limited

- Urban Decay

- Too Faced Cosmetics, LLC

- Markwins Beauty Products, Inc. (wet n wild)

- Burt's Bees

- bareMinerals

- Charlotte Tilbury Beauty Inc.

- Milani Cosmetics

- Garnier LLC

Recent Developments

-

In 2023, The Body Shop launched a new collection of cruelty-free, vegan, and high-performance makeup, featuring ingredients like hyaluronic acid, tea tree oil, and vitamin C. This new generation of makeup not only enhances self-expression but also provides skincare benefits.

-

In December 2023, The Body Shop became the first global beauty brand to achieve 100% vegan product formulations across all ranges, certified by The Vegan Society. This milestone aligns with their long-standing commitment to cruelty-free beauty, having campaigned against animal testing since 1989. This strategic initiative sets a new standard in the industry, promoting vegan and cruelty-free products and reducing animal exploitation in beauty products.

-

In March 2021, Garnier was officially certified as cruelty-free by Cruelty Free International under the Leaping Bunny programme, marking a significant ethical milestone. This certification involved an extensive 18-month investigation of Garnier's entire supply chain, encompassing up to 500 suppliers and over 3,000 ingredients. As part of this initiative, Garnier ceased sales in mainland China, where animal testing is mandatory for certain cosmetics.

Cruelty-free Cosmetics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.83 billion

Revenue forecast in 2030

USD 23.54 billion

Growth Rate (Revenue)

CAGR of 6.8% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, distribution channel, and region

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, U.K., France, Italy, Spain, China, Japan, India, Australia, Brazil, South Africa, Saudi Arabia

Key companies profiled

e.l.f. Cosmetics, Inc., The Body Shop International Limited, Urban Decay, Too Faced Cosmetics, LLC, Markwins Beauty Products, Inc. (wet n wild), Burt's Bees, bareMinerals, Charlotte Tilbury Beauty Inc., Milani Cosmetics, Garnier LLC

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cruelty-Free Cosmetics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cruelty-free cosmetics market report on the basis of product, end use, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Skincare

-

Facial Skincare

-

Lotions, Face Creams, & Moisturizers

-

Cleansers & Face Wash

-

Facial Serums

-

Face Masks

-

Sunscreen/Sun Care

-

Others

-

-

Body Skincare

-

Hair Removal Products

-

Lotions, Creams, & Moisturizers

-

Body Sunscreen/Sun Care

-

Body Scrub

-

Others

-

-

-

Haircare

-

Shampoo

-

Conditioner

-

Oils

-

Serums

-

Others

-

-

Makeup

-

Fragrance

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Women

-

Men

-

Unisex

-

Children

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Pharmacies & Drugstores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global cruelty-free cosmetics market size was estimated at USD 14.84 billion in 2023 and is expected to reach USD 15.83 billion in 2024.

b. The global cruelty-free cosmetics market is expected to grow at a compound annual growth rate of 6.8% from 2024 to 2030 to reach USD 23.54 billion by 2030.

b. The cruelty-free cosmetics market in North America accounted for a revenue share of 32.1% of the global market in 2023. This prominence is driven by strong consumer demand for ethical and sustainable beauty products, with major brands like Too Faced, Tarte Cosmetics, and Fenty Beauty leading the charge.

b. e.l.f. Cosmetics, Inc., The Body Shop International Limited, Too Faced, Tarte Cosmetics, Urban Decay, and Fenty Beauty are some of the key market participants.

b. The market growth is attributed to increasing consumer awareness and demand for ethical and sustainable beauty products, stringent regulations against animal testing, and innovations in alternative testing methods.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.