- Home

- »

- Distribution & Utilities

- »

-

Critical Power And Cooling Market Size & Share Report 2030GVR Report cover

![Critical Power And Cooling Market Size, Share & Trends Report]()

Critical Power And Cooling Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Power Type, Cooling Type), By End-use (Industrial, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-393-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Critical Power And Cooling Market Trends

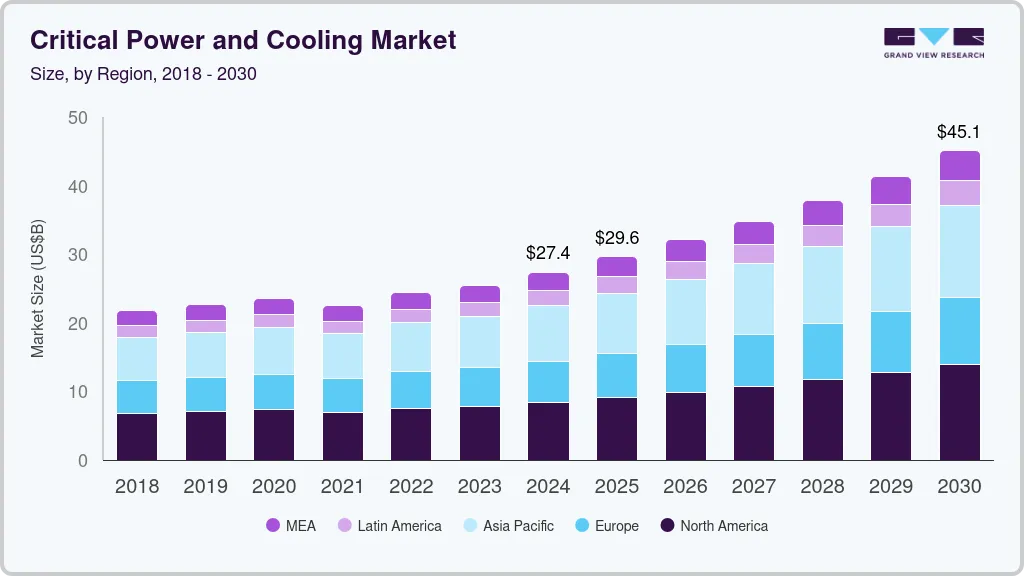

The global critical power and cooling market size was estimated at USD 27,367.8 million in 2024 and is estimated to grow at a CAGR of 8.8% from 2025 to 2030. The market is driven by the rapid expansion of data centers fueled by the growing demand for cloud computing and digital services, necessitating efficient cooling solutions for optimal operational performance.

The rapid expansion of cloud computing, digitization, and telecommunications is driving heightened demand for data canters, which necessitate controlled environments for optimal performance. Simultaneously, advancements in the industrial and commercial sectors underscore the need for dependable, uninterrupted power supply solutions, fueling growth in the critical power and cooling market.

Drivers, Opportunities & Restraints

The market is propelled by escalating demand from growing data centers driven by the rapid expansion of cloud computing and digital services. These facilities require sophisticated cooling systems to maintain optimal operating temperatures for their sensitive equipment. The growth in digital data, IoT applications, and online services further amplifies the need for reliable power solutions and efficient cooling technologies, thereby driving substantial investments in the market.

Regulatory constraints and safety considerations regarding the handling and storage of critical power equipment present significant challenges in the market. Compliance with stringent environmental standards and safety regulations adds complexity and increases operational costs for stakeholders. Additionally, concerns over potential risks related to equipment failure, operational disruptions, and environmental impact constrain the widespread adoption of critical power and cooling solutions, impacting market growth to some extent.

Opportunities in the market are abundant, particularly with increasing investments in industrial and commercial sectors aiming to enhance operational resilience and sustainability. Advancements in technology, such as energy-efficient solutions and smart grid integration, present opportunities for innovation and market expansion. Moreover, the rising demand for reliable power supply solutions in emerging economies, coupled with government initiatives promoting energy efficiency and green technologies, creates a favorable landscape for growth and investment in the critical power and cooling sector.

Type Insights & Trends

“Critical Power Type held the largest revenue share of the critical power and cooling market in 2023.”

Critical power type segment includes uninterruptible power supply (UPS) systems, generators, power distribution units (PDUs), and energy storage solutions. The demand for UPS systems remains robust, driven by their essential role in providing backup power to sensitive equipment in industries such as data centers, telecommunications, and healthcare. Generators also play a critical role, particularly in sectors requiring continuous power supply during outages or emergencies.

The critical cooling type segment encompasses precision air conditioning systems, chillers, and liquid cooling solutions. These systems are vital for maintaining optimal operating temperatures in data centers, industrial facilities, and commercial buildings. Increasingly, advancements in cooling technologies focus on energy efficiency and sustainability, aligning with stringent environmental regulations and operational demands.

End-use Insights & Trends

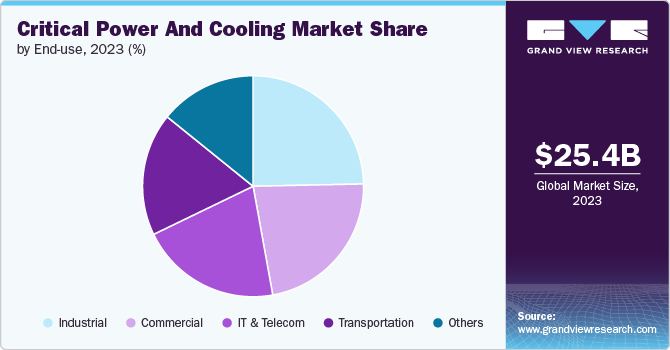

“Industrial segment held the largest revenue share of critical power and cooling market in 2023.”

The IT & Telecom sector is crucial in the market due to its heavy reliance on uninterrupted power supply and efficient cooling. Data centers, essential for digital services and cloud computing, drive significant demand. The sector's expansion of mobile devices, IoT, and data storage intensifies the need for reliable infrastructure. Stringent uptime requirements propel investments in advanced power backups and cooling technologies.

The transportation sector is poised as the fastest-growing segment in the critical power and cooling market, driven by the electrification of vehicles and advancements in automotive technologies. As electric vehicles (EVs) gain traction globally, there is a burgeoning demand for charging infrastructure that relies on robust power distribution and cooling solutions to ensure efficient operation and reliability.

Additionally, the integration of smart transportation systems, such as autonomous vehicles and connected infrastructure, further escalates the need for resilient power supply and climate control mechanisms. Government initiatives promoting sustainable transportation solutions and reducing carbon emissions also spur investments in critical power and cooling technologies within this rapidly evolving segment.

Regional Insights

“U.S. dominated the revenue share of the North America critical power and cooling market.”

North America critical power and cooling market is driven by robust economic growth and technological advancements. The U.S. leads the region, propelled by extensive data centers and telecommunications infrastructure investments. For instance, in February 2024, AT&T announced that it would provide fiber-enabled broadband services to over 2000 business and residential locations in Sevastopol, Wisconsin. The project planning and engineering is expected to start in the first quarter of 2024, with the completion of the network buildout projected in 2 years.

U.S. Critical Power and Cooling Market Trends

The critical power and cooling market of the U.S. is characterized by its leadership in data center expansions and advancements in digital technology. With a strong emphasis on uninterrupted power supply and efficient cooling systems, the market thrives on the increasing demand from industries such as IT, telecommunications, and healthcare. Government initiatives promoting energy efficiency and renewable energy sources drive investments in sustainable infrastructure solutions, shaping the future landscape of the market.

Asia Pacific Critical Power And Cooling Market Trends

Asia Pacific critical power and cooling marketis driven by rapid industrialization and urbanization. Countries like China, India, and Japan lead the market with substantial investments in data centers, telecommunications networks, and smart city infrastructure.

For instance, in January 2024, AWS and Google Cloud will invest heavily in their data center operations while recognizing the need for sustainability due to increased energy consumption. AWS announced USD 35 billion in cloud data center campuses in Virginia, U.S., by 2040 and USD 15 billion in expansion of its existing data center regions in Japan by 2027.

Europe Critical Power And Cooling Market Trends

The critical power and cooling market of Europeis witnessing significant growth. The region’s leadership in automotive manufacturing and IT services drives demand for robust power supply and precision cooling systems. Increasing adoption of renewable energy sources and smart grid technologies enhances the market's focus on sustainability and operational resilience. Innovations in data center management and green building practices contribute to Europe's role as a frontrunner in advancing critical power and cooling solutions across various industries.

For instance, in June 2023, IBM announced it would open its quantum data center in Europe. This data center is expected to provide government agencies, research institutions, and companies access to advanced quantum computing. It is expected to be operational by 2024 and features several IBM quantum computing systems with utility-scale quantum processors of over 100 qubits.

Key Critical Power And Cooling Company Insights

Some of the key players operating in the market include Schneider Electric and Eaton Corporation

-

Eaton Corporation is a global leader in power management solutions, specializing in critical power and cooling technologies. The company offers a comprehensive portfolio of products and services tailored for diverse industrial and commercial applications. Eaton's expertise spans uninterruptible power supplies (UPS), power distribution units (PDUs), and advanced cooling systems, ensuring reliable operation and energy efficiency in data centers, manufacturing facilities, and healthcare institutions worldwide.

-

Schneider Electric is a prominent provider of energy management and automation solutions, prominently featuring in the critical power and cooling market. With a focus on sustainability and innovation, it delivers a wide range of products including UPS systems, cooling solutions, and energy management software. Their solutions cater to various sectors such as data centers, telecommunications, and industrial facilities, offering enhanced reliability and operational efficiency while supporting environmental objectives.

Key Critical Power And Cooling Companies:

The following are the leading companies in the critical power and cooling market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Asetek A/S

- Cyber Power Systems

- Daikin Industries, Ltd.

- Delta Electronic, Inc.

- Eaton Corporation

- General Electric

- Johnson Controls, Inc.

- Rittal GmbH & Co. Kg

- Schneider Electric

- Siemens

- Socomec

- Stulz GmbH

- Vertiv Co.

Recent Developments

-

In June 2022, Schneider Electric, a leader in energy management and automation, conducted three independent research studies to assess sustainability maturity within IT and data center sectors, focusing on achieving net zero IT operations. Recent disclosures from these studies unveiled at a Delhi press conference, underscored a notable gap in sustainability actions.

-

In June 2022, Schneider Electric introduced the enhanced mySchneider IT Partner Program, aimed at fostering partner growth through a streamlined, collaborative approach. This updated program places a stronger emphasis on supporting diverse business models. It enables partners to differentiate themselves in the industry by specializing in multiple IT competencies and serving as strategic advisors.

Critical Power and Cooling Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 29,601.0 million

Revenue forecast in 2030

USD 45,086.1 million

Growth rate

CAGR of 8.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Schneider Electric; Asetek A/S; ABB; Siemens; Delta Electronic, Inc.; Vertiv Co.; Daikin Industries, Ltd.; Eaton Corporation; Johnson Controls, Inc.; General Electric; Rittal GmbH & Co. Kg; Cyber Power Systems; Socomec; Stulz GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Critical Power and Cooling Market Report Segmentation

This report forecasts revenue growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global critical power and cooling market report based on type, end-use, and region.

-

Type Outlook (Revenue, USD Billion; 2018 - 2030)

-

Critical Power Type

-

Critical Cooling Type

-

-

End-use Outlook (Revenue, USD Billion; 2018 - 2030)

-

Industrial

-

Commercial

-

IT & Telecom

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global critical power and cooling market size was estimated at USD 25.43 billion in 2023 and is expected to reach USD 27.37 billion in 2024.

b. The global critical power and cooling market is expected to grow at a compound annual growth rate of 8.7% from 2024 to 2030 to reach USD 45.09 billion by 2030.

b. By end use, industrial dominated the market with a revenue share of over 24.0% in 2023.

b. Some of the key vendors of the global critical power and cooling market are Schneider Electric, Asetek A/S, ABB, Siemens, Delta Electronic, Inc., Vertiv Co., Daikin Industries, Ltd., Eaton Corporation, Johnson Controls, Inc., General Electric, Rittal GmbH & Co. Kg, Cyber Power Systems, Socomec, and Stulz GmbH.

b. The key factor driving the growth of the global critical power and cooling market is attributed to the significant growth driven by increasing demand from various sectors, including construction & mining, commercial, and industrial.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.