- Home

- »

- Clothing, Footwear & Accessories

- »

-

Cricket Apparel And Equipment Market Size Report, 2030GVR Report cover

![Cricket Apparel And Equipment Market Size, Share & Trends Report]()

Cricket Apparel And Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Cricket Apparel, Cricket Shoes, Cricket Equipment), By End Use (Professional Players, Recreational Players), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-341-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cricket Apparel And Equipment Market Summary

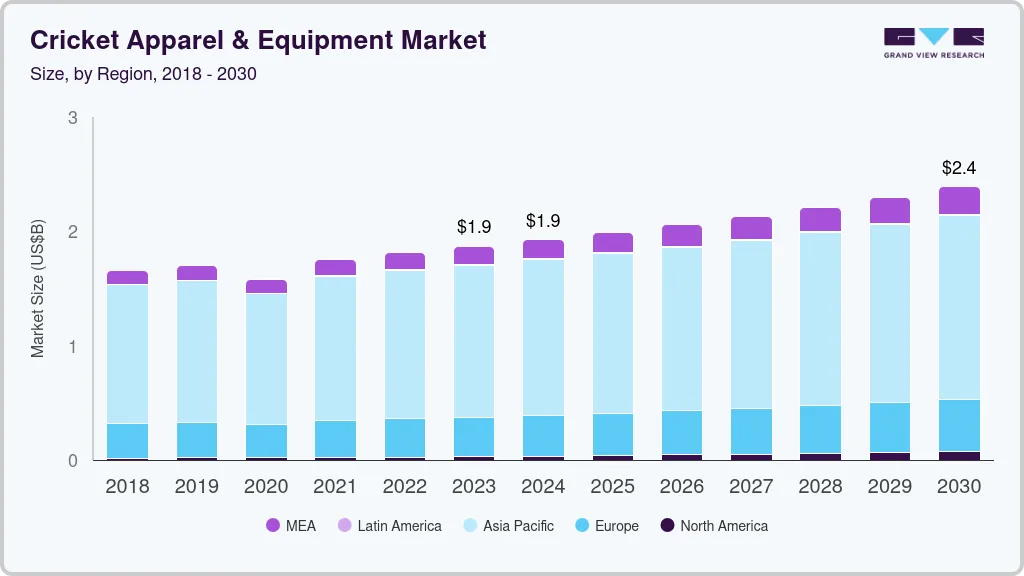

The global cricket apparel & equipment market size was estimated at USD 1.86 billion in 2023 and is projected to reach USD 2.39 billion by 2030, growing at a CAGR of 3.7% from 2024 to 2030. The market is primarily driven by increasing global participation in cricket, spurred by the popularity of professional leagues like the Indian Premier League (IPL) and Big Bash.

Key Market Trends & Insights

- The cricket apparel & equipment market in Asia Pacific accounted for a revenue share of 71.2% in 2023.

- India cricket apparel & equipment market is expected to grow at a CAGR of 3.6% from 2024 to 2030.

- By product, cricket apparel accounted for the largest revenue share of 61.9% in 2023.

- By end use, professional cricket players’ apparel and equipment accounted for the largest revenue share in 2023.

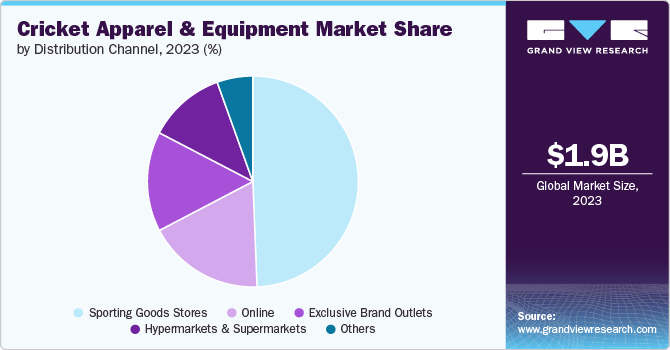

- By distribution channel, sales through sporting goods stores accounted for the largest revenue share of 49.4% in 2023 in the cricket apparel and equipment market.

Market Size & Forecast

- 2023 Market Size: USD 1.86 Billion

- 2030 Projected Market Size: USD 2.39 Billion

- CAGR (2024-2030): 3.7%

- Asia Pacific: Largest market in 2023

Technological advancements in equipment, such as lightweight materials and advanced design for improved performance and safety, also play a significant role in the adoption of the products. Furthermore, evolving consumer preferences toward personalized and fashionable cricket gear further contribute to market growth. Strategic initiatives by manufacturers, including product diversification and partnerships with professional players, enhance market competitiveness. These factors are expected to drive the demand for high-quality cricket apparel and equipment across amateur and professional levels worldwide during the forecast period.Cricket's popularity is expanding beyond traditional strongholds like India, England, Australia, and Pakistan. Countries in Asia, Africa, and the Americas are witnessing a surge in participation due to increased infrastructure development, grassroots programs, and televised international matches. The advent of Twenty20 (T20) leagues such as the Indian Premier League (IPL), Big Bash League (BBL), and Caribbean Premier League (CPL) has significantly boosted cricket's global appeal. These leagues attract top international players and have popularized cricket among younger audiences, driving demand for high-quality equipment and apparel.

Women's cricket has gained momentum globally, supported by international tournaments like the ICC Women's Cricket World Cup and the Women's T20 Challenge. This growth has created a demand for specialized cricket gear tailored to female players, including protective equipment and clothing designed for comfort and performance.

Manufacturers in the cricket apparel and equipment market are implementing strategic initiatives to strengthen their market position and meet consumer demands. Companies are diversifying their product offerings to include a wide range of equipment and apparel suited for different formats of the game (Test, ODI, T20) and playing conditions (e.g., day-night matches). Continuous innovation in materials, design, and functionality ensures products remain competitive in the market. Furthermore, manufacturers are collaborating with international cricket stars and professional teams to enhance brand visibility and credibility. Sponsorship deals and endorsements help manufacturers showcase their products' performance capabilities and appeal to aspiring cricketers worldwide, further driving the demand for cricket apparel & equipment during the forecast period.

Moreover, investments in sports infrastructure, including cricket grounds, practice nets, and indoor facilities, expand access to cricket training and competitive opportunities for players of all ages and skill levels. These initiatives cultivate grassroots participation, talent development, and sustained interest in cricket equipment and apparel among aspiring athletes, further driving the demand and growth of the cricket apparel & equipment market across the world during the forecast period.

Product Insights

Cricket apparel accounted for the largest revenue share of 61.9% in 2023. Leading apparel brands secure endorsement deals and sponsorships with international cricket teams, leagues, and individual players, increasing their market visibility and credibility. Official partnerships with cricketing bodies and tournaments resulting in brand recognition and consumer trust, driving sales of licensed apparel among fans and supporters, driving demand and sales of cricket apparel by fans & supporters during the forecast period.

Furthermore, cricket apparel is designed to enhance player performance and comfort during matches. Key features include moisture-wicking fabrics that manage sweat and maintain body temperature, ergonomic cuts for unrestricted movement, and lightweight materials that offer agility without compromising durability. Manufacturers are innovating the apparel category by incorporating the above features driving the increasing adoption of these apparel by professional players driving the overall cricket apparel market during the forecast period.

The cricket shoes market is expected to grow at the highest CAGR of 5.2% from 2024 to 2030. Cricket is a sport characterized by its dynamic nature, involving rapid sprinting, sharp turns, and precise footwork, necessitating specialized footwear that offers durability, agility, and superior grip. This has driven the demand for shoes designed specifically for cricket. Moreover, there is a growing awareness among players about the importance of wearing the right shoes for cricket to enhance performance and prevent injuries further driving demand for specialized footwear. All these factors are expected to drive the market growth for cricket shoes during the forecast period.

End Use Insights

Professional cricket players’ apparel and equipment accounted for the largest revenue share in 2023. Manufacturers invest heavily in research and development to innovate cricket equipment that enhances performance metrics. This involves integrating cutting-edge materials and manufacturing techniques to produce lighter, more resilient equipment that aids professional players in achieving peak performance, thus leading to increased sales and demand for cricket apparel and equipment for professional players during the forecast period.

The recreational segment is expected to grow with a CAGR of 4.3% from 2024 to 2030. recreational gear is often more accessible and affordable. This affordability factor allows a broader demographic of cricket enthusiasts, including hobbyists, beginners, and occasional players, to invest in basic equipment such as entry-level bats, gloves, and pads. Furthermore, Manufacturers offer entry-level bats, gloves, pads, and apparel that are affordable yet functional, allowing new players to invest in basic gear without significant financial commitment, which is expected to drive growth in sales of cricket apparel and equipment by recreational players during the forecast period.

Distribution Channel Insights

Sales through sporting goods stores accounted for the largest revenue share of 49.4% in 2023 in the cricket apparel and equipment market. These retailers offer a wide range of products catering to various sporting activities, including specialized gear for cricket. The extensive range available meets the diverse needs and preferences of cricket sport enthusiasts, thereby driving sales through this channel. Sporting goods stores also provide a personalized retail experience tailored to the needs of their customers, often employing knowledgeable staff who offer expert advice and guidance on apparel & equipment selection.

Moreover, many leading cricket apparel & equipment brands strategically partner with these stores to expand their market reach and make their products more accessible to consumers. This collaboration ensures that consumers have access to a wide selection of cricket apparel and equipment from both established and emerging brands. This availability of diverse product offerings further drives sales through sporting goods stores, further contributing to the growth of the cricket apparel and equipment market through this channel during the forecast period.

The online segment is expected to grow with a CAGR of 6.3% from 2024 to 2030. Online channels offer convenience, allowing customers to browse, compare, and purchase cricket apparel & equipment from the comfort of their homes. Furthermore, online platforms facilitate transparent pricing and easy comparison shopping, enabling consumers to quickly compare prices, features, and customer reviews across different brands and retailers.

Moreover, changing consumer preferences, particularly among younger demographics across the world, favor online shopping due to its convenience, flexibility, and seamless user experience. As digital natives become a larger share of the consumer market, the preference for online channels is expected to drive high sales growth through this channel in the cricket apparel & equipment market during the forecast period.

Regional Insights

North America cricket apparel & equipment market is expected to grow at a CAGR of 14.8% from 2024 to 2030. Cricket's integration into mainstream sports culture in North America is gradually expanding its appeal beyond traditional cricket-playing communities. As an alternative sport to baseball and basketball, cricket attracts a diverse audience interested in exploring new athletic pursuits. Furthermore, the increasing participation of youth in cricket leagues, school programs, and community initiatives across North America is further driving demand for cricket apparel & equipment.

U.S. Cricket Apparel And Equipment Market Trends

The cricket apparel & equipment market in the U.S. is expected to grow at a CAGR of 15.1% from 2024 to 2030. There has been a noticeable increase in youth participation in cricket across the U.S. Schools, colleges, and community organizations are increasingly adopting cricket into their sports programs, introducing young athletes to the game. This growing interest in cricket among American youth fuels demand for cricket equipment, including junior-sized bats, youth gloves, and safety gear designed for beginners and amateur players, driving the sales of cricket apparel & equipment in the country during the forecast period.

Asia Pacific Cricket Apparel And Equipment Market Trends

The cricket apparel & equipment market in Asia Pacific accounted for a revenue share of 71.2% in 2023. Cricket holds profound cultural importance in countries like India, Pakistan, Australia, and New Zealand, cultivating a strong market for cricket merchandise. The sport's popularity fuels demand for authentic jerseys, bats, gloves, and protective equipment among fans and players. Increasing disposable incomes enable consumers to invest in premium cricket gear, emphasizing performance and durability. Youth participation in cricket leagues and training programs nurtures early adoption of specialized equipment, driving sustained demand for the cricket apparel & equipment in the region during the forecast period.

India cricket apparel & equipment market is expected to grow at a CAGR of 3.6% from 2024 to 2030. Cricket is more than just a sport in India. The country's obsession with cricket is prominently displayed during major tournaments like the Indian Premier League (IPL) and international matches, where fans enthusiastically support their favorite teams and players. This passionate fan base translates into a robust demand for cricket apparel and equipment, including jerseys, bats, gloves, helmets, and protective gear.

Furthermore, India's rapid digital transformation has significantly impacted the cricket apparel & equipment market. The proliferation of smartphones, internet connectivity, and e-commerce platforms has made it easier for cricket enthusiasts across the country to access a wide range of merchandise online. Major sports brands and retailers leverage digital channels to reach a broader audience, offering convenience, competitive pricing, and a diverse product range. This digital accessibility has democratized the market, allowing consumers from tier-1 cities to rural areas to purchase cricket gear with ease, further driving the sales of cricket apparel & equipment in the country during the forecast period.

Europe Cricket Apparel And Equipment Market Trends

The cricket apparel & equipment market in Europe is expected to grow at a CAGR of 4.0% from 2024 to 2030. Europe's role as a host for international cricket tournaments, such as the ICC Champions Trophy and domestic leagues like the County Championship in England, enhances the visibility and popularity of cricket within the region. Furthermore, there is a notable investment in sports infrastructure, including the construction of cricket stadiums, training facilities, and coaching academies, further expected to contribute to the growth of the cricket apparel & equipment market in Europe during the forecast period.

Key Cricket Apparel And Equipment Company Insights

The market is characterized by numerous well-established and emerging players. Manufacturers are expanding their product lines to cater to diverse customer segments, including professional players, amateur enthusiasts, and youth cricketers. This involves offering a range of products at various price points to accommodate different budgets and needs. Furthermore, companies are constantly upgrading materials and designs to enhance the performance, durability, and comfort of cricket gear such as bats, gloves, and protective equipment. Moreover, companies are also engaging in partnerships with cricket teams and players to increase their brand visibility and credibility, with sponsorships and endorsements enhancing market presence and brand loyalty.

Key Cricket Apparel And Equipment Companies:

The following are the leading companies in the cricket apparel and equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Adidas AG

- Nike, Inc.

- Puma SE

- Gray-Nicolls Sports Ltd.

- Gunn & Moore Limited

- Kookaburra Sport Pty Ltd.

- Sanspareils Greenlands (SG)

- Slazenger Limited

- Spartan Sports International

- Sareen Sports Industries (SS)

Recent Developments

-

In June 2024, FanCode Shop, the merchandising division of FanCode, has renewed its exclusive licensing and merchandising partnership with the International Cricket Council (ICC) in India. This partnership allows FanCode Shop to create official fan merchandise and accessories for the ICC Men's T20 World Cup 2024 and ICC Women’s T20 World Cup 2024. As a result, Team India jerseys made available in select cities, including Mumbai, Ahmedabad, Delhi, Hyderabad, Kolkata, and Bangalore.

-

In April 2024, GR8 Sports India Pvt Ltd, a manufacturer specializing in Kashmir willow cricket bats, unveiled its latest bat designed for Women's International Cricket. This bat was used by around six international players from the West Indies Women's Team during their tour of Pakistan, encompassing three One Day Internationals and five T20 Internationals against Pakistan.

-

In May 2024, Adidas AG unveiled the Team India jersey for the 2024 International T20 World Cup. The jersey is now accessible to cricket fans through their stores and online platforms. Additionally, Adidas AG announced its ongoing partnership as the official kit sponsor for the Indian cricket team, extending until March 2028.

-

In February 2024, PUMA India has partnered with Delhi Capitals as their official kit sponsor for the Indian Premier League 2024. The collaboration entails a multi-year agreement with the team. The team kit includes training wear, accessories, travel gear, and athleisure, all designed with the same aesthetic as the jersey.

Cricket Apparel And Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.93 billion

Revenue forecast in 2030

USD 2.39 billion

Growth Rate (Revenue)

CAGR of 3.7% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end user, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, UK, Ireland, Netherlands, Scotland, Australia, Pakistan, India, New Zealand, Sri Lanka, Bangladesh, South Africa, U.A.E.

Key companies profiled

Adidas AG; Nike, Inc.; Puma SE; Gray-Nicolls Sports Ltd.; Gunn & Moore Limited; Kookaburra Sport Pty Ltd.; Sanspareils Greenlands (SG); Slazenger Limited; Spartan Sports International; Sareen Sports Industries (SS)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cricket Apparel And Equipment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cricket apparel and equipment market report on the basis of product, end use, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cricket Apparel

-

Jerseys & T-Shirts

-

Pants

-

Others

-

-

Cricket Shoes

-

Cricket Equipment

-

Cricket Bats

-

Cricket Balls

-

Helmets

-

Gloves

-

Pads

-

Others

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Professional Players

-

Recreational Players

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Sporting Goods Stores

-

Hypermarkets & Supermarkets

-

Exclusive Brand Outlets

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Ireland

-

Netherlands

-

Scotland

-

-

Asia Pacific

-

Australia

-

Pakistan

-

India

-

New Zealand

-

Sri Lanka

-

Bangladesh

-

-

Central & South America

-

Middle East & Africa

-

South Africa

-

U.A.E.

-

-

Frequently Asked Questions About This Report

b. The global cricket apparel and equipment market size was estimated at USD 1.86 billion in 2023 and is expected to reach USD 1.93 billion in 2024.

b. The global cricket apparel and equipment market market is expected to grow at a compounded growth rate of 3.7% from 2024 to 2030 to reach USD 2.39 billion by 2030.

b. Cricket apparel dominated the cricket apparel & equipment market with a share of 61.7% in 2023. The increasing global participation in cricket, the growing popularity of T20 leagues, and the influence of major international tournaments boost demand for licensed and commemorative merchandise.

b. Some key players operating in the cricket apparel and equipment market include Adidas AG; Nike, Inc.; Puma SE; Gray-Nicolls Sports Ltd.; Gunn & Moore Limited; Kookaburra Sport Pty Ltd.; Sanspareils Greenlands (SG); Slazenger Limited; Spartan Sports International; and Sareen Sports Industries (SS).

b. The market is driven by increasing global participation, the popularity of T20 leagues, technological advancements in gear, infrastructure development, and the influence of major international tournaments. Rising health and fitness trends also contribute to the growing demand for high-quality cricket products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.