Credentialing Software And Services In Healthcare Market Size, Share & Trends Analysis Report By Component (Software, Services), By Functionality, By Deployment Type, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-279-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

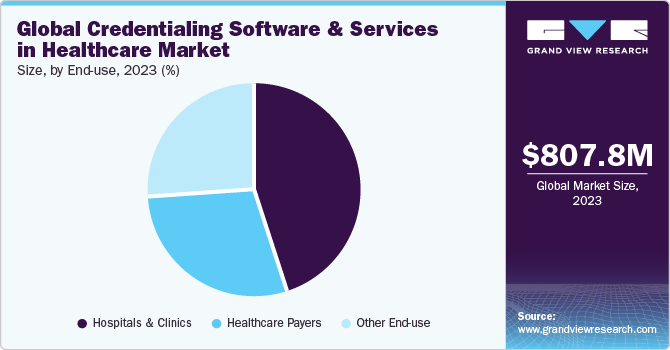

The global credentialing software and services in healthcare market size was estimated at USD 807.8 million in 2023 and is expected to grow at a CAGR of 8.3% from 2024 to 2030. The growth is attributed to the increasing awareness of the advantages of credentialing solutions, growing adoption of cloud-based solutions, rising technological advancements in healthcare IT infrastructure, and a growing number of strategic initiatives undertaken by the market players. For instance, in March 2024, Noridian Healthcare Solutions, LLC partnered with Acorn Credentialing to elevate health plans’ provider enrollment and credentialing operations. Together, the companies accelerated onboarding processes and reduced abrasion caused by slow and inefficient processes.

An article published by BillingParadise, a medical billing company, in November 2023, highlighted that physicians spend USD 7,618 annually to submit credentialing applications to the payers. Automated credentialing offers significant advantages over manual credentialing processes in the healthcare industry. It allows healthcare organizations to prioritize patient care over administrative duties, increasing efficiency, and reducing resource utilization. This streamlined process helps save money & time and optimizes return on investment for healthcare organizations. Thus, credentialing process automation saves around USD 29,000 annually for physicians and around 3 hours required for filling credentialing information.

Moreover, integration capabilities are crucial for healthcare IT infrastructure, allowing different systems to communicate and share data seamlessly. Credentialing software that integrates with other healthcare systems, such as electronic health records and practice management systems, enhances interoperability & data exchange. Thus, prominent players in the market are focusing on advancements in integration capabilities. For example, Symplr is making advancements in its Connected Enterprise vision by integrating its SaaS solutions with a unified user interface, an API Gateway (featuring EHR integration), and a shared range of platform services. This allows synchronized workflows across solutions.

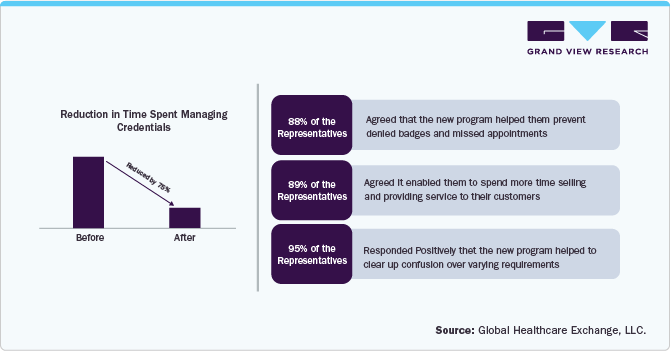

Case Study Insights:

A pharmaceutical company that serves healthcare systems across the U.S. faced critical issues ensuring that its 2,000+ representatives comprehended and complied with the conditions set by each healthcare facility. The lack of a dedicated resource to facilitate the credentialing process was a major hindrance, which imposed a burden on the existing staff and necessitated a substantial investment of time from the sales representatives to fulfill the credentialing requirements.

Solution:

The pharmaceutical company opted for Global Healthcare Exchange, LLC's Credentialing Managed Service. It helped the pharmaceutical company with the following parameters:

-

Customized project path to establish procedures and processes to meet the credentialing requirements

-

Daily assistance with credentialing across credentialing agencies and hospitals

-

Communication and activities to drive adherence and lower access denial

-

Aid for seamless interactions between hospitals, reps, and credentialing agencies

Result:

Market Concentration & Characteristics

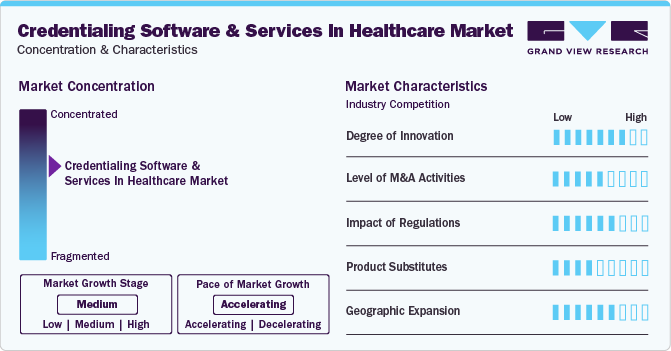

The degree of innovation in the credentialing software and services industry is high. The advancements in innovation can be attributed to the growing utilization of cloud computing, artificial intelligence (AI) & machine learning (ML), and IT solutions. The activities, such as mergers, acquisitions, and partnerships, enable companies to expand geographically, financially, and technologically. For instance, in December 2020, sympler acquired TractManager from Arsenal Capital Partners. The acquisition strengthens the credentialing portfolio, as TractManager has previously acquired Newport Credentialing Solutions, a company specializing in credentialing solutions, in 2018.

The impact of regulations is moderate in the industry. Increasing regulatory compliance requirements for credentialing software & services highlights the need for robust security measures and data protection standards. For instance, in October 2022, compliance with the Health Insurance Portability and Accountability Act (HIPAA) and the Health Information Technology for Economic and Clinical Health (HITECH) Act is essential in the healthcare sector. These standards focus on safeguarding confidential information and ensuring secure electronic data transfer.

Companies in the industry undergo geographic expansion strategies to maintain their position in emerging markets and customer base from these regions. The market expansion is done by launching products and facilities in new locations or forging partnerships, mergers, and acquisitions with companies from different locations.

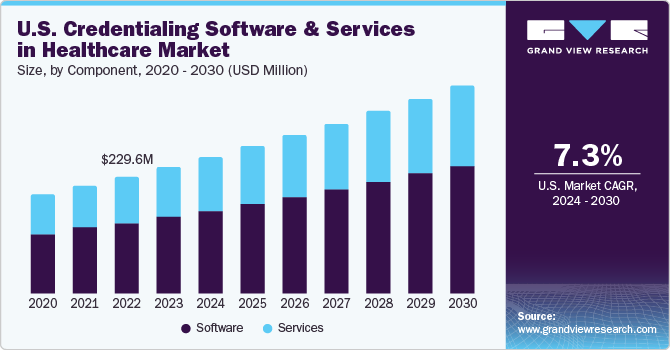

Component Insights

The software segment dominated the credentialing software and services in healthcare market with the largest revenue share of 59.6% in 2023. Healthcare credentialing software enables healthcare organizations and insurance companies to effectively store and manage the records of healthcare providers while ensuring that they possess the required certifications and licenses to practice. Deploying credentialing software solutions accelerates the provider enrollment process and improves its precision.

Hence, market players are focused on launching credentialing solutions and partnerships to improve operational workflows, financial efficiencies, and patient safety outcomes. For instance, in February 2024, Medallion introduced a one-day credentialing solution for healthcare associations to quickly and accurately transform the credentialing procedure. The solution can help complete primary source verifications instantly and with almost 100% accuracy. It offers Instant Primary Source Verifications (PSVs), Automated Quality Assurance (QA), and NCQA Compliance.

The services segment held a substantial market share in 2023. The services offered include real-time status updates, automated verification processes, and personalized assistance designed to optimize business operations, save resources and time, and ensure compliance & accuracy. For instance, the professional services provided by Applied Statistics & Management Inc. are delivered by a team of skilled data services experts with extensive experience in integrating diverse credentialing systems and data streams. It ensures a seamless and productive implementation process. By leveraging its expertise, the company aims to minimize downtime and disruptions, facilitating a smooth and swift transition to the new system for uninterrupted operations.

End-use Insights

The hospitals and clinics segment dominated the market with the largest share of 45.1% in 2023. The credentialing process is mandatory for all physicians who intend to provide patient care within a hospital setting, regardless of whether they are employed or working as independent practitioners. The automated process helps hospitals with quick billing & reimbursement, compliance, quality of care, productivity & efficiency, and payment & reimbursement. Hence, hospitals and clinics opt for automated credentialing solutions that help them optimize their operations, resulting in high operational efficiency and revenue.

The healthcare payers segment is expected to grow at the fastest CAGR during the forecast period. Payer credentialing is an ongoing process that spans the entire duration of the provider's career. Completing this process enables the provider to continue billing a specific payer. To make the credentialing process efficient and quick, numerous payers opt for credentialing services contributing to the segment's growth. Moreover, numerous companies are boosting the segment through product launches, partnerships, and acquisitions, among other strategic initiatives. For instance, in January 2024, DentalXChange introduced a credentialing platform called CredentialConnect, designed for dental practices and DSOs to simplify the payer credentialing process.

Functionality Insights

The credentialing and enrollment segment dominated the market with the largest revenue share of 55.3% in 2023. Credentialing and enrollment function as a substantial checks and balances system that effectively ensures the maintenance of high quality and standards in the Healthcare system. Additionally, it offers advantages, such as helping reduce medical blunders and malpractice, facilitating insurance reimbursements, assists in retaining staffing levels, and more.

Hence, market players are undertaking several initiatives to develop, advance, and promote credentialing and enrollment solutions considering the abovementioned advantages. For instance, in August 2022, QGenda launched QGenda Credentialing, which automates provider privileging, credentialing, and payer enrollment. It enables health systems to reduce administrative time and enhance data compliance and accuracy significantly. The proposed solution establishes an authentic and centralized source of provider credentialing data while automating the process of tracking and conveying the current status of providers.

The provider information management segment is expected to grow at the fastest CAGR from 2024 to 2030. Provider information management, also known as Provider Data Management (PDM), leverages technology, services, and procedures to facilitate healthcare organizations in efficiently gathering, consolidating, and managing extensive information about the providers in their ecosystems.

For instance, in August 2023, Madaket Health introduced the Madaket Provider Data Exchange to assist payers in complying with the No Surprises Act by providing real-time updates to their provider directory. The platform leverages Madaket's provider data management (PDM) system and directory of more than 80% of providers to assist payers in meeting the 48-hour requirement of the No Surprises Act without difficulty.

Deployment Type Insights

The cloud-based segment held the largest revenue share of 68.1% in 2023. Utilizing cloud-based medical credentialing software helps harness the potential of cloud computing to simplify and automate the credentialing process. It ensures that the credentialing data is updated by refreshing the information whenever changes or renewals occur and notifying the user of potential problems or expirations. In addition, cloud-based medical credentialing software can generate analytics and reports, which can be used to monitor and improve the credentialing process and compliance and save significant time.

For instance, Credsy.com, an organization specializing in delivering cloud-based credentialing solutions, has saved over 100,000 administrative hours for healthcare entities within the U.S. One of its clients, Virtual Care, experienced an 80% reduction in onboarding time and a 65% increase in provider credentialing speed. This improvement in efficiency has allowed Virtual Care to attend to more patients and generate higher revenues.

The on-premise segment is expected to grow at a significant CAGR from 2024 to 2030. On-premises data storage enables local data retention, providing greater control over sensitive information. It reduces the risk of data breaches or unauthorized access to company information. Moreover, on-premises solutions can be particularly useful for companies that must comply with strict regulations. In addition, on-premises systems offer several performance benefits, including low latency and a short feedback loop for rapid changes. In the event of an outage, on-site personnel can make necessary adjustments to the infrastructure, ensuring uninterrupted business operations.

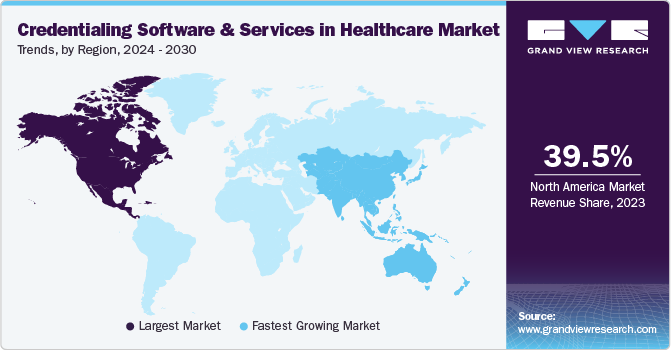

Regional Insights

North America dominated the credentialing software and services in the healthcare market with a revenue share of over 39.5% in 2023. Growth in the region can be attributed to the increasing emphasis on regulatory compliance, patient safety, and operational efficiency within the healthcare sector. Furthermore, the shortage of healthcare professionals in North America and the need for workforce optimization are expected to drive the adoption of credentialing software & services. These solutions enable healthcare facilities to efficiently manage provider credentials, streamline onboarding processes, and ensure qualified professionals are available to meet patient care requirements.

U.S. Credentialing Software And Services In Healthcare Market Trends

The credentialing software and services in the healthcare market in the U.S. is being driven by the growing adoption of EHR among office-based physicians and nonfederal acute care hospitals, the rising need for automated provider credentialing, and the presence of well-established healthcare infrastructure. For instance, in April 2023, symplr, a provider of enterprise healthcare operations software, unveiled four new product suites as a key component of its Connected Enterprise initiative. The suites align with credentialing services as they ensure that credentialed staff are efficiently managed & utilized, optimizing workforce resources.

Europe Credentialing Software And Services In Healthcare Market Trends

The Europe credentialing software & services in healthcare market followed North America in terms of revenue share in 2023 and is expected to maintain its position during the forecast period. The region’s revenue share can be justified by the contribution from developed European economies, such as Germany and the UK. Moreover, the rising technological advancements and the growing adoption of EHRs are expected to propel market growth. Favorable government initiatives for creating digital health & research to secure patient data is another key factor expected to drive market growth.

The credentialing software and services in healthcare market in Germany dominated in the European region in 2023. This can be attributed to the concerted efforts of public and private entities in Germany to raise awareness about cutting-edge technologies within the healthcare sector and to increased investments and the growing adoption of advanced technology. For instance, in September 2020, German hospitals & clinics are anticipated to invest USD 3.25 billion (€3 billion) to boost digitalization, which is expected to propel advanced digitization, emergency capacities, and IT security.

The UK credentialing software & services in healthcare market is expected to grow significantly during the forecast period. The strategic focus on modernizing healthcare infrastructure is anticipated to increase the demand for reliable credentialing software & services in the healthcare sector, propelling market growth. According to Medix Staffing Solutions article published in July 2023, the NHS assigned USD 2.17 billion (£2 billion) to facilitate the implementation of Electronic Patient Records (EPR/EHR) across all NHS trusts, as part of a broader digital transformation initiative. This investment is further projected to necessitate the use of credentialing software to reduce data breaches.

Asia Pacific Credentialing Software And Services In Healthcare Market Trends

Asia Pacific is anticipated to register the fastest growth over the forecast period. Growth can be attributed to the growing awareness of credentialing software & services benefits in healthcare settings, such as hospitals, the rising disposable incomes, and collaborative efforts by health departments & companies to encourage the use of credentialing software & services and improve the safety & quality of healthcare services in the region.

The credentialing software and services in healthcare market in China has a significant market share in 2023. The rising government support to boost healthcare infrastructure is expected to impact market growth positively. For instance, in September 2022, the Chinese State Council announced a loan of USD 246.40 billion as an incentive policy as part of its economic stimulus package. The loan was designed to enhance and modernize equipment in medical facilities, research institutes, universities, and public buildings.

The India credentialing software and services in healthcare market is expected to grow significantly during the forecast period. Growth in the country can be attributed to the increasing number of international collaborations & partnerships and improvements in healthcare infrastructure. In addition, the presence of government organizations, such as the National eHealth Authority of India (NeHA), which aims at facilitating the integration of multiple health information systems, is facilitating market growth.

Key Credentialing Software And Services In Healthcare Company Insights

The market is fairly competitive. Some of the most notable participants in the market are symplr, HealthStream, Bizmatics, Inc. (Constellation Software Inc.), Applied Statistics & Management, Inc., and others. These players are adopting various strategies such as new product launches, partnerships, and acquisitions to strengthen their market position.

Key Credentialing Software And Services In Healthcare Companies:

The following are the leading companies in the credentialing software and services in healthcare market. These companies collectively hold the largest market share and dictate industry trends.

- symplr

- HealthStream

- Bizmatics, Inc. (Constellation Software Inc.)

- Naviant

- OSP Labs

- Wybtrak, Inc.

- Applied Statistics & Management, Inc.

- 3WON

- HCA Management Services, L.P.

Recent Developments

-

In February 2024, Applied Statistics and Management Inc. (ASM) announced that its premier software, MD-Staff, received the 2024 Best in KLAS Award for Credentialing. This award highlights MD-Staff’s dedication to delivering remarkable credentialing offerings and its ongoing support for healthcare organizations globally.

-

In January 2024, CareCloud, Inc. partnered with Kovo HealthTech Corporation, a healthcare technology and billing-as-a-service company. The partnership enables Kovo’s customers to access advanced credentialing assistance, EHR solutions, practice management software, and a unified clearinghouse.

-

In June 2023, HealthStream launched a credential solution, CredentialStream. It comprises all the necessary components for requesting, collecting, and authenticating provider information, creating a centralized ‘Source of Truth’ to support subsequent processes.

-

In April 2023, symplr introduced four product suites under its Connected Enterprise initiative and unveiled the newest version of the Midas Care Management solution during the annual Healthcare Information and Management Systems Society (HIMSS) Conference. It includes the following suites: symplr Workforce Suite, symplr Supply Chain Suite, symplr Quality Suite, and symplr Credentialing Suite.

-

In February 2021, Harris, a Constellation Software Inc. subsidiary, announced acquiring Bizmatics Inc., a healthcare provider based in the U.S. The acquisition strengthened Harris’ position in the market as Bizmatics Inc. is one of the key players in the credentialing software and services industry.

Credentialing Software And Services In Healthcare Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 879.52 million |

|

Revenue forecast in 2030 |

USD 1.42 billion |

|

Growth rate |

CAGR of 8.3% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, functionality, deployment type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; U.K.; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

symplr; HealthStream; Bizmatics, Inc. (Constellation Software Inc.); Naviant; OSP Labs; Wybtrak, Inc.; Applied Statistics & Management, Inc.; 3WON; HCA Management Services, L.P. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Credentialing Software And Services In Healthcare Market Report Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global credentialing software and services in healthcare market report based on component, functionality, deployment type, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Functionality Outlook (Revenue, USD Million, 2018 - 2030)

-

Credentialing and Enrollment

-

Provider Information Management

-

-

Deployment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud Based

-

On-Premise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Healthcare Payers

-

Other End-use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global credentialing software and services in healthcare market was valued at USD 807.8 million in 2023 and is expected to reach USD 879.52 million in 2024.

b. The global credentialing software and services in healthcare market is expected to grow at a compound annual growth rate of 8.3% from 2024 to 2030 to reach USD 1.42 billion in 2030.

b. North America dominated the credentialing software and services in healthcare market with a revenue share of 39.5% in 2023. Growth in the region can be attributed to the increasing emphasis on regulatory compliance, patient safety, and operational efficiency within the healthcare sector

b. Some key players operating in the global credentialing software and services in healthcare market include symplr, HealthStream, Bizmatics, Inc. (Constellation Software Inc.), Naviant, OSP Labs, Wybtrak, Inc., Applied Statistics & Management, Inc., and 3WON.

b. Key factors driving the market growth are increasing awareness of the advantages of credentialing solutions, growing adoption of cloud-based solutions, rising technological advancements in healthcare IT infrastructure, and a growing number of strategic initiatives undertaken by the market players

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."