Creatine Supplements Market Size, Share & Trends Analysis Report By Form (Powder, Liquid, Capsules/Tablets), By Distribution Channel (Hypermarkets & Supermarkets, Pharmacy & Drug Stores, Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-341-5

- Number of Report Pages: 97

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Creatine Supplements Market Size & Trends

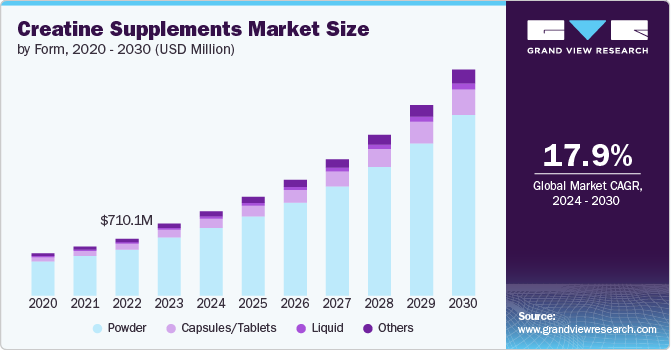

The creatine supplements market size was estimated at USD 901.2 million in 2023 and is expected to grow at a CAGR of 17.9% from 2024 to 2030. Increasing awareness of fitness and the benefits of creatine supplementation for improving athletic performance, muscle mass, and strength are driving the market growth. As sedentary lifestyles and unhealthy diets contribute to the rise in lifestyle diseases such as diabetes, cardiovascular diseases, obesity, and cancer, there is a growing emphasis on health and fitness.

Creatine supplements are widely used in the sports and fitness industry to enhance athletic performance, increase muscle mass, and improve strength. Creatine is a naturally occurring compound found in muscle cells and is also present in various foods, particularly in red meat and seafood. The primary role of creatine in the body is to help produce energy during high-intensity exercise or heavy lifting. Given its efficacy and safety, creatine supplements have gained immense popularity among athletes, bodybuilders, and fitness enthusiasts.

Creatine stands as one of the most established and renowned ingredients in sports nutrition. Athletes have relied on creatine for years to enhance exercise capacity and performance, increase muscle mass, and aid in muscle recovery. Despite the introduction and adoption of newer ingredients in the sports nutrition market over the years, the demand for creatine has remained consistently robust and has even seen growth.

Creatine is backed by substantial research demonstrating its effectiveness across various sports nutrition endpoints. The benefits of creatine are extensive, encompassing enhanced force and power output, increased strength and anaerobic threshold, and improved workout capacity.

The exercise preferences of active millennial men and women significantly influence the demand for creatine supplements. As millennials increasingly participate in high-intensity and endurance activities, creatine supplements have become an essential part of their fitness regimens. A study by Glanbia PLC reveals that strength training and CrossFit are the most common types of exercise for active Millennial men, with 24% engaging in these activities. These forms of exercise are known for their high intensity and demand substantial muscular strength, endurance, and recovery. Creatine is renowned for its ability to enhance muscle strength, power output, and recovery, making it an ideal supplement for those involved in strength training and CrossFit. The increasing demand for creatine supplements among Millennial men is driven by their desire to improve performance, increase muscle mass, and reduce recovery time.

The exercise preferences of active Millennials, including strength training, CrossFit, running, cycling, swimming, and holistic fitness activities, create a substantial market for creatine supplements. The specific benefits of creatine, such as enhanced muscle strength, power, endurance, and recovery, align perfectly with the fitness goals and routines of Millennial men and women. As these demographics continue to prioritize fitness and seek effective ways to enhance their performance, the demand for creatine supplements is expected to grow, driving the overall expansion of the market.

Form Insights

The powdered creatine supplements market accounted for a revenue share of 80.7% in 2023. Powdered creatine supplements are driving significant growth in the market due to their convenience, versatility, and effectiveness. These supplements are easy to use, typically mixed into water or shakes, making them convenient for consumption before or after workouts. They offer a customizable dosage, allowing users to adjust intake based on their specific fitness goals and body requirements, which appeals to athletes and fitness enthusiasts alike.

The capsule/tablets creatine supplements market is expected to grow at a CAGR of 18.9% from 2024 to 2030. Capsules and tablets of creatine supplements are growing rapidly due to their convenience, precise dosage control, portability, and expanding form offerings. These factors collectively contribute to their appeal and widespread adoption among consumers seeking effective and hassle-free ways to support their fitness goals and overall well-being.

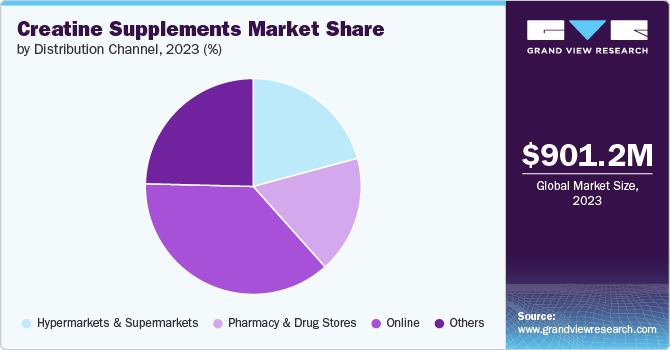

Distribution Channel Insights

Sales through online retail stores accounted for a revenue share of 37.0% in 2023. These platforms offer unmatched convenience, allowing consumers to browse, compare, and purchase creatine supplements from the comfort of their homes or on-the-go via mobile devices. The extensive form selection available online enables consumers to explore various brands and formulations, read reviews, and make informed purchasing decisions tailored to their specific needs. Competitive pricing, frequent discounts, and bulk purchase options online appeal to price-conscious consumers seeking value.

Sales of creatine supplements through hypermarkets & supermarkets are expected to grow with a CAGR of 18.1% from 2024 to 2030. Hypermarkets and supermarkets often allocate significant shelf space to health and wellness forms, including sports nutrition supplements like creatine. This visibility enhances form accessibility and exposure to a broader consumer base, including casual fitness enthusiasts and new users exploring supplement options. These retail channels benefit from established trust and credibility among consumers. Shoppers often perceive hypermarkets and supermarkets as reliable sources of quality forms, including dietary supplements. This trust factor is crucial in influencing purchase decisions, especially for health-related forms.

Regional Insights

North America creatine supplements market accounted for a revenue share of 38.0% in 2023. North America, particularly the United States, has a robust sports and fitness culture deeply ingrained in its society. This culture promotes a high level of awareness and adoption of sports nutrition supplements like creatine among athletes, fitness enthusiasts, and the general population seeking health and performance benefits. The region boasts a strong presence of leading manufacturers, distributors, and retailers specializing in sports nutrition forms. This infrastructure supports extensive form availability and accessibility across various retail channels, including specialty health stores, online platforms, and mainstream retail outlets.

U.S. Creatine Supplements Market Trends

The creatine supplements market in the U.S. is expected to grow at a CAGR of 18.9% from 2024 to 2030. This growth is driven by several factors that are increasing interest in creatine supplements. These include rising healthcare costs, regulatory changes in food laws impacting form claims and labeling, rapid advancements in science and technology, a growing geriatric population, and a heightened focus on achieving wellness through dietary practices. In March 2023, the U.S. Food and Drug Administration (FDA) launched a new webpage called the Dietary Supplement Ingredient Directory. This directory allows the public to look up ingredients used in dietary supplements and find information about the FDA's actions and communication regarding each ingredient. The directory aims to be a one-stop shop for ingredient information that was previously scattered across different FDA web pages.

Europe Creatine Supplements Market Trends

Creatine supplements market in Europe is expected to grow at a CAGR of 14.8% from 2024 to 2030. The increasing availability of creatine supplements through various distribution channels in Europe, including online retail platforms, specialty stores, and pharmacies, has improved accessibility for consumers across Europe. This ease of access has further contributed to the market's expansion. Growing technological innovation in the nutraceuticals sector offers new opportunities in the European region for the creatine supplements market. The Federation of European Nutrition Societies (FENS) funds and invests in various nutritional foods & nutria-cosmetics businesses. The federation operates and nurtures the growth of such businesses in 26 countries in the region.

Asia Pacific Creatine Supplements Market Trends

Creatine supplements market in Asia Pacific is expected to grow with a CAGR of 19.3% from 2024 to 2030. The Asia Pacific market is anticipated to witness increasing demand for creatine supplements as key participants are introducing their brands in the untapped markets of Southeast Asia. China, Japan, and India are among the largest markets for creatine supplements in Asia Pacific owing to the presence of a large consumer base in these countries. Japan and Australia have experienced heightened awareness regarding the health benefits of creatine supplements over the years, which is expected to strengthen the regional market growth over the forecast period.

Key Companies & Market Share Insights

The global creatine supplements market is characterized by the presence of numerous well-established players such as Glanbia PLC, GNC Holdings Inc., Ajinomoto, The Hut Group (Myprotein), Weider Global Nutrition, BSN, and others. Market players in the creatine supplements industry contend with fierce competition among themselves, particularly those ranked among the top manufacturers with varied form offerings. These companies boast extensive distribution networks that enable them to effectively cater to a broad customer base, spanning both regional and international markets.

Key Creatine Supplements Companies:

The following are the leading companies in the creatine supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Glanbia PLC

- GNC Holdings Inc.,

- Ajinomoto

- The Hut Group (Myprotein)

- Weider Global Nutrition

- BSN

- MUSCLETECH

- Nutrex Research Inc,

- Allmax Nutrition

- GAT WHP

Recent Developments

-

In January 2024, Ascent Protein, a prominent figure in the sports nutrition sector, unveiled Ascent Clean Creatine, a new form aimed at enhancing athletic performance. This addition enriches Ascent's extensive lineup of essential sports nutrition forms, which already include whey protein, plant protein, pre-workout formulas, and micellar casein. This launch underscores Ascent's dedication to offering athletes a comprehensive selection of high-quality nutrition solutions.

-

In December 2023, MuscleTech introduced a new flavor, delicious citrus burst, featuring chewable tablets containing 1 gram of Creapure creatine monohydrate per tablet.

-

In November 2022, Jocko Fuel launched JOCKO creatine supplements for improved fitness performance, strength & recovery.

Creatine Supplements Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1,053.7 million |

|

Revenue forecast in 2030 |

USD 2,830.5 million |

|

Growth rate (Revenue) |

CAGR of 17.9% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Form, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S; Canada; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; Brazil; Mexico; South Africa |

|

Key companies profiled |

Glanbia PLC; GNC Holdings Inc.; Ajinomoto; The Hut Group (Myprotein); Weider Global Nutrition; BSN; MUSCLETECH; Nutrex Research Inc; Allmax Nutrition; GAT WHP |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Creatine Supplements Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global creatine supplements market report based on form, distribution channel, and region.

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Liquid

-

Capsules/Tablets

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Pharmacy & Drug Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global market for creatine supplements was estimated at USD 901.2 million in 2023 and is expected to reach USD 1,053.7 million in 2024.

b. The global creatine supplements market is expected to grow at a compounded growth rate of 17.9% from 2024 to 2030, reaching USD 2,830.5 million by 2030.

b. North America dominated the global creatine supplements market with a share of 38.0% in 2023 due to the higher level of awareness and adoption of sports nutrition supplements like creatine among athletes, fitness enthusiasts, and the general population seeking health and performance benefits

b. Some key players operating in the creatine supplements market include Glanbia PLC, GNC Holdings Inc., Ajinomoto, The Hut Group (Myprotein), Weider Global Nutrition, BSN, and others.

b. Key factors that are driving the market growth include increasing awareness of fitness and the benefits of creatine supplementation for improving athletic performance, muscle mass, and strength is driving market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."