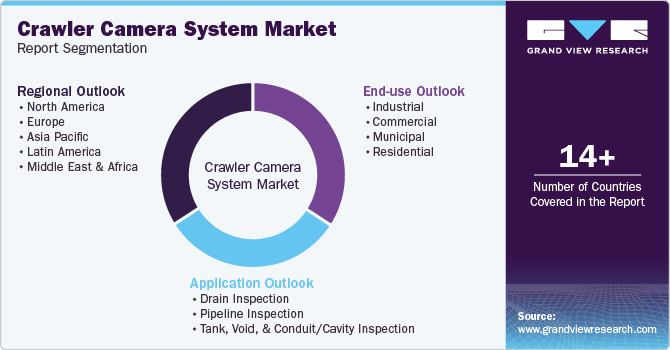

Crawler Camera System Market Size, Share & Trends Analysis Report By Application (Drain Inspection, Pipeline Inspection, Tank, Void, and Conduit/Cavity Inspection), By End-use (Industrial, Commercial), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-536-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Crawler Camera System Market Trends

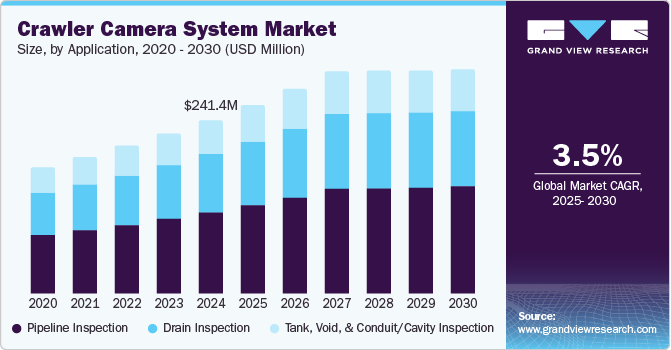

The global crawler camera system market size was valued at USD 241.4 million in 2024 and is projected to grow at a CAGR of 3.5% from 2025 to 2030. Rising adoption in various application areas, product enhancements enabled by the technology advancements and changing consumer preferences are some of the key growth driving factors for this market.

Changes in government regulations and mandates regarding pipeline inspections, safety concerns of inspection personnel, increasing infrastructural developments and enhancement projects initiated by governments and other organizations, and a rise in demand for municipal use and commercial applications are adding to the growth opportunities for this market. The rules and regulations regarding the timely inspections of public infrastructure systems and critical infrastructure elements contribute to the growing use of advanced crawler camera systems.

The complications related to underwater establishment inspection, developments, or enhancements are increasing demand for crawler camera systems equipped with cutting-edge technology features. Innovations in technological capacities, exploration area abilities, and overall features are stimulating the demand for this market. In recent years, multiple governments and local administration authorities have adopted these systems to enhance the capabilities associated with pipeline or drain inspections.

The increasing occurrence of disasters caused by climate change, landslides, heavy downpours, and more have resulted in the growing requirements for frequent inspections of drain pipes in prime cities worldwide. Administrative agencies have focused on adding a fleet of such systems in technology capacities for improved crisis management and disaster responses. Industrial and residential buyers also contribute to the growth potential of this market.

Application Insights

The pipeline inspection segment dominated the global crawler camera system industry with a revenue share of 46.7% in 2024. In recent years, government authorities such as municipal corporations and organizations such as facility management and repair service providers have focused on adopting advanced technologies to ensure enhanced maintenance and post-installation upkeep of pipelines. This includes water supply management, wastewater management, and more. To reduce the risks associated with deploying human resources in highly hazardous settings, organizations have preferred the use of technology tools such as crawler cameras during the inspection of pipelines. The availability of high-quality products, advancements in technology, and ease of use are projected to fuel the growth of this segment in the coming years.

The drain inspection segment is projected to experience a significant CAGR from 2025 to 2030. This is attributed to the growing utilization of municipal corporations and other organizations specializing in critical or public infrastructure management and related services. Many incidents associated with drain inspections where professionals are exposed to risks of unsafe environments, harmful gases or liquids, and injuries primarily drive the demand for technology assistance. Crawler cameras, equipped with remote monitoring technology and enhanced features such as high-end imaging capabilities, water resistance, and others, are extensively utilized by authorities for drain inspections.

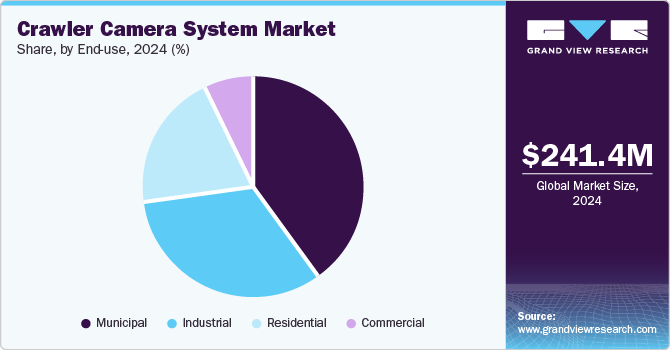

End-use Insights

The municipal use segment held the largest revenue share of this market in 2024. Municipal corporations in multiple cities worldwide take care of development and enhancement. Municipal corporations in various cities worldwide oversee the development and maintenance of public infrastructure elements. This includes water supply management, gas supply, waste water management, and more. Many municipal corporations have embraced technology tools such as crawler cameras to ensure enhanced performances, reduced risks, and improved inspection activities of pipelines, tanks, drains, and others. Growing urbanization in numerous countries and increasing strain on public infrastructure are projected to influence the growth of this segment during the forecast period.

The industrial use segment is anticipated to experience a significant growth from 2025 to 2030. Deployment of human resources for inspection or management of critical infrastructure elements such as tanks, pipelines, internal conduits, drains, and others has posed multiple challenges and risks in recent years. However, using technology tools such as crawler cameras has helped industrial facilities eliminate such risks with reduced risks and improved performances. Advancements in technology, ease of use, the convenience offered by-products, enhanced availability and accessibility, and cost savings are key growth-driving factors for this segment.

Regional Insights

North America crawler camera system market dominated the global industry with revenue share of 31.0% in 2024. This is attributed to the presence of large pipeline networks, drain facilities, tanks and other critical infrastructures in numerous cities, demand for technology assistance from government authorities, robust industrial environment comprising manufacturing facilities, chemical process plants and others. In addition, ease of accessibility and availability also influence the growth of this market.

U.S. Crawler Camera System Market

The U.S. crawler camera system market held the largest revenue share in 2024. The advancements in robotics technology, availability of multiple brand products in the country, presence of large cities and associated government authorities, increasing utilization by municipal and industrial users, and significant demand from the critical infrastructure management industry are driving growth for this market. The presence of multiple technology and innovation companies, ongoing research, and portfolio enhancements by major market participants are projected to generate an upsurge in demand for crawler cameras in the U.S. market.

Europe Crawler Camera System Market Trends

Europe crawler camera system market was identified as one of the key regions for the global market in 2024. The use of crawler cameras for drain and pipeline inspections by government authorities, the rising focus of organizations and government on the adoption of technology tools instead of human resource deployments in risky work environments, and regulations regarding maintenance and upkeep of facilities and public infrastructure are some of the growth driving factors for this market. The availability of domestic and global brand products, ease of use, and enhanced awareness regarding benefits associated with embracing the assistance of technology are projected to add growth opportunities for this market.

Germany crawler camera system market held largest revenue share of the regional industry in 2024. This is attributed to the robust manufacturing industry, presence of multiple cities, and public infrastructure facilities such as pipelines, drains, water tanks, wastewater management facilities, and more, increasing utilization of technology by the industrial sector, and availability of technologically advanced products.

Asia Pacific Crawler Camera System Market Trends

The Asia Pacific crawler camera system market is anticipated to experience the fastest CAGR of 5.4% from 2025 to 2030. The growth of this market is primarily driven by aspects such as the growing availability of enhanced technology tools portfolios offered by the key companies in the global and domestic market, increasing demand from municipal corporations and organizations operating in the facility management or critical infrastructure management services industry, and rise in awareness regarding the risks associated with the deployment of human resources in significantly hazardous environments.

China crawler camera system market dominated the Asia Pacific market in 2024. This is attributed to factors such as the large presence of industrial facilities and manufacturing sector participants in the country, growing urbanization, highly populated cities that continuously require fully functioning public infrastructure facilities, and enhancing demand from government authorities.

Key Crawler Camera System Company Insights

Some of the key companies in the global crawler camera system industry are Deep Trekker Inc., iPEK International GmbH (IDEX), Kummert GmbH, AM Industrial, and others. To address the growing demand for advanced technology and increasing competition, the key companies are embracing strategies such as enhanced portfolios, research and development, inclusion of improved technologies, innovation, and collaboration with government agencies and other organizations.

-

Deep Trekker Inc. offers an extensive portfolio of advanced technology-driven products such as underwater ROVs (remotely operated vehicles), utility crawlers, submersible cameras, CCTV pipe crawlers, and more. The company's pipe crawler offerings include the A-200 8” and DT320 Mini 6” - 12”.

-

iPEK International GmbH (IDEX) offers a range of products equipped with advanced technology. These include mobile inspection systems, mainline crawler systems, lateral inspection systems, push rod systems, HD-video nozzles, halophytic zoom pole cameras, and others.

Key Crawler Camera System Companies:

The following are the leading companies in the crawler camera system market. These companies collectively hold the largest market share and dictate industry trends.

- Deep Trekker Inc.

- AM Industrial

- iPEK International GmbH (IDEX)

- CUES Inc.

- Eddyfi

- Kummert GmbH

- Minicam Limited

- Rausch USA

- Inspector Systems

- Subsite Electronics

Recent Developments

-

In October 2024, Fiberscope, one of the key suppliers of industrial inspection technology devices from North America, launched the pipe crawler robot SIGMA HD-LR (LONG RANGE), equipped with capacities to perform inspections up to 5,577 feet in every run. The product is characterized by features such as full HD sensors, optical image stabilization, angle and pressure sensors, auto focus control, remote monitoring technology, 4x4 powertrain body, gyrometer and inclinometer, anti-corrosion capacities, touchscreen control monitor and more.

Crawler Camera System Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 262.3 million |

|

Revenue forecast in 2030 |

USD 312.2 million |

|

Growth rate |

CAGR of 3.5% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, Australia, South Korea, Brazil, South Africa |

|

Key companies profiled |

Deep Trekker Inc.; AM Industrial; iPEK International GmbH (IDEX); CUES Inc.; Eddyfi; Kummert GmbH; Minicam Limited; Rausch USA; Inspector Systems; Subsite Electronics |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Crawler Camera System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the global crawler camera system market report based on application, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drain Inspection

-

Pipeline Inspection

-

Tank, Void, and Conduit/Cavity Inspection

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Commercial

-

Municipal

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."