- Home

- »

- Medical Devices

- »

-

Cranial Implants Market Size, Share & Growth Report, 2030GVR Report cover

![Cranial Implants Market Size, Share & Trends Report]()

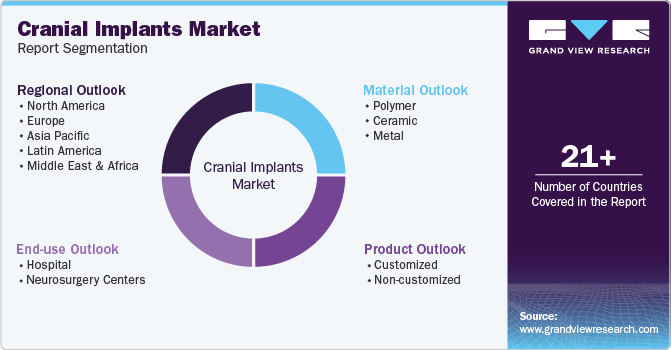

Cranial Implants Market Size, Share & Trends Analysis Report By Product (Customized, Non-customized), By End Use (Hospital, Neurosurgery Centers), By Material (Polymer, Ceramic, Metal), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-124-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Cranial Implants Market Size & Trends

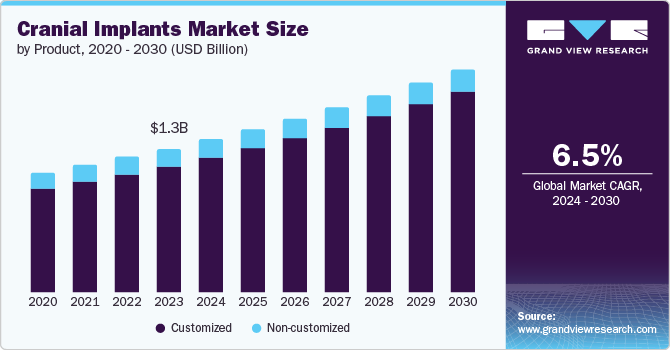

The global cranial implants market size was valued at USD 1.34 billion in 2023 and is projected to grow at a CAGR of 6.5% from 2024 to 2030. The driving factors of the growth include the rising prevalence of neurological diseases due to the rise in the geriatric population, traumatic injuries and wounds, and the increase in the number of road accidents.

According to an article published by the World Health Organization (WHO) in March 2024, more than one in three people are affected by a neurological condition contributing to the leading cause of illness and disability worldwide. According to the Institute for Health Metrics and Evaluation (IHME), located at the University of Washington, data published in March 2024, nearly 43% of the world population is affected by neurological conditions. This rising prevalence of neurological diseases is driving market growth.

In addition, the rising geriatric population is further expected to add to the market growth. According to the United Nations (UN) data published in January 2023, the older population is estimated to grow from 761 million in 2021 to 1.6 billion by 2050. The rising elderly population is more susceptible to neurological diseases, enhancing cranial implants treatment and boosting market growth.

The increasing number of road accident cases and the high prevalence of traumatic brain injury (TBI) is another driving factor of the market growth. According to the World Health Organization (WHO) report published in December 2023, around 1.19 million people lost their lives because of road accidents. According to the BRAIN-AMN (Academy for Multidisciplinary Neurotraumaology) data published in November 2022, 69 million people globally suffer from traumatic brain injury (TBI). Such rising instances of brain injuries boost market growth.

Product Insights

The customized product segment dominated the market with a share of 87.6% in 2023 and is expected to grow at the fastest CAGR over the forecast period. The rising prevalence of road accidents is causing an increase in the number of traumatic brain injuries. Since the skull structure and contour of every individual differs, surgeons prefer customized solutions for every patient, which drives market growth.

Companies offering customized solutions for cranial implants include Stryker, which offers CMF PEEK customized implants and 3D systems VSP solutions. Companies are also involved in innovating advanced solutions approved by the FDA. For instance, 3D Systems, Inc. received FDA approval in April 2024 and has provided 510(K) clearance for a 3D-printed customized cranial implant solution. Such innovative progressions are driving the segment growth.

End Use Insights

The hospital segment dominated the market and accounted for a share of 72.1% in 2023. The driving factors of the segment growth include the rising adoption of cranial implant procedures carried out in hospitals due to the availability of skilled neurosurgeons. The hospitals have neurology departments dedicated to providing neurological treatments. In addition, the hospitals are medically fully equipped with advanced technologies and professional teams to consult in complex situations. Most diagnostic tests, such as CT scans and MRI scans, are performed in hospitals, offering integrated healthcare under one roof, which boosts the segment growth.

The neurosurgery centers segment is expected to register the fastest CAGR during the forecast period. The driving factors of the segment growth are the rising number of traumatic brain injuries (TBI), and the high adoption of cranial implants. Neurosurgery centers offer personalized treatment enhancing the experience of the patients. The centers are dedicated to offering neurological solutions to both children and adults, providing consolidated care under one roof, boosting the segment growth.

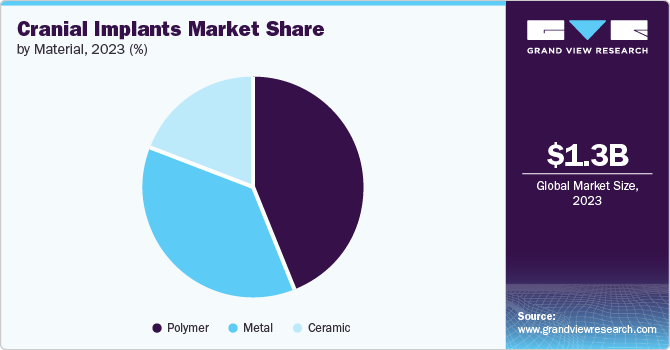

Material Insights

The polymer segment dominated the market and accounted for a share of 44.2% in 2023. The commonly used material for cranial implants is a polymer used in the form of PEEK (polyetheretherketone). This material is a preferred choice for reconstructing significant cranial defects with a customized inlay implant. It offers biocompatibility, can be modified for interoperability and is compatible with CT scans, MRI scans and radiation therapy. Various companies offering PEEK implants for cranial procedures are Xilloc Medical Int B.V., Johnson & Johnson Services, Inc., and Stryker.

The ceramic segment is expected to register the fastest CAGR during the forecast period. The driving factor of segment growth is the material being ultrasound compatible used for treating brain tumors. For instance, according to the University of Gothenburg data published in October 2020, bioceramic implants are proven to stimulate regeneration of the skull bone. Such progressions are expected to drive the segment growth.

Regional Insights

North America cranial implants market dominated the market in 2023 owing to the rising geriatric population, increasing traumatic brain injuries, and neurological conditions. According to the Government of Canada data published in April 2022, around 861,000 people were aged 85 and above as per the 2021 census. Old age people are susceptible to neurological diseases such as Alzheimer. For instance, The Alzheimer Society of Canada has projected 1.5 million new Alzheimer's dementia cases by 2050. In addition, the rise in traumatic brain injuries drives the adoption of cranial implants. For instance, according to the Brain Injury Canada data published in July 2023, the Public Health Agency of Canada estimated about 165,000 people suffer from traumatic brain injury, boosting the adoption of cranial implants and driving market growth.

U.S. Cranial Implants Market Trends

The U.S. cranial implants market accounted for a 60.5% share of the global market in 2023. The driving factors of the market growth include rising geriatric population and increasing traumatic brain injuries. For instance, according to the U.S. Census Bureau data published in May 2023, people above 65 accounted for 16.8% of the population. The rise in traumatic brain injuries boosts the adoption of cranial implants. For instance, according to the Centers for Disease Control and Prevention (CDC), about 214,110 traumatic brain injury cases were seen in 2020, and over 69,000 people lost their lives to traumatic brain injuries in 2021. Such growing incidences drive the market growth of cranial implants in the country.

Europe Cranial Implants Market Trends

Europe cranial implants market accounted for a significant market share in 2023 in the cranial implants market. According to the European Union (EU) data published in February 2024, more than one-fifth of the population is aged 65 years and above, accounting for 21.3% of the total population in the region. According to the National Library of Medicine report published in September 2022, nearly 7.7 million people are living with traumatic brain injury-related disabilities. Such rising prevalence is encouraging companies to offer cranial implant solutions, boosting the market growth in the region.

The rising geriatric population and increasing traumatic brain injuries are primarily driving the market growth in Germany. According to Rehacare, an International Trade Fair for Rehabilitation and Care data published in July 2021, traumatic brain injuries are more susceptible to older age people. Various companies are involved in innovating advanced solutions in the cranial implants market. The key players driving the market growth include evonos GmbH & Co. KG, 3di GmbH, and KLS Martin Group.

Asia Pacific Cranial Implants Market Trends

Asia Pacific cranial implants market is estimated to register the fastest CAGR over the forecast period. The factors driving the market growth include the rising geriatric population and rising road accidents causing traumatic brain injuries. According to the Connectivity organization, over 200,000 Australians suffer from traumatic brain injuries each year. Such instances encourage companies to innovate and develop advanced solutions. For instance, Singular Health Group collaborated with CSIRO and Osteopore International Pte Ltd in October 2021 to develop an artificial intelligence (AI)-based tool to design replacement cranial implants.

The rising road accidents and high prevalence of traumatic brain injuries drive market growth in India. According to the Indian Head Injury Foundation, India has the highest rate of head injury, claiming more than 100,000 lives and about 1 million people suffering from serious head injuries. For instance, DICUL AM PRIVATE LIMITED reconstructed 75% of the skull lost due to Mucormycosis through customized titanium cranial implants in February 2022. Such instances encourage the adoption of cranial implants, boosting market growth.

Key Cranial Implants Company Insights

Some companies in the Cranial Implants market include B. Braun SE, Johnson & Johnson Services, Inc., Stryker, evonos GmbH & Co. KG, Kelyniam Global Inc., and Acumed LLC. Key companies are involved in strategic initiatives such as in innovating new products, collaborating with institutions and other industries, and establishing partnerships.

-

B. Braun SE is a Germany-based medical and pharmaceutical device company with more than 5,000 healthcare products in its portfolio. The company offers medication management in oncology, smart infusion management, technical service, and various therapies addressing neurosurgery, oncology, nutrition therapy, pain therapy, and infusion therapy.

-

Johnson & Johnson Services, Inc. is a global healthcare company offering a wide range of products such as feminine hygiene, baby care, beauty, and over the counter products. In addition, the company also offers products for cranial implants such as MatrixNEURO system, MatrixNEURO Preformed Mesh, and cranial tube clamps.

Key Cranial Implants Companies:

The following are the leading companies in the cranial implants market. These companies collectively hold the largest market share and dictate industry trends.

- B. Braun SE

- Johnson & Johnson Services, Inc.

- Stryker

- Zimmer Biomet

- Acumed LLC

- evonos GmbH & Co. KG

- Medartis AG

- Renishaw plc.

- Kelyniam Global Inc.

- Anatomics Pty Ltd

View a comprehensive list of companies in the Cranial Implants Market

Recent Developments

-

In October, 2023, 3D Systems, Inc. produced patient-specific (customized) 3D-printed cranial implant using point-of-care technologies at University Hospital Basel

-

In May 2022, Medartis AG acquired Medartis Inc. enabling Medartis AG to build strong relationships to U.S. design surgeons and an experienced research & development team.

-

In January 2022, Mediplast AB entered a strategic licensing agreement with Fin-ceramica faenza spa to market hydroxyapatite, a custom-made implant.

Cranial Implants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.43 billion

Revenue forecast in 2030

USD 2.09 billion

Growth Rate

CAGR of 6.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, End Use, Material

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

B. Braun SE, Johnson & Johnson Services, Inc., Stryker, Zimmer Biomet, Acumed LLC, evonos GmbH & Co. KG, Medartis AG, Renishaw plc., Kelyniam Global Inc., Anatomics Pty Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cranial Implants Market Segmentation:

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cranial implants market report based on product, end use, material, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Customized

-

Non-customized

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Neurosurgery Centers

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polymer

-

Ceramic

-

Metal

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."