- Home

- »

- Clinical Diagnostics

- »

-

COVID-19 Detection Kits Market Size & Share Report, 2030GVR Report cover

![COVID-19 Detection Kits Market Size, Share & Trends Report]()

COVID-19 Detection Kits Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (RT-PCR Assay Kits), By Sample Type (Nasopharyngeal), By Mode (Centralized Testing), By End-use (Laboratories), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-026-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2020 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

COVID-19 Detection Kits Market Trends

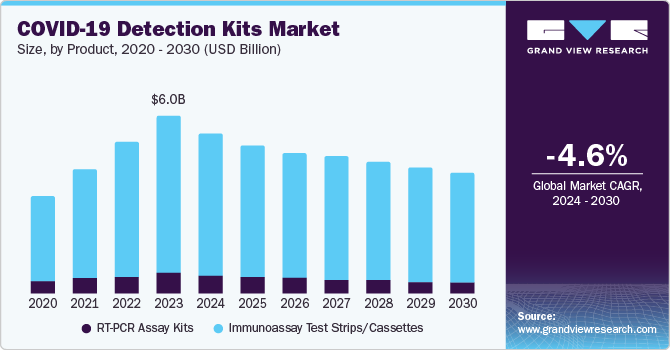

The global COVID-19 detection kits market size is estimated to be USD 6.01 billion in 2023 and is expected to decline at a CAGR of -4.6% from 2024 to 2030. According to the World Health Organization (WHO) data, as of February 2022, over 422 million confirmed cases and over 5.8 million deaths have been reported globally. This surge in COVID-19 infections has led to a significant increase in the demand for COVID-19 detection kits globally. The high number of COVID-19 cases has created an urgent need for widespread testing to identify infected individuals, monitor the spread of the virus, and implement appropriate public health measures. This has driven governments, healthcare providers, and diagnostic laboratories to ramp up their COVID-19 testing capabilities.

Several nations were developing kits and apps and tracking programs for mass testing of COVID-19.The COVID-19 smartphone app established by Britain uses Bluetooth signals to identify COVID-19-affected individuals. This centralized approach also provides detailed data on the symptoms and risks of infection. Such initiatives accelerate the detection of infected patients, further impacting the COVID-19 detection kits market.

Manual testing, pitfalls in read-out timing, and visual reporting lead to uncertain outcomes compared to automated tests. Regarding this, QIAGEN developed an easy-to-use digital test, Access Anti-SARS-CoV-2 Total, in August 2020. This serology test is conducted on a portable digital device to offer reliable results in 10 minutes and mitigate such risks. The availability of smart testing solutions offers rapid, accurate, and reliable results, mitigating the risks associated with manual testing.

The utility of serology tests has expanded with the initiation of multiple SARS-CoV-2 serological surveys globally, thus propelling the demand for these tests. For instance, the National Institutes of Health serosurvey includes investigating blood samples of over 10,000 U.S. adults with no confirmed history of coronavirus infection to detect anti-SARS-CoV-2 protein IgM and IgG antibodies. It also includes additional tests to evaluate the immune responses of volunteers to the virus.

The COVID-19 detection kits market is expected to decline due to the decreasing demand for testing as the pandemic recedes globally. The number of new cases and overall testing demand are decreasing, which significantly contributes to the expected market decline. Additionally, many countries have relaxed COVID-19 regulations, such as mask mandates and travel restrictions, further reducing the need for widespread testing. The increasing global vaccination rate, with over 13.1 billion doses administered as of January 2023 data by WHO , reduces the urgency for COVID-19 detection kits, contributing to the market's decline.

Market Concentration & Characteristics

The innovation in the COVID-19 detection kits market could be considered high. The urgency of the pandemic has accelerated research and development efforts in molecular diagnostics, leading to the introduction of innovative technologies such as RT-PCR (Reverse Transcription Polymerase Chain Reaction), CRISPR-based tests, antigen tests, and next-generation sequencing for COVID-19 detection.

Several companies engage in mergers and acquisitions to enhance their market position. For instance, in April 2021, DiaSorin acquired Luminex to expand its molecular diagnostics portfolio and strengthen its presence in the U.S. Luminex's multiplexing technology strengthens DiaSorin's offerings, enabling entry into the syndromic panel market and a significant presence in point-of-care and hospital settings.

Regulative agencies such as the World Health Organization (WHO) play a significant role in coordinating global efforts to combat the COVID-19 pandemic, including regulating the use of detection kits. The WHO guides the development, evaluation, and deployment of diagnostic tests for COVID-19 to ensure their accuracy and reliability.

The product substitutes in the COVID-19 detection kits market are moderate. While there are some variations in the types of COVID-19 tests available, such as rapid antigen tests or molecular PCR tests, these are not direct substitutes for one another.

The global market for COVID-19 detection kits has seen remarkable growth due to the demand for quick and precise diagnostics during the pandemic. North America and the Asia Pacific have been pivotal regions, with the latter experiencing rapid adoption driven by increasing infections and government efforts to enhance testing.

Product Insights

The immunoassay test strips/cassettes segment dominated the market in 2023, with a revenue share of 88.9%. This is attributed to several benefits of these products, as they are easy to use and require minimal training and equipment. This makes them accessible to many users, including healthcare professionals and non-specialized personnel. Additionally, they are often more affordable than other tests, such as PCR-based tests, making them a viable option for healthcare settings and countries with limited resources. Immunoassay tests can provide rapid results, often within minutes, which is crucial for timely diagnosis and treatment of COVID-19.

The decline in the RT-PCR Assay Kits segment is attributed to the technological advancements. As new technologies emerge, such as rapid antigen tests or next-generation sequencing methods, they may offer faster results or higher sensitivity than traditional RT-PCR assays. This can lead to a shift in demand towards these newer technologies, causing a decline in the market share of RT-PCR assay kits. Cost considerations also play a significant role in shaping market trends. While RT-PCR assay kits are highly accurate and reliable, they can be relatively expensive compared to other testing methods. As healthcare providers and governments seek cost-effective solutions for mass testing or surveillance programs, they may opt for alternative testing technologies that offer comparable performance at a lower price point.

Sample Type Insights

The Nasopharyngeal (NP) swab held the largest market share 48.2% in 2023 owing to the high usage of NP swabs for molecular testing. Nasopharyngeal swabs are considered one of the most accurate methods for detecting COVID-19. Compared to other samples, such as saliva or anterior nasal swabs, they have the highest sensitivity and accuracy in detecting the SARS-CoV-2 virus. Most COVID-19 diagnostic tests that have received emergency use authorization (EUA) or regulatory approval from agencies such as the FDA are based on NP swab samples. This regulatory acceptance and validation of NP swab-based tests have solidified their position in the market.

Furthermore, the development of 3D-printed NP swabs by USF Health Radiology and Northwell Health System's teams in August 2020 has boosted the adoption of NP swabs. These cost-efficient and fast alternatives to conventional NP swabs are being used by major service providers such as LabCorp and Quest Diagnostics for effective testing. This innovation has enhanced the efficiency of NP swab collection and expanded their availability, further contributing to their dominance in the COVID-19 detection kit market.

On the contrary, the nasal swabs segment is expected to decline over the forecast period. This decline is due to the development of highly accurate COVID-19 tests that use saliva instead of nasal swabs. Saliva-based tests are becoming more popular because they are convenient and easy to use. The shift from nasal swabs is driven by the increasing demand for at-home testing and the need for simpler and more accessible testing methods. The rise of self-testing and at-home testing has also contributed to the decrease in the use of nasal swabs.

Mode Insights

The Centralized Testing (Non-PoC) segment held the largest share of 76.1% in 2023 and is expected to decline over the forecast period. Centralized testing methods, such as laboratory-based PCR tests, are known for their high accuracy and reliability in detecting COVID-19 infections. These tests are often considered the benchmark for diagnosis due to their sensitivity in detecting even low viral loads. Centralized testing facilities can process many samples efficiently, making them a preferred choice for many healthcare providers. This scalability is crucial during surges in COVID-19 cases or when mass testing is required.

However, the time taken to process samples and deliver results can limit centralized testing, especially in situations where rapid diagnosis is critical for timely intervention and containment of the virus. This delay can lead to a decline in the demand for centralized testing, contributing to its expected decline in market share. The shift towards point-of-care (POC) testing, which provides rapid results, to drive this decline. POC testing has gained popularity due to its ability to deliver quick and accurate results, making it more suitable for situations where rapid diagnosis is necessary.

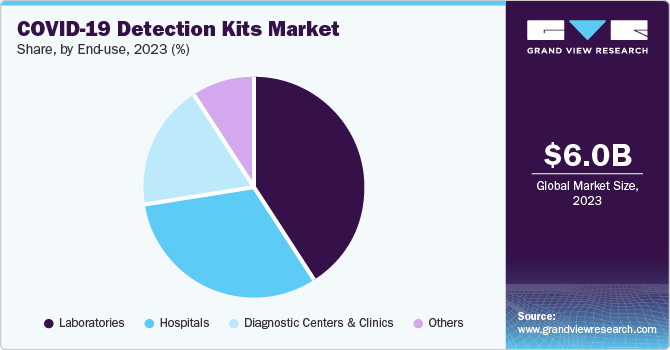

End-use Insights

The Laboratories segment held the largest share, 39.33%, in 2023 but is expected to decrease over the forecast period. This dominance was mainly due to the initial surge in demand for centralized testing during the early stages of the pandemic. Centralized laboratories were the primary testing facilities, ensuring accurate and reliable results. However, as the pandemic progressed, there was a growing need for rapid and decentralized testing to enable quick decision-making and containment efforts. This shift towards point-of-care testing devices, which can deliver results within minutes at the testing site, reduced the reliance on centralized laboratories.

The development of innovative technologies, such as rapid antigen tests and molecular point-of-care devices, further facilitated the decentralization of testing. These advancements allowed for faster and more convenient testing options outside traditional laboratory settings. The emergence of numerous manufacturers offering point-of-care COVID-19 detection kits intensified competition in the market. This competitive landscape favored companies specializing in rapid testing solutions, leading to a decline in market share for traditional laboratory-focused players.

Regional Insights

The North America COVID-19 detection kits market accounted for 20.30% share in 2023. The region has significantly increased the number of COVID-19 cases, driving the demand for rapid and accurate diagnostic tools. Governments in North America have implemented various measures to combat the pandemic, including the development and distribution of COVID-19 detection kits.

U.S. COVID-19 Detection Kits Market Trends

The U.S. had been heavily affected by the pandemic, with over 0.1 billion total cases as of April 2023, making it the country with the highest number of cases globally. This high incidence of COVID-19 infections had driven the demand for COVID-19 detection kits in the region. Due to this, regulatory bodies, such as the U.S. FDA and Health Canada, are continuously granting the Emergency Use Authorizations (EUA) to coronavirus test kits to boost the testing capacity, which fuels the region’s growth.

Europe COVID-19 Detection Kits Market Trends

The high incidence of COVID-19 infections in Europe had driven the demand for COVID-19 detection kits. Countries such as Italy and Spain witness the highest number of COVID-19-related deaths in the region due to their high geriatric population and lower healthcare infrastructure. According to the National Library of Medicine, Spain and France have seen a significant prevalence of COVID-19 following Italy, which was the hardest-hit country in Europe. Spain ranks as the second-highest country in terms of COVID-19 deaths in Europe.

The UK COVID-19 detection kits drugs market is projected to grow during the forecast period. The UK government's initiatives and policies regarding widespread testing and surveillance for COVID-19 significantly drive the demand for detection kits. Public health strategies, testing campaigns, and regulatory requirements can substantially impact the market. The UK Health Security Agency also launched a new national surveillance program, providing thousands of adults daily with free access to antibody tests. This initiative aims to enhance our understanding of immunity against COVID-19 resulting from vaccination and prior infection.

The COVID-19 detection kits drug market in France is projected to grow from 2024 to2030. The robust healthcare infrastructure in France, including hospitals, diagnostic centers, and clinics, has facilitated efficient testing operations. This infrastructure supported the adoption of various types of COVID-19 detection kits, which contributed to market growth. Public awareness campaigns about testing and early detection had also driven the demand for COVID-19 detection kits in France. Increased awareness among the population has led to higher testing rates and a greater need for reliable testing solutions.

Asia Pacific COVID-19 Detection Kits Market Trends

The COVID-19 detection kits market in Asia Pacific is anticipated to witness the fastest growth over the forecast period. This is attributive to the continuous upsurge in coronavirus cases in Asian countries such as India, a rise in the number of diagnostic facilities, and the implementation of mass testing programs in this region. As of June 2020, Wuhan, a province of China, completed the mass testing of its 11 million individuals and ended up with 206 positive asymptomatic cases of COVID-19 in Wuhan.

The China COVID-19 detection kits market is expected to grow over the forecast period. With a large population and dense urban areas, China has faced a high demand for COVID-19 testing. This demand has driven the need for efficient and accurate detection kits, leading to increased market growth. Rapid technological advancements have led to the development of more sophisticated and reliable COVID-19 detection kits. Chinese companies have been at the forefront of innovation in this field, attracting domestic and international demand. BGI Genomics is a leading Chinese biotechnology company that developed COVID-19 detection kits early in the pandemic. Leveraging government support, technological expertise, and strategic partnerships, BGI Genomics ramped up production to meet the surging demand for testing across China.

The COVID-19 detection kits market in India is anticipated to grow over the forecast period. Government support and regulatory approvals drive the India COVID-19 detection Kit market. The government has been actively promoting, developing, and commercializing indigenous diagnostic kits, such as the DIPCOVAN kit developed by the Defence Institute of Physiology and Allied Sciences (DIPAS) in collaboration with Vanguard Diagnostics Pvt Ltd. The kit has received regulatory approvals from the Indian Council of Medical Research (ICMR), the Drugs Controller General of India (DCGI), the Central Drugs Standard Control Organisation (CDSCO), and the Ministry of Health and Family Welfare for manufacturing and distribution. This support and approval have boosted the confidence of local manufacturers and investors, leading to increased investment and innovation in the diagnostics sector.

Latin America COVID-19 Detection Kits Market Trends

Latin American countries had been heavily affected by the pandemic, with a significant increase in the number of confirmed cases. The rising focus on preventing the spread of the COVID-19 pandemic has led to advances in innovative diagnostic technologies, including in Latin America, which has resulted in the expansion of the regional COVID-19 detection kits market.

Brazil COVID-19 detection kits market is projected to grow. Manufacturers are continuously innovating and developing more advanced COVID-19 detection kits. These advancements aim to improve the tests' accuracy, speed, and ease of use, further driving market growth in Brazil. For Instance, Researchers at Biolinker, a biotech startup in São Paulo, Brazil, are creating an affordable and efficient COVID-19 test using locally available materials. The startup is based at the University of São Paulo's CIETEC, a collaboration between USP and IPEN.

Middle East & Africa COVID-19 Detection Kits Market Trends

The MEA region has seen a significant increase in awareness and education about COVID-19, which has led to a greater demand for COVID-19 detection kits. As of December 2020, the Arab countries in the Middle East and North Africa (MENA) region have recorded over 3.2 million confirmed cases of SARS-CoV-2 and approximately 55,000 deaths from COVID-19. This increased awareness has also led to a greater understanding of the importance of testing and the need for accurate and reliable results.

The UAE COVID-19 detection kits market is expected to grow during the forecast period. The UAE government has implemented various measures to combat the pandemic, including developing and distributing COVID-19 detection kits. Regulatory approvals have also been granted for using these kits in the country. The rising focus on preventing the spread of the COVID-19 pandemic has led to advances in innovative diagnostic technologies, including in the UAE, which has expanded the country's COVID-19 detection kits market. The UAE established 13 drive-through COVID-19 testing centers nationwide, including the most extensive testing facility in Masdar City, Abu Dhabi.

Key COVID-19 Detection Kits Company Insights

Market participants are incessantly developing several types of kits for the detection of SARS-CoV-2 infection across the globe. Such new product development initiatives along with partnership & collaboration models, agreements, business expansion, and merger & acquisition strategies are undertaken by the company as a response to the rising demand for COVID-19 test capabilities globally. This is expected to intensify the competition among key participants in future market space. For instance, in August 2020, PerkinElmer, Inc. entered into a public-private partnership with the California government to provide up to 150,000 new daily tests initiating from mid-November. The partnership also focuses on lowering the overall cost per COVID-19 test to nearly USD 47.99. This initiative is anticipated to double the capacity of COVID-19 tests and further strengthen the market presence of Perkin Elmer in the global market.

Key COVID-19 Detection Kits Companies:

The following are the leading companies in the COVID-19 detection kits market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche AG

- Perkin Elmer, Inc.

- Thermo Fisher Scientific, Inc.

- Veredus Laboratories

- DiaSorin

- altona Diagnostics GmbH

- Mylab Discovery Solutions Pvt Ltd.

- Abbott

- Luminex Corporation

- Quidel Corporation

Recent Developments

-

In December 2023, HiMedia Laboratories had launched its HiGenoMB RT-PCR kits, which can detect the JN.1 variant of SARS-CoV-2, which is a descendant of the BA.2.86 (Pirola) variant of Omicron. The JN.1 variant has been identified as a variant of concern due to its immune-escape capabilities and is causing an increasing number of cases worldwide.

-

In September 2022, the FDA has granted DiaSorin’s Simplexa COVID-19 Direct kit 510 (k) clearance, a significant development in the fight against the COVID-19 pandemic. This clearance allows for the detection of the SARS-CoV-2 virus using samples obtained from nasal or nasopharyngeal swabs. The kit is specifically designed for use on the LIAISON MDX platform, a molecular diagnostic system known for its efficiency and accuracy.

-

In January 2022, Roche Diagnostics India introduced a new COVID-19 At-Home Test, an over-the-counter test designed for detecting SARS-CoV-2 infection in individuals showing symptoms of COVID-19. This test offers individuals the convenience of testing for the virus from their homes, providing a quick and accessible option for those who suspect they may have been infected with the coronavirus.

COVID-19 Detection Kits Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.4 billion

Revenue forecast in 2030

USD 4.06 billion

Growth rate

CAGR of -4.6% from 2024 to 2030

Actual data

2020 - 2023

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, sample type, mode, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

F. Hoffmann-La Roche AG; Perkin Elmer, Inc.; Thermo Fisher Scientific, Inc.; Veredus Laboratories; DiaSorin; altona Diagnostics GmbH; Mylab Discovery Solutions Pvt Ltd.; Abbott; Luminex Corporation; Quidel Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global COVID-19 Detection Kits Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2030. For this study, Grand View Research has segmented the global COVID-19 detection kits market report based on product, sample type, mode, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2020 - 2030)

-

RT-PCR Assay Kits

-

Immunoassay Test Strips/Cassettes

-

-

Sample Type Outlook (Revenue, USD Million, 2020 - 2030)

-

Nasopharyngeal (NP) Swab

-

Oropharyngeal (OP) Swab

-

Nasal Swabs

-

Others

-

-

Mode Outlook (Revenue, USD Million, 2020 - 2030)

-

Decentralized or Point-of-Care (PoC) Testing

-

Centralized Testing (Non-PoC)

-

-

End-use Outlook (Revenue, USD Million, 2020 - 2030)

-

Laboratories

-

Hospitals

-

Diagnostic Centers and Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2020 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global COVID-19 detection kits market size was estimated at USD 6.01 billion in 2023 and is expected to reach USD 5.4 billion in 2024.

b. The global COVID-19 detection kits market is expected to witness a compound annual growth rate of -4.6% from 2024 to 2030 to reach USD 4.06 billion by 2030.

b. Nasopharyngeal (NP) swab dominated the COVID-19 detection kits market with a revenue share of 48.2% in 2023 owing to the high adoption rate of RT-PCR assays that relies on NP swab for testing coupled with the presence of a substantial number of players that are engaged in a constant supply of swabs to cater the COVID-19 detection kits market.

b. Some key players in the COVID-19 detection kits market are F. Hoffmann-La Roche AG; Perkin Elmer, Inc.; Thermo Fisher Scientific, Inc.; Veredus Laboratories; DiaSorin; altona Diagnostics GmbH; Mylab Discovery Solutions Pvt Ltd.; Abbott; Luminex Corporation; Quidel Corporation; and Becton, Dickinson and Company.

b. Increasing approvals of immunoassay tests by regulatory agencies; ongoing seroprevalence surveys to assess the infection rate, and expanding implementation of POC & rapid testing are some key driving factors of the COVID-19 detection kits market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.