- Home

- »

- Automotive & Transportation

- »

-

Courier, Express, And Parcel Market Size, Share Report 2030GVR Report cover

![Courier, Express, And Parcel Market Size, Share & Trends Report]()

Courier, Express, And Parcel Market (2024 - 2030) Size, Share & Trends Analysis Report By Service, By Business Model, By Destination (Domestic, International), By End-use, By Mode Of Transport, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-422-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Courier, Express, And Parcel Market Summary

The global courier, express, and parcel market size was valued at USD 461.69 billion in 2023 and is projected to reach USD 925.48 billion by 2030, growing at a CAGR of 10.6% from 2024 to 2030. The market is a critical component of the global logistics and transportation industry, facilitating the delivery of goods and documents across various distances, from local to international destinations.

Key Market Trends & Insights

- The courier, express, and parcel (CEP) market in Asia Pacificdominated the global CEP market in 2023 and accounted for a 40.3% share of the global revenue.

- The courier, express, and parcel market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030.

- North America courier, express, and parcel (CEP) marketis expected to witness steady growth from 2024 to 2030.

- Based on service, the standard delivery segment dominated the market in 2023 and accounted for more than 37% share of global revenue.

- In terms of business model, the business-to-business (B2B) segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 461.69 billion

- 2030 Projected Market Size: USD 925.48 billion

- CAGR (2024-2030): 10.6%

- Asia Pacific: Largest market in 2023

- India: Fastest growing market

The market is defined by the provision of delivery services that cater to different time sensitivities and customer requirements. Courier services typically involve the delivery of smaller packages and documents, often with a same-day or next-day delivery guarantee. These services are characterized by high reliability and tracking capabilities, making them ideal for urgent and critical shipments. Express services are similar but often extend to slightly larger packages and include expedited shipping options, with delivery timelines generally ranging from same-day to three days, depending on the distance and service level.

Parcel services, on the other hand, cover the shipment of a broader range of goods, from small items to larger packages, with delivery times varying based on distance, service selected, and the nature of the goods. The market serves a wide range of customers, including individuals, businesses, and governments, providing essential services for sectors such as e-commerce, manufacturing, healthcare, and retail.

The market is currently undergoing a significant transformation driven by several key trends. Preeminent among these is the exponential growth of e-commerce, which has precipitated a substantial increase in parcel volumes. Consequently, courier, express, and parcel (CEP) providers have invested heavily in infrastructure expansion, last-mile delivery enhancements, and the integration of advanced technologies such as automation, robotics, and artificial intelligence to meet heightened consumer expectations for rapid and dependable deliveries. Moreover, the imperative to reduce environmental impact has compelled the industry to adopt sustainable practices, including the utilization of electric and hybrid vehicles, carbon offset initiatives, and eco-friendly packaging. Additionally, alternative delivery methods, such as bicycle couriers and drone technology, are being explored to minimize the industry's ecological footprint.

The market is subject to a complex regulatory environment that varies by region and country. Customs regulations play a critical role in the cross-border shipment of goods, with CEP companies required to comply with various customs procedures, tariffs, and import/export restrictions. In some regions, there are also specific regulations related to the transport of certain goods, such as hazardous materials, perishable items, and high-value shipments. In addition to customs regulations, data protection laws are becoming increasingly important in the CEP market, particularly with the rise of e-commerce and the increased collection of customer data. Regulations such as the General Data Protection Regulation (GDPR) in Europe require companies to implement robust data protection measures, including securing customer information and providing transparency in data usage. Compliance with these regulations is essential to maintaining customer trust and avoiding significant fines.

Technological advancements represent a major opportunity in the market. The adoption of automation, AI, and machine learning in logistics operations is enabling companies to enhance efficiency, reduce costs, and improve service quality. For instance, automated sorting systems and AI-driven route optimization are helping CEP providers manage increasing parcel volumes while maintaining timely deliveries. Additionally, the use of big data analytics is providing companies with valuable insights into customer behavior, enabling them to offer more personalized services and improve customer satisfaction.

Service Insights

The standard delivery segment dominated the market in 2023 and accounted for more than 37% share of global revenue. This segment encompasses deliveries that do not require expedited services and can be delivered within a typical timeframe, usually ranging from 3 to 7 days. Businesses and consumers frequently use standard delivery for non-urgent shipments, which constitutes a significant volume of the overall parcel traffic. The high demand for standard delivery is driven by its affordability, making it the preferred choice for bulk and routine shipments. Additionally, standard delivery services have well-established networks and infrastructure, which enable reliable and consistent service. The rise in e-commerce, particularly for non-perishable goods and less time-sensitive items, further boosts the demand for standard delivery services.

The same-day delivery segment is projected to expand at the fastest growth rate during the forecast period 2024 to 2030. This service promises delivery within hours of order placement, catering to urgent needs and enhancing customer satisfaction. The surge in e-commerce, especially in urban areas where consumers expect rapid delivery of goods, fuels this growth. Companies are investing heavily in logistics technologies and last-mile delivery solutions to meet the high expectations for same-day delivery. Additionally, the COVID-19 pandemic accelerated the adoption of same-day delivery as businesses adapted to changing consumer behaviors, emphasizing the need for quick and reliable delivery services. The growth of same-day delivery is further supported by advancements in real-time tracking, route optimization, and the use of localized warehouses.

Business Model Insights

The business-to-business (B2B) segment dominated the market in 2023. B2B deliveries often involve bulk shipments, scheduled logistics, and higher-value transactions, making it a cornerstone of the CEP industry. Industries such as manufacturing, retail, and healthcare heavily rely on B2B CEP services to maintain supply chain efficiency and meet production timelines. The B2B model benefits from long-term contracts and recurring shipments, providing a stable revenue stream for CEP providers. Moreover, B2B deliveries often require specialized handling, secure transport, and compliance with regulatory standards, which CEP companies are well-equipped to manage. The growth of global trade and the expansion of industrial activities continue to drive the demand for B2B CEP services.

The business-to-consumer (B2C) segment is projected to grow at the fastest rate during the forecast period 2024 to 2030. Online shopping has transformed consumer expectations, leading to an increased demand for direct-to-consumer deliveries. B2C CEP services cater to individual customers who order products online and expect timely and reliable delivery to their doorsteps. The rise of mobile commerce, convenience shopping, and personalized delivery options have further propelled the growth of B2C services. Additionally, technological advancements such as real-time tracking, automated sorting, and efficient last-mile delivery solutions enhance the customer experience and streamline operations for CEP providers. The trend of retailers offering free or low-cost shipping as a competitive differentiator also boosts the B2C segment's growth.

Destination Insights

The domestic segment dominated the market in 2023 as they encompass a large volume of shipments within national borders. This segment benefits from well-established infrastructure, regional hubs, and a high frequency of deliveries driven by local e-commerce activities. Domestic deliveries are often more cost-effective and faster due to shorter transit times and fewer regulatory hurdles compared to international shipments. Businesses and consumers prefer domestic CEP services for the convenience and reliability they offer, making them a significant portion of the overall market. The rise of local e-commerce platforms and regional marketplaces further enhances the demand for domestic CEP services, reinforcing their dominant position in the market.

The international segment is projected to witness the fastest growth from 2024 to 2030, driven by globalization and the increase in cross-border e-commerce. Consumers are increasingly purchasing products from overseas retailers, necessitating efficient international shipping solutions. The demand for international CEP services is also fueled by businesses expanding their market reach and sourcing products globally. These services require advanced logistics capabilities, including customs clearance, international warehousing, and compliance with varying regulations across countries. Technological advancements, such as improved tracking systems and better logistics management, have made international shipping more efficient and reliable. As a result, international CEP services are growing at a significant pace, capturing a larger share of the market.

Mode of Transport Insights

The roadways segment dominated the market in 2023, primarily due to their extensive reach and flexibility. They are the preferred mode for last-mile delivery, connecting urban and rural areas with efficiency and cost-effectiveness. The infrastructure for road transport, including highways and local roads, is well-developed in many regions, enabling reliable and timely deliveries. Road transport is particularly advantageous for short to medium distances, offering door-to-door services that are essential for both B2B and B2C segments. The dominance of roadways is also attributed to their ability to handle a wide variety of parcel sizes and weights, making them suitable for diverse delivery needs. Additionally, advancements in vehicle technology, route optimization software, and real-time tracking systems have significantly enhanced the efficiency of road transport. Despite challenges such as traffic congestion and environmental concerns, roadways remain integral to the logistics network due to their unmatched versatility and scalability.

The airways segment is projected to grow at the fastest growth rate during the forecast period 2024, driven by the increasing demand for expedited delivery services. The growth is fueled by the rise of e-commerce and global trade, requiring swift and reliable international shipments. Air transport is crucial for long-distance and time-sensitive deliveries, offering unparalleled speed compared to other modes. The expansion of global air cargo networks and the development of dedicated air freight services by major logistics companies have significantly contributed to this growth. Additionally, technological advancements in aircraft and cargo handling have improved the efficiency and capacity of air transport. While airways are more expensive, their ability to meet the demands of express delivery and international shipping makes them indispensable. The growth of air transport is further supported by the increasing number of e-commerce companies offering premium delivery options, such as next-day or same-day international shipping. This mode of transport is essential for high-value and perishable goods, ensuring that the CEP market can meet the diverse needs of modern consumers and businesses.

End Use Insights

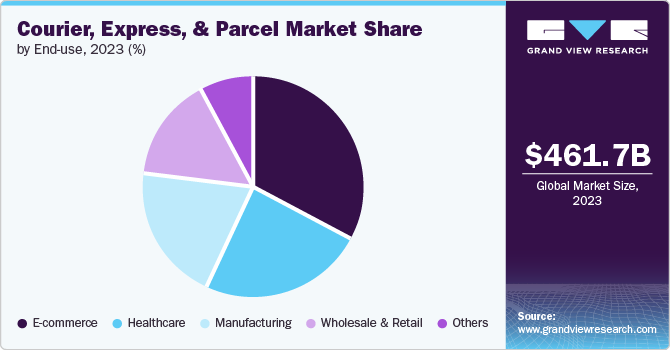

The e-commerce segment dominated the market in 2023, driven by the exponential growth of online shopping. Major e-commerce platforms like Amazon, Alibaba, and others are continually expanding their logistics capabilities to meet consumer demands for faster delivery times. The proliferation of mobile devices and improved internet access has further accelerated e-commerce growth, making it a critical driver for the CEP market. Technological advancements, such as automated sorting centers, real-time tracking, and sophisticated inventory management systems, have enhanced the efficiency and reliability of e-commerce deliveries. Additionally, the COVID-19 pandemic has significantly boosted online shopping, reinforcing the dominance of this segment. E-commerce's growth trajectory shows no signs of slowing down, with continuous innovations in delivery services, including drones and autonomous vehicles, expected to further transform the market.

The wholesale and retail segment is projected to grow at the fastest CAGR during the forecast period 2024 to 2030. Retailers are under pressure to maintain lean inventory levels and ensure timely replenishment of stock to meet consumer demand, necessitating reliable and rapid CEP services. This growth is particularly notable in the context of omnichannel retail strategies, where seamless integration between online and offline channels is crucial for customer satisfaction. Wholesale distributors also rely heavily on CEP services to manage large volumes of goods and facilitate swift deliveries to retailers and end consumers. The integration of advanced technologies, such as real-time tracking, route optimization, and automated warehousing, has significantly enhanced the efficiency and reliability of delivery services in this segment. Additionally, the globalization of retail markets has led to increased cross-border trade, further boosting demand for international CEP services. The segment's growth is also supported by the rise of specialty retail, which often requires customized and flexible delivery solutions.

Regional Insights

North America courier, express, and parcel (CEP) marketis expected to witness steady growth from 2024 to 2030, driven by a thriving e-commerce sector, advancements in logistics technology, and increasing consumer expectations for faster delivery times. The United States and Canada are the primary contributors to this growth, with the U.S. market being particularly strong due to its large consumer base and the dominance of e-commerce giants like Amazon and Walmart. The region's growth is further supported by significant investments in logistics infrastructure, including the expansion of warehousing facilities, the adoption of automated sorting systems, and the use of advanced data analytics for route optimization. The rise of same-day and next-day delivery services has heightened competition among CEP providers, leading to continuous innovation in last-mile delivery solutions.

Moreover, North America’s focus on sustainability is driving the adoption of electric delivery vehicles and green logistics practices, which are becoming increasingly important to meet regulatory requirements and consumer demand for environmentally friendly services. The growing trend of cross-border e-commerce between the U.S. and Canada is also boosting the demand for international CEP services. Overall, North America's CEP market is on a rapid growth trajectory, driven by a combination of technological innovation, consumer demand, and a strong e-commerce ecosystem.

U.S. Courier, Express, And Parcel Market Trends

The courier, express, and parcel market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. The U.S. is home to some of the largest e-commerce platforms in the world, such as Amazon and eBay, which have set high standards for delivery speed and efficiency, driving the need for robust CEP networks. The country’s large geographical area and diverse population require sophisticated logistics solutions, including regional distribution centers, automated sorting facilities, and advanced route optimization technologies. The rise of same-day and next-day delivery services has intensified competition in the CEP market, pushing companies to continuously innovate and improve their service offerings.

Additionally, the U.S. government’s emphasis on infrastructure development, particularly in the transportation and logistics sectors, is facilitating the growth of the CEP market. Sustainability is also becoming a key focus, with CEP providers increasingly adopting electric vehicles, green packaging, and carbon-neutral delivery options to meet regulatory requirements and consumer expectations. Overall, the U.S. CEP market is growing significantly, driven by a dynamic e-commerce landscape, technological advancements, and a strong focus on customer satisfaction.

Asia Pacific Courier, Express, And Parcel Market Trends

The courier, express, and parcel (CEP) market in Asia Pacificdominated the global CEP market in 2023 and accounted for a 40.3% share of the global revenue. Major economies like China, Japan, South Korea, and India are key contributors to this dominance, with China being the largest market due to its vast e-commerce ecosystem. The region's large and growing middle class, coupled with a high penetration of smartphones and the internet, has led to a surge in online shopping, which in turn fuels demand for CEP services.

Additionally, the rise of cross-border e-commerce has significantly increased the volume of international parcels, further strengthening the region’s position. Asia Pacific’s dominance is also supported by significant investments in logistics infrastructure, including the expansion of airports, ports, and road networks, as well as advancements in technology like automation and AI-driven logistics solutions. Moreover, the region's focus on improving last-mile delivery services and the emergence of innovative delivery models, such as drone deliveries and locker systems, have enhanced service efficiency and customer satisfaction. As a result, Asia Pacific remains at the forefront of the CEP market, with continuous growth expected in the coming years.

India courier, express, and parcel (CEP) market is expected to grow at the fastest CAGR from 2024 to 2030. The country’s young and tech-savvy population is a major force behind the booming online retail market, with millions of new users engaging in online shopping each year. The government’s push toward digitalization, coupled with the rise of digital payment platforms, has further accelerated e-commerce adoption, thereby boosting demand for efficient and reliable CEP services.

Additionally, the Indian logistics sector is undergoing a transformation with the advent of new technologies such as real-time tracking, route optimization, and AI-driven analytics, which are enhancing operational efficiency and delivery speeds. Tier 2 and Tier 3 cities are also witnessing rapid growth in e-commerce, requiring CEP providers to expand their reach and improve last-mile delivery capabilities in these areas. Moreover, the entry of global players and the rise of local startups in the logistics space are intensifying competition, leading to better services and more options for consumers. Overall, India's CEP market is on a steep growth trajectory, positioning it as a key driver of the Asia Pacific region's dominance in the global market.

Europe Courier, Express, and Parcel Market Trends

The CEP market in Europe is expected to grow at a significant CAGR from 2024 to 2030. Rising internet penetration and widespread adoption of online shopping have increased the demand for quick and reliable delivery services, particularly in densely populated urban areas. Furthermore, Europe’s emphasis on sustainability and green logistics is shaping the CEP market, with many companies investing in electric vehicles, carbon-neutral delivery options, and environmentally friendly packaging to meet regulatory requirements and consumer expectations. The integration of advanced technologies, such as automated sorting centers and AI-powered route planning, has also improved operational efficiency and reduced delivery times.

The growth of the CEP market in Europe is further supported by the development of seamless cross-border logistics within the EU, facilitating faster and more efficient international deliveries. Additionally, the region's strong focus on customer experience is driving innovation in last-mile delivery solutions, including the use of parcel lockers, smart home delivery systems, and real-time tracking services. Overall, Europe's CEP market is growing significantly, driven by a combination of technological innovation, sustainability efforts, and a strong e-commerce sector.

France courier, express, and parcel market is expected to grow at a significant CAGR from 2024 to 2030, driven by the rapid expansion of its e-commerce sector, increasing cross-border trade, and significant investments in logistics and delivery infrastructure. The country’s robust e-commerce market, led by local giants like Cdiscount.com and international players such as Amazon, has fueled the demand for fast and reliable delivery services. Additionally, France's strategic location in Western Europe makes it a crucial hub for cross-border logistics, further boosting the CEP market. The French government’s focus on digitalization and innovation in the logistics sector has also played a key role in this growth, with initiatives aimed at improving last-mile delivery efficiency and reducing environmental impact. The adoption of electric vehicles and the development of urban logistics hubs are part of France's efforts to create a more sustainable and efficient delivery network. Furthermore, the growing trend of omnichannel retailing in France, where consumers demand seamless integration between online and offline shopping experiences, is driving the need for more sophisticated and flexible delivery solutions. Overall, France's CEP market is growing rapidly, positioning it as the fastest-growing market in Europe, with continued expansion expected in the coming years.

Courier, Express, And Parcel Company Insights

The competitive landscape of the courier, express, and parcel (CEP) market is characterized by intense rivalry among both global giants and regional players, driven by the surging demand for fast and reliable delivery services in an increasingly digital world. Key industry leaders, such as DHL, FedEx, UPS, and SF Express, dominate the market with extensive networks, advanced logistics capabilities, and a strong focus on innovation. These companies continually invest in cutting-edge technologies, including automation, artificial intelligence, and blockchain, to enhance operational efficiency, optimize delivery routes, and improve customer experience. The rapid growth of e-commerce has also spurred competition, particularly in the last-mile delivery segment, where companies are experimenting with drones, autonomous vehicles, and crowd-sourced delivery models to meet escalating consumer expectations for speed and convenience.

Regional and local players, often more agile, are carving out niches by offering specialized services, such as same-day delivery, customized logistics solutions, and superior customer service tailored to local markets. The rise of start-ups in the logistics tech space is further intensifying competition, pushing traditional players to innovate or collaborate with new entrants to stay competitive. Additionally, the growing emphasis on sustainability is driving companies to adopt greener practices, such as electric delivery fleets and carbon-neutral shipping options, adding another layer of competition based on environmental responsibility.

Key Courier, Express, And Parcel Companies:

The following are the leading companies in the courier, express, and parcel market. These companies collectively hold the largest market share and dictate industry trends.

- FedEx

- Amazon Logistics

- Aramex

- Deutsche Post DHL Group

- United Parcel Service Inc. (UPS)

- SF Express (Group) Co. Ltd.

- One World Express Inc. Ltd.

- Qantas Airways Limited

- Royal Mail Group Limited

- Yamato Transport Co., Ltd.

- TNT Express

- Blue Dart Express Ltd.

Recent Developments

-

In February 2024, Emirates Post Group, rebranded as 7X, unveiled EMX, a new subsidiary dedicated to reshaping the courier, express, and parcel (CEP) industry in the UAE. Leveraging cutting-edge technologies, EMX aims to deliver unparalleled logistics solutions, prioritizing speed, reliability, and customer-centric services.

-

In May 2023, Interroll launched the High Performance Conveyor Platform (HPP) specifically designed for the demanding courier, express, and parcel market. This platform incorporates an intelligent diverter module, enabling flexible sorting capabilities and high throughput. The HPP's robust construction, combined with the innovative Multi Belt Switch, ensures efficient and gentle handling of various package types while maximizing system uptime and return on investment.

-

In November 2022, DHL Express introduced a groundbreaking digital service point in the UAE, marking a significant advancement in the courier, express, and parcel (CEP) industry. This fully automated service point, the first of its kind in the Middle East and the DHL network is located at Dubai Digital Park. The initiative underscores DHL Express' leadership position in the UAE market and sets a new standard for customer experience in the logistics sector.

Courier, Express, And Parcel Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 506.23 billion

Revenue forecast in 2030

USD 925.48 billion

Growth rate

CAGR of 10.6% from 2024 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Service, business model, destination, mode of transport, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, United Arab Emirates (UAE), Kingdom of Saudi Arabia (KSA), South Africa

Key companies profiled

Amazon Logistics; Aramex; Blue Dart Express Ltd; Deutsche Post DHL Group; FedEx; One World Express Inc. Ltd; Qantas Airways Limited; Royal Mail Group Limited; SF Express (Group) Co. Ltd; TNT Express; United Parcel Service Inc. (UPS); Yamato Transport Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Courier, Express, And Parcel Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global courier, express, and parcel market report based on service, business model, destination, mode of transport, end use, and region:

-

Service Outlook (Revenue, USD Billion, 2017 - 2030)

-

Standard Delivery

-

Express Delivery

-

Same-Day Delivery

-

Last-Mile Delivery

-

-

Business Model Outlook (Revenue, USD Billion, 2017 - 2030)

-

Business-to-Business (B2B)

-

Business-to-Consumer (B2C)

-

Customer-to-Customer (C2C)

-

-

Destination Outlook (Revenue, USD Billion, 2017 - 2030)

-

Domestic

-

International

-

-

Mode of Transport Outlook (Revenue, USD Billion, 2017 - 2030)

-

Roadways

-

Airways

-

Railways

-

Waterways

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

E-commerce

-

Healthcare

-

Manufacturing

-

Wholesale & Retail

-

Other

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global courier, express, and parcel market size was estimated at USD 461.69 billion in 2023 and is expected to reach USD 506.23 billion in 2024.

b. The global courier, express, and parcel market is expected to grow at a compound annual growth rate of 10.6% from 2024 to 2030, reaching USD 925.48 billion by 2030.

b. Asia Pacific dominated the courier, express, and parcel (CEP) market in 2023 and accounted for a 40.3% share of the global revenue. TThe region's large and growing middle class, coupled with a high penetration of smartphones and the internet, has led to a surge in online shopping, which in turn fuels demand for CEP services.

b. Some key players operating in the courier, express, and parcel (CEP) market include FedEx Corporation, Amazon Logistics, Aramex, Deutsche Post DHL Group, United Parcel Service Inc. (UPS), SF Express (Group) Co. Ltd, One World Express Inc. Ltd, Qantas Airways Limited, Royal Mail Group Limited, Yamato Transport Co., Ltd., TNT Express, and Blue Dart Express Ltd.

b. The ccourier, express, and parcelmarket is propelled by several key factors. The shift towards online shopping has led to a substantial increase in parcel volumes, with consumers expecting faster and more reliable delivery options. Furthermore, as environmental concerns become more prominent, CEP companies are under increasing pressure to reduce their carbon footprint. This has led to the adoption of green logistics practices, such as the use of electric and hybrid delivery vehicles, carbon offset programs, and the development of more efficient packaging solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.