- Home

- »

- Electronic & Electrical

- »

-

Countertop Oven Market Size, Share & Trends Report, 2030GVR Report cover

![Countertop Oven Market Size, Share & Trends Report]()

Countertop Oven Market Size, Share & Trends Analysis Report By Category (Conventional, Smart), By Capacity (10 litres, 10-20 litres, 21-30 litres), By Application (Residential, Commercial), By Distribution Channel (Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-469-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Countertop Oven Market Size & Trends

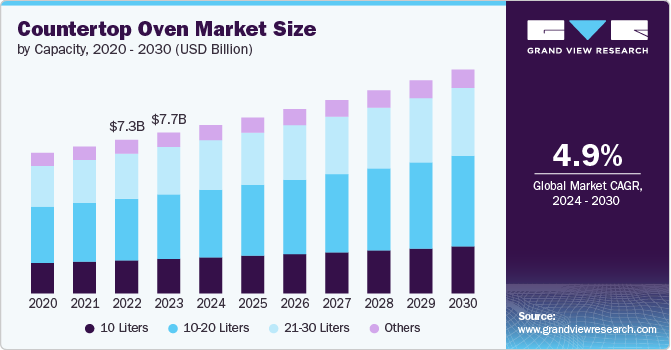

The global countertop oven market size was estimated at USD 7.68 billion in 2023 and is projected to grow at a CAGR of 4.9% from 2024 to 2030. The market is witnessing significant growth, driven by several factors that align with evolving consumer preferences. One of the primary reasons for this expansion is the increasing popularity of compact appliances, especially in urban areas with limited space. As more people live in smaller apartments or homes with limited kitchen space, countertop ovens have become a preferred choice due to their space-saving design. Their compact size makes them suitable for smaller kitchens without compromising functionality, which appeals to modern households looking for efficient kitchen solutions.

Versatility and multi-functionality are also key factors contributing to the rise of countertop ovens. Many models are equipped with multiple cooking functions, such as baking, toasting, broiling, and even air frying, making them a convenient all-in-one appliance. This eliminates the need for multiple kitchen gadgets, providing a streamlined and efficient cooking experience. Additionally, countertop ovens are known for being more energy-efficient than traditional ovens, consuming less electricity while delivering similar results. This eco-friendly aspect resonates with consumers seeking to reduce their energy consumption and cut down on utility bills.

The growing health-conscious mindset among consumers has also fueled the demand for countertop ovens, particularly those with air-frying capabilities. Health-conscious cooking trends emphasize using less oil, and countertop ovens with air-fry functions allow consumers to prepare crispy, fried-like foods with minimal oil, making them an appealing option for healthier meals. Coupled with busy lifestyles, the convenience of countertop ovens, which heat up faster and cook meals more quickly than conventional ovens, further drives their popularity. This time-saving feature is particularly attractive to individuals looking for efficient cooking solutions.

Technological advancements have also played a role in expanding the countertop oven market. Many modern models now have digital controls, timers, and preset cooking functions, enhancing the overall user experience. Some even include smart features such as Wi-Fi connectivity, allowing users to control the oven remotely. This level of convenience and innovation has attracted tech-savvy consumers who are looking to upgrade their kitchen appliances. Moreover, the trend of small-batch cooking, particularly among smaller households or individuals, has made countertop ovens a practical choice for preparing single servings or smaller portions, further boosting their demand.

Additionally, as more people prioritize energy-efficient appliances that align with their eco-conscious values, countertop ovens have emerged as a viable and appealing option. Additionally, the post-pandemic trend of home cooking and baking has spurred the demand for user-friendly appliances that simplify meal preparation, positioning countertop ovens as a preferred choice for households looking to cook or bake at home. These combined factors contribute to the growing market for countertop ovens and are expected to continue driving its expansion in the coming years.

Category Insights

Conventional ovens accounted for a share of 93.5% in 2023. Conventional countertop ovens offer a wide range of cooking functions, such as baking, broiling, toasting, and reheating. Their straightforward design and ease of use make them a popular choice for both novice and experienced cooks. The ability to perform multiple cooking tasks with a single appliance adds to their appeal, particularly in households seeking simplicity and functionality.The compact size of conventional countertop ovens makes them an attractive option for kitchens with limited space. They fit well on countertops, providing a practical cooking solution without needing a full-sized oven. This space efficiency is particularly valued in urban areas and smaller homes where maximizing kitchen space is important.

Smart oven is expected to grow at a CAGR of 6.0% from 2024 to 2030. Smart countertop ovens offer advanced features like digital controls, programmable settings, and connectivity with mobile apps. This integration allows users to control and monitor their oven remotely, set cooking times, and receive notifications. The convenience of managing cooking processes from a smartphone or tablet appeals to tech-savvy consumers who value ease and efficiency in the kitchen. Many smart countertop ovens come with features that support healthier cooking methods, such as air frying and dehydration. Additionally, these ovens often include customizable cooking programs and recipe suggestions based on user preferences and dietary needs.

Capacity Insights

10-20 liters accounted for a revenue share of 40.1% in 2023. Countertop ovens with a 10-20 liter capacity offer an optimal balance between compact and functional. This size is large enough to handle everyday cooking tasks like baking, roasting, and toasting, but still small enough to fit comfortably in most kitchens. It is perfect for small to medium households that need versatility without taking up too much counter space.Many countertop ovens in the 10-20 liters range come equipped with multi-functional features like convection baking, air frying, broiling, and toasting. The growing preference for appliances that can perform several tasks in one device drives demand, as consumers seek cost-effective solutions for diverse cooking needs in a single compact oven.

21-30 liters is expected to grow at a CAGR of 5.3% from 2024 to 2030. In larger kitchens where space is less constrained, consumers often prefer countertop ovens with larger capacities to complement their existing appliances. The 21-30 liter size provides a good balance between a compact footprint and the ability to handle substantial cooking tasks, making it a popular choice for those with more kitchen counter space. The increasing interest in home cooking and baking, driven by trends such as gourmet cooking and meal prepping, contributes to the demand for larger countertop ovens. These ovens allow users to bake bread, roast larger cuts of meat, or prepare multiple dishes simultaneously, accommodating the needs of enthusiastic home cooks and bakers.

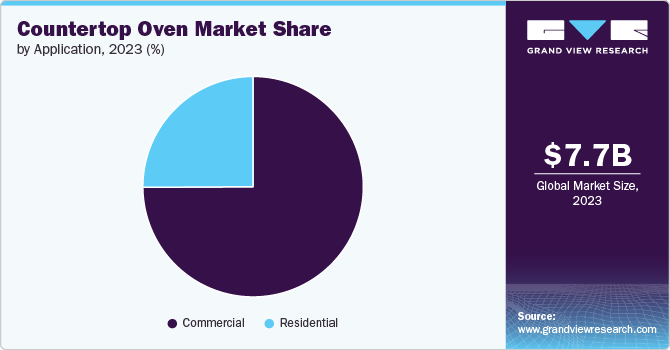

Application Insights

Commercial accounted for a revenue share of 74.9% in 2023. In commercial kitchens, particularly in small restaurants, cafés, food trucks, and catering services, space is often limited. Countertop ovens provide an efficient solution, offering the functionality of traditional ovens without taking up valuable kitchen space, making them ideal for businesses operating in smaller spaces. Countertop ovens are highly versatile, with many models capable of performing multiple cooking tasks such as baking, toasting, roasting, and air frying. This versatility allows commercial kitchens to perform various cooking tasks with a single appliance, reducing the need for multiple devices and improving workflow efficiency in busy environments like restaurants and cafés.

Residential is expected to grow at a CAGR of 5.3% from 2024 to 2030. Modern households prioritize convenience and efficiency in cooking, and countertop ovens offer faster preheating and cooking times compared to traditional ovens. Their ability to handle quick meals and multi-functional capabilities (like air frying, baking, and broiling) makes them highly appealing for busy families and individuals looking for time-saving kitchen appliances.As more people live in apartments or smaller homes, especially in urban areas, space-saving appliances like countertop ovens have become essential. Their compact design fits easily in small kitchens without compromising functionality, making them a popular choice for homeowners who need efficient use of space.

Distribution Channel Insights

Sales through offline stores accounted for a revenue share of 79.9% in 2023. Offline stores allow customers the opportunity to physically inspect the ovens, assess their build quality, and see the features up close. This hands-on experience can help consumers make more informed purchasing decisions. Many offline stores offer live demonstrations of the product, allowing customers to see how the oven works and evaluate its performance before buying.

Sales through online stores is expected to grow at a CAGR of 5.4% from 2024 to 2030. Online stores provide extensive product descriptions, specifications, and user reviews that help consumers make informed decisions. Detailed information and customer feedback can offer insights into product performance and reliability. Consumers can easily compare different models, prices, and features on e-commerce platforms, which helps them find the best option that meets their needs and budget.

Regional Insights

The countertop oven market in North America is expected to grow at a CAGR of 5.0% during the forecast period. North American consumers are increasingly looking for appliances that can help save time and make cooking more convenient. Countertop ovens heat up faster and cook meals more quickly than traditional ovens, making them ideal for busy individuals and families seeking efficient meal preparation solutions.There is a rising trend toward health-conscious lifestyles in North America, with more people opting for cooking methods that use less oil and fat. Many countertop ovens now come with air-frying features, allowing consumers to prepare healthier meals with minimal oil, which aligns with the demand for healthier cooking options.

U.S. Countertop Oven Market Trends

The countertop oven market in the U.S. is facing intense competition due to massive category innovations in countertop ovens. The increasing number of smaller households, including singles and couples, along with the trend of urban living in cities with limited kitchen space, driving the demand for compact, versatile kitchen appliances like countertop ovens. Their space-saving design makes them perfect for small kitchens and apartments.

Europe Countertop Oven Market Trends

The countertop oven market in Europe is expected to grow at a CAGR of 5.5% during the forecast period from 2024 to 2030. The rise in home cooking and baking, which accelerated during the COVID-19 pandemic, continues to drive demand for countertop ovens in Europe. Many consumers seek convenient and efficient appliances to prepare homemade meals, and countertop ovens offer quick heating and multi-functional capabilities, making them popular for everyday use.

Asia Pacific Countertop Oven Market Trends

The countertop oven market in Asia Pacific accounted for a revenue share of 44.0% in 2023 of the global market. China, India, and other South Asian countries have large middle-class populations with increased. The expanding middle-class population in countries like China, India, and Southeast Asia has led to a rise in disposable income, and changing consumer lifestyle preferences, are driving the market growth. More people are investing in modern kitchen appliances, including countertop ovens, which offer convenience and efficiency in meal preparation, catering to busy lifestyles.Consumers are looking for healthier cooking solutions as health consciousness rises in the Asia Pacific region. Countertop ovens with air-fry capabilities allow for low-oil cooking, appealing to the demand for healthier meal preparation methods. Additionally, the convenience of multi-functional appliances is becoming more attractive as people seek efficient cooking options.

Key Countertop Oven Company Insights

The countertop oven market is characterized by dynamic competitive dynamics shaped by a combination of factors, including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Countertop Oven Companies:

The following are the leading companies in the countertop oven market. These companies collectively hold the largest market share and dictate industry trends.

- Cuisinart

- Breville

- Hamilton Beach

- Oster

- Black+Decker

- KitchenAid

- Ninja

- De'Longhi

- Wolf Gourmet

- Sharp

Recent Developments

-

In July 2024, Smeg introduced a new multifunctional countertop oven designed to enhance culinary experiences in the kitchen. This innovative appliance combines various cooking functions, allowing users to bake, grill, and roast with ease. The countertop oven features a sleek design typical of Smeg’s aesthetic, making it a stylish addition to any kitchen. Equipped with advanced technology, the oven offers precise temperature control and multiple cooking modes to accommodate a variety of recipes. Its compact size makes it ideal for smaller kitchens or for those looking to save space without sacrificing functionality.

-

In January 2024, Panasonic, a leading provider of consumer lifestyle technologies, announced an expanded partnership with Fresco, the leading smart kitchen platform for the world's top appliance brands. The companies will collaborate to deliver a revolutionary cooking assistant for Panasonic kitchen appliances, starting with the Panasonic HomeCHEF 4-in-1 multi-oven. Panasonic will showcase the new smart appliance and connected cooking experience at the Consumer Electronics Show (CES) 2024, which will be held from January 9 to 12 in Las Vegas.

Countertop Oven Market Report Scope

Report Attribute

Details

Market application value in 2024

USD 8.03 billion

Revenue forecast in 2030

USD 10.69 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Category, application, capacity, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Cuisinart; Breville; Hamilton Beach; Oster; Black+Decker; KitchenAid; Ninja; De'Longhi; Wolf Gourmet; Sharp

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Countertop Oven Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented global countertop oven market based on category, capacity, application, distribution channel, and region.

-

Category Outlook (Revenue, USD Billion, 2018 - 2030)

-

Conventional

-

Smart

-

-

Capacity Outlook (Revenue, USD Billion, 2018 - 2030)

-

10 Liters

-

10-20 Liters

-

21-30 Liters

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

Hypermarkets & Supermarkets

-

Electronic Stores

-

Exclusive Brand Stores

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global countertop oven market size was estimated at USD 7.68 billion in 2023 and is expected to reach USD 8.03 billion in 2024.

b. The global countertop oven market is expected to grow at a compounded growth rate of 4.9% from 2024 to 2030 to reach USD 10.69 billion by 2030.

b. 10-20 litres of countertop ice maker accounted for a market share of 40.1% in 2023. Countertop ovens in this capacity range are often more energy-efficient than larger, traditional ovens, reducing electricity consumption. As energy costs become a concern for many consumers, especially in urban areas, the ability to cook efficiently while saving on utility bills is a major factor driving the growth of this market segment.

b. Some key players operating in countertop oven market include Cuisinart, Breville, Hamilton Beach, Oster, Black+Decker and others.

b. Key factors that are driving the market growth include rising demand for compact living spaces and increasing technological advancements in ovens

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."