Cosmetics And Personal Care Packaging Equipment Market Size, Share & Trends Analysis Report By Product (Cleaning, Wrapping, Filling, Labelling), By Application (Skin Care, Hair Care), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-935-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2020 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

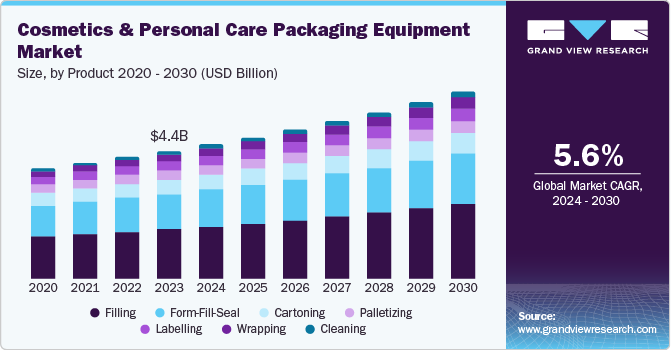

The global cosmetics and personal care packaging equipment market size was valued at USD 4.4 billion in 2023 and is projected to grow at a CAGR of 5.6% from 2024 to 2030. The growth is attributed to the rising consumer preferences for personalized, convenient, and affordable products which have led to demand for innovative and efficient manufacturing to deal with stock-keeping unit (SKU) proliferation. To acquire a larger customer base in global cosmetics market, companies are focusing on enhanced packaging techniques and material, further expanding the market at a rapid pace. Moreover, with the exponential growth of e-commerce sector, the need of packaging has also emerged significantly. As the packaging requirements of online distribution channels are different from retail outlets, the market is expected to have a positive impact in coming years. The increasing popularity of online shopping among young consumers is boosting the growth of safe packaging equipments that can be used to enhance the supply chain solutions for doorstep deliveries.

Rising awareness pertaining to the depletion of natural resources followed by regulatory, social, and tax pressures is expected to drive the demand for eco-friendly solutions from leading manufacturers. This has increased the focus on optimizing machinery by incorporating Artificial Intelligence (AI)-enabled or fully automated filling and warehousing technologies along with customizing machinery on the basis of new regulation standards of sustainability.

The market is seeing an uptick in demand for rental machinery. Continuously evolving consumer demands and the explosion of SKUs especially in the consumer goods sector wherein there is constant change in the packaging needs have created opportunities for the manufacturers providing rental machinery.

Beauty giants are experiencing a decline in sales due to changing consumer tastes and nimble competitors, especially in the U.S. The cosmetics & personal care packaging equipment market is expected to witness slower growth due to the current economic uncertainties and the rising demand for inexpensive over-the-counter skincare products in emerging economies, such as India and China. Such factors are projected to restrict the growth of the market over the forecast period.

Product Insights

The filling machine segment dominated the market with a market share of 38.9% in 2023. User friendly features of these machines such as low maintenance cost, high performance with uniform product quality, safety from any contamination is driving the segment growth. Post COVID-19 pandemic, the consumers and manufacturers are cautious about keeping the products free from any contamination throughout the packaging and delivery process. Also, maintaining the nutritional value of cosmetic products is an important aspect of filling machines, further expanding the scope of this market.

The cleaning segment based on products in the market is expected to register the fastest CAGR of 7.0% over the forecast period. The demand for labeling equipment is anticipated to witness significant CAGR over the forecast period, owing to the increasing consumption of label-intensive non-durable goods along with a rising need for shippers to accurately track items for security and safety reasons, especially in the personal care industry.

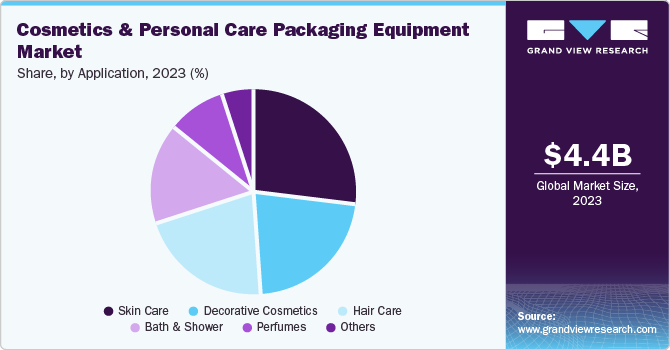

Application Insights

The skincare category held the largest share of 27.0% in 2023. The increasing popularity of moisturizers, anti-ageing creams and serums have also expanded the need of suitable packaging material. The dynamic skincare products market and preference to customized, sustainable packaging have shaped the market in recent years.

The rising demand for hair care and styling products to suit myriad customer profiles coupled with the changing consumer shift towards personalized products and the new trend of mix-your-own products is anticipated to drive the segment growth in the coming years.

The decorative cosmetics segment is anticipated to be the fastest growing sub segment in the coming years. This segment includes products such as lipsticks, eye liners and foundation, which are gaining huge popularity among consumers to enhance the overall look. The packaging needs of these specially developed products are different as well. The primary objective is to protect the product from heat, moisture and dust. Also, any damage during transport and handling needs to be avoided.

Cosmetic brands are focusing on creating a look that appeals to a target demographic that needs to be memorable and easy to understand owing to the increasingly widespread online distribution channels. In addition, cosmetic manufacturers are exploring the usage of smart tools to provide personalized options which have increased the product demand in recent times.

Regional Insights

North America cosmetics and personal care packaging equipment market held a market share of 24.8% in 2023 and is expected to grow at a CAGR of 5.2% during the forecast period. Presence of big companies in cosmetics sector and large number of customers using these products, eventually have expanded the market in region.

Also, the growing e-commerce sector has augmented the regional growth, owing to the need of different packaging and warehousing solutions.

Asia Pacific Cosmetics And Personal Care Packaging Equipment Market Insights

Asia Pacific cosmetics and personal care packaging equipment market dominated the global market accounting for the largest revenue share of 38.1% in 2023. Presence of highly populated countries such as China and India, increasing awareness about personal care products and large companies operating in the region are key driving factors of the market. To acquire the large customer base, companies are emphasizing on improving the manufacturing and packaging technologies along with advanced design techniques, further propelling the regional growth. Increase in income ranges of middle class population and inclination towards herbal products are eventually rising the demand of packaging machinery.

Europe Cosmetics And Personal Care Packaging Equipment Market Insights

Europe accounted for a revenue share of 28.6% in 2023 and is projected to grow at a CAGR of 4.3% over the forecast period. The key factors supporting the growth are increasing urbanization and innovation in packaging technologies. Consumers are preferring single use packaging alternatives which have given rise to research and development of various personal care packaging applications.

Key Cosmetics And Personal Care Packaging Equipment Company Insights

Major market players include Wimco Engineering; Syntegon Technology GmbH; Marchesini Group S.p.A.; Wimco Ltd; and AMET Packaging, Inc. and others. The cosmetics and personal care packaging equipment manufacturers are developing innovative solutions through research and investments in manufacturing facilities.

-

Prosys manufactures filling machinery for squeeze tube, filling cartridges, unit dose tubes, airless pumps, single & dual barrel syringes, and rigid containers for the pharmaceutical, cosmetic, food, sealant, chemical, adhesive, and grease Industries

Key Cosmetics And Personal Care Packaging Equipment Companies:

The following are the leading companies in the cosmetics and personal care packaging equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Wimco Engineering

- Syntegon Technology GmbH

- Marchesini Group S.P.A.

- Prosys Fill

- AMET Packaging, Inc. (acquired APACKS)

View a comprehensive list of companies in the Cosmetics And Personal Care Packaging Equipment Market

Recent Developments

-

In July 2024, ProSys Fill announced the launch of LB300 Lip Balm Filler. It is designed for high-volume and efficient manufacturing in cosmetics and personal care.

-

In June 2024, Syntegon acquired Azbil Telstar. Azbil Telstar, a part of Azbil Corporation, is listed on Tokyo Stock Exchange Prime Market. Its production plants are situated in UK, China and Spain and serves global life science, pharma and medtech companies, especially clients in western and southern Europe, India and the U.S.

Cosmetics And Personal Care Packaging Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.6 billion |

|

Revenue forecast in 2030 |

USD 6.5 billion |

|

Growth rate |

CAGR of 5.6% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, , Japan, China, India, South Korea, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE |

|

Key companies profiled |

Bosch Packaging Technology, Inc.; Marchesini Group S.p.A.; Wimco Ltd; Prosy's Innovative Packaging Equipment; AMET Packaging, Inc. (acquired APACKS) |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cosmetics And Personal Care Packaging Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyses the latest industry trends in each of the sub-segments from 2020 to 2030. For this study, Grand View Research has segmented the global cosmetics and personal care packaging equipment report based on product, application and region.

-

Product Outlook (Revenue, USD Million, 2020 - 2030)

-

Filling

-

Labelling

-

Cleaning

-

Form-Fill-Seal

-

Cartoning

-

Wrapping

-

Palletizing

-

-

Application Outlook (Revenue, USD Million, 2020 - 2030)

-

Skin Care

-

Hair Care

-

Decorative Cosmetics

-

Bath and Shower

-

Perfumes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2020 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."