- Home

- »

- Plastics, Polymers & Resins

- »

-

Cosmetic And Toiletry Containers Market Size Report, 2030GVR Report cover

![Cosmetic And Toiletry Containers Market Size, Share & Trends Report]()

Cosmetic And Toiletry Containers Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Plastics, Metal, Glass), By Product (Bottles, Tubes), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-3-68038-708-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cosmetic And Toiletry Containers Market Summary

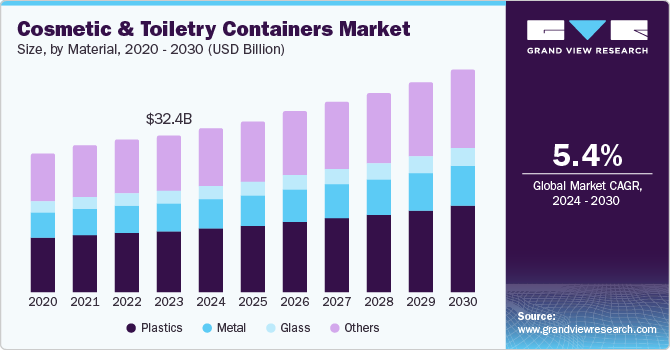

The global cosmetic and toiletry containers market size was estimated at USD 32.4 billion in 2023 and is projected to reach USD 46.5 billion by 2030, growing at a CAGR of 5.4% from 2024 to 2030. The market growth is driven by the increasing consumer demand for personal care and beauty products, fueled by rising disposable incomes and a growing awareness of personal grooming.

Key Market Trends & Insights

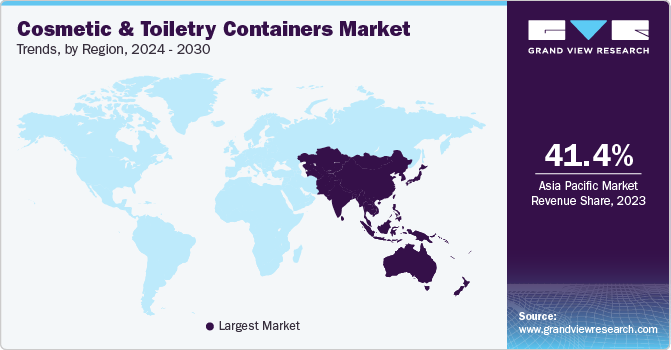

- Asia Pacific dominated the global cosmetic & toiletry containers market with a revenue share of 41.4% in 2023.

- China Asia Pacific cosmetic and toiletry containers market led in 2023.

- Based on material, the plastics segment accounted for a revenue share of 39.7% in 2023.

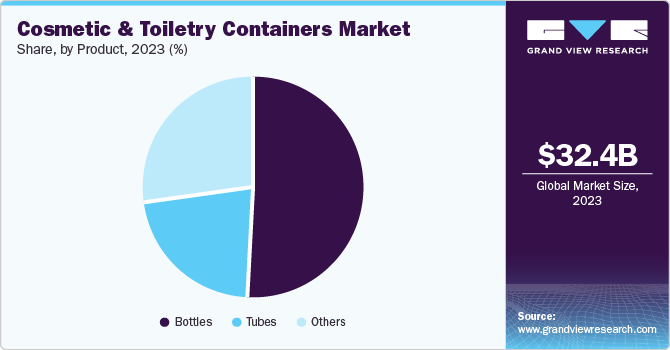

- Based on product, the bottles segment held the largest market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 32.4 Billion

- 2030 Projected Market Size: USD 46.5 Billion

- CAGR (2024-2030): 5.4%

- Asia Pacific: Largest market in 2023

In addition, the trend towards sustainable and eco-friendly packaging solutions is pushing manufacturers to innovate and adopt recyclable and biodegradable materials, which is further propelling market growth.

The expansion of e-commerce platforms has also made these products more accessible to a broader audience, contributing to higher sales. Moreover, advancements in packaging technology, such as airless dispensers and smart packaging, are enhancing product shelf life and user experience, thereby boosting market demand. Lastly, the influence of social media and beauty influencers is shaping consumer preferences and driving the popularity of various cosmetic and toiletry products, leading to increased demand for diverse and aesthetically appealing packaging solutions.

Material Insights

The plastics segment accounted for a revenue share of 39.7% in 2023 attributed to the versatile nature of plastics, which enables manufacturers to design a diverse range of container shapes, sizes, and functionalities to meet varied consumer preferences. Additionally, plastic containers are lightweight, durable, and cost-effective, making them an attractive choice for both manufacturers and consumers. The ability to produce plastic containers in large volumes through efficient manufacturing processes further enhances their appeal.

The advancements in plastic materials, such as the development of biodegradable and recyclable plastics, are addressing environmental concerns and aligning with the growing demand for sustainable packaging solutions. The widespread use of plastics in cosmetic and toiletry containers is also driven by their compatibility with various product formulations, ensuring the integrity and safety of the contents.

The metal segment is expected to grow at a CAGR of 5.1% over the forecast period. Metal containers are gaining popularity due to their premium appearance and superior protective properties. These containers offer excellent barrier protection against light, air, and moisture, which helps in preserving the quality and shelf life of cosmetic and toiletry products. The recyclability of metals also makes them an environmentally friendly option, appealing to eco-conscious consumers and brands.

In addition, metal containers are often associated with luxury and high-end products, enhancing their desirability in the market. The growing trend of using metal packaging for niche and specialty products, such as perfumes and high-end skincare items, is further driving the demand in this segment. Innovations in metal packaging, such as the use of lightweight alloys and decorative finishes, are also contributing to the segment’s growth by offering unique and aesthetically pleasing packaging solutions.

Product Insights

The bottles segment held the largest market revenue share in 2023 largely due to the widespread use of bottles for various products, including shampoos, conditioners, lotions, and perfumes. The versatility in design and functionality makes bottles a preferred choice for both manufacturers and consumers. In addition, the aesthetic appeal of bottles, which can be enhanced through various decoration techniques such as labeling, printing, and embossing, plays a significant role in attracting consumers.

The tubes segment is projected to grow fastest over the forecast period. Tubes are increasingly popular for products such as creams, gels, and ointments due to their convenience and hygienic dispensing. The ability to squeeze out the exact amount of product needed without exposing the rest to air and contaminants is a significant advantage. Tubes are also lightweight and portable, making them ideal for travel-sized products. The growing trend towards on-the-go lifestyles and the demand for travel-friendly packaging are key factors driving the growth of the tubes segment.

Regional Insights

The North American cosmetic and toiletry containers market was identified as highly lucrative in 2023. The region hosts numerous renowned cosmetic and personal care companies with a substantial customer base. Continuous refinement of product formulations and categories necessitates new and improved packaging solutions. North American consumers are increasingly demanding luxury beauty products, driving the need for high-quality packaging. Premium packaging is crucial for companies to establish and maintain their brand image and market positioning.

U.S. Cosmetic And Toiletry Containers Market Trends

The U.S. cosmetic & toiletry containers market is expected to grow rapidly in the coming years. Consumers are seeking high-end packaging for luxury products, including compact and eco-friendly options. High-quality packaging is essential for effective branding and market positioning. An increasing number of consumers are prioritizing environmental sustainability, favoring eco-friendly products and packaging. Regulatory pressures on packaging waste disposal are also influencing market trends.

Asia Pacific Cosmetic And Toiletry Containers Market Trends

Asia Pacific dominated the global cosmetic & toiletry containers market with a revenue share of 41.4% in 2023. The increase in popularity of DIY skincare products made by beauty fans has led to a higher demand for these items. Moreover, easy access to items made by Chinese companies has increased the popularity of cosmetic and toiletry products. In addition, the increasing fame of beauty lovers and business owners and the increasing need for products that can be used at home are also predicted to boost the market in emerging areas such as India and China.

China Asia Pacific cosmetic and toiletry containers market led in 2023. The increasing disposable income of the middle class has spurred demand for beauty and personal care products. Rapid urbanization has shifted consumer preferences towards premium and international brands. The proliferation of online shopping platforms has enhanced the availability of beauty products nationwide. Many companies are adopting direct-to-consumer strategies, bypassing traditional retail channels and increasing the demand for innovative packaging solutions.

Europe Cosmetic And Toiletry Containers Market Trends

The cosmetic and toiletry containers market in Europe is anticipated to witness significant growth. Europe has a background of well-known cosmetic and personal care companies that have established a loyal following among consumers. The need for innovative packaging solutions arises due to constant innovation in product formulations and categories. European consumers frequently prefer luxury and premium items, leading to an increase in demand for high-end packaging. Good packaging is necessary to uphold brand reputation and positioning in today's competitive market.

The UK cosmetic and toiletry containers market held a substantial market share in 2023. The UK market consists of an increasing number of people caring about the environment and thus expecting eco-friendly packaging. Strict environmental regulations are promoting the positioning of green packaging. The UK leads in packaging technology, resulting in advanced and practical containers. Creative packaging solutions improve the consumer's perception and attractiveness of the product.

Key Cosmetic And Toiletry Containers Company Insights

Some key companies in the cosmetic & toiletry containers market include SKS Bottle & Packaging, Inc., Albea S.A., Gerresheimer Holdings GmbH, and others. The manufacturers of cosmetics and toiletry containers majorly focus on product innovations and launches with respect to different shapes, sizes, designs, and raw materials.

-

Albea S.A. offers beauty and healthcare packaging products including plastic & laminate tubes, packaging, gift kits, cosmetic accessories, and promotional items for the skincare, make-up, fragrance, personal, oral care, pharma, food, travel, and sports markets.

-

Gerresheimer Holdings GmbH offers packaging solutions for the pharmaceutical and life science sectors through its subsidiary companies. The company creates and manufactures unique items constructed from glass and plastic, such as syringe systems, insulin pens, and inhalers, for secure medication dosing and usage.

Key Cosmetic & Toiletry Containers Companies:

The following are the leading companies in the cosmetic & toiletry containers market. These companies collectively hold the largest market share and dictate industry trends.

- SKS Bottle & Packaging, Inc.

- Albea S.A.

- Gerresheimer Holdings GmbH

- Silgan Holdings Inc.

- APC PACKAGING

- Berry Global Inc. (RPC Group Plc)

- Amcor Plc

- FusionPKG

- Libo Cosmetics Co., Ltd.

- B & I Polycontainers Pty Ltd

Recent Developments

-

In July 2024, Silgan Holdings Inc. completed the acquisition of Weener Plastics Holdings B.V., a supplier of dispensing solutions for food, personal care, and healthcare products, for USD 930 million.

-

In November 2023, Berlin Packaging completed the acquisition of Nest-Filler PKG Co., Ltd., a supplier specializing in packaging for the cosmetics and beauty industry. This acquisition was expected to strengthen Berlin Packaging's position in the Asian market.

Cosmetic And Toiletry Containers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 33.9 billion

Revenue forecast in 2030

USD 46.5 billion

Growth rate

CAGR of 5.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Thailand, Indonesia, Malaysia, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

SKS Bottle & Packaging, Inc.; Albea S.A.; Gerresheimer Holdings GmbH; Silgan Holdings Inc.; APC PACKAGING; Berry Global Inc. (RPC Group Plc); Amcor Plc; FusionPKG; Libo Cosmetics Co., Ltd.; B & I Polycontainers Pty Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cosmetic And Toiletry Containers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cosmetic and toiletry containers market report based on material, product, and region:

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Plastics

-

Metal

-

Glass

-

Others

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Bottles

-

Tubes

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Indonesia

-

Malaysia

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.