- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Cosmetic Pigments Market Size And Share Report, 2030GVR Report cover

![Cosmetic Pigments Market Size, Share & Trends Report]()

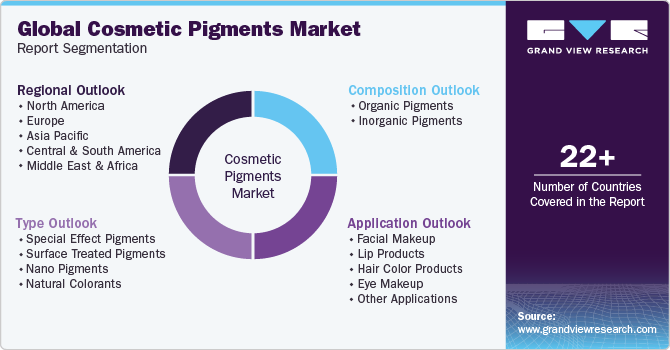

Cosmetic Pigments Market (2024 - 2030) Size, Share & Trends Analysis Report By Composition (Organic, Inorganic), By Type (Special Effect Pigments, Nano Pigments), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-232-2

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cosmetic Pigments Market Summary

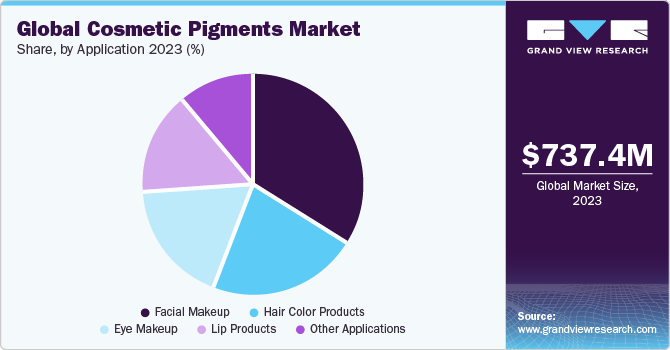

The global cosmetic pigments market size was estimated at USD 737.45 million in 2023 and is projected to reach USD 1215.52 million by 2030, growing at a CAGR of 7.4% from 2024 to 2030. The cosmetic industry is witnessing a surge in demand for organic and natural products, leading to the growth of product utilization.

Key Market Trends & Insights

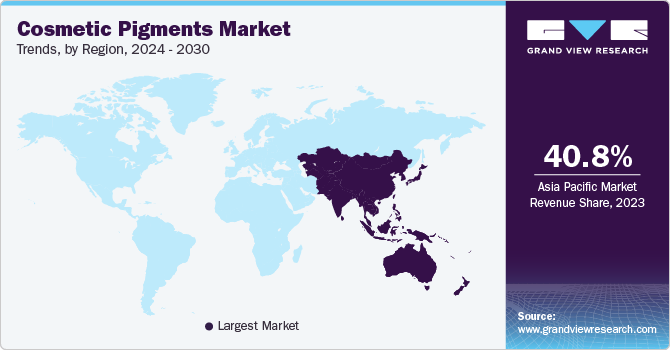

- The cosmetic pigments market in Asia Pacific dominated the market with the revenue share of 40.8% in 2023.

- Based on composition, the inorganic pigments segment led the market with the largest revenue share of 62.46% in 2023.

- Based on type, the surface treated pigments type segment dominated the market share in 2023.

- Based on application, the facial makeup segment led the market with the largest revenue share of 34.18% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 737.45 Million

- 2030 Projected Market Size: USD 1215.52 Million

- CAGR (2024-2030): 7.4%

- Asia Pacific: Largest market in 2023

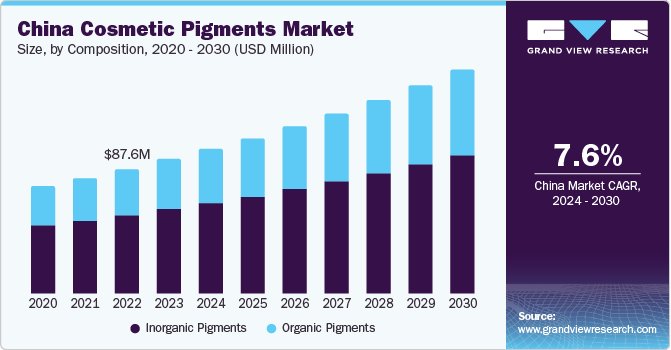

This trend is fueled by the increasing consumer preference for products with natural ingredients and the rising awareness of the potential benefits of organic cosmetics.China has experienced a significant increase in demand for cosmetic pigments in recent years. The growth in demand can be attributed to several factors. Firstly, the rise of the cosmetic industry in China has led to an increased demand for cosmetic products, including color cosmetics such as lip colors, nail paints, and eye makeup products. As Chinese beauty and personal care continue to expand, the demand for the product is expected to maintain its growth momentum.

The changing behavior among Chinese consumers towards skincare and beauty care routines has also contributed to the increased demand for cosmetic pigments. Chinese consumers are increasingly embracing premium products and incorporating additional steps in their skincare and cosmetic routines. This trend has led to higher year-over-year beauty spending and an increased demand for these products.

Furthermore, the evolving distribution channels in China, such as e-commerce platforms like Tmall and JD.com, as well as emerging channels like Douyin and Xiaohongshu, have provided opportunities for brands to reach a wider audience and tap into the growing demand for cosmetic products. The accessibility of these platforms has made it easier for consumers to purchase cosmetic products, thereby driving the demand for cosmetic pigments.

Market Concentration & Characteristics

The market can be characterized as moderately consolidated with a mix of major players and smaller manufacturers. The competitive landscape is influenced by several factors, including the presence of key players, market share, and product offerings. Some major players in the global market are Koel Colors, Sudarshan Chemical, DIC Corporation, Sun Chemical, Sensient Cosmetic Technologies, Neelikon, LANXESS, Clariant, ALTANA AG, Venator Materials PLC., and Fujian Kuncai Material Technology Co., Ltd.

Regulatory scenarios also play a significant role in shaping the market. Compliance with the regulations related to product safety, labelling, and ingredient restrictions is crucial for manufacturers and suppliers in the industry. Regulatory bodies such as Food and Drug Administration (FDA) in the U.S. and the European Union’s Cosmetic Regulations set guidelines and standards for the use of pigments in cosmetic. Adhering to these regulations ensures consumer safety and product quality.

Other factors that influenced the market include trends and consumer preferences. For instance, the increasing demand for natural and organic ingredients in cosmetic has led to market growth. Interest in natural pigments derived from plant sources. In addition, advancements in technology and research contribute to the development of innovative pigments that offer improved performance, color stability, and sustainability.

Composition Insights

Based on composition, the inorganic pigments segment led the market with the largest revenue share of 62.46% in 2023. This high share of this segment can be attributed to inorganic pigments, such as titanium dioxide and iron oxides, which are experiencing increasing demand in the cosmetic industry due to their excellent color stability, opacity, and UV protection properties.

Titanium dioxide, for instance, is widely used in sunscreens and other cosmetic products due to its ability to reflect and scatter UV radiation, providing effective protection against the sun's harmful rays. Iron oxides are favored for their natural color tones and are commonly used in a wide range of cosmetic products, including foundations, eyeshadows, and lipsticks. The growing focus on sun protection and the demand for long-lasting, stable colors in cosmetic are driving the rising demand for inorganic pigments.

The organic pigments segment is also witnessing a surge in demand, due to their versatility, bright and vivid color options, and compatibility with various formulations. Organic pigments are derived from carbon-based molecules and are known for their vibrant colors, making them popular choices for cosmetic applications such as lipsticks, eyeliners, and nail polishes. The increasing consumer preference for natural and organic ingredients in cosmetic, along with the rising demand for bold and unique color options, is fueling the market growth of organic pigments.

Type Insights

Based on type, the surface treated pigments type segment dominated the market share in 2023. This high share of this segment can be attributed to the fact that surface-treated pigments are witnessing increasing demand in the cosmetic industry due to their ability to enhance the optical properties, texture, and pigment payoff of cosmetic formulations. Manufacturers are developing and launching surface treatments for cosmetic pigments that aim to further cosmetic formulations by providing superior optical properties, luxurious textures, and optimum pigment payoff. This trend is driven by the growing emphasis on product innovation and the pursuit of high quality, visually appealing cosmetic products. As a result, the market for surface treated pigments is expected to expand significantly, contributing to the overall market growth.

The nano pigments segment is also gaining traction in the market, driven by their unique properties and applications. Nano pigments offer the advantage of enhanced color intensity, improved dispersion, and the ability to create novel effects in cosmetic products. The development of nano pigments through proprietary technologies ensures uniform particle size distribution, excellent consistency, and brighter shades, thereby meeting the demand for advanced and innovative pigment options in the cosmetic industry. This growing popularity of nano pigments is expected to contribute to the market's growth trajectory, aligning with the increasing consumer preference for high-performance and visually striking cosmetic products.

The special effect pigments segment is witnessing a surge in demand within the Cosmetic pigment market, driven by the desire to create unique and visually captivating cosmetic formulations. These pigments offer distinctive visual effects such as shimmer, sparkle, and iridescence, allowing cosmetic manufacturers to develop products with enhanced aesthetic appeal. The market's growth is fueled by the increasing consumer demand for cosmetic products that offer special visual effects, driving the innovation and incorporation of special effect pigments into a wide range of cosmetic formulations. As a result, the demand for special effect pigments is expected to contribute to the positive market growth.

Application Insights

Based on application, the facial makeup segment led the market with the largest revenue share of 34.18% in 2023. This high share of this segment can be attributed to the growth in facial makeup, including products such as mineral powders, loose & pressed powders, powders, creams, face bronzing lotions, blushers, and foundation, accounts for the largest market share. The increasing demand for root makeup products further supports the market growth for this application segment. Cosmetic pigments, especially pearlescent pigments, are utilized in facial makeup to cover blemishes and uneven skin tones, thereby meeting the rising demand for products that match the natural skin tone of consumers. In addition, cosmetic brands are emphasizing the development of new and unique colors to create vibrant effects in beauty products such as lipsticks and lip glosses, further driving the demand for bright colors, including neon pink and blaze orange.

Cosmetic pigments play a crucial role in eye makeup products, contributing to the vibrant and long-lasting shades of eyeshadows, eyeliners, and mascaras. The market for cosmetic pigments in eye makeup is driven by the increasing demand for advanced and visually captivating eye makeup formulations. The use of these products in eye makeup allows for a wide range of shades and hues to be achieved, offering excellent color stability, opacity, and coverage. This trend aligns with the growing consumer preference for high-performance and visually striking eye makeup products.

The lip products segment is another significant driver of market growth. Pigments add color to lipsticks, lip glosses, and other lip products, contributing to the diverse range of shades and hues available to consumers. The demand for these products in lip makeup is fueled by the increasing consumer preference for vibrant and long-lasting lip colors. In addition, the use of pigments in lip products offers advantages in terms of color stability, minimal migration, and reduced risk of allergies, making them a preferred choice in cosmetic formulations.

Regional Insights

The cosmetic pigments market in North America accounted for a significant share in 2023, owing to the rise in demand for new and high-quality cosmetic products as cosmetic pigments provide colors that are both bright and long-lasting. Furthermore, there is a growing need for plant and mineral-based pigment due to the increased awareness of the value of natural and organic materials. In addition, the emergence of social media and influencer culture has increased demand for fashionable, Instagram-worthy cosmetic products, which is fueling the market growth.

U.S. Cosmetic Pigments Market Trends

The cosmetic pigments market in the U.S. is driven by the growing need for a variety of pigments as customers look for cosmetic that provide diversity and long-lasting color. In addition, the consumer's increasing preferences towards safer and more sustainable solutions as well as the trend towards clean natural beauty products is driving the market growth in the country. Moreover, a range of pigment colors is required to accommodate various skin tones due to the diverse population in the US thereby fueling the market growth.

The Canada cosmetic pigments market growth influenced by various factors, including market trends, consumer preferences, and regional production. The Canadian cosmetic market experiences extreme competition, with the domination of major global players. The provinces of Quebec and Ontario are home to the largest producers of cosmetic and skincare products and are also the most active consumer marketplaces for such products in Canada. The enhancement of bio-actives and new cosmetic materials is an important part of the Canadian cosmetic manufacturing industry, with success depending on product innovation, effective sales and marketing, and efficient operations.

Asia Pacific Cosmetic Pigments Market Trends

The cosmetic pigments market in Asia Pacific dominated the market with the revenue share of 40.8% in 2023. This can be attributed to the owing factors such as the high availability of raw materials, rapid industrialization, and the growth of the personal care industry. The region's rapid industrialization and commercialization, especially in the personal care industry, are expected to further increase the consumption of inorganic cosmetic pigments during the forecast period, with the market projected to witness healthy growth.

The China cosmetic pigments market stands out as a goldmine, being the second-largest skincare and cosmetic market globally after the USA with a market share of 29.11%. The demand for natural or organic cosmetic in China is predicted to further grow, and e-commerce platforms and digital marketing strategies dominate the industry. Identifying strategic trends, such as ever-evolving social media platforms, male customer demands, and Gen-Z preferences, will be essential to positioning oneself at the forefront of success within this lucrative market. The rising demand for premium cosmetic products in the country is expected to increase over the medium term, driven by the inflating income of individuals and the increasing demand for skincare and cosmetic products.

Europe Cosmetic Pigments Market Trends

The cosmetic pigments market in Europe is driven by various strict regulations and laws governing the compounds used in cosmetic that have fueled innovation in pigment to fulfill safety and compliance criteria. In addition, the growing awareness of eco-friendly products is also driving the growth of the market. Moreover, the impact of European fashion trends on international beauty standards has led to a need for innovative and cutting-edge pigment formulas, thereby driving market growth.

The UK cosmetic pigments market growth is influenced by global trends, with rising demand for natural or organic, herbal, and halal products, and innovative and eco-friendly packaging designs. The increasing demand for premium cosmetic products is expected to drive market growth in the country, with the rising demand for cosmetic products owing to the increasing demand for premium cosmetic products.

Central & South America Cosmetic Pigments Market Trends

The cosmetic pigments market in Central & South America is driven by increasing demand for pigment colors that represent regional customs and tastes due to the region's rich cultural diversity and colorful history. In addition, a growing middle class has resulted in increasing expenditure on cosmetic products especially pigment due to economic growth and rising disposable income in the countries like Brazil and Mexico. Furthermore, the growth of beauty bloggers and social media influencers has pushed trends and raised demand for innovative pigment formulas, thereby fueling the market expansion. Moreover, the need for pigment colors that accommodate a range of ethnicities has increased due to a greater emphasis on inclusivity and representation is driving the market growth as well as product innovation.

The Brazil cosmetic pigments market is anticipated to witness the substantial CAGR during the forecast period, driven by factors such as increasing self-consciousness about appearance, combined with the ability to spend more, the rise in the middle-aged population, and the rising demand for men's grooming products. The market is estimated to witness the substantial CAGR during the forecast period, owing to factors such as organized supply chains and the rising prevalence of the online market, which provides better and more choices.

Middle East & Africa Cosmetic Pigments Market Trends

The cosmetic pigments market in Middle East & Africa is driven by the rising self-care rituals and the region's cultural emphasis on grooming and attractiveness. In addition, the large market for pigment makers is created by the increasing demand for cosmetic driven by fast urbanization and a growing young population. Moreover, the need for new pigment formulation has increased due to growing globalization and exposure to foreign beauty trends which is fueling the market growth in the region.

The Saudi Arabia cosmetic pigments market is expected to witness a significant CAGR over the forecast period. This growth is driven by factors such as the growing urbanization rate, higher disposable income, and the rising demand for different shades of foundations and blushes. In addition, the Saudi Arabian cosmetic market is witnessing a boom through e-commerce channels, with the rising demand for natural or organic, herbal, halal products and innovative and eco-friendly packaging designs further attributing to the market growth in the country.

Key Cosmetic Pigments Company Insights

Some of the key players operating in the market include Clariant, Neelikon, LANXESS, Sensient Cosmetic Technologies, Sun Chemical, DIC Corporation, Sudarshan Chemical, and Koel Colors, among others.

-

Sudarshan Chemical Industries Limited is one of the largest pigment producers in India, with a presence in the global market for 70 years, manufacturing and supplying pigments for various applications, including cosmetic. Their Sudacos range offers high purity US FDA approved D&C pigments with color consistency and dispersibility

-

Sun Chemical, a part of DIC Group, is one of the leading producers of electronic materials, functional products, color and display technologies, packaging and graphic solutions, and products for the automotive and healthcare industries

ALTANA AG, Venator Materials PLC., and Fujian Kuncai Material Technology Co., Ltd. among others, are some of the emerging market participants:

-

ALTANA AG is operating as a global specialty chemicals company. The company is involved in the production of a wide range of specialty chemicals, including additives and coatings that are used in various industries, including cosmetic. The company's commitment to innovation and sustainability positions it as a significant player in the global specialty chemicals market

-

Venator Materials PLC is a manufacturer of chemical products, including an array of pigments and additives. The company's product portfolio encompasses color pigments that are utilized in various applications, including cosmetic. Venator's commitment to providing high-quality pigments and additives positions it as a key player in the global market

Key Cosmetic Pigments Companies:

The following are the leading companies in the cosmetic pigments market. These companies collectively hold the largest market share and dictate industry trends.

- Koel Colors Private Limited

- Sudarshan Chemical

- DIC Corporation

- Sun Chemical

- Kobo

- Ocres de France

- Sensient Cosmetic Technologies

- Neelikon Food Dyes and Chemicals Ltd.

- LANXESS

- Clariant

- Altana AG

- Venator Materials PLC.

- Fujian Kuncai Material Technology Co., Ltd.

Recent Developments

-

In April 2023, Merck launched Rona flux pigments. Rona flux pigments offer high color intensity and pronounced metallic optical effects without the use of metals, allowing for a striking, color-intense look with a metallic allure, reflecting the current popular trend in color Cosmetic

-

In September 2022, Givaudan Active Beauty, a leader in the development of innovative cosmetic ingredients, announced the launch of New Purple 2364. This exciting new pigment offers a vibrant and intense purple hue while adhering to key sustainability and ethical principles

-

In August 2022, NSG introduces the METASHINE Aurora Series, glass-flake effect pigments that deliver captivating, aurora-like luminescence. Specifically formulated for point makeup applications, these pigments utilize advanced Optical Brightening Materials (OBMs) to achieve an unparalleled level of light manipulation and radiance

Cosmetic Pigments Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 792.0 million

Revenue forecast in 2030

USD 1,215.52 million

Growth rate

CAGR of 7.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in tons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Composition, type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Koel Colors; Sudarshan Chemical; DIC Corporation; Sun Chemical; Sensient Cosmetic Technologies; Neelikon; LANXESS; Clariant; Altana AG; Venator Materials PLC.; Fujian Kuncai Material Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cosmetic Pigments Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cosmetic pigments market report based on composition, type, application, and region:

-

Composition Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Organic Pigments

-

Inorganic Pigments

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Special Effect Pigments

-

Surface Treated Pigments

-

Nano Pigments

-

Natural Colorants

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Facial Makeup

-

Lip Products

-

Hair Color Products

-

Eye Makeup

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global cosmetics pigments market size was valued at USD 737.45 million in 2023 and is projected to reach USD 792.0 million in 2024.

b. The global cosmetics pigments market is expected to grow at a CAGR of 7.4% from 2024 to 2030 to reach USD 1,215.52 million in 2030.

b. Asia Pacific dominated the market and accounted for a share of approximately 40.86% in 2023. This high share of this segment can be attributed to the owing factors such as high availability of raw materials, rapid industrialization, and the growth of the personal care industry.

b. Some of the key players operating in the market include Clariant, Neelikon, LANXESS, Sensient Cosmetic Technologies, Sun Chemical, DIC Corporation, Sudarshan Chemical, and Koel Colors, among others.

b. The cosmetics industry is witnessing a surge in demand for organic and natural products, leading to the growth of the product utilization. This trend is fueled by the increasing consumer preference for products with natural ingredients and the rising awareness of the potential benefits of organic cosmetics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.