- Home

- »

- Plastics, Polymers & Resins

- »

-

Corrugated Boxes Market Size, Share, Industry Report, 2030GVR Report cover

![Corrugated Boxes Market Size, Share & Trends Report]()

Corrugated Boxes Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Slotted Box, Rigid Box), By Material (Linerboard, Medium), By Printing Technology, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-308-1

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Corrugated Boxes Market Summary

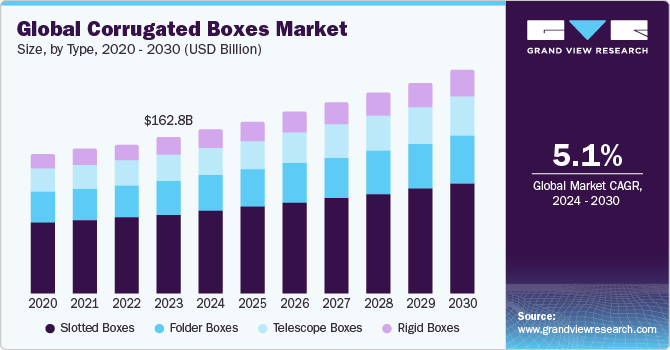

The global corrugated boxes market size was estimated at USD 162.82 billion in 2023 and is projected to reach USD 230.64 billion by 2030, growing at a CAGR of 5.1% from 2024 to 2030. The growth is attributed to the rising demand for corrugated boxes from various end-use industries such as e-commerce, food & beverage, industrial, textile, home & personal care, and agriculture among others.

Key Market Trends & Insights

- Asia Pacific corrugated boxes market accounted for the largest revenue share of over 52.0% in 2023.

- China corrugated boxes market dominated and accounted for a share of over 29.0% in 2023.

- By material, the linerboard held the highest market share of over 64.0% in 2023.

- By type, the slotted boxes segment dominated market with a share of over 51.0% in 2023.

- By printing technology, the flexographic printing segment accounts for the highest share of over 51.0% in 2023.

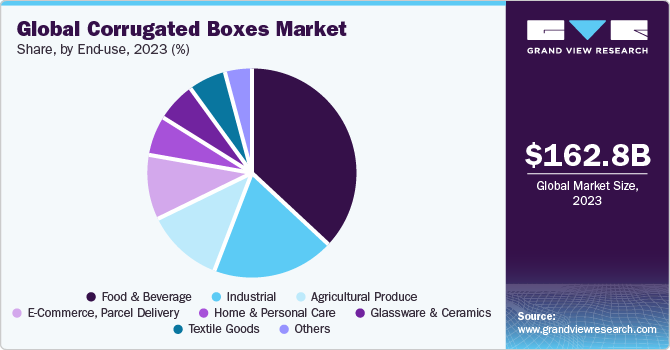

- By end use, the food & beverage segment dominated the market and accounted for a share of over 36.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 162.82 Billion

- 2030 Projected Market Size: USD 230.64 Billion

- CAGR (2024-2030): 5.1%

- Asia Pacific: Largest market in 2023

Additionally, the growing demand for sustainable material-based packaging is also driving the demand for corrugated boxes. Corrugated boxes are recyclable, easy to store, and inexpensive. These boxes comprise of fluted material and liner layers made of kraft paper, making these boxes lightweight. The flutes provide strength and impact resistance to the boxes which provide protection to products from dents and scratches. Furthermore, corrugated boxes comply with stringent packaging regulations related to packaging material for industries such as food & beverage which further presents positive forecast for corrugated boxes market. For instance, corrugated boxes raw materials include recycled papers and starch glue as adhesive for binding the corrugated sheet layers which do not affect the quality of product, thus making corrugated boxes a safe packaging product.Growing investments in promoting sustainable packaging are significantly contributing to market growth. There have been growing investments being secured by market players operating in market from various government programs. For instance, in May 2024, U.S.-based Franklin Mountain Packaging secured more than USD 40,000 under New Mexico Job Training Incentive Program (JTIP). Franklin Mountain Packaging is engaged in the manufacturing of corrugated sheets for the corrugated box industry. Such investments can positively influence market growth.

Growing e-commerce industry is another driving factor contributing to the market growth. E-commerce has led to a surge in online shopping, requiring more corrugated boxes to ship products. The emphasis on faster deliveries in e-commerce puts pressure on packaging to be durable and protective during transit, thus driving demand for corrugated boxes. According to International Trade Administration (ITA), global e-commerce sales for business to business (B2B) have been rising steadily with B2B e-commerce market expected to reach USD 36.0 trillion in 2026. Thus positive e-commerce market forecast is anticipated to directly influence demand for corrugated boxes.

Fluctuating raw material prices is a major restraining factor impacting market. Kraft paper is the raw material for corrugated boxes. This material faces demand from other industries as well, resulting in drop in supply and consequently rise in price of raw material. The rising energy costs have also contributed to price rise of corrugated boxes raw materials. The market also faces challenge from flexible packaging products such as flexible pouches and mailers used to ship e-commerce products.

Corrugated boxes getting crushed during converting process is a common issue that can compromise their strength and usability. Addressing this problem can create a positive growth opportunity for corrugated box manufacturers. For instance, in February 2024, Arkansas based corrugated box manufacturer, Alpha Packaging, Inc. procured the EMBA 175 QS Ultima machine which is a non-crush converting machine creating stronger flutes and more durable corrugated boxes. Such developments related to new converting machines which address crushing problems during the converting process can increase consumer confidence in the quality of corrugated boxes.

Market Concentration & Characteristics

The corrugated boxes market is witnessing significant growth characterized by buyer trends, regulatory trends, increasing investments by market players in setting up new production plants, technologies related to corrugated box printing, and increasing the recycled content percentage.

The impact of regulations plays a pivotal role in shaping the industry dynamics of market. For instance, companies are required to report on their sustainability practices and obtain certifications such as Forest Stewardship Council (FSC) and Programme for the Endorsement of Forest Certification (PEFC) to demonstrate responsible sourcing of raw materials. Similarly, the U.S. Sustainable Forestry Initiative (SFI) and similar programs in other regions promote sustainable forest management, affecting how paper and pulp are sourced for corrugated boxes.

Corrugated box manufacturers are also investing in new machines to enhance the quality of corrugated boxes produced and increase their production capabilities. For instance, in December 2023, U.S.-based Pacificolor announced to invest more than USD 200,000 in procurement of new machines. The investment includes the integration of Reproflex3’s high-definition Vortex screening technology and the installation of an AV Flexologic Mounting Machine in its production facility.

The level of mergers and acquisitions in market is high as global players focus on increasing their market presence by acquiring local or companies with a regional presence. For instance, in April 2024, Ireland-based Zeus Group acquired Weedon Group. This acquisition is aimed at increasing its presence in the corrugated packaging market.

Type Insights

The slotted boxes dominated market with a share of over 51.0% in 2023. Slotted corrugated boxes are typically constructed from a single sheet of corrugated fiberboard. The blank is scored and slotted to facilitate folding. Among slotted corrugated boxes, the regular slotted corrugated box style is the most common. In this, all flaps are of the same length and the outer two flaps are one-half corrugated box’s width. Slotted corrugated boxes can be easily customized in terms of size, strength, and printing options. This versatility allows them to cater to a wide range of products and industries, from electronics and automotive parts to food and beverages.

Rigid corrugated box also known as bliss box is expected to grow with the fastest CAGR of 5.2% from 2024 to 2030. Rigid boxes are known for their superior strength and protection capabilities. They are designed with a separate lid and base, offering robust protection for fragile or heavy items during transit and handling. This feature makes them ideal for packaging items that require extra protection, such as electronics, glassware, and automotive parts.

Material Insights

The linerboard held the highest market share of over 64.0% in 2023. A linerboard is a flat material that forms the lower as well as the upper surface of a corrugated sheet. It is used to sandwich the flutes or medium. Linerboard provides a smooth printing surface for graphics, text, and product information on the outside of corrugated boxes. It also contributes to the structural integrity and protective capabilities of the box, ensuring that contents are securely contained and protected during shipping and handling. The linerboard holds a high share since it accounts for a major portion of corrugated boxes.

The medium material segment is expected to progress with a CAGR of 4.8% from 2024 to 2030. Medium is the kraft paper that is formed into arches and glued between the linerboards. When a flat surface board is laid on the tips of these flutes, the arches form strong columns that can carry a large amount of weight. The flutes keep the linerboard sheets distinct, increasing the board's bending rigidity.

Printing Technology Insights

The flexographic printing accounts for the highest share of over 51.0% in 2023. Flexographic printing uses a cylinder, an imaged sleeve, or a plate to apply graphics or text onto a substrate.Flexographic also provides clear printing and branding on boxes and is best suited for large-scale runs. It is also a cost-effective solution that requires minimal machine setup time, thus contributing to its high market share.

The lithographic printing technology is expected to progress with a CAGR of 5.7% from 2024 to 2030. Lithographic printing offers high-quality print outputs with excellent color reproduction and fine details. This capability is increasingly valued in the packaging industry, where brands seek to enhance product presentation and shelf appeal.

End-use Insights

The food & beverage dominated the market and accounted for a share of over 36.0% in 2023. Food and beverage products often require reliable and durable packaging solutions to ensure freshness, prevent contamination, and comply with food safety regulations. Corrugated boxes provide excellent protection during storage, transportation, and display, making them essential for packaging these perishable goods. Furthermore, corrugated boxes are widely used in retail environments for both primary and secondary packaging of food and beverage products. They play a crucial role in brand recognition, shelf visibility, and consumer appeal, contributing to the overall marketing and sales strategies of food and beverage companies.

The e-commerce and parcel delivery segment is expected to grow with a CAGR of 6.2% from 2024 to 2030. The increasing preference for online shopping has significantly boosted the demand for corrugated boxes. The COVID-19 pandemic accelerated this trend, with more consumers shifting to online platforms for purchasing a wide range of products, including groceries, electronics, clothing, and more. E-commerce requires packaging that can withstand the rigors of shipping and handling. Corrugated boxes provide excellent cushioning and protection for products, reducing the risk of damage during transit. Their strength and durability make them ideal for ensuring that goods reach consumers in good condition.

Regional Insights

The corrugated boxes market in North America is projected to grow with the fastest CAGR from 2024 to 2030 owing to the growing e-commerce sector in the region. Improvements in digital infrastructure, including faster internet speeds and mobile device proliferation, have made it easier for consumers to shop online. Enhanced website designs, user interfaces, and payment gateways also contribute to a seamless shopping experience, thus contributing to escalating online shopping, which presents a positive market outlook in North America.

U.S. Corrugated Boxes Market Trends

The U.S. corrugated boxes marketheld a significant share in 2023 accounting for a share of over 55.0%. E-commerce is a growing industry in the U.S. which is attributed to significant demand for corrugated boxes. According to the U.S. Department of Commerce, e-commerce accounted for 15.9% of total retail sales in the country in the first quarter of 2024. This figure was estimated to be higher than the previous quarter, indicating a positive market demand for corrugated boxes.

The corrugated boxes market in Mexico is expected to progress with a CAGR of 4.7% from 2024 to 2030. According to the International Trade Administration (ITA), Mexico holds a position as 5th largest automobile parts producer globally. According to ITA, more than 600 companies supplying automotive spares to U.S. automotive manufacturers have their facilities established in Mexico. Moreover, Mexico exports 87% of its automotive parts produced to the U.S. which can drive demand for corrugated boxes.

Asia Pacific Corrugated Boxes Market Trends

Asia Pacific corrugated boxes market accounted for the largest revenue share of over 52.0% in 2023. The high market share is attributed to APAC's high market share is attributed to efficient demand and supply cycles in the food and beverage, electronics, and personal care industries, particularly in India, Japan, and China. E-commerce growth is propelling the market in the area. In addition, this region has a significant presence of corrugated box manufacturers which contributes to its high market share.

China corrugated boxes market dominated and accounted for a share of over 29.0% in 2023. The market is highly competitive with the presence of players such as Bohui Group, Nine Dragons Worldwide (China) Investment Group Co., Ltd, and Lee & Man Paper Manufacturing Ltd among others. Chinese manufacturers benefit from economies of scale due to high production volumes. This allows them to produce corrugated boxes at lower costs compared to other countries, making them highly competitive in both domestic and international markets. In addition, China’s export-oriented economy means that a significant portion of its manufactured goods are destined for international markets. These goods require robust packaging solutions for safe transit, further increasing the demand for corrugated boxes.

The corrugated boxes market in Japan is primarily driven by its growing manufacturing sector. According to the Ministry of Economy, Trade and Industry (METI), the manufacturing sector of Japan is categorized into fabricated metals, industrial machinery, iron and steel, and chemicals. The Japanese government is also inviting foreign direct investments to set up manufacturing plants in the country to boost its manufacturing sector, thus presenting a positive market outlook for corrugated boxes demand for packaging of products for exports. According to the Japan External Trade Organization (JETRO), the flow of FDI in Japan in 2022 for transportation equipment increased by 8.5% and for electrical machinery the FDI inflow increased by 34.3%.

Europe Corrugated Boxes Market Trends

Europe corrugated boxes market is driven by growing stringent rules developed by European Union on packaging waste management. Under the EU Directive, by 2024-year end, all European countries are mandated to establishedproducer responsibility schemes for all packaging. The Directive also sets the specific targets for recycling, wherein, paper and cardboard based packaging current target is 60%, which is highest among other materials and this target is expected to reach 75% by 2025 and 85% by 2030. Since corrugated boxes are recyclable and reusable. The directives aimed at reducing packaging waste can drive packaging users to adopt paperboard-based packaging, thus presenting positive market outlook for corrugated boxes market.

The corrugated boxes market in Germany accounted for largest share of over 20.0% in 2023. High share can be attributed to its high share in exports of cartons, boxes & cases, of corrugated paper or board. According to Observatory of Economic Complexity (OEC), Germany holds highest share in exports of corrugated boxes among European countries. Also, the country has significant presence of corrugating companies as per FEFCO, thus indicating a positive market forecast for corrugated boxes market.

The Spain corrugated boxes market is expected to progress with a CAGR of 5.8% from 2024 to 2030. According to Centre for the Promotion of Imports from developing countries fresh vegetables and fruits is an important industry in Spain. According to the Ministry of External Affairs, Spain holds 17.3% of the vegetable cultivation and 40.1% of Europe’s cultivation area. On account of this, Spain has the highest production share in the Europe region for oranges and other small citrus fruits. Thus, high agricultural produce area results in increased exports of fruits and vegetables driving demand for corrugated boxes.

Central & South America Corrugated Boxes Market Trends

The corrugated boxes market in Central & South Americais projected to grow at a significant CAGR from 2024 to 2030. The market is experiencing growth driven by various factors, including economic development, industrialization, and the rise of e-commerce. As economies in Central and South America continue to develop, there is an increasing demand for consumer goods, electronics, and industrial products, all of which require reliable packaging solutions, thereby influencing demand for corrugated boxes.

Brazil corrugated boxes market accounted for the largest share of 31.0% in 2023 in the region. According to the Brazilian Association of Fruit Producers and Exporters (ABRAFRUTAS), a 26.7% rise in the value of fruits exported was reported in 2023. This expansion resulted in 1.085 million tons of fruits being shipped to various international markets. Growing fruit exports indicate a positive demand for corrugated boxes.

Middle East & Africa Corrugated Boxes Market Trends

The Middle East & Africa corrugated boxes marketis experiencing growth on account of rapid urbanization and economic growth in countries like the United Arab Emirates, Saudi Arabia, and South Africa which are driving demand for consumer goods, which in turn boosts need for corrugated packaging solutions.

The corrugated boxes market in Saudi Arabia growth can be attributed to growing imports of printing and packaging technologies. According to VDMA Services GmbH, Germany-based Machinery and Equipment Manufacturers Association, Saudi Arabia is a major importer of printing and packaging equipment, indicating a strong growth potential for the packaging industry, which can present a growth opportunity for corrugated boxes.

Key Corrugated Boxes Company Insights

Some key companies operating in the corrugated boxes market include Rengo Co., Ltd, Mondi, DS Smith, Smurfit Kappa Group, and International Paper.

Smurfit Kappa is one of the leading integrated paper-based packaging manufacturers globally. This company is located in 1 country in the African part of the Middle East & Africa, has a presence in 22 countries in Europe, and 13 countries in the Americas. In Europe, Smurfit Kappa leads in corrugated packaging production.

Rengo Co. Ltd is one of the leading corrugated packaging manufacturers in Japan and a major player in the global market. This company holds a 30.0% share in the domestic corrugated packaging market in Japan. Its product portfolio includes tray-type corrugated packaging S-lock tray, L-lock tray, no staple corrugated box, and corrugated cushions.

Some of the emerging players in the market are Trombini, NBM Pack, and Pretoria Box Manufacturers (Pty) Ltd among others.

-

Trombini is one of the largest multilayer paper bags and corrugated box manufacturers in Brazil. This company has facilities located in Rio Grande do Sul, Santa Catarina, and Paraná in Brazil, thus catering to the domestic market. Its product portfolio includes supplying recycled paper and kraft liners, corrugated cardboard sheets, corrugated boxes, and multilayer paper bags.

-

Pretoria Box Manufacturers (Pty) Ltd is a corrugated box manufacturer located in South Africa. Its factory is situated in Hermanstad and has an employee strength of around 100 people.

Key Corrugated Boxes Companies:

The following are the leading companies in the corrugated boxes market. These companies collectively hold the largest market share and dictate industry trends.

- International Paper

- DS Smith

- Smurfit Kappa

- Rengo Co. Ltd

- Mondi

- Cascades Inc.

- Packaging Corporation of America

- Georgia-Pacific, LLC

- WestRock Company

- Nine Dragons Worldwide (China) Investment Group Co., Ltd.

- National Carton Factory (NCF)

- Australian Corrugated Packaging

- Visy

- GB Pack

- TGI Packaging Pvt. Ltd

- Trombini

- NBM Pack

- Pretoria Box Manufacturers (Pty) Ltd

- Bohui Group

- Lee & Man Paper Manufacturing Ltd

Recent Developments

-

In April 2024, International Paper closed a USD 7.2 billion (GBP 5.8 billion) deal to acquire a 66.3% share in DS Smith. Since DS Smith dominates the UK market, this acquisition can help International Paper strengthen its presence in the UK.

-

In January 2024, WestRock Company announced plans to construct a new corrugated box manufacturing facility in Pleasant Prairie, Wisconsin. The company plans to close its existing corrugated box manufacturing facility in North Chicago upon completion of new facility construction.

Corrugated Boxes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 170.88 billion

Revenue forecast in 2030

USD 230.64 billion

Growth rate

CAGR of 5.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, Volume in million square meters, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors and trends

Segments covered

Type, material, printing technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

International Paper; DS Smith; Smurfit Kappa; Rengo Co. Ltd; Mondi; Cascades Inc.; Packaging Corporation of America; Georgia-Pacific, LLC; WestRock Company; Nine Dragons Worldwide (China) Investment Group Co., Ltd.; National Carton Factory (NCF); Australian Corrugated Packaging; Visy; GB Pack; TGI Packaging Pvt. Ltd; Trombini; NBM Pack; Pretoria Box Manufacturers (Pty) Ltd; Bohui Group; Lee & Man Paper Manufacturing Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Corrugated Boxes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global corrugated boxes market report based on the type, material, printing technology, end-use and region:

-

Type Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Slotted Boxes

-

Telescope Boxes

-

Folder Boxes

-

Rigid Boxes

-

-

Material Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Linerboard

-

Medium

-

Others

-

-

Printing Technology Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Flexographic Printing

-

Digital Printing

-

Lithographic Printing

-

Others

-

-

End-use Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Industrial

-

Home & Personal Care

-

Textile Goods

-

Glassware & Ceramics

-

E-Commerce, Parcel Delivery

-

Agricultural Produce

-

Others

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global corrugated boxes market was estimated at around USD 162.82 billion in the year 2023 and is expected to reach around USD 170.88 billion in 2024.

b. The global corrugated boxes market is expected to grow at a compound annual growth rate of 5.1% from 2024 to 2030 to reach around USD 230.64 billion by 2030.

b. Slotted corrugated boxes emerged as a dominating box type segment with a value share of over 51.0% in the year 2023. Slotted corrugated boxes can be easily customized in terms of size, strength, and printing options. This versatility allows them to cater to a wide range of products and industries, from electronics and automotive parts to food and beverages, thus contributing to their high market share.

b. Some of the key players in corrugated boxes market include International Paper; DS Smith; Smurfit Kappa; Rengo Co. Ltd; Mondi; Cascades Inc.; Packaging Corporation of America; Georgia-Pacific, LLC; WestRock Company; Nine Dragons Worldwide (China) Investment Group Co., Ltd.; National Carton Factory (NCF); Australian Corrugated Packaging; and Visy among others.

b. Growing demand for sustainable material based packaging and flourishing e-commerce industry are expected to drive the corrugated boxes market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.