Corn Market Size, Share & Trends Analysis Report By Nature (Organic Corn, Conventional Corn), By End-use (Food & Beverages, Animal Feed, Industrial Use, Ethanol Production), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-180-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Corn Market Size & Trends

The global corn market size was estimated at USD 297.27 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 3.6% from 2024 to 2030. The market is a significant component of the worldwide agricultural business. Corn is a versatile commodity used for multiple uses, including food, animal feed, and industrial applications such as ethanol generation.Corn is a vital component in many diets, and a significant portion of global production is used for human consumption in the form of food, sweeteners, and cooking oil. A large portion of corn is used as animal feed. It is an important source of nourishment for livestock such as chickens, cattle, and swine.

The widespread demand for corn across several end-user industries, including food processing, feed production, ethanol generation, pharmaceuticals, and cosmetics, is expected to boost the demand for corn in the coming years. Also, corn has witnessed robust demand across the U.S. food and beverages sector, and its production has increased significantly. According to the latest Crop Production report from the USDA's National Agricultural Statistics Service in September 2023, the agency forecasts a 10 percent increase in corn production for 2023, projecting it to reach 15.1 billion bushels, compared to the previous year.

Corn is a primary source of ethanol production, and the volume of ethanol production from corn has increased tenfold in recent years, driven by extensive demand within the alcoholic beverages and pharmaceutical sectors.According to the data from the National Corn Ethanol Union (UNEM), corn ethanol production in Brazil has experienced significant growth of up to 4.43 billion liters in the 2022/23 season from 40 million liters in 2013/14. Also, ethanol plants have emerged prominently in Brazil, especially across the Center-West region. Such an aspect has raised the demand for corn across ethanol-producing plants.

Cornmeal is a versatile ingredient used in a wide range of dishes. It is a key component in traditional recipes from various American regions, contributing to the diversity of American cuisine. It is also a staple crop of Native American cultures, and ground corn is used as a staple food. Increasing awareness about gluten-free products has heightened the demand for cornmeal. Also, the growing emphasis on environment-friendly and sustainable packaging solutions has increased the use of biodegradable materials. Corn-based bioplastics, generated from corn starch, are developing as an environment-friendly alternative to standard plastics, boosting corn demand for ecologically acceptable packaging materials.

According to the findings from Trivium Packaging, the consumer desire for products in sustainable packaging has increased, driven by a growing number of environmentally conscious consumers. In collaboration with Earth Day, the 2023 Buying Green Report conducted a survey in which 82% of the respondents expressed increased willingness to pay more for sustainable packaging, marking a four-point increase from 2022.

Market Concentration & Characteristics

The degree of innovation in the corn industry is high. There is a constant stream of new technologies, practices, and varieties being developed to improve the efficiency, sustainability, and quality of corn production. Precision farming techniques leverage technology such as GPS, sensors, and data analytics to optimize various aspects of corn cultivation. This includes precise planting, irrigation, and fertilization, leading to increased efficiency and reduced environmental impact.

Several market players such as Archer-Daniels-Midland (ADM), Cargill, Inc., and Syngenta are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

Food safety regulations ensure corn product safety and protect customers from potential health risks. These regulations establish standards for pesticide residues, mycotoxin levels, and other contaminants in corn. Corn cultivation and processing are subject to environmental restrictions to reduce their impact. These regulations cover water resource management, pesticide use, and garbage disposal.

In many recipes, rice and wheat flour can be used instead of corn flour. It has a neutral flavor and texture and is created from ground rice and wheat. Also, sugarcane is an alternative feedstock for biofuel production, particularly in regions where it is a major crop. Sugarcane ethanol is an alternative to corn-based ethanol.

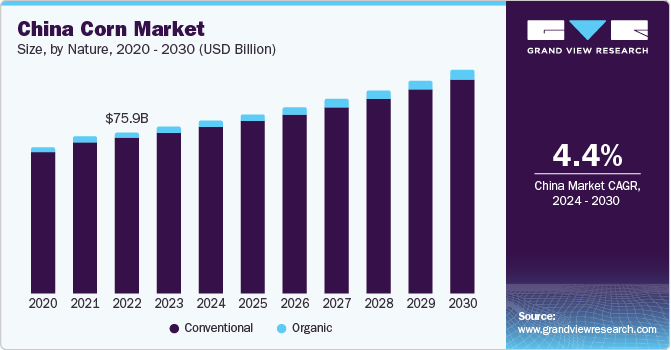

Nature Insights

The conventional segment accounted for the largest revenue share of around 96.0% in 2023. Conventional corn production emphasizes the use of advanced agricultural technologies, machinery, and synthetic inputs such as fertilizers and pesticides.With the increasing global demand for corn as a staple food, animal feed, and industrial raw material (such as for ethanol production), conventional corn farming has proven crucial in meeting this rising demand efficiently.The conventional approach is frequently adopted due to its economic feasibility, particularly in large-scale commercial farming operations. The use of technology and standardized inputs has the potential to streamline processes and reduce costs for farmers and agribusinesses.

The organic segment is anticipated to witness the fastest CAGR of over the forecast period owing to increasing consumer health concerns and growing awareness of organically produced food crops. Organic corn is growing as a result of strict organic certification standards. Consumers frequently seek out "organic" products because they trust that these items conform to specific regulations on the use of synthetic inputs and comply with sustainable farming practices. Non-profit organizations often launch campaigns prohibiting the sale of food products derived from genetically modified organisms (GMOs).

These initiatives ensure transparency in food labeling and foster consumer environmental awareness. These efforts encourage individuals to choose non-GMO products when purchasing. In September 2023, Toxin Free USA, a non-profit organization dedicated to consumer protection and education, adopted a proactive approach by launching a campaign aimed at restricting genetically modified organisms (GMO) corn in Whole Foods Market in several cities across the U.S.

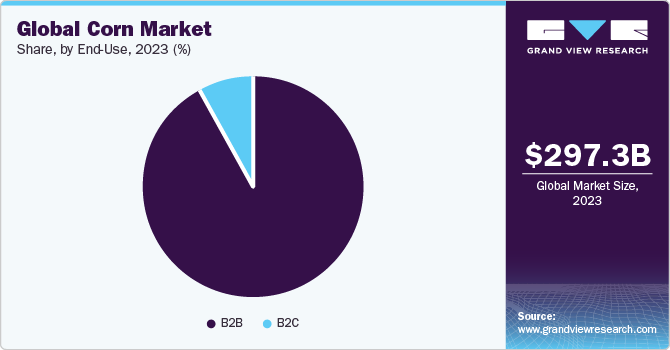

End-use Insights

The B2B segment accounted for the largest revenue share in 2023. The segment is essential because it involves B2B transactions relating to the production of food and beverages. Corn is a significant ingredient in many foods, including pasta, bread, pastries and breakfast cereals, therefore the food and beverage industry is a major contributor to the B2B segment's growth. B2B connections are used by food processors such as bakeries to ensure a consistent and high-quality supply of vital components. Also, the animal feed sector plays a crucial role in utilizing corn as a primary component for livestock and poultry nutrition. Within the animal husbandry sector, farms and feed mills actively participate in B2B transactions to secure a supply of corn for the production of high-quality animal feed.

B2B transactions in the ethanol production sector include the sourcing of corn from agricultural producers by biofuel companies. This establishes a crucial link in the supply chain, ensuring a consistent and reliable source of raw material for ethanol production. Corn is used in the B2B segment for various industrial applications, including producing starch for industrial processes, and pharmaceuticals. Companies operating in these industries engage in B2B transactions to acquire corn specifically tailored for these distinct applications.

The others category in the B2B segment encompasses diverse applications of corn, which includes cosmetics, personal care products, and construction materials. Corn-based ingredients are used in cosmetics and personal care items, and corn star is used in construction materials. Corn suppliers and companies engage in B2B transactions to source corn.

B2C segment is anticipated to grow at a significant CAGR over the forecast period. B2C segment comprises of online and offline. B2C segment plays a crucial role in the corn market, serving as the direct link between corn producers and consumers. This segment encompasses various channels through which corn and corn-based products reach the end consumers, influencing purchasing decisions and shaping consumer perceptions of corn.

Regional Insights

Asia Pacific held the highest market share of 37.6% in 2023. In most Asian countries, corn is primarily grown for human consumption, but the demand for feed grains has been steadily increasing due to the expanding livestock industry. This shift in demand has led to a growing share of corn being diverted towards animal feed production.According to data from the Ministry of Agriculture, the cultivation of corn for livestock feed in the country is experiencing significant growth. In 2021, the harvested quantity reached 8,000 tons, marking a fourfold increase compared to the production level seven years prior.

North America also held a significant market share in 2023. In recent years, the growing number of fuel ethanol production facilities in the U.S. has created an increased demand for corn for ethanol production. The growing demand for biofuels, increased focus on renewable energy sources, and government initiatives supporting the ethanol sector have played a key role in driving the production of ethanol generation, which in turn is positively impacting the market growth for corn.

Key Companies & Market Share Insights

Some of the key players operating in the market include China National Cereals, Oils and Foodstuffs Corporation (COFCO); Archer-Daniels-Midland (ADM); and Cargill, Inc.

-

China National Cereals, Oils and Foodstuffs Corporation (COFCO) is a leading food and agriculture multinational corporation headquartered in China. It is one of the largest food companies in the world, with operations in over 160 countries and territories.

-

Archer-Daniels-Midland (ADM) is an American multinational food and agriculture corporation headquartered in Chicago, Illinois. It is the world's largest agricultural processor and food ingredient provider.

-

Cargill, Incorporated is an American multinational corporation that specializes in trading, processing, and distribution of agricultural products and commodities.

Scoular and Adani Wilmar are some of the emerging market participants in the global corn market.

-

Scoular has expanded its operations into new markets around the world, including China, India, and Brazil.

-

Adani Wilmar is an emerging player in the global edible oil and agri-business industry. The company has a strong presence in India and Indonesia, and it is expanding its operations into other markets around the world.

Key Corn Companies:

- China National Cereals, Oils and Foodstuffs Corporation (COFCO)

- Archer-Daniels-Midland (ADM)

- Cargill, Inc.

- CHS Inc.

- Bunge Limited

- Monsanto

- Corteva Agriscience

- Adani Wilmar

- Agrium Inc.

- Scoular

Recent Developments

-

In August 2023, Bayer has introduced biotech seeds ‘Deklab DK95R’ in Indonesia with the aim of boosting the country's corn production.

-

In April 2023, Origin Agritech Ltd., a Chinese agriculture technology company, announced its majority-owned joint venture agreement with Shihezi City in Xinjiang Province. The deal was made to allocate 13,300 hectares of farmland for cultivating Nutritionally Enhanced Corn (NEC).

-

In March 2023, Corteva Agriscience revealed its intentions to launch Vorceed Enlist corn products commercially. Vorceed Enlist corn incorporates three above-ground insect protection modes of action and three below-ground insect protection modes of action, including RNAi technology.

Corn Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 305.32 billion |

|

Revenue forecast in 2030 |

USD 377.27 billion |

|

Growth rate |

CAGR of 3.6% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Nature, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Australia; Indonesia; Brazil; South Africa |

|

Key companies profiled |

China National Cereals; Oils and Foodstuffs Corporation (COFCO); Archer-Daniels-Midland (ADM); Cargill, Inc.; CHS Inc.; Bunge Limited; Monsanto; Corteva Agriscience; Adani Wilmar; Agrium Inc.; Scoular |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Corn Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global corn market report based on nature, end-use, and region:

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

Food & Beverages

-

Animal Feed

-

Industrial Use (Biofuels, Starch, Adhesives, Pharmaceuticals)

-

Ethanol Production

-

Others (Cosmetics, Personal Care Products, Construction Materials)

-

-

B2C

-

Offline

-

Online

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global corn market size was estimated at USD 297.27 billion in 2023 and is expected to reach USD 305.32 billion in 2024.

b. The global corn market is expected to grow at a compounded growth rate of 3.6% from 2024 to 2030 to reach USD 377.27 billion by 2030.

b. "Asia Pacific held a highest market share of 37.6% of the global market in 2023. Asia Pacific dominated the market owing to high consumption patterns, a growing population, a significant livestock and poultry industry. Factors such as favorable agricultural practices, government policies, and diverse industrial uses further contribute to the region's prominence in the global corn market.

b. Some key players operating in corn market include China National Cereals, Oils and Foodstuffs Corporation (COFCO); Archer-Daniels-Midland (ADM); Cargill, Inc.; CHS Inc.; Bunge; Glencore; Louis Dreyfus Company; Ardent Mills.

b. Key factors that are driving the market growth include a surge in global demand fueled by population growth, the expansion of the livestock and poultry industry, and increased usage in biofuel production. Furthermore, the global push for renewable energy sources and efforts to reduce reliance on fossil fuels have led to increased demand for biofuels. Corn-based ethanol is used as a cleaner alternative to traditional gasoline, contributing to the growth of the corn market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."