- Home

- »

- Advanced Interior Materials

- »

-

Copper Alloys Market Size, Share And Growth Report, 2030GVR Report cover

![Copper Alloys Market Size, Share & Trend Report]()

Copper Alloys Market (2025 - 2030) Size, Share & Trend Analysis Report, By Type (Brass, Bronze), By End Use (Building & Construction, Automotive & Transportation), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-457-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Copper Alloys Market Summary

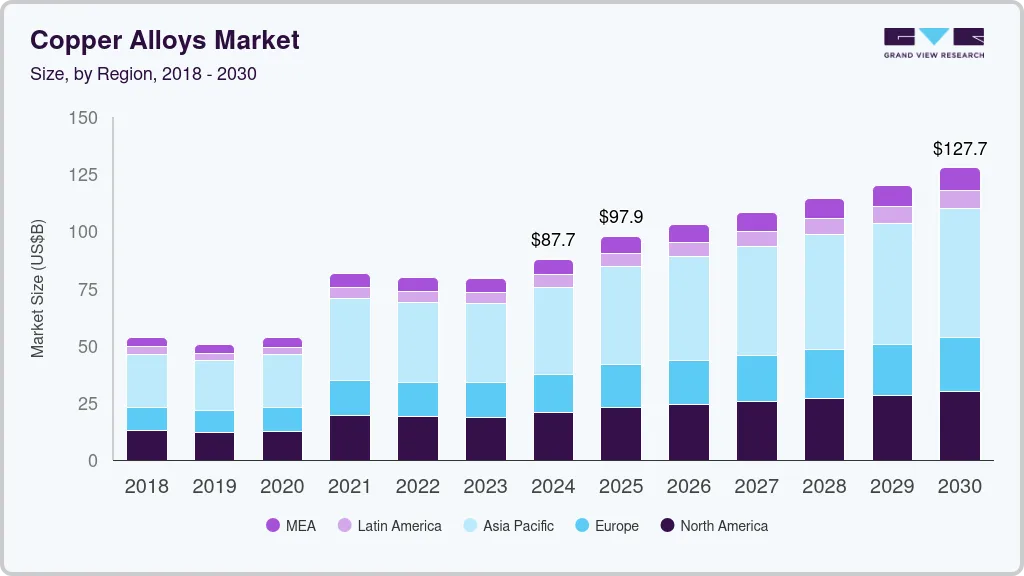

The global copper alloys market size was estimated at USD 87,710.7 million in 2024 and is estimated to grow at a CAGR of 5.5% from 2025 to 2030. The primary driving factor of the copper alloys market is the increasing demand for advanced materials in high-performance applications, particularly in the automotive, aerospace, and electronics sectors.

Key Market Trends & Insights

- North America dominated the global copper alloys market with the largest revenue share in 2023.

- The copper alloys market in the U.S. led the North America market and held the largest revenue share in 2023.

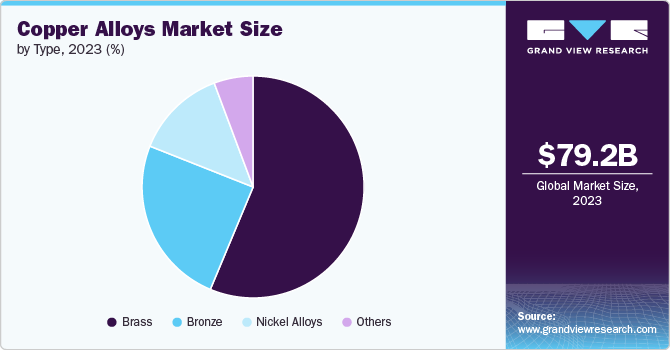

- By type, the brass segment led the market, holding the largest revenue share in 2023.

- By end use, the automotive and transportation segment is expected to grow at the fastest CAGR from 2024 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 87,710.7 Million

- 2030 Projected Market Size: USD 127,732.2 Million

- CAGR (2025-2030): 5.5%

- North America: Largest market in 2023

This growth is further fueled by the shift towards sustainable and energy-efficient technologies requiring specialized copper alloy solutions.

The primary driver for the global copper alloys market is the expanding electronics and automotive industries, particularly due to the surge in electric vehicles (EVs). EVs require more copper for wiring, motors, and connectors compared to traditional vehicles. For example, a single EV can require over 183 pounds of copper, significantly boosting demand for copper alloys. In addition, the rising infrastructure development across the Asia Pacific region, particularly in China and India, is fueling the use of copper alloys in construction and electrical grids.

A significant restraint on the global copper alloy market is the volatile prices of raw materials and copper itself. Price fluctuations, often driven by supply-demand imbalances and geopolitical factors, can result in high production costs, impacting the profit margins of end users such as automotive and electronics manufacturers. For instance, the rising energy costs in Europe are further exacerbating this challenge, making it more difficult for manufacturers to manage operating expenses while maintaining competitive prices.

The increasing focus on sustainability and recycling offers a key opportunity in the copper alloy market. Recycling copper is far more energy-efficient than primary production, consuming up to 85% less energy and reducing the environmental impact. With global emphasis on circular economies, manufacturers that integrate recycled copper into their production processes stand to benefit from reduced costs and enhanced market positioning, especially in industries such as renewable energy and green building. In addition, the growth of the renewable energy sector-which uses copper alloys extensively in wind turbines and solar power systems-presents a long-term opportunity.

Price Trends of Copper Alloys

The price trend of copper alloys has been fluctuating since 2023, primarily driven by the volatility in copper prices and supply-demand dynamics. After a sharp rise in copper prices in early 2023, due to supply constraints and high demand from industries such as electric vehicles (EVs) and renewable energy, prices have started stabilizing as supply chains improved and industrial activity slowed. However, high energy costs, especially in Europe, continue to influence copper alloy prices upward. In addition, the recycling of copper has helped offset some of the raw material cost hikes. Global economic uncertainties, particularly in China’s real estate sector, are also moderating demand growth, causing slight corrections in prices.

Type Insights & Trends

“Brass held the largest revenue share of the copper alloys market in 2023.”

Brass, an alloy of copper and zinc, is the largest sub-segment within the copper alloy market, accounting for a significant share due to its widespread use in various industries. Its excellent corrosion resistance and workability make it ideal for plumbing, electrical connectors, and architectural applications. In the automotive industry, brass is used extensively in radiators, fuel systems, and connectors, boosting its demand. The construction sector also relies on brass for durable plumbing fixtures, while decorative applications use its aesthetic appeal for hardware and fittings.

Nickel alloys, particularly copper-nickel alloys, are the fastest-growing sub-segment, driven by their corrosion resistance in marine and offshore industries. These alloys are widely used in desalination plants, seawater piping, and shipbuilding. The renewable energy sector also drives the demand for copper-nickel alloys in wind turbines and geothermal plants, where resistance to harsh environmental conditions is critical.

End Use Insights & Trends

“Electrical & electronics held the largest revenue share of copper alloys market in 2023.”

The electrical & electronics sector is the largest sub-segment, primarily due to copper alloys' excellent electrical conductivity. Copper alloys are essential in manufacturing connectors, terminals, and electrical wiring. The growing demand for consumer electronics, coupled with the global expansion of 5G infrastructure and the Internet of Things (IoT), is driving significant growth in this segment. The increasing use of copper alloys in renewable energy systems and power grids further fuels demand.

The automotive and transportation sector is the fastest growing subsegment, driven by the increasing penetration of EVs. Copper alloys are integral to the high-performance electrical systems of EVs, particularly in batteries, motors, and charging systems. According to the Copper Development Association, EVs require more copper per vehicle than traditional vehicles, with estimates suggesting around 183 pounds per EV compared to 50 pounds in conventional cars. This is driving significant growth in the automotive sector's use of copper alloys.

Regional Insights

The shift toward electrification and the increasing demand for hybrid and fuel-efficient vehicles in regions such as North America is further propelling the growth of copper alloys in this sector. Innovations in autonomous vehicles and smart transportation infrastructure also contribute to this demand, making automotive one of the most dynamic and rapidly expanding segments in the copper alloy market.

U.S. Copper Alloys Market Trends

In the U.S., the copper alloys market has experienced significant growth, primarily driven by the growing demand in construction, electrical, and industrial applications. The expansion of infrastructure projects and the increasing use of copper alloys in high-performance applications, such as aerospace and defense, are key factors propelling this trend. Additionally, the shift towards sustainable energy solutions and the growing production of electric vehicles is anticipated to further drive the market’s upward trajectory in the U.S.

Europe Copper Alloys Market Trends

The copper alloys market in Europe has shown a steady growth trajectory, driven by the rising demand in automotive and electronics sectors. The European market is expected to continue expanding due to increased adoption of advanced copper alloys in EVs and renewable energy technologies. Germany, Italy, and France are leading contributors to this growth, supported by their strong manufacturing bases and technological advancements. The EU’s focus on green energy and the transition to electric mobility are expected to further boost the demand for copper alloys in the coming years.

“Asia Pacific held largest revenue share of the global copper alloys market in 2023.”

Asia Pacific Copper Alloys Market Trends

The industrial and electrical applications are the primary drivers of brass demand, particularly in Asia Pacific, where urbanization and infrastructure development are increasing. Brass's recyclability also adds to its attractiveness, particularly in regions focused on sustainable practices such as Europe. With the shift toward green building solutions and the growing EV sector, brass is expected to maintain a strong presence due to its utility in connectors and terminals.

Key Copper Alloys Company Insights

Some of the key players operating in the market include Aurubis AG, and KME Group S.p.A.

-

Aurubis AG is a major player in the copper industry, headquartered in Hamburg, Germany. The company focuses on the production of copper and copper alloys, including rolled products, continuous cast products, and copper wire rods. Aurubis operates extensive recycling facilities, which contribute to its robust supply chain and sustainability practices.

-

KME Group S.p.A., Italy-based, is a leading copper and copper alloy product manufacturer. The company offers a range of solutions, including sheets, strips, and rods, catering to various industries such as automotive, electrical, and construction. KME has a significant presence in Europe and operates several production sites. The company's 2023 revenue highlights its key position in the European copper alloy market.

Key Copper Alloys Companies:

The following are the leading companies in the copper alloys market. These companies collectively hold the largest market share and dictate industry trends.

- Amari Copper Metals

- AMPCO Metal

- Aurubis AG

- Constellium SE

- Copper Alloys Ltd.

- Jiangxi Copper Corporation

- KME Group S.p.A.

- Mitsubishi Materials Corporation

- Nexans

- poongsan corporation

- SCHLENK SE

- Thyssenkrupp Materials Services

- Wieland

Recent Developments

-

In January 2024, Wieland Copper Products announced a significant modernization and expansion project in East Alton, Illinois, with an investment of USD 500 million. This initiative aims to enhance the company's manufacturing capabilities and increase production efficiency by upgrading its facilities and technologies.

-

In August 2023, Wieland acquired Small Tube Products to strengthen its position in the specialized copper and copper alloy tube market. This acquisition will expand Wieland's product portfolio and enhance its manufacturing capabilities, particularly in high-precision applications. Integrating Small Tube Products' expertise and resources is expected to improve Wieland's market reach and customer service, positioning the company to better meet the evolving needs of aerospace, automotive, and industrial applications.

Copper Alloys Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 97,898.7 million

Revenue forecast in 2030

USD 127,732.2 million

Growth rate

CAGR of 5.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons, revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America, Europe; Asia Pacific; Central & South Africa; Middle East; Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Russia; China; India; Japan; South Korea; Brazil; UAE

Key companies profiled

Aurubis AG; Amari Copper Metals; AMPCO Metal; Constellium SE; Thyssenkrupp Materials Services; Wieland; KME Group S.p.A.; Nexans; poongsan corporation; Mitsubishi Materials Corporation; SCHLENK SE; Copper Alloys Ltd.; Jiangxi Copper Corporation; Hyundai Steel; United States Steel Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Copper Alloys Market Report Segmentation

This report forecasts revenue and volume growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global copper alloys market report on the basis of type, end use, and region:

-

Type Outlook (Volume, Kil0tons; Revenue, USD Billion, 2018 - 2030)

-

Brass

-

Bronze

-

Nickel Alloys

-

Others

-

-

End Use Outlook (Volume, Kil0tons; Revenue, USD Billion, 2018 - 2030)

-

Building & Construction

-

Automotive & Transportation

-

Electrical & Electronics

-

Industrial Machinery

-

Others

-

-

Regional Outlook (Volume, Kil0tons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global copper alloys market size was estimated at USD 79.24 billion in 2023 and is expected to reach USD 87.71 billion in 2024.

b. The global copper alloys market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 127.73 billion by 2030.

b. By type, brass dominated the copper alloys market in 2023.

b. Some of the key vendors of the global copper alloys market are Aurubis AG, Amari Copper Metals, AMPCO Metal, Constellium SE, Thyssenkrupp Materials Services, Wieland, KME Group S.p.A., Nexans, poongsan corporation, Mitsubishi Materials Corporation, SCHLENK SE, Copper Alloys Ltd., Jiangxi Copper Corporation, among others.

b. The key factor driving the growth of the global copper alloys market is the increasing demand for advanced materials in high-performance applications, particularly in the automotive, aerospace, and electronics sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.