- Home

- »

- Specialty Polymers

- »

-

Copolyester Elastomers Market Size, Industry Report, 2030GVR Report cover

![Copolyester Elastomers Market Size, Share & Trends Report]()

Copolyester Elastomers Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Injection Molding, Blow Molding), By Application (Automotive, Industrial), By Region (North America, Europe), And Segment Forecasts

- Report ID: 978-1-68038-053-8

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Copolyester Elastomers Market Trends

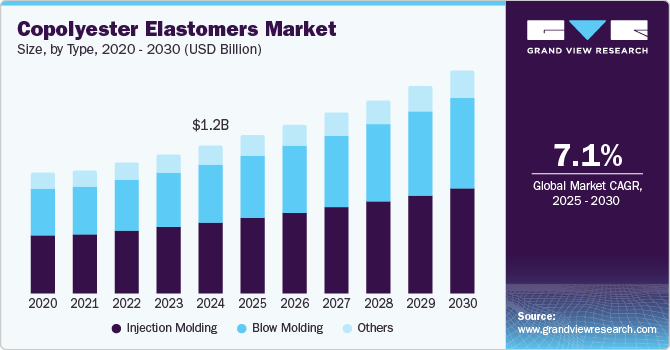

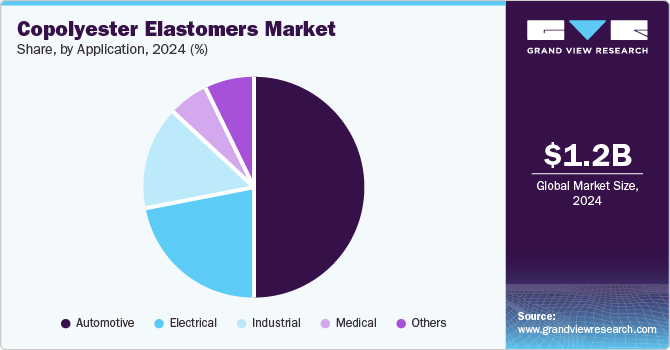

The global copolyester elastomers market size was valued at USD 1.20 billion in 2024 and is expected to grow at a CAGR of 7.1% from 2025 to 2030. This growth is attributed to the increasing demand for lightweight, high-performance materials in the automotive sector, which seeks to enhance fuel efficiency and reduce emissions. In addition, rising environmental concerns are prompting industries to replace traditional materials with sustainable alternatives such as copolyester elastomers. Furthermore, the healthcare sector's shift towards non-allergenic and recyclable materials further fuels market expansion. Moreover, advancements in manufacturing technologies and favorable government policies support the markets’ growth.

Copolyester elastomers are highly versatile materials that combine the properties of flexibility, strength, and durability, making them suitable for a wide array of applications. These materials are widely used as substitutes for rubber due to their excellent mechanical properties and adaptability. In the automotive industry, they are utilized for manufacturing durable seals and protective coverings for wires and cables. In addition, they can be formulated to create soft products, such as children’s toys, ensuring safety by eliminating harmful chemicals. The incorporation of biodegradability into these materials further enhances their appeal, aligning with sustainability goals and expanding their potential uses in environmentally conscious industries.

Copolyester elastomers are gaining prominence in the medical sector as replacements for conventional materials such as polyvinyl chloride (PVC) and silicone rubber in applications that require flexibility and elasticity. They are used in products such as medical tubing, IV bags, and syringe stoppers due to their ability to meet stringent safety and performance requirements. The healthcare industry is increasingly moving away from materials such as PVC and silicone due to environmental concerns and the need for safer alternatives. Copolyester elastomers offer a non-allergenic option, making them particularly suitable for individuals’ sensitive to latex.

Furthermore, the growing demand for innovative materials in industries such as automotive and healthcare continues to drive the adoption of copolyester elastomers. Their ability to combine performance with sustainability makes them an attractive solution for modern manufacturing challenges. Moreover, as industries prioritize safety, environmental responsibility, and efficiency, copolyester elastomers are emerging as a critical material across diverse sectors.

Type Insights

The injection molding dominated the global copolyester elastomers industry and accounted for the largest revenue share of 47.8% in 2024. This growth is attributed to its high productivity and efficiency in processing. This method allows for the rapid production of a diverse range of products, from simple components to complex parts, while minimizing waste. In addition, the clean nature of injection molding, coupled with shorter cycle times and improved formability, enhances its appeal to manufacturers. Furthermore, as industries increasingly seek efficient and sustainable production methods, the injection molding segment is expected to maintain its dominance.

The blow molding segment is expected to grow at a CAGR of 7.5% over the forecast period, owing to its suitability for producing lightweight hollow parts and containers. This method is particularly advantageous for creating large volumes of products with consistent quality and reduced material usage. In addition, the rising demand for packaging solutions in various sectors, especially consumer goods and food and beverage industries, fuels the adoption of blow molding techniques. Furthermore, advancements in blow molding technology are enabling the production of more complex shapes and designs, further driving the growth of this segment within the copolyester elastomers market.

Application Insights

The automotive application segment led the market and accounted for the largest revenue share of 50.2% in 2024, primarily driven by the increasing demand for lightweight, high-performance materials. Furthermore, as manufacturers strive to enhance fuel efficiency and reduce emissions, copolyester elastomers are favored for their excellent mechanical properties, such as durability and resistance to heat and chemicals. Moreover, these materials are extensively used in various components, including seals and under-the-hood parts, making them essential for modern vehicle designs that prioritize sustainability and performance.

The industrial segment is expected to grow at the fastest CAGR of 6.9% from 2025 to 2030, due to their versatility and superior performance characteristics. Industries are increasingly adopting these materials for manufacturing products that require flexibility and durability, such as gaskets, seals, and hoses. In addition, the ability of copolyester elastomers to withstand harsh environmental conditions while maintaining their integrity makes them ideal for various industrial applications. Furthermore, the push for sustainability and the need for recyclable materials further enhance their appeal in industrial settings, contributing to the overall growth of this segment in the market.

Regional Insights

The Asia Pacific copolyester elastomers market dominated the global market and accounted for the largest revenue share of 43.0% in 2024, primarily driven by rapid industrialization and increasing demand from the automotive and electronics sectors. In addition, countries such as China and India are witnessing significant growth in manufacturing capabilities, leading to a higher consumption of lightweight, high-performance materials. Furthermore, government regulations promoting fuel efficiency and sustainability also boost the market.

China Copolyester Elastomers Market Trends

The copolyester elastomers market in China led the Asia Pacific market and held the largest revenue share in 2024, driven by the booming automotive industry, which seeks lightweight materials to improve fuel efficiency and reduce emissions. Furthermore, stringent environmental regulations are pushing manufacturers to adopt more sustainable materials, thus increasing the demand for copolyester elastomers. Moreover, advancements in technology and manufacturing processes are enabling the production of high-quality components that meet international standards.

Latin America Copolyester Elastomers Market Trends

Latin America copolyester elastomers market is expected to grow at a CAGR of 7.6% over the forecast period, owing to increasing investments in infrastructure and automotive sectors. The region's expanding manufacturing base is creating a demand for durable and flexible materials suitable for various applications. Furthermore, rising consumer awareness regarding eco-friendly products is driving the shift towards sustainable alternatives such as copolyester elastomers. Moreover, government initiatives aimed at promoting local manufacturing and reducing dependency on imports also play a crucial role in enhancing market prospects in Latin America.

North America Copolyester Elastomers Market Trends

The copolyester elastomers market in North America is expected to grow significantly over the forecast period, driven by robust demand from the automotive and healthcare industries. In addition, the increasing emphasis on lightweight materials for fuel-efficient vehicles aligns with the properties of copolyester elastomers, making them a preferred choice for manufacturers. Furthermore, the healthcare sector's shift towards safer, non-toxic materials is boosting the adoption of these elastomers in medical devices.

U.S. Copolyester Elastomers Market Trends

The U.S. copolyester elastomers market dominated the North American market and accounted for the largest revenue share in 2024, owing to the increasing adoption of lightweight and high-performance materials in the automotive industry to meet stringent fuel efficiency and emission norms. Furthermore, the rising demand for sustainable alternatives to traditional plastics and rubbers supports market expansion. Moreover, the U.S. also benefits from advanced manufacturing facilities and significant investments in research and development, fostering innovation in product applications across industries such as healthcare, consumer goods, and electronics.

Key Copolyester Elastomers Company Insights

Key companies in the global copolyester elastomers industry include BASF SE, Celanese Corporation, Arkema Group, and others. These players are adopting various strategies to enhance their competitive edge. These include investing in research and development to innovate new products and improve existing formulations. In addition, firms are expanding their product portfolios to cater to diverse applications across industries. Furthermore, strategic partnerships and collaborations are also being pursued to leverage complementary strengths and access new markets.

-

Arkema Group manufactures a wide range of products, including adhesives, advanced materials, and coating solutions. Operating within segments such as High Performance Polymers and Coating Resins, the company provides innovative solutions that meet the evolving needs of sectors including automotive, construction, and consumer goods.

-

PolyOne Corporation, now Avient Corporation, develops and manufactures a diverse array of products tailored for various applications across multiple industries. Operating primarily in the specialty polymer segment, the company focuses on delivering customized solutions that enhance performance and sustainability.

Key Copolyester Elastomers Companies:

The following are the leading companies in the copolyester elastomers market. These companies collectively hold the largest market share and dictate industry trends.

- DuPont

- BASF SE

- Celanese Corporation

- Arkema Group

- Eastman Chemical Company

- PolyOne Corporation

- LyondellBasell Industries N.V.

- Mitsubishi Chemical Corporation

- DSM Engineering Plastics

- Kuraray Co., Ltd.

Recent Developments

-

In October 2024, BASF announced the launch of its new Elastollan 1400 TPU series, featuring ether-based thermoplastic polyurethane with exceptional hydrolysis resistance. This innovative material is designed for diverse applications, including copolyester elastomers, offering superior mechanical properties and aging stability. The series promises lower carbon footprints, appealing to environmentally conscious manufacturers. Experimental grades are now available for sampling, allowing customers to experience the enhanced performance firsthand across various industries, such as transportation and footwear.

-

In July 2024, Celanese unveiled its new biobased Hytrel TPC, specifically designed for foamed athletic footwear. This innovative material, a type of copolyester elastomer, enhances comfort and performance while promoting sustainability. The biobased formulation reduces reliance on fossil fuels, aligning with eco-friendly manufacturing practices. Celanese aims to meet the growing demand for sustainable materials in the footwear industry, providing manufacturers with a high-performance option that supports both environmental goals and consumer expectations for quality and durability.

-

In January 2024, Eastman and Lubrizol announced a collaboration aimed at enhancing the adhesion strength of thermoplastic elastomers (TPEs) over molded onto Eastman's Tritan copolyester TX1501HF. This partnership focuses on optimizing processing variables to achieve a significant 124% improvement in adhesion strength, crucial for applications where mechanical interlocks are not feasible. The research highlights the potential of using sustainable materials such as Tritan Renew and Lubrizol's ESTANE ECO TPU in consumer goods, paving the way for innovative designs that leverage copolyester elastomers.

Copolyester Elastomers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.27 billion

Revenue forecast in 2030

USD 1.79 billion

Growth Rate

CAGR of 7.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, Denmark, Sweden, Norway, China, India, Japan, Australia, South Korea, Indonesia, Vietnam, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

DuPont; BASF SE; Celanese Corporation; Arkema Group; Eastman Chemical Company; PolyOne Corporation; LyondellBasell Industries N.V.; Mitsubishi Chemical Corporation; DSM Engineering Plastics; Kuraray Co., Ltd.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Copolyester Elastomers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global copolyester elastomers market report based on type, application, and region.

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Injection Molding

-

Blow Molding

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Electrical

-

Industrial

-

Medical

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.