Coordinate Measuring Machine Market Size, Share & Trends Analysis Report By Type (Fixed CMM, Portable CMM), By Industry Vertical (Automotive, Heavy Machinery Manufacturing, Aerospace, Electronics), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-383-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

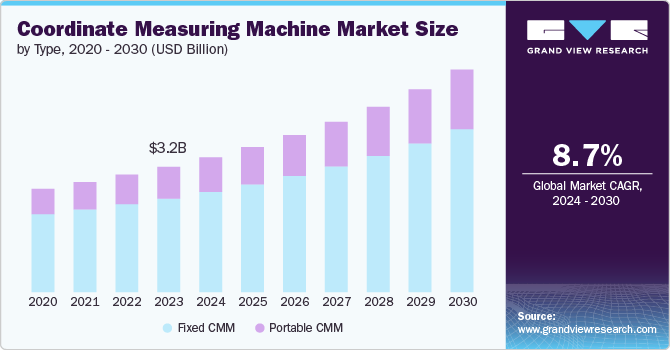

The global coordinate measuring machine market size was estimated at USD 3.20 billion in 2023 and is expected to grow at a CAGR of 8.7% from 2024 to 2030. A coordinate measuring machine (CMM) serves as a vital tool within manufacturing and assembly processes. These machines, capable of both manual and computer-controlled operation, primarily function to measure the physical geometrical characteristics of objects, ensuring parts and assemblies adhere to their design specifications. CMMs utilize a probing system to detect discrete points on the surface of the object, which is then used to generate a 3D representation of the part being measured. The data obtained from CMMs is critical for quality control and assurance in various industries, including automotive, aerospace, electronics, and medical devices.

The CMM market has been experiencing significant evolution due to advancements in technology and increasing demand for precision and efficiency in manufacturing processes. One notable trend is the integration of CMMs with automation and smart manufacturing systems. This integration allows for real-time data collection and analysis, enhancing production efficiency and reducing human error. Additionally, portable CMMs are gaining popularity due to their flexibility and convenience, enabling measurements in different locations within a manufacturing facility. The shift towards non-contact CMMs, which use optical or laser sensors, is also notable as they offer higher speed and the ability to measure delicate or soft materials without causing damage.

The use of CMMs is subject to various international standards and regulations to ensure accuracy and reliability in measurements. Standards such as ISO 10360, which specifies the acceptance and re-verification tests for CMMs, are crucial for maintaining the consistency and quality of measurements. Compliance with these standards is essential for manufacturers to achieve certification and meet customer expectations. Industry-specific regulations, such as those in the aerospace sector (AS9100), require stringent quality assurance processes, further driving the adoption of CMMs to meet these regulatory demands.

The increasing complexity of manufactured parts, particularly in the automotive and aerospace industries, necessitates the use of advanced measurement tools to ensure precision and quality. The rise of Industry 4.0 and smart manufacturing initiatives is another significant driver as manufacturers seek to enhance productivity through automation and real-time data analysis. Additionally, the growing emphasis on quality control and adherence to international standards across various industries is propelling the demand for CMMs. The expansion of the electronics industry, particularly in emerging economies, is also contributing to market growth, as precise measurement tools are essential for the production of high-quality electronic components.

However, the high cost of advanced CMMs can be a significant barrier for small and medium-sized enterprises (SMEs), limiting their adoption. The complexity of CMM operations and the need for skilled personnel to operate and maintain these machines also pose challenges, as there is a need for more qualified technicians in the market. Additionally, the rapid pace of technological advancements means that CMMs can quickly become obsolete, leading to higher replacement and upgrade costs for manufacturers. Economic fluctuations and uncertainties in global trade policies can also impact the investment in new CMM technologies, particularly in industries sensitive to economic cycles.

Nonetheless, the increasing adoption of additive manufacturing (3D printing) presents a significant opportunity, as CMMs are essential for ensuring the quality of 3D-printed parts. The trend towards miniaturization in electronics and medical devices also creates a demand for more precise measurement tools, further driving CMM adoption. Additionally, the expansion of the manufacturing sector in emerging economies such as China and India provides a vast market for CMMs, as these regions increasingly emphasize quality control and adherence to international standards.

Technological advancements in CMMs, such as the development of multi-sensor systems and advancements in software capabilities, are also opening new avenues for market growth. These innovations enable more comprehensive and accurate measurements, enhancing the overall value proposition of CMMs. Moreover, the integration of artificial intelligence (AI) and machine learning (ML) in CMMs can lead to predictive maintenance and improved measurement accuracy, providing a competitive edge for manufacturers who adopt these advanced systems.

Type Insights

The fixed CMM segment dominated the market in 2023 and accounted for a more than 75% share of global revenue. Fixed CMMs, encompassing bridge, cantilever, and gantry CMMs, currently dominate the market. This dominance is attributed to their superior accuracy, repeatability, and wider measurement envelope. These machines excel in high-precision applications for complex parts, particularly in the aerospace, medical, and machine tool industries. Additionally, fixed CMMs offer better stability for intricate measurements and heavier workpieces. However, their larger footprint, higher initial cost, and limited flexibility compared to portable options can be drawbacks.

The portable CMM segment is projected to witness significant growth from 2024 to 2030. Portable CMMs, including articulated arm and handheld CMMs, are experiencing a faster growth rate due to their portability, user-friendliness, and affordability. These CMMs are ideal for on-site inspections, quick measurements, and applications requiring access to hard-to-reach areas. The growing demand for flexibility in manufacturing environments and the increasing adoption of automation are driving the growth of this segment. However, portable CMMs typically have a smaller measurement envelope and may have limitations in accuracy compared to fixed CMMs.

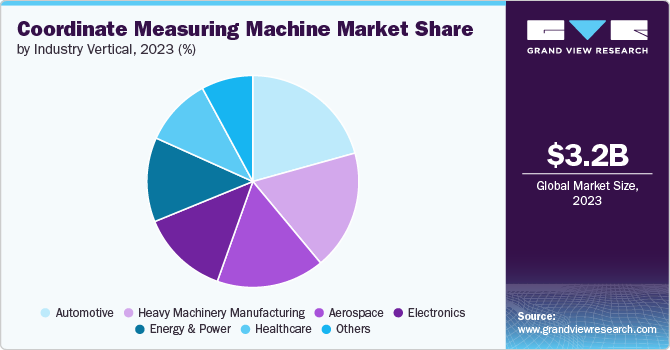

Industry Vertical Insights

The automotive segment dominated the market in 2023. The segment's growth is propelled due to its stringent quality control requirements for complex parts like engines, transmissions, and body panels. Fixed CMMs are widely used for high-precision measurements of these parts, ensuring adherence to tight tolerances. The increasing demand for lightweight and fuel-efficient vehicles is further driving the need for precise dimensional control, solidifying the automotive industry's position as a leading user of CMMs.

The electronics segment is projected to witness significant growth from 2024 to 2030. This is fueled by the miniaturization of electronic components and the ever-increasing demand for high-density circuitry. Portable CMMs, with their flexibility and non-destructive testing capabilities, are particularly well-suited for measuring these intricate components. Additionally, the rise of automation in electronics manufacturing is creating a need for faster and more efficient inspection methods, further propelling the growth of CMMs in this sector.

Regional Insights

North America dominated the coordinate measuring machine (CMM) market in 2023 and accounted for a 35.1% share of the global revenue. This dominance is fueled by a robust and technologically advanced manufacturing sector, particularly in the aerospace, automotive, and medical device industries. Stringent quality control regulations and a culture of precision manufacturing necessitate the adoption of advanced CMM technology. Additionally, the presence of leading CMM manufacturers within the region creates a strong ecosystem for research, development, and market adoption of innovative CMM solutions.

U.S. Coordinate Measuring Machine Market Trends

The coordinate measuring machine (CMM) market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. This surge is primarily driven by the increasing adoption of automation in manufacturing processes. As manufacturing relies more heavily on automated systems, the need for highly accurate and consistent dimensional measurements becomes paramount. Furthermore, the growing demand for complex parts with intricate features necessitates advanced CMM capabilities to ensure product quality and dimensional tolerances are met. Government initiatives promoting the adoption of advanced manufacturing technologies further contribute to the expansion of the CMM market in the U.S.

Asia Pacific Coordinate Measuring Machine Market Trends

The coordinate measuring machine (CMM) market in Asia Pacific is anticipated to witness the fastest growth during the forecast period 2024 to 2030. This rapid expansion is primarily a consequence of the region's burgeoning industrial landscape, particularly in countries like China and India. The rise of these manufacturing giants leads to a surge in demand for quality control solutions like CMMs. Additionally, the growing adoption of automation and Industry 4.0 principles across the region creates fertile ground for the integration of advanced measurement technologies, further accelerating the growth of the CMM market.

The coordinate measuring machine (CMM) market in China is expected to grow at a significant CAGR from 2024 to 2030. This growth is driven by the increasing demand for high-precision measurement tools within the region's expanding automotive, aerospace, and electronics industries. These tools are essential for maintaining product quality and adhering to international standards. This demand fuels the rapid adoption of CMM technology across these sectors. As China strives to maintain its manufacturing dominance, the need for advanced CMM solutions is expected to continue propelling market growth.

The Japan coordinate measuring machine market is expected to grow at a significant CAGR from 2024 to 2030. The region's well-developed automotive and electronics industries heavily rely on CMM technology for dimensional control and quality assurance. While growth might be slower compared to emerging economies, Japan's unwavering commitment to maintaining the highest quality standards ensures a steady and consistent demand for CMMs. This focus on precision measurement is likely to continue driving market growth in the foreseeable future.

The coordinate measuring machine (CMM) market in India is expected to grow at the fastest CAGR in Asia Pacific from 2024 to 2030. Government initiatives promoting "Make in India" programs and attracting foreign investments significantly contribute to the expansion of the manufacturing base. Additionally, the rise of the domestic automotive and aerospace industries creates a need for advanced quality control solutions. As India embraces automation and Industry 4.0 principles, the integration of CMM technology becomes increasingly crucial. This confluence of factors positions India as a rising star in the global CMM market, boasting immense potential for future growth.

Europe Coordinate Measuring Machine Market Trends

The coordinate measuring machine (CMM) market in Europe is expected to grow at a significant CAGR from 2024 to 2030. A long-standing tradition of excellence in automotive and aerospace manufacturing has established a strong demand for CMMs within the region. Similar to North America, stringent regulations and a focus on precision drive market growth. However, due to the well-established nature of these industries, European markets are likely at a more mature stage compared to North America. This translates to a more consistent and steadier, rather than explosive, growth pattern for the CMM market in Europe.

The France coordinate measuring machine market is expected to grow at a significant CAGR from 2024 to 2030. The French aerospace industry is a major driver, demanding high-precision measurement solutions for critical components. Additionally, the French government actively supports initiatives promoting advanced manufacturing technologies. This, coupled with the increasing adoption of automation across various sectors, fosters a dynamic environment that propels demand for advanced CMM solutions.

Key Coordinate Measuring Machine Company Insights

Key players operating in the coordinate measuring machine (CMM) market are prioritizing various growth strategies, such as new product development, partnerships, and collaborations, to gain an edge over competitors. The following are some instances of such initiatives.

-

In February 2024, Renishaw expanded its AGILITY CMM range, known for speed and accuracy. These machines integrate Renishaw's REVO 5-axis multi-sensor system, bringing its capabilities directly to the shop floor. This allows manufacturers to perform various measurements and generate reports using a single CMM with a wider selection of REVO sensors.

-

In February 2024, LK Metrology introduced a new high-accuracy coordinate measuring machine (CMM), the Altera C HA, designed for manufacturers requiring precise component inspection at an affordable cost. Offered in five sizes, the Altera C HA boasts superior accuracy and repeatability, making it a suitable alternative to expensive ultra-high-accuracy CMMs.

-

In April 2023, Hexagon's Manufacturing Intelligence division launched the next generation of Leitz PMM-C CMMs, known for their ultra-high accuracy. These new models offer a modular design for customization, potentially faster measurements with a 20% throughput increase, and improved features for operator safety and energy efficiency.

-

In May 2022, Mitutoyo America Corporation unveiled an enhanced version of their MiSTAR 555 CMM, the MiSTAR 555, with the PH20 5-axis probe system. This upgrade boasts improved measuring capabilities, expanded access to features, and a significant throughput increase. The MiSTAR 555 with PH20 system surpasses conventional CMMs through its open architecture, wide temperature accuracy range, environment-resistant scale, and space-saving design.

Key Coordinate Measuring Machine Companies:

The following are the leading companies in the coordinate measuring machine market. These companies collectively hold the largest market share and dictate industry trends.

- Carl Zeiss AG

- COORD 3 S.R.L.

- Creaform 3D

- FARO Technologies, Inc.

- Hexagon AB

- Keyence Corporation

- Micro Vu Corporation

- Mitutoyo Corporation

- Nikon Metrology NV

- Perceptron, Inc.

- Qingdao Leader Metrology Instruments Co.

- Renishaw plc

- Tokyo Seimitsu Co., Ltd.

- Wenzel Group

- Werth Messtechnik GmbH

Coordinate Measuring Machine Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.44 billion |

|

Revenue forecast in 2030 |

USD 5.68 billion |

|

Growth rate |

CAGR of 8.7% from 2024 to 2030 |

|

Actual Data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, industry vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; United Arab Emirates (UAE); Kingdom of Saudi Arabia (KSA); South Africa |

|

Key companies profiled |

Carl Zeiss AG; COORD 3 S.R.L.; Creaform 3D; FARO Technologies, Inc.; Hexagon AB; Keyence Corporation; Micro Vu Corporation; Mitutoyo Corporation; Nikon Metrology NV; Perceptron, Inc.; Qingdao Leader Metrology Instruments Co.; Renishaw plc, Tokyo Seimitsu Co., Ltd.; Wenzel Group; Werth Messtechnik GmbH |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Coordinate Measuring Machine Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global coordinate measuring machine market report based on type, industry vertical, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed CMM

-

Bridge

-

Cantilever

-

Gantry

-

-

Portable CMM

-

Articulated Arm

-

Handheld

-

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace

-

Heavy Machinery Manufacturing

-

Energy & Power

-

Electronics

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the coordinate measuring machine (CMM) market include Carl Zeiss AG, COORD 3 S.R.L., Creaform 3D, FARO Technologies, Inc., Hexagon AB, Keyence Corporation, Micro Vu Corporation, Mitutoyo Corporation, Nikon Metrology NV, Perceptron, Inc., Qingdao Leader Metrology Instruments Co., Renishaw plc, Tokyo Seimitsu Co., Ltd., Wenzel Group, and Werth Messtechnik GmbH.

b. The increasing complexity of manufactured parts, particularly in the automotive and aerospace industries, necessitates the use of advanced measurement tools to ensure precision and quality. The rise of Industry 4.0 and smart manufacturing initiatives is another significant driver as manufacturers seek to enhance productivity through automation and real-time data analysis.

b. The global coordinate measuring machine market size was estimated at USD 3.20 billion in 2023 and is expected to reach USD 3.44 billion in 2024.

b. The global coordinate measuring machine market is expected to grow at a compound annual growth rate of 8.7% from 2024 to 2030, reaching USD 5.68 billion by 2030.

b. North America dominated the coordinate measuring machine (CMM) market, with a share of 35.1% in 2023. This dominance is fueled by a robust and technologically advanced manufacturing sector, particularly in the aerospace, automotive, and medical device industries. Stringent quality control regulations and a culture of precision manufacturing necessitate the adoption of advanced CMM technology.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."