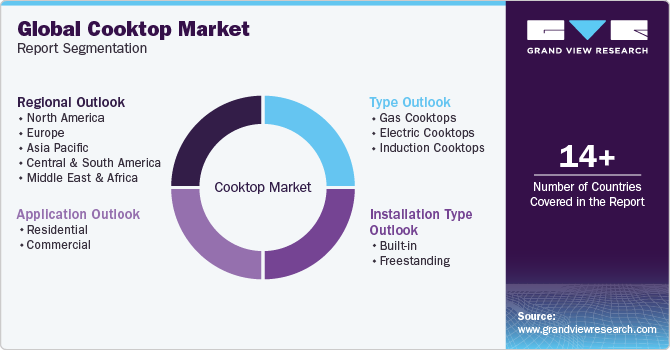

Cooktop Market Size, Share & Trends Analysis Report By Type (Gas Cooktops, Induction Cooktops), By Installation Type (Built-in, Freestanding), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-302-3

- Number of Report Pages: 88

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Cooktop Market Size & Trends

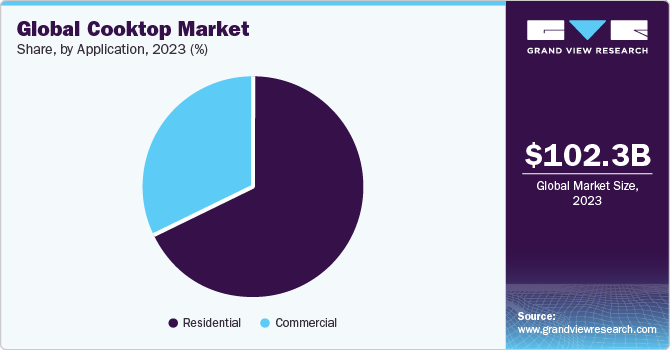

The global cooktop market size was estimated at USD 102.29 billion in 2023 and is expected to grow at a CAGR of 7.8% from 2024 to 2030. Technological advancements and innovation in cooktop features, such as induction cooking, smart connectivity, and energy efficiency, are also major drivers, appealing to tech-savvy and environmentally conscious consumers. The increasing availability of diverse designs and customizable options caters to varying aesthetic preferences and kitchen layouts, making cooktops an attractive choice for home renovators and new homeowners.

The rapid expansion of the commercial sector, especially the hospitality industry, is creating a growing demand for various kinds of cooktops. The hotel construction pipeline in the U.S. is experiencing consistent growth, as highlighted by Lodging Econometrics (LE) in January 2024. By the end of the third quarter of 2023, the U.S. had 59,569 operational hotels. Similarly, Europe saw the opening of 316 new hotels in 2023, with the region’s total pipeline standing at 1,706 projects at the end of the fourth quarter of 2023, according to Lodging Econometrics. This significant development of hotels and commercial kitchens has prompted the need for various types of cooktops, such as induction cooktops, gas ranges, and electric cooktops, to support the constant inflow of guests and patrons.

An increasing number of consumers have been cooking their food in the recent past. This could be due to growing health consciousness and the desire to eat nutritious home-cooked meals, the need to avoid food from unhygienic environments or places that use unhealthy ingredients and practices, and the rising costs of eating out.

According to the 2020 Residential Energy Consumption Survey (RECS) released by the U.S. Energy Information Administration (EIA) in August 2022, approximately 79% of households in the U.S. prepared at least one hot meal at home every day. Furthermore, households in the New England Census Division and the Pacific Census Division were generally more inclined to prepare hot meals at home daily. The need to cook multiple meals a day and the preference for freshly prepared food are key factors driving the regular use of and demand for cooktops.

Market key players strategically leverage trade shows as integral platforms for driving sales and showcasing their product offerings. These trade shows serve as vital opportunities for manufacturers and distributors to engage with potential customers, industry professionals, and stakeholders in a focused and immersive environment. By participating in trade shows, key players can effectively demonstrate the features, functionality, and innovative aspects of their cooktops, thereby generating interest and excitement among attendees.

Furthermore, trade shows facilitate networking opportunities, allowing companies to connect with industry peers, prospective partners, and suppliers. For instance, in February 2023, Samsung Electronics Co. unveiled groundbreaking innovations at the Kitchen & Bath Industry Show (KBIS) 2023 in Las Vegas, Nevada, setting new standards for sustainable, intelligent, and tailored living solutions.

Market Concentration & Characteristics

The degree of innovation in the market is notably high, characterized by the integration of advanced technologies and design enhancements aimed at improving cooking efficiency, safety, and user experience. Induction cooktops, which offer rapid heating and precise temperature control, represent a significant innovation, attracting consumers seeking both performance and energy efficiency. Smart cooktops equipped with Wi-Fi and Bluetooth connectivity enable remote monitoring and control via smartphone apps, aligning with the broader trend of smart home integration. Additionally, features like touch controls, customizable cooking zones, and built-in safety mechanisms, such as automatic shut-off and child locks, enhance functionality and user convenience.

Regulation significantly impacts the market by setting standards for safety, energy efficiency, and environmental sustainability that manufacturers must adhere to. Agencies such as the U.S. Department of Energy (DOE) and the Environmental Protection Agency (EPA) enforce guidelines that ensure cooktops meet specific energy consumption criteria, pushing companies to innovate and develop more energy-efficient models. Safety regulations mandate features like automatic shut-off and child locks, enhancing consumer confidence and driving demand for compliant products. Environmental regulations also encourage the reduction of harmful emissions and the use of eco-friendly materials, promoting the development of sustainable cooktops.

The end-user concentration in the market is primarily focused on homeowners, professional chefs, and culinary enthusiasts who seek high-quality, efficient, and aesthetically pleasing cooking solutions. Homeowners, particularly those engaged in kitchen renovations or new home constructions, represent a significant segment, driven by the desire for modern, stylish, and energy-efficient appliances. Professional chefs and serious home cooks demand advanced features, such as precise temperature control and induction technology, that support sophisticated cooking techniques.

Type Insights

The gas cooktops accounted for a revenue share of around 44% in 2023. The demand for gas cooktops is driven by their precise and instant temperature control, which appeals to both professional chefs and home cooks seeking reliable and responsive cooking performance. Additionally, gas cooktops are often favored for their durability, cost-effectiveness, and ability to function during power outages, making them a practical choice for many consumers. Recognizing this trend, in November 2023, ZLINE, a pioneering luxury kitchen and bath appliance brand, introduced an innovative Professional Gas Ranges (SGR) line. These ranges, meticulously crafted for style and reliability, cater to the evolving needs of modern homeowners, and offer enhanced culinary experience at home.

The induction cooktops segment is projected to grow at a CAGR of 10.3% from 2024 to 2030. The demand for induction cooktops is driven by their energy efficiency and rapid cooking capabilities, which appeal to environmentally conscious and time-sensitive consumers. Their precise temperature control and safety features, such as cool-to-touch surfaces, make them attractive to families and culinary enthusiasts seeking both performance and safety. Additionally, the sleek and modern design of induction cooktops fits well with contemporary kitchen aesthetics, appealing to homeowners looking to upgrade their kitchen space.

Installation Type Insights

The built-in cooktop accounted for a revenue share of around 65% in the 2023. The demand is expected to be driven by the increasing focus on kitchen aesthetics and design, with consumers seeking sleek and modern appliances that seamlessly integrate into their kitchen spaces. The benefits of style, functionality, and smart home technology that come with built-in cooktops are boosting the segment’s growth.

The freestanding cooktop is projected to grow at a CAGR of 7.1% from 2024 to 2030. The demand for free-standing cooktops is driven by their flexibility in kitchen layout and ease of installation, making them an ideal choice for both renters and homeowners looking for convenient and versatile cooking solutions. These cooktops often come with integrated ovens, providing an all-in-one appliance that maximizes space efficiency, especially in smaller kitchens. Additionally, the variety of styles, features, and price points available in free-standing cooktops cater to a wide range of consumer preferences and budgets, enhancing their appeal across different market segments.

Application Insights

Residential application of cooktop accounted for a revenue share of around 68% in 2023. New players are venturing into the market, particularly within the residential category of cooktops, with the launch of multi-functional and convenient designs in cooktops. In June 2023, the popular culinary TV show MasterChef revolutionized Indian kitchens by bringing professional-level performance, quality, and precision to home cooking. It introduced a diverse range of home appliances and cookware on Flipkart, an Indian e-commerce marketplace. The brand introduced various small kitchen appliances, including induction and gas cooktops.

The demand for cooktop in commercial application is expected to grow at a CAGR of 7.8% from 2024 to 2030. This is driven by the need for high-performance, durable, and energy-efficient appliances capable of handling the rigorous demands of professional kitchens. Restaurants, catering services, and hospitality businesses require advanced cooktops with precise temperature control, rapid heating capabilities, and robust construction to ensure efficient and consistent food preparation. Additionally, the trend towards open kitchen designs in restaurants, where cooking becomes a part of the dining experience, increases the demand for aesthetically pleasing and reliable cooktops that can withstand constant use while enhancing the overall ambiance.

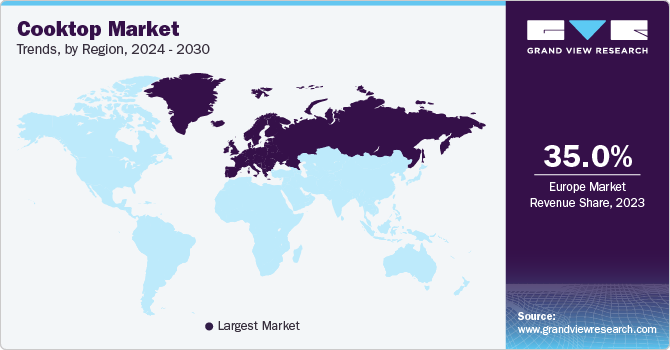

Regional Insights

The cooktop market in North America accounted for a share of 21% of the global revenue in 2023. The downsizing of living spaces in North America has compelled people to seek compact home appliances, including efficient and space-saving cooktops. In response to these changing demands, Danby, a well-known refrigeration and specialized appliance manufacturer in North America, has been producing European-sized appliances for 75 years. Its small cooktops and appliances are designed for contemporary kitchens and provide creative solutions for apartments and smaller households.

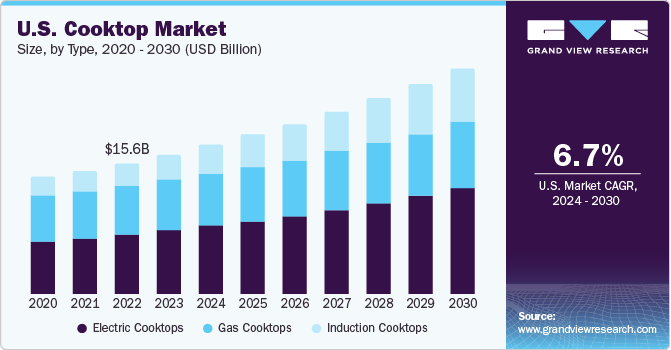

U.S. Cooktop Market Trends

The cooktop market in the U.S. is expected to grow at a CAGR of 6.7% from 2024 to 2030. The new stringent energy standards proposed by the U.S. Department of Energy have led to a rise in demand for induction cooktops in the U.S. Home cooks, concerned about losing their favorite gas ranges, are exploring alternative options. Induction cooking, once considered a high-end feature, has become more popular.

Europe Cooktop Market Trends

The Europe cooktop market emerged and accounted for a revenue share of around 35% in 2023. People across European countries spend a lot of time enjoying a meal with their peers, family, and friends at social gatherings. This rich dining culture not only means a lot more consumers cook and eat meals at home, but it has also led to the opening up of numerous restaurants across the region. This scenario has positively impacted the cooktops market in Europe.

Asia Pacific Cooktop Market Trends

The Asia Pacific cooktop market is projected to grow at a CAGR of 9.7% from 2024 to 2030. The growing number of hotels, resorts, and service apartments in the region drives the demand for cooktops and other kitchen appliances in commercial applications. Rapid growth in emerging economies, coupled with increasing tourism activities, contribute to the expansion of the hospitality sector, further presenting lucrative opportunities for manufacturers to penetrate new markets and expand their customer base.

Key Cooktop Company Insights

The market features both established global firms and emerging players. Key industry leaders prioritize product innovation, differentiation, and distinctive designs in line with evolving consumer preferences. These major players leverage extensive global distribution networks to reach diverse customer bases and tap into emerging markets.

Key Cooktop Companies:

The following are the leading companies in the cooktop market. These companies collectively hold the largest market share and dictate industry trends.

- BSH Hausgeräte GmbH

- Miele & Cie. KG

- Whirlpool Corporation

- Electrolux AB

- Haier

- Samsung

- Sub-Zero Group, Inc.

- Panasonic Holdings Corporation

- Versuni Holding B.V.

- Smeg S.p.A

Recent Developments:

-

In April 2024,Whirlpool Corporation announced the completion of its transaction with Arçelik A.Ş, resulting in the creation of a new European appliance company called Beko Europe B.V. Whirlpool Corporation now holds a 25 percent stake in Beko Europe B.V., with Arçelik owning the remaining 75 percent. This merger combines Whirlpool Corporation's European appliance business with Arçelik's consumer electronics and small domestic appliance businesses.

-

In February 2024,Samsung announced that 11 of its induction cooking products had received ENERGY STAR certifications, including one induction cooktop and 10 induction ranges. This certification underscores Samsung's commitment to sustainability and energy efficiency. The company also announced the launch of new energy-efficient products, such as the Bespoke AI Slide-In Induction Range, and introduced home energy monitoring and management settings through SmartThings Energy.

Cooktop Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 109.71 billion |

|

Revenue forecast in 2030 |

USD 172.51 billion |

|

Growth rate |

CAGR of 7.8% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, installation type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; South Africa |

|

Key companies profiled |

BSH Hausgeräte GmbH; Miele & Cie. KG; Whirlpool Corporation; Electrolux AB; Haier; Samsung; Sub-Zero Group, Inc.; Panasonic Holdings Corporation; Versuni Holding B.V.; and Smeg S.p.A |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cooktop Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cooktop market based on the type, installation type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Gas Cooktops

-

Electric Cooktops

-

Induction Cooktops

-

-

Installation Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Built-in

-

Freestanding

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cooktop market was estimated at USD 102.29 billion in 2023 and is expected to reach USD 109.71 billion in 2024.

b. The global cooktop market is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030 to reach USD 172.51 billion by 2030.

b. Europe dominated the cooktop market with a share of around 35% in 2023. Regulatory measures aimed at encouraging the adoption of cleaner energy solutions and decreasing the dependence on gas for cooking and heating purposes are key factors influencing the cooktop market in Europe.

b. Some of the key players operating in the cooktop market include BSH Hausgeräte GmbH; Miele & Cie. KG; Whirlpool Corporation; Electrolux AB; Haier; Samsung; Sub-Zero Group, Inc.; Panasonic Holdings Corporation; Versuni Holding B.V.; Smeg S.p.A.

b. Key factors that are driving the cooktop market growth include rising preference for technologically advanced cooking methods and energy-efficient appliances. In addition, the hospitality sector's demand for high-quality cooktops designed for commercial applications is driving market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."