- Home

- »

- Consumer F&B

- »

-

Cooking Wine Market Size, Share, Industry Report, 2030GVR Report cover

![Cooking Wine Market Size, Share & Trends Report]()

Cooking Wine Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Dessert Wine, White Wine, Red Wine, Others), By Application (B2B, B2C), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68038-202-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cooking Wine Market Size & Trends

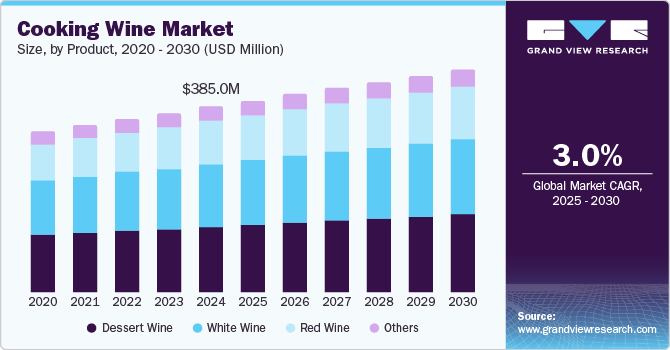

The global cooking wine market size was valued at USD 385.0 million in 2024 and is projected to grow at a CAGR of 3.0% from 2025 to 2030. Increasing globalization of different cuisines and awareness regarding the taste and nutritional benefits of wines in culinary preparations have created a steady demand for cooking wines worldwide. Additionally, rising disposable income levels of consumers and changing lifestyle patterns have created the trend of premiumization in food purchases, leading to the launch of high-quality and premium products. This is especially evident in developed markets such as North America and Europe, where consumers are willing to pay more for premium or artisanal cooking wines.

The growing demographic of health-conscious individuals globally has increased interest in alcohol-free and low-alcohol cooking wines. These products provide the same depth of flavor without the effects of conventional alcohol, making them appealing to those who avoid alcohol for health, religious, or personal reasons. Compared to regular wine, cooking wine has more salt and preservatives, such as sodium and sulfites, to help preserve the wine and prevent its spoilage once opened. Furthermore, it may contain added sugar or flavor enhancers, aiming to enhance the dishes' flavors, such as tenderizing meat or providing a deep umami or acidity to sauces. The rising popularity of food influencers, YouTube channels, and Instagram cooking tutorials has made cooking techniques, recipes, and ingredients, including cooking wines, more accessible to consumers. Thus, social media channels continue to shape food trends, increasing consumer awareness regarding cooking wines.

The steadily expanding global foodservice industry, owing to the presence of international chains and independent restaurants that are incorporating diverse culinary styles, presents another avenue for the growth of the cooking wine industry. These restaurants generally use wine in cooking as part of their menu offerings to appeal to consumers seeking authentic or fusion dishes, increasing the availability of both local and imported cooking wines. Manufacturers are launching a range of products to cater to the demand from both eating establishments and households. Chefs and restaurants extensively use wines to create sauces, marinades, and reductions or to deglaze pans for flavor development. High-end and specialty restaurants incorporate premium wines in their preparations to make complex dishes, while casual dining establishments use affordable options in large quantities.

There is growing innovation in the types of wines used for cooking. For instance, some companies are creating cooking wine blends that combine different varieties of wine to provide a more tailored flavor experience for different dishes. Additionally, cooking wines with reduced alcohol or special blends designed for specific applications, such as Asian, Mediterranean, or French cuisines, are gaining popularity. Increasing availability of ready-to-use wine products, such as cooking wine sprays or pre-mixed wine-based sauces, makes it easier for home cooks and busy professionals to use wine in cooking without opening a full bottle, adding convenience to the process. Such developments are expected to boost further expansion of the global market for cooking wines in the coming years.

Product Insights

The dessert wine segment accounted for the largest revenue share of 35.5% in the global cooking wine industry in 2024. Increasing consumer interest in gourmet cooking and preparation of restaurant-quality dishes at home has created a sustained demand for dessert wines such as Sauternes, Port, Moscato, and Sherry. These products are widely used in recipes to add richness, sweetness, and complexity to flavors. Dessert wines are considered especially valuable in sauces, dessert fillings, and caramel reductions. They are known for their sweetness and complex flavor profiles, making them an ideal ingredient for adding richness to dishes. They can be used in sauces as a wine reduction, as well as in caramel, ice creams, and custards. The balance of sweetness and acidity in such products elevates the flavor profile of various culinary preparations, aiding their demand.

Meanwhile, the red wine segment is anticipated to grow at the fastest CAGR during the forecast period in the global market. Red wine has been an essential ingredient in several classic European dishes, particularly in French, Italian, and Spanish cuisines. Recipes such as coq au vin, beef bourguignon, and osso buco are heavily reliant on the depth of flavor that red wine imparts to the dish. The continued growth in the popularity of these cuisines worldwide has thus driven sales of red wine in recent years. Red wine, particularly its dry varieties such as Cabernet Sauvignon and Merlot, is often associated with potential health benefits due to its antioxidant content, which is believed to support heart health. This has led to an increased perception of red wine as a healthier option in cooking compared to other alcohol-based ingredients. This form of wine provides a unique tannic bitterness and acidity, which can balance and enhance the flavors of both savory and sweet foods.

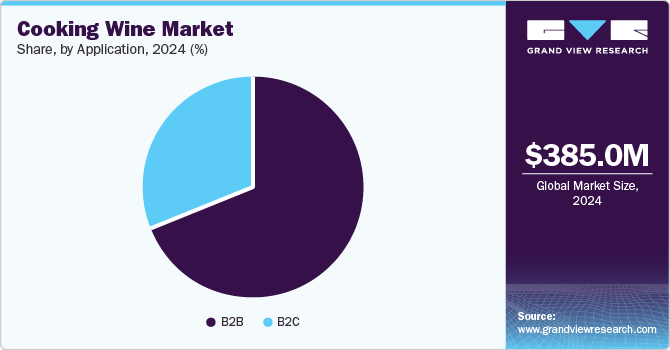

Application Insights

The B2B segment accounted for the largest revenue share in the global market in 2024, aided by rising product demand among restaurants, food service providers, catering companies, and food manufacturers. Businesses in these sectors purchase cooking wines to enhance the flavor of their dishes and for practical, cost-effective purposes. Cooking wines appeal to restaurants and catering establishments as they help reduce the cost of ingredients. Moreover, these ingredients often have a longer shelf life than regular wines due to their added preservatives and high salt content. This makes them a practical choice for commercial kitchens, which may not utilize large amounts of wine daily. The extended shelf life thus reduces waste and helps food service providers manage their inventory more effectively. Cooking wines are considered a staple ingredient among businesses specializing in French, Italian, Spanish, or other Mediterranean cuisines.

The B2C segment, on the other hand, is expected to grow at the highest CAGR from 2025 to 2030 in the global cooking wine industry. Factors such as consumer interest in home cooking, the emergence of novel food preparation trends, and the increased popularity of gourmet and health-conscious culinary practices have created a strong demand for these products among households. The high affordability of cooking wines has made them popular among consumers, who may not want to invest in expensive wines solely for cooking purposes. Cooking wines are also in significant demand during special occasions or holidays, when people prepare elaborate meals such as roasts and slow-cooked stews. Such dishes often require wine to add complexity to the flavor, leading to the use of cooking wines.

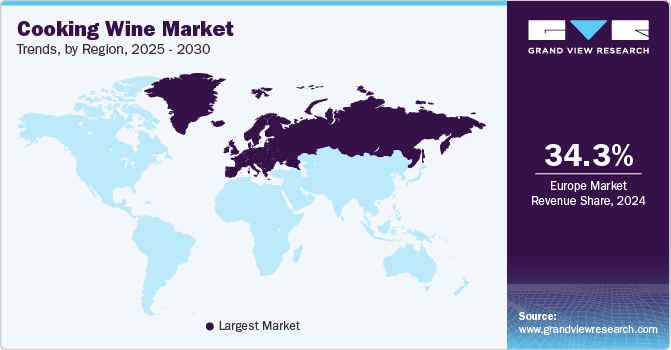

Regional Insights

The Europe cooking wine market accounted for the largest global revenue share of 34.3% in 2024, owing to the widespread incorporation of different wine varieties as ingredients in regional cuisines. Wine has traditionally been a key ingredient in many European culinary preparations. Cooking with wine is embedded in culinary traditions in countries such as France, Italy, Spain, and Portugal. For example, in French cooking, red Bordeaux or white Burgundy wines are commonly used in sauces, stews, and marinades, while Italian consumers use wines such as Chianti or Marsala in a wide variety of dishes. A shift toward healthier eating habits among regional consumers is another notable market driver that has helped influence the cooking approach with wine. The demand for premium cooking wines among high-income groups also aids regional market expansion as consumers become more particular about the ingredients they use in their cooking.

The U.K. accounted for a leading revenue share in the regional market in 2024, owing to the popularization of home cooking trends encouraging British consumers to experiment with different cuisines and cooking techniques. This interest in creating restaurant-style meals at home often includes using cooking wines to enhance flavor in dishes such as stews, sauces, and marinades. Moreover, the increasing sophistication of British cooking, especially among younger generations and food enthusiasts, has boosted the use of cooking wines to elevate home-cooked meals. A strong restaurant and pub culture in the economy further drives the consumption of cooking wines in such establishments. On the other hand, manufacturers are also increasing product availability in retail and grocery stores to cater to the home cooking demographic.

North America Cooking Wine Market Trends

North America cooking wine market accounted for a substantial revenue share in the global market in 2024. The steadily growing use of wines designed for cooking in households across the U.S. and Canada, coupled with the presence of several local manufacturers, aids market growth in the region. Consumers are exploring more diverse and international cuisines due to globalization trends, leading to the rising popularity of Mediterranean, French, and Italian dishes, which often require wine in their preparations. A substantial portion of consumers in North America is increasingly focusing on health and wellness, which influences their alcohol consumption patterns. As a result, non-alcoholic or low-alcohol cooking wines have become more popular, especially among health-conscious individuals or those avoiding alcohol for medical or lifestyle reasons.

U.S. Cooking Wine Market Trends

The U.S. cooking wine market accounted for a dominant revenue share in the North American cooking wine industry in 2024. In recent years, there has been a growing trend of U.S. consumers aiming to recreate gourmet dishes at home. Cooking with wine, especially in dishes such as beef bourguignon or coq au vin, is an effective and convenient way to elevate home-cooked meals. Popular wine-based sauces, such as red wine reductions, beurre blanc, and Marsala sauce, have become a standard presence in many restaurants across the country, especially those serving European or Mediterranean cuisine. These sauces require specific types of cooking wines to create the right flavor profile. Products made with sustainable farming practices, as well as those that use minimalistic or recycled packaging, present another avenue for market expansion in the U.S.

Asia Pacific Cooking Wine Market Trends

Asia Pacific is expected to grow at the highest CAGR in the cooking wine market during the forecast period. The increasing presence of restaurants and hotels influenced by Western cultures in fast-developing economies such as India and China has helped create a steady demand for ingredients such as cooking wines. Furthermore, Asian economies also have a well-defined culture of using wines, such as Shaoxing wine in China and sake and mirin in Japan, to prepare food items. These wines are commonly used in marinades, stir-fries, sauces, and soups to add depth of flavor, tenderize meat, and balance the dish's flavors. The continued growth of the middle-class and high-income demographics presents promising opportunities for market players to sell their cooking wines in this region. In fast-growing economies such as India, Indonesia, and the Philippines, cooking wines remain relatively affordable, making them accessible to a broader demographic.

China accounted for the largest revenue share in the Asia Pacific market for cooking wines in 2024. The rapidly expanding urban population in the country and the subsequent demand for premium cooking ingredients have compelled local manufacturers to expand their offerings in this market. Shaoxing wine is a staple in Chinese cooking, particularly in soups, braised dishes, marinades, and stir-fries. It has been used in Chinese cuisine for centuries and is regarded for its ability to enhance flavors and tenderize meat. Additionally, the emergence of online shopping platforms such as Taobao, JD.com, and Tmall has made cooking wines more accessible to consumers in urban and rural areas. Consumers can now access a broader range of cooking wines from different regions of China or overseas without needing to visit specialty stores, driving product sales through the B2C segment.

Key Cooking Wine Company Insights

Some major companies involved in the global cooking wine industry include AAK AB, Batory Foods, and Stratas Foods, among others.

-

AAK AB is a global producer of specialty vegetable oils and fats headquartered in Malmö, Sweden. The company is extensively involved in developing products catering to various segments, including bakery, chocolate and confectionery, foodservice and retail, dairy and ice cream, animal nutrition, special nutrition, and personal care. In the foodservice & retail category, AAK AB makes frying oils and shortenings, mayonnaise and dressings, margarines, spreads, sauces and condiments, specialty oils, and wine vinegars. Vinegar offerings include balsamic vinegar, white balsamic vinegar, organic apple cider vinegar, champagne wine vinegar, and sherry wine vinegar.

-

Stratas Foods is a U.S.-based supplier of specialty food ingredients, primarily focusing on fats, oils, dressings, sauces, and mayonnaise offerings. The company extensively caters to foodservice, food ingredients, and retail segments. Stratas Foods has a range of vinegar products, including Admiration Vinegars, Viva Vinegars, and Petria Vinegar. The Admiration Vinegar category includes Apple Cider Flavored Vinegar, Cider Flavored Vinegar, Distilled White Vinegar, Red Italian Style Vinegar, Sherry Cooking Wine, and White Cooking Wine.

Key Cooking Wine Companies:

The following are the leading companies in the cooking wine market. These companies collectively hold the largest market share and dictate industry trends.

- AAK AB

- Batory Foods

- PALMETTO CANNING

- ECOVINAL, S.L.U.

- Elegre

- Iberica Export

- Marina Foods, Inc.

- Stratas Foods

- The Kroger Co.

- Mizkan America Inc.

- Roland Foods, LLC

Recent Developments

-

In October 2024, AAK announced the divestment of its Foodservice facility in New Jersey, the U.S., with the company signing an agreement with Stratas Foods for this acquisition. This development is part of AAK’s long-term strategy to optimize its operations in the Foodservice segment, which manufactures more than 300 specialty products, including condiments, dressings, sauces, frying oils, cooking wines, and ingredients. The company simultaneously announced plans to invest significantly in its European Foodservice division, thus strengthening its presence in the Nordic region and the UK.

-

In June 2023, Batory Foods announced the acquisition of Tri-State Companies, a notable distributor and logistics provider for food ingredients based in Ohio. The addition of Tri-State’s 100,000-square-foot, multi-temperature zone distribution center has helped strengthen Batory’s services in the Midwest, Northeast, and Southeast U.S.

Cooking Wine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 397.9 million

Revenue forecast in 2030

USD 462.3 million

Growth Rate

CAGR of 3.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

February 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, Saudi Arabia

Key companies profiled

AAK AB; Batory Foods; PALMETTO CANNING; ECOVINAL, S.L.U.; Elegre; Iberica Export; Marina Foods, Inc.; Stratas Foods; The Kroger Co.; Mizkan America Inc.; Roland Foods, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cooking Wine Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cooking wine market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dessert Wine

-

White Wine

-

Red Wine

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

B2C

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.