- Home

- »

- Consumer F&B

- »

-

Cooking Oil Market Size, Share And Growth Report, 2030GVR Report cover

![Cooking Oil Market Size, Share & Trends Report]()

Cooking Oil Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Soybean Oil, Sunflower Oil), By Packaging (Bottles, Pouches, Cans, Jars), By End-use (Residential, Commercial), By Processing Type, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-427-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cooking Oil Market Summary

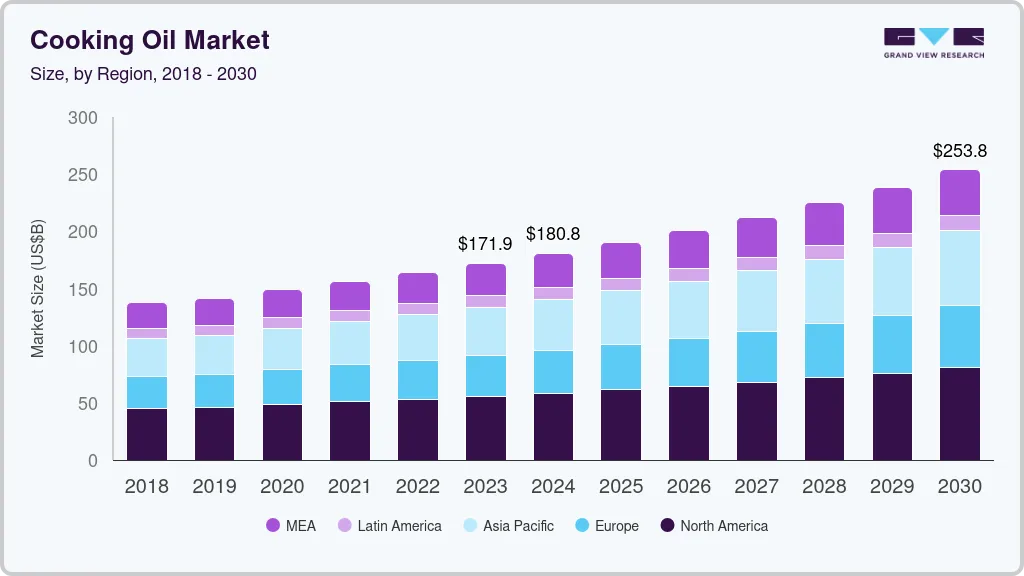

The global cooking oil market size was estimated at USD 171,938.3 million in 2023 and is projected to reach USD 253,750.0 million by 2030, growing at a CAGR of 5.8% from 2024 to 2030. The demand for cooking oil is steadily increasing due to several key factors. Population growth is a primary driver, as a larger global population naturally leads to higher consumption of essential food items, including cooking oil.

Key Market Trends & Insights

- North America dominated the cooking oil market with the revenue share of 32.4% in 2023.

- Asia Pacific region is expected to exhibit the fastest CAGR of 6.7% from 2024 to 2030.

- Based on processing type, the refined segment led the market with the largest revenue share of 80.2% in 2023.

- Based on packaging, the bottles segment led the market with the largest revenue share of 42.4% in 2023.

- Based on end use, the commercial segment led the market with the largest revenue share of 72.6% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 171,938.3 Million

- 2030 Projected Market Size: USD 253,750.0 Million

- CAGR (2024-2030): 5.8%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

In addition, urbanization and changing lifestyles have shifted dietary patterns, with more people consuming processed and convenience foods that often require the use of cooking oil. The rise in disposable incomes, particularly in developing countries, has also allowed consumers to spend more on food, leading to greater demand for higher-quality and specialty oils.

A wide variety of cooking oils are available on the market, catering to different culinary needs and preferences. Common vegetable oils include palm oil, soybean oil, sunflower oil, and canola (rapeseed) oil, all of which are widely used for cooking, frying, and in processed foods. Olive oil, known for its health benefits, is a staple in Mediterranean cooking, while coconut oil is popular for its use in both culinary and health and beauty products. Animal-based oils like butter, ghee, and lard are also used in traditional cooking methods in various cultures. Moreover, specialty oils such as avocado, flaxseed, and grapeseed oil are favored in health-conscious markets for their nutritional properties.

Globally, palm oil stands out as the most consumed cooking oil. Its popularity is due to its affordability, versatility, and stability at high temperatures, making it a preferred choice for both household cooking and industrial food production. Palm oil is also a key ingredient in a wide range of processed foods and non-food products, including soaps and cosmetics, contributing to its high global consumption.

Several factors and trends are driving the increasing demand for cooking oils. Price and affordability play a significant role, especially in the widespread use of palm oil. Health trends are also influential, with consumers increasingly opting for oils rich in unsaturated fats, such as olive and avocado oil, due to their perceived health benefits. The growing popularity of convenience and ready-to-eat foods has further fueled the demand for oils used in their production. In addition, sustainability and ethical sourcing are becoming more important to consumers, leading to a rise in demand for sustainably sourced oils. Culinary trends and the global influence of diverse cuisines have also contributed to the popularity of specific oils like olive and sesame oil. Finally, the use of cooking oils in biofuel production, particularly soybean and palm oil, adds another dimension to their demand.

Type Insights

Based on type, the palm oil segment led the market with the largest revenue share of 28.5% in 2023. Palm oil is one of the most cost-effective vegetable oils available, making it a popular choice for both consumers and industries, especially in developing countries.It is incredibly versatile and used in a wide array of products beyond cooking oil, including processed foods, snacks, margarine, and baked goods. Its ability to remain stable at high temperatures makes it ideal for frying and other cooking methods.

The sunflower oil segment is expected to grow at the fastest CAGR of 6.8% from 2024 to 2030. Sunflower oil is high in unsaturated fats, particularly omega-6 fatty acids, and low in saturated fats, making it a popular choice among health-conscious consumers who seek heart-healthy cooking options.As consumers become more aware of healthy cooking oils, sunflower oil is gaining popularity. Its increased availability in supermarkets and grocery stores has also contributed to its rising demand.

Processing Type Insights

Based on processing type, the refined segment led the market with the largest revenue share of 80.2% in 2023. Refined oils are processed to remove impurities, which extends their shelf life and makes them more stable for long-term storage and use, especially in tropical and warm climates.Refining removes strong flavors and odors from the oil, making it ideal for cooking a wide variety of dishes without altering the taste, which is particularly appealing to consumers and food manufacturers.

The unrefined segment is expected to grow at the fastest CAGR of 6.2% from 2024 to 2030. Unrefined oils are often associated with organic and sustainably produced products, which align with the values of consumers who prioritize environmentally friendly and ethically produced goods. These oils maintain the natural flavor and aroma of the source ingredient, which is appealing to those who prefer authentic and natural tastes in their cooking. In August 2023, Tata Consumer Products (TCP) expanded into the premium cold-pressed oils market with the launch of its new range under the brand Tata Simply Better. This collection features four 100% pure and unrefined cold-pressed oils: Virgin Cold-Pressed Coconut Oil, Cold-Pressed Groundnut Oil, Cold-Pressed Mustard Oil, and Cold-Pressed Sesame (Gingelly) Oil.

Packaging Insights

Based on packaging, the bottles segment led the market with the largest revenue share of 42.4% in 2023. Bottled cooking oil is easy to handle, pour, and store, making it convenient for both home use and commercial kitchens. The packaging allows for easy dispensing and minimizes spills. Glass bottles, in particular, help preserve the freshness and quality of the oil by protecting it from light and air, which can cause oxidation and spoilage. PET bottles, while less protective than glass, are still preferred for their ability to keep the oil sealed and safe.

The pouches segment is expected to grow at the fastest CAGR of 6.3% from 2024 to 2030. Pouches generally cost less to produce and transport compared to rigid packaging like glass bottles or plastic containers. This cost savings can be passed on to consumers, making pouches a more economical option.Modern pouches are designed to be leak-proof and secure, minimizing the risk of spills and ensuring the oil remains clean and uncontaminated. This makes them a practical choice for both home use and transport.

End-use Insights

Based on end use, the commercial segment led the market with the largest revenue share of 72.6% in 2023. Commercial kitchens often prepare large quantities of food, and cooking oil is essential for frying, sautéing, and other cooking methods that require high heat. Its ability to handle large volumes makes it indispensable in restaurants, hotels, and food service establishments.

The residential segment is expected to grow at the fastest CAGR of 6.1% from 2024 to 2030. Many types of cooking oil, such as olive oil, contain healthy fats and beneficial nutrients. Consumers often choose cooking oils based on their nutritional profiles, preferring oils that contribute to a balanced diet.Cooking oil is essential for a wide range of cooking techniques, including frying, baking, and grilling. Its versatility makes it a staple in home kitchens for preparing various types of meals.

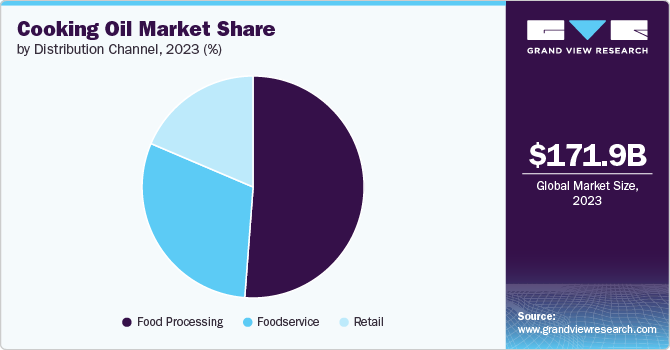

Distribution Channel Insights

Based on distribution channel, the food processing channel segment led the market with the largest revenue share of 51.2% in 2023. Food processing centers ensure that cooking oil is refined and processed under strict quality control standards. This helps maintain high quality, safety, and consistency, which are crucial for consumer confidence and satisfaction.

The food service segment is expected to grow at the fastest CAGR of 6.6% from 2024 to 2030. Food services typically purchase cooking oil in large quantities, which is more cost-effective compared to buying smaller amounts. This is particularly beneficial for commercial kitchens and restaurants that use oil extensively. Food services may offer specialty oils that are not commonly available in retail stores. This includes oils with specific flavor profiles or culinary properties that are essential for certain types of cuisine or cooking techniques.

Regional Insights

North America dominated the cooking oil market with the revenue share of 32.4% in 2023. In North America, cooking oil choices are influenced by factors such as flavor, health benefits, and cooking needs. Canola oil is popular for its neutral flavor, high smoke point, and heart-healthy profile, making it versatile for various cooking methods. Olive oil is favored for its distinct taste and health benefits, especially in Mediterranean cuisine. Vegetable oil is commonly used due to its cost-effectiveness, versatility, and neutral flavor, while avocado oil is gaining popularity for its high smoke point and nutritional value. Consumers select oils based on these attributes to suit their cooking preferences and health considerations.

U.S. Cooking Oil Market Trends

The cooking oil market in U.S. is expected to grow at the fastest CAGR during the forecast period. The demand for cooking oil in the U.S. is increasing. The expansion of the food service sector, including restaurants and fast-food chains, contributes to higher demand for cooking oil. The need for large quantities of oil for frying, sautéing, and other cooking methods drives increased purchases.As consumers become more health-conscious, there is a rising interest in oils that offer health benefits, such as those rich in unsaturated fats and antioxidants. This has led to increased demand for oils like olive oil and avocado oil.

Europe Cooking Oil Market Trends

The cooking oil market in Europe is expected to grow at a significant CAGR of 6.2% during the forecast period. European consumers are increasingly focused on health and nutrition, leading to a higher demand for oils with health benefits, such as those high in unsaturated fats and omega-3 fatty acids. This includes oils like olive oil, avocado oil, and flaxseed oil.The growth in plant-based and vegetarian diets across Europe has led to increased use of cooking oils as a primary source of healthy fats. Consumers following these diets often choose oils that align with their dietary preferences.

Asia Pacific Cooking Oil Market Trends

The cooking oil market in Asia Pacific is expected to grow at the fastest CAGR of 6.7% from 2024 to 2030. Rapid population growth and increasing urbanization in the Asia-Pacific region are driving higher food consumption, including cooking oil. As more people move to cities and adopt modern lifestyles, there is an increased need for cooking oil in both households and food service establishments.The region is experiencing shifts in dietary habits, including greater adoption of Western-style diets and more diverse culinary practices.

Key Cooking Oil Company Insights

The market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products. Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Cooking Oil Companies:

The following are the leading companies in the cooking oil market. These companies collectively hold the largest market share and dictate industry trends.

- Archer Daniels Midland Company

- Cargill, Incorporated

- Bunge Limited

- Wilmar International Limited

- Olam International Limited

- Marico

- Sime Darby Plantation

- Fuji Oil Group

- George Weston Foods Limited

- Nutiva

Recent Developments

-

In July 2024, Louis Dreyfus Company relaunched its edible oil brand, Vibhor, specifically targeting the North Indian market. This strategic move aims to cater to the growing demand for high-quality edible oils in the region. The company plans to offer Vibhor in various packaging options, including 1-liter, 5-liter, and 15-liter containers, to enhance accessibility for consumers. The brand will focus on promoting its health benefits and quality, leveraging the increasing consumer awareness regarding nutrition and wellness

-

In February 2023, Cargill India launched its first edible oil brand, Gemini Pureit, in South India, supported by a USD 35 million investment in an existing facility in Nellore, Andhra Pradesh. The sunflower oil will be produced at this plant and distributed across four South Indian states. Cargill plans to gradually increase investments in the region and expand its product range over the coming years

Cooking Oil Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 180.82 billion

Revenue forecast in 2030

USD 253.75 billion

Growth rate

CAGR of 5.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, processing type, packaging, end use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Archer Daniels Midland Company; Cargill, Incorporated; Bunge Limited; Wilmar International Limited; Olam International Limited; Marico; Sime Darby Plantation; Fuji Oil Group; George Weston Foods Limited; Nutiva

Customization scope

Free Report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Cooking Oil Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cooking oil market report based on type, processing type, packaging, end-use, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Soybean Oil

-

Sunflower Oil

-

Palm Oil

-

Olive Oil

-

Coconut Oil

-

Others

-

-

Processing Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Refined

-

Unrefined

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Pouches

-

Cans

-

Jars

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Food Processing

-

Food Service

-

Retail

-

Hypermarkets & Supermarkets

-

Convenience stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cooking oil market size was estimated at USD 171.94 billion in 2023 and is expected to reach USD 180.82 billion in 2024.

b. The global cooking oil market is expected to grow at a compounded growth rate of 5.8% from 2024 to 2030 to reach USD 253.75 billion by 2030.

b. Palm cooking oil accounted for a share of 28.1% in 2023. Palm oil production is more efficient than other vegetable oils, as palm trees produce a higher yield per hectare. This efficiency makes palm oil a more sustainable option for mass production, contributing to its widespread availability.hem a convenient choice for consumers looking to quickly purchase baking supplies.

b. Some key players operating in cooking oil market include Archer Daniels Midland Company, Cargill, Incorporated, Bunge Limited, Wilmar International Limited, and others.

b. Key factors that are driving the market growth include rising processed food consumtion among consumers and increasing health consiousness among consumers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.