- Home

- »

- Next Generation Technologies

- »

-

Conversational Systems Market Size, Industry Report, 2030GVR Report cover

![Conversational Systems Market Size, Share & Trends Report]()

Conversational Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Component, By Type (Text Assistant, Voice Assisted & Others), By Application (Branding & Advertisement, Customer Support & Personal Assistant), By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-864-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Conversational Systems Market Size & Trends

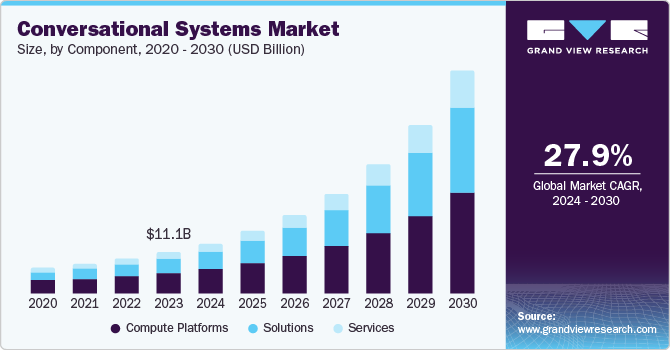

The global conversational systems market size was valued at USD 11.14 billion in 2023 and is projected to grow at a CAGR of 27.9% from 2024 to 2030. The growth is primarily driven by the rising demand for AI-powered customer support services, which enhance efficiency and customer satisfaction. The increased operational efficiency through task automation and cost reduction, improved accessibility via voice-based interactions, advancements in AI (Artificial Intelligence) and NLP (Natural Language Processing), and the rising demand for digital assistants across various industries are further driving the market growth.

Conversational systems can provide round-the-clock customer support, ensuring prompt responses to inquiries and issues. By analyzing customer data, these systems can offer tailored recommendations and solutions, improving customer satisfaction. Advanced NLP capabilities allow conversational systems to understand and respond to user queries in a more human-like manner. Conversational systems can automate routine tasks, such as answering FAQs and scheduling appointments, freeing up human agents to focus on more complex issues fueling the market growth. By automating processes, businesses can reduce operational costs and improve efficiency.

Conversational systems can be accessed through voice commands, making them accessible to individuals with disabilities or those who prefer hands-free interaction. Continued advancements in artificial intelligence and natural language processing are enabling more sophisticated conversational systems with improved understanding and response capabilities. The increasing popularity of smart home devices, such as smart speakers and virtual assistants, has created a demand for conversational systems that can interact with these devices seamlessly. Conversational systems are being widely adopted for customer support, providing efficient and personalized assistance driving the market growth.

Component Insights

Compute platforms dominated the market and accounted for a share of 49.4% in 2023. As voice assistants are being widely adopted for interacting with computing systems, numerous application developers are gearing up to deliver this increasingly critical functionality. Furthermore, vendors are focusing on providing customized text and voice interfaces on compute platforms. Also, businesses are widely adopting this platform owing to its user-friendly interface and it also allows agents to effectively react to the changing state of conversations.

Services are expected to register the fastest CAGR of 29.4% during the forecast period. With changing times, customers are expecting quality service anywhere, anytime, on the channel of their preference, and in the language of their choice. Businesses are widely adopting conversational services in order to provide immediate support to their customers and offer improved quality customer service. Increasing demand for customer services across the globe is anticipated to propel the adoption over the forecast period.

Type Insights

Text assistant conversational systems accounted for the largest market revenue share of 62.5% in 2023. In the text-assisted conversational systems, graphs, Graphics Interchange Format (GIF) files, and text messages are used to communicate with customers. Numerous website platforms, such as chatbots or personal assistants and live streaming solutions use text as one of the most significant mediums to interact with their clients. The text assistant systems can effectively integrate several accessible tools, such as prompts, user text instructions, and user dictionaries, to enable representatives to enhance and model text output applications by easily forming optimization data.

Voice assisted conversational systems are projected to grow at the fastest CAGR of 30.7% over the forecast period. The voice-assisted conversational systems are widely used by businesses to identify words or phrases in user-spoken languages and then convert that data into a machine-readable format. These AI-enabled voice-assisted systems are widely used in various applications, such as sales support, product marketing, and customer service applications. Powerful turning tools, custom voices, and multi-language capabilities are allowing vendors in improving their voice-assisted conversational systems’ productivity, thereby creating growth opportunities for the segment over the forecast period.

Application Insights

The customer support & personal assistant segmentdominated the market and accounted for a share of 33.3% in 2023 due to their ability to enhance customer satisfaction and efficiency. Conversational systems solutions are widely used in customer support and personal assistant applications as it quickly resolves customer queries and automatically route complex queries to support agents. Furthermore, these systems support and empower representatives to enhance customer service quality and improve organizational efficiency. Also, these systems assist support agents to focus on delivering personalized customer experiences.

The branding & advertisement segment is expected to register the fastest CAGR of 29.5% during the forecast period. Businesses are leveraging the conversational systems platform to generate awareness and post ads about the latest and forthcoming products through this digital channel. Furthermore, these systems can also be used by businesses for up-selling and cross-selling purposes leading to a drop in the operational cost. Businesses are widely adopting AI-based conversational systems to deliver an initial set of product information to the customers and identify their interest levels.

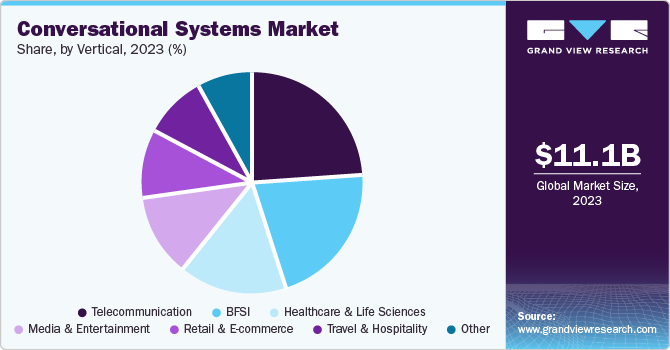

Vertical Insights

Telecommunication accounted for the largest market revenue share of 24.2% in 2023 due to the growing demand for efficient customer support and personalized services. Telecommunication industry players are widely adopting conversational systems to offer better value to their customers. Telecommunication businesses are increasingly serving larger user bases and areas. Nowadays, for the telecommunication industry, offering internet and phone services isn’t enough. Increasing focus on adopting new digital technologies coupled with the growing focus on improving customer experience is expected to drive the market growth in the telecommunication segment.

Retail & e-commerce is projected to grow at the fastest CAGR of 29.6% over the forecast period. The retail and e-commerce industry is adopting conversational systems as they held enable live chat support at the point of sale and drive customer purchase decisions with related recommendations. It also replicates in-store assistance on various digital channels, with a multilingual voice assistant. Furthermore, it helps retail and e-commerce businesses in saving customer support costs by automating common user queries to an advanced live agent system.

Regional Insights

North America dominated the global conversational systems market in 2023. The presence of leading technology companies, coupled with a strong focus on innovation and research, has contributed to the region's growth. The high adoption of smartphones, smart home devices, and other connected technologies has created a favorable environment for the adoption of conversational systems.

U.S. Conversational Systems Market Trends

The U.S. conversational systems market dominated the regional market in 2023.The country's strong R&D capabilities, coupled with a large consumer base and early adoption of new technologies, have made it an ideal environment for the development and deployment of conversational systems. Furthermore, the presence of major technology companies and venture capital firms in the U.S. has provided significant investment and support for the growth of this market.

Europe Conversational Systems Market Trends

Conversational systems market in the Europe was identified as a lucrative region in 2023 driven byincreasing digitalization, a focus on customer experience, and advancements in AI and NLP technologies. Moreover, government initiatives and regulations supporting digital transformation and innovation have created a favorable environment for the growth of conversational systems in Europe.

The Germany conversational systems market is expected to grow rapidly in the coming years. The country's high levels of industrialization and automation have created a demand for intelligent systems that can improve efficiency and productivity.

Asia Pacific Conversational Systems Market Trends

Conversational systems market in Asia Pacific is anticipated to witness significant growth driven by large and growing population, increasing digitalization, and rising disposable income. The region's diverse cultural and linguistic landscape has also spurred the development of multilingual conversational systems, making them more accessible to a wider range of consumers.

The India conversational systems market held a substantial market share in 2023.The country's growing middle class and increasing smartphone penetration have created a favorable environment for the adoption of conversational systems. Furthermore, India's strong IT industry and talent pool have contributed to the development of innovative conversational systems tailored to the region's specific needs and preferences.

Key Conversational Systems Company Insights

Joint ventures, product innovation, merger and acquisition, research and development, and geographical expansion are some of the prominent strategies adopted by key players to ensure long-term sustenance in the market. For instance, in April 2020, Amazon Web Services, Inc. opened its office in Milan, Italy. This is the company’s 76th availability zone within the 24 geographic regions around the world. This expansion enabled the company to serve data centers located in the country.

Numerous vendors are focusing on integrating various technologies, such as machine learning and natural language processing in their conversational systems solutions to increase their brand awareness. These solutions are widely used by end-use industries in branding and advertisement and customer support applications. Prominent players are focusing on expanding their solution offerings range. For instance, in May 2020, IBM Corporation introduced Watson AIOps, a product that leverages natural language understanding, machine learning, and AI technologies to automate IT operations.

Key Conversational Systems Companies:

The following are the leading companies in the conversational systems market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- TENEO.AI

- Baidu, Inc.

- Conversica, Inc.

- Google LLC

- IBM Corporation

- Microsoft Corporation

- Nuance Communications, Inc.

- Oracle

- SAP SE

Recent Developments

- In October 2023, Lumeto, announced an upgrade to InvolveXR platform. It is the first customizable conversational system, AI driven, for healthcare simulation in VR.

Conversational Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.55 billion

Revenue forecast in 2030

USD 59.35 billion

Growth rate

CAGR of 27.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, application, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; South Africa; UAE

Key companies profiled

Amazon Web Services; Inc.; TENEO.AI ; Baidu; Inc.; Conversica; Inc.; Google LLC; IBM Corporation; Microsoft Corporation; Nuance Communications; Inc.; Oracle; SAP SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Conversational Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global conversational systems market report based on component, type, application, vertical, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Compute Platforms

-

Solutions

-

Services

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Text Assistant

-

Voice Assisted

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Branding & Advertisement

-

Customer Support & Personal Assistant

-

Data Privacy & Compliance

-

Others

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Healthcare & Life Sciences

-

Media & Entertainment

-

Retail & E-commerce

-

Telecommunication

-

Travel & Hospitality

-

Other

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.