Conversational AI Market Size, Share & Trends Analysis Report By Component (Solutions, Managed Services, Professional Services), By Type, By Deployment, By Technology, By End User, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-944-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Conversational AI Market Size & Trends

The global conversational AI market size was estimated at USD 11.58 billion in 2024 and is anticipated to grow at a CAGR of 23.7% from 2025 to 2030. The key factors influencing the growth of the conversational AI industry are rising demand and reduced chatbot development costs, AI-powered customer support services, and omnichannel deployment. AI-powered messaging and speech-based apps are rapidly uprooting contemporary mobile and web applications and are consequently expected to emerge as a new mode of communication. Numerous industry leaders, including Google, Amazon, and Walmart, have successfully implemented conversational AI within their customer service operations. This strategic integration offers substantial advantages, such as 24/7 availability of intelligent chatbots, enabling rapid issue resolution and enhanced customer convenience. Furthermore, conversational AI facilitates personalized interactions by leveraging past customer preferences to tailor responses effectively. By concurrently serving multiple customers, conversational AI significantly minimizes wait times, thereby optimizing the overall customer experience.

In January 2024, Walmart leveraged Generative AI to enhance its customer experience, building upon a long history of AI/ML in retail. By understanding customer needs through NLP models and leveraging its vast data, Walmart can personalize product recommendations and streamline the shopping process. Walmart's GenAI Search allows customers to express their needs in natural language, generating comprehensive product lists and simplifying the decision-making process. This technology aims to save customers time and effort, enabling them to focus on enjoying life rather than spending hours shopping.

The creation of hybrid conversational AI models that mix generative and discriminative methods is rising. These models might be more effective and efficient when doing tasks like picture classification, language translation, and natural language processing. Many development initiatives are underway for the effective and efficient use of these technologies for enterprise use cases to solve actual business problems. Numerous generative Al businesses have emerged to use Al's capacity to provide human-like responses in a conversational context. It could transform how users communicate with technology by enabling more natural and human-like discussions that are catered to unique requirements and tastes.

Conversational AI excels as a foundation for co-pilot systems and digital assistants, enabling seamless interaction through natural language. These AI-powered tools enhance productivity across various domains, from customer service (e.g., Ada AI Agent) to professional software (e.g., Microsoft 365 Copilot) and software development (e.g., GitHub Copilot). Empirical evidence demonstrates significant productivity gains, with 70% of Microsoft 365 Copilot users reporting increased productivity and 88% of GitHub Copilot users experiencing faster work completion. For instance, Intellias leverages this technology through IntellAssistant, a platform that accelerates the development and deployment of custom digital assistants for clients, reducing development time from six months to just one by providing a pre-built infrastructure and customizable functionalities.

Public sector organizations are leaning increasingly towards using conversational AI platforms as governments worldwide attempt to allow broad-scale digital transformation and reimagine the citizen experience. The development of mobile devices and the rise of digital native populations are fostering a trend where individuals expect to be able to interact with their governments instantly online. More public sector organizations will adopt conversational Al to increase productivity and efficiency, improving the overall process of digitally providing citizen services to satisfy this demand.

The cognitive competencies of a conversational AI chatbot can be utilized in online assistance to consumers in their purchase journey. Nowadays, conversational AI products offer support for a restricted number of languages, and most virtual assistants and chatbots are better compatible with English. However, conversational AI offerings have initiated serving support for regional languages, and the implementation of these products is gaining significant prominence across the globe. Prominent market participants are focused on enhancing their product and service offerings. For instance, recently, support for seven new languages for actions on Google Assistant has been offered by Google. With this upgradation, Google currently delivers support for 16 languages.

Component Insights

The solution segment led the conversational AI industry in 2024, accounting for 61.1% share of the global revenue. The leading share is attributed to companies' large-scale implementation of in-house conversational AI technologies. Moreover, AI-enhanced support systems can offer users accessibility to services and round-the-clock assistance, enabling organizations to deliver dependable customer service. For instance, In January 2022, Visionstate Corp. introduced innovative Vicci 2.0, a state-of-the-art conversational chatbot artificial intelligence (AI) powered customer service kiosk. Visionstate is implementing this technology on its Vicci 2.0 platform to serve on-site customer service influenced by artificial intelligence. The Vicci 2.0 platform can back a broad range of consumers through its modification capability to support various languages.

The service segment registered a CAGR growth of 24.7% over the forecast period. Major players in the market, like Accenture, offer wholesome AI training and system integration services to enable businesses to implement AI advancements in their communication services. The company's Conversational AI Platform is created to handle organizations' usual problems when executing conversational AI solutions. These challenges include delivering at pace, enhancing from proof of concept to enterprise-level, and how to operate a living system. By centralizing the maintenance, design, creation, and publishing of conversational experiences in a common platform, organizations can enable scaling across the enterprise by breaking conventional silos.

Type Insights

The chatbot segment led the market in 2024, accounting for a significant share of the global revenue. Prominent development in machine learning and NLP in chatbots is augmenting market growth. Chatbots are primarily used for collecting data. In addition, customers can engage with chatbots to obtain clarity about any product or service or if they need to book any appointments. With the advancement of Natural Language Processing (NLP) technology, chatbots can now comprehend and produce language like that of humans. Deep learning models and machine learning algorithms have been essential in improving chatbot accuracy and contextual awareness.

The Intelligent Virtual Assistants (IVA) segment registered a CAGR growth in the forecast period. There are numerous conversational AI service providers in the market, developing virtual assistants and chatbots with restricted user-personalized characteristics. By continuously learning from interactions, IVAs become more efficient over time, personalizing user experiences and anticipating needs to provide proactive help. Examples of IVAs include Apple’s Siri, Amazon’s Alexa, and Google Assistant, which are capable of executing voice commands, integrating with smart devices, and enhancing the way users interact with technology. This technology is transforming industries by offering scalable, 24/7 service and improving overall user satisfaction.

Deployment Insights

The on-premises segment led the market in 2024, accounting for a prominent share of the global revenue. This is attributable to the flexibility delivered to the customer, due to which the transaction is done only once. The costs are relatively cheaper than expenditures incurred on the cloud by the consumer. Strict rules or concerns about data privacy and security may exist in some sectors, such as healthcare, banking, or government. Organizations have complete control over their data and lower the risk of data breaches or unauthorized access by keeping conversational AI On-Premises which is fueling the market growth. Moreover, when real-time communication and minimal latency are essential, On-Premises conversational AI is useful. Organizations reduce network latency and guarantee quick reaction times by deploying the conversational AI system locally, which is crucial for time-sensitive applications.

The cloud segment registered the highest CAGR growth in the forecast period owing to the rising prominence of cloud-based technologies and services in businesses across the globe.Platforms for cloud conversational AI are frequently updated with new functions, enhancements, and developments in machine learning and NLP. By doing this, organizations benefit from the newest innovations and advancements without having to invest significantly in infrastructure or software changes.Global access to cloud conversational AI technologies enables companies to service clients in various time zones and geographical locations. Their universal accessibility increases the impact and reach of conversational AI applications.

Technology Insights

The NLP segment led the conversational AI industry in 2024, accounting for a significant revenue share of global revenue. NLP ensures the processing of large quantities of natural language data. It also enables streamlining of the documentation processes to enhance their efficiency, including documentation accuracy. For instance, SAP (Systems, Applications, and Products in Data Processing) SE (Societas Europaea), a global operating software company based in Europe, developed current applications with improved, automated capabilities like automatic translation and the Incident Solution Matching service based on machine learning and artificial intelligence (AI) advancements. Moreover, Speech recognition systems that translate spoken words into written text are included in NLP. Thus, voice-based interactions with users can be facilitated by conversational AI systems that can process and comprehend spoken inputs.

The Automatic Speech Recognition (ASR) segment registered the highest CAGR growth over the forecast period. ASR facilitates the creation of speech user interfaces that let people converse verbally with conversational AI systems. ASR systems enable natural and intuitive interactions by transcribing spoken inputs, giving users hands-free and eye-free experiences. Moreover, due to differences in pronunciation, background noise, and other circumstances, ASR systems produce transcriptions that could be inaccurate. Methods including mistake correction algorithms and confidence scores are used to increase the accuracy of transcriptions and determine the degree of confidence in the recognized speech.

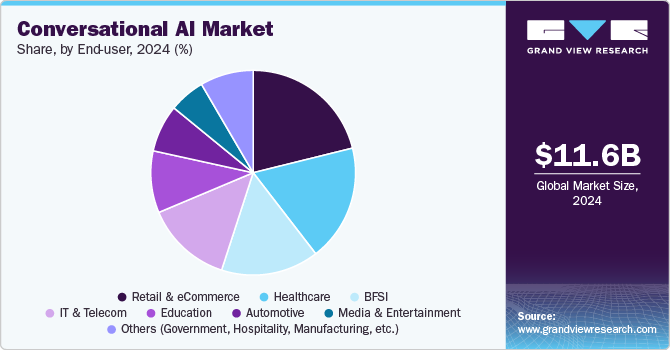

End User Insights

Based on the end user, The retail and e-commerce segment led the market in 2024, accounting for a prominent share of global revenue. Through persuasive, more expressive, and intelligent conversational AI tools and techniques, retail and e-commerce industries serve customers better. Conversational AI enables companies to provide chatbots and virtual assistants for round-the-clock customer service. These AI-powered customer service representatives can respond to frequent consumer questions, give product details, help with order tracking, and provide after-sale assistance. Conversational AI minimizes response times and increases customer satisfaction by providing immediate, personalized support.

The automotive segment registered the highest CAGR growth over the forecast period.AI voice assistants can serve vehicle controls, alerts, real-time recommendations, and much more, catering to passengers and drivers for a more convenient daily commute.By offering voice-guided directions, real-time traffic updates, and contextual information about nearby sites of interest, AI improves navigation systems. Voice commands can be used by drivers to input locations, seek alternate routes, or inquire about gas stations, dining options, or parking facilities in the area.

The conversational AI healthcare chatbot is one of the most influential and mature AI-powered healthcare technologies established so far, which stands to radically change the way patients, payers, and medical care providers interact with one another. These bots also play a crucial part in providing vital healthcare information to specifically targeted people at the right time. Healthcare or Medical chatbots can be implemented to achieve various objectives, from revealing valuable insights and improving healthcare systems to assisting medical personnel and improving patient experience.

Regional Insights

North America conversational AI market is anticipated to have dominance in the conversational AI market revenue share 26.1% 2024 throughout the forecast period. The region's widespread adoption of emerging technologies and the rapidly increasing need for customer support services powered by artificial intelligence are both driving market progress. Furthermore, most organizations in North America are investing in technological advancements to satisfy and help their customers' requirements. The rapidly growing health consciousness among the population also fuels the demand for conversational AI. The healthcare industry in North America is advancing to implement augmented and virtual reality, robotics, and AI. This would help deliver intelligent services and technologies for evidence-based health and focus on preventive and collaborative care.

U.S. Conversational AI Market Trends

The U.S. conversational AI market held a dominant position in 2024. This surge is driven by increasing demand for personalized customer interactions across various sectors, including retail, healthcare, and finance, as businesses leverage AI to enhance user engagement and streamline operations24. The integration of advanced technologies like natural language processing and generative AI is further propelling this growth, enabling more human-like interactions and efficient customer support solutions

Europe Conversational AI Market Trends

Europe’s conversational AI market is also growing as in Europe. This expansion is fueled by the increasing demand for AI-driven customer support services and the rising adoption of omnichannel communication strategies. Notably, sectors such as retail, banking, and automotive are leveraging conversational AI to enhance customer engagement and streamline operations. The integration of advanced technologies like natural language processing (NLP) and automated speech recognition is further driving innovation within the market. Additionally, the growing emphasis on personalized customer experiences through social media platforms presents significant opportunities for market players to expand their offerings and reach more consumers effectively.

Asia Pacific Conversational AI Market Trends

The Asia Pacific conversational AI market is anticipated to grow at a significant CAGR from 2025 to 2030. The Asia Pacific region is projected to witness the highest growth during the forecast period, attributed to increasing awareness among organizations about innovative customer support services and technologies. In addition, increasing development in the e-commerce sector, rising acceptance of conversational AI in the retail industry, technological advancement in consulting and healthcare, and progressing internet penetration in this region are fueling the use and demand of the market.

Key Conversational AI Company Insights

The market is characterized by strong competition, with a few major worldwide competitors owning a significant market share. The major focus is developing new products and collaborating among the key players.

-

Microsoft is a leading technological company that offers a diverse range of products and services, with a strong emphasis on enhancing productivity through innovative solutions. Among its key offerings is Microsoft 365 Copilot, which integrates advanced AI capabilities into the Microsoft 365 suite, helping businesses streamline workflows and focus on essential tasks. Additionally, Microsoft provides Microsoft Teams, a comprehensive platform for online meetings, collaboration, and communication, facilitating seamless teamwork in hybrid work environments. The company's commitment to conversational AI is evident in its Copilot feature, designed to act as a personal assistant that supports users with intelligent responses and suggestions across various applications. This focus on AI-driven tools positions Microsoft as a pivotal player in transforming how organizations operate and interact in the digital age. With solutions tailored for business needs, Microsoft continues to empower organizations to harness the full potential of technology for enhanced efficiency and collaboration.

-

IBM is a major player in the conversational AI market, offering a suite of advanced AI tools and solutions designed to enhance business operations. Their services include the IBM Watson platform, which enables businesses to leverage AI for customer engagement, data-driven decision-making, and automation of IT infrastructure. Additionally, IBM provides tailored AI models optimized for scalability, allowing organizations to transition from pilot projects to full-scale implementations. With a focus on secure hybrid cloud solutions and robust consulting services, IBM empowers companies to innovate responsibly and efficiently in the age of AI.

Key Conversational AI Companies:

The following are the leading companies in the conversational AI market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft

- Amazon Web Services, Inc.

- IBM

- Oracle

- Nuance Communications, Inc.

- FIS

- SAP SE

- Artificial Solutions

- Kore.ai, Inc.

- Avaamo

- Conversica, Inc.

- Jio Haptik Technologies Limited

- Rasa Technologies Inc.

- Solvvy

- Pypestream Inc.

- Kasisto

- Cognigy

Recent Developments

-

In October 2024, Microsoft announced significant advancements in its Cloud for Healthcare platform, aimed at transforming patient care and enhancing healthcare workflows. The new innovations include multimodal medical imaging AI models in Azure AI Studio, which facilitate the integration of diverse healthcare data types. Additionally, Microsoft Fabric now offers comprehensive data solutions that streamline access to patient insights, while the healthcare agent service in Copilot Studio aims to automate administrative tasks and improve clinical workflows. Collaborations with leading healthcare organizations are underway to develop AI solutions that alleviate nursing burdens, allowing professionals to focus more on patient care. Microsoft emphasizes its commitment to responsible AI practices to ensure these technologies positively impact the healthcare ecosystem.

-

In March 2023, Nuance Communications launched Dragon Ambient eXperience (DAX) Express, a new AI-powered clinical documentation solution. Built upon the successful DAX platform and leveraging OpenAI's GPT-4, DAX Express automates the creation of clinical notes by combining conversational and ambient AI. This solution aims to reduce administrative burdens for clinicians, allowing them to focus on patient care. DAX Express integrates seamlessly with existing Dragon Medical solutions and the electronic medical record, enhancing efficiency and improving the overall healthcare experience.

Conversational AI Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 14.29 billion |

|

Revenue forecast in 2030 |

USD 41.39 billion |

|

Growth rate |

CAGR of 23.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segment scope |

Component, type, deployment, technology, end user, region |

|

Region scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Brazil |

|

Key companies profiled |

Google; Microsoft; Amazon Web Services, Inc.; IBM; Oracle; Nuance Communications, Inc.; FIS; SAP SE; Artificial Solutions; Kore.ai, Inc.; Avaamo; Conversica, Inc.; Jio Haptik Technologies Limited; Rasa Technologies Inc.; Solvvy; Pypestream Inc.; Kasisto; Cognigy. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Conversational AI Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the conversational AI market report based on component, type, deployment, technology, end user, and region:

-

Component Outlook (Revenue, USD Million; 2018 - 2030)

-

Solutions

-

Managed Services

-

Professional Services

-

Training and Consulting

-

System Integration and Implementation

-

Support and Maintenance

-

-

-

Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Chatbots

-

Intelligent virtual assistant (IVA)

-

-

Deployment Outlook (Revenue, USD Million; 2018 - 2030)

-

On-Premises

-

Cloud

-

-

Technology Outlook (Revenue, USD Million; 2018 - 2030)

-

Natural Language Processing (NLP)

-

ML and Deep Learning

-

Automatic Speech Recognition (ASR)

-

-

End User Outlook (Revenue, USD Million; 2018 - 2030)

-

BFSI

-

Healthcare

-

IT and Telecom

-

Retail and eCommerce

-

Education

-

Media and Entertainment

-

Automotive

-

Others (Government, Hospitality, Manufacturing, etc.)

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global conversational AI market size was estimated at USD 11.58 billion in 2024 and is expected to reach USD 14.29 billion in 2025.

b. The global conversational AI market is expected to grow at a compound annual growth rate of 23.7% from 2025 to 2030 to reach USD 41.39 billion by 2030.

b. North America accounted for the highest value share in 2024 owing to Al's strong research and development capabilities in developed economies, research institutes, and several prominent Al enterprises in this region.

b. Some key players operating in the conversational AI market include Google, Microsoft, Amazon Web Services, Inc., IBM, Oracle, Nuance Communications, Inc., FIS; among others.

b. Key factors that are driving the market growth include rising investment in advanced technologies and increasing demand for AI-powered customer support services.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."