- Home

- »

- Medical Devices

- »

-

Contrast Media Market Size, Share, Industry Report, 2033GVR Report cover

![Contrast Media Market Size, Share & Trends Report]()

Contrast Media Market (2026 - 2033) Size, Share & Trends Analysis Report By Modality (Ultrasound, Magnetic Resonance Imaging), By Product, By Application, By Route Of Administration, By End Use, By Region And Segment Forecasts, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-357-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Contrast Media Market Summary

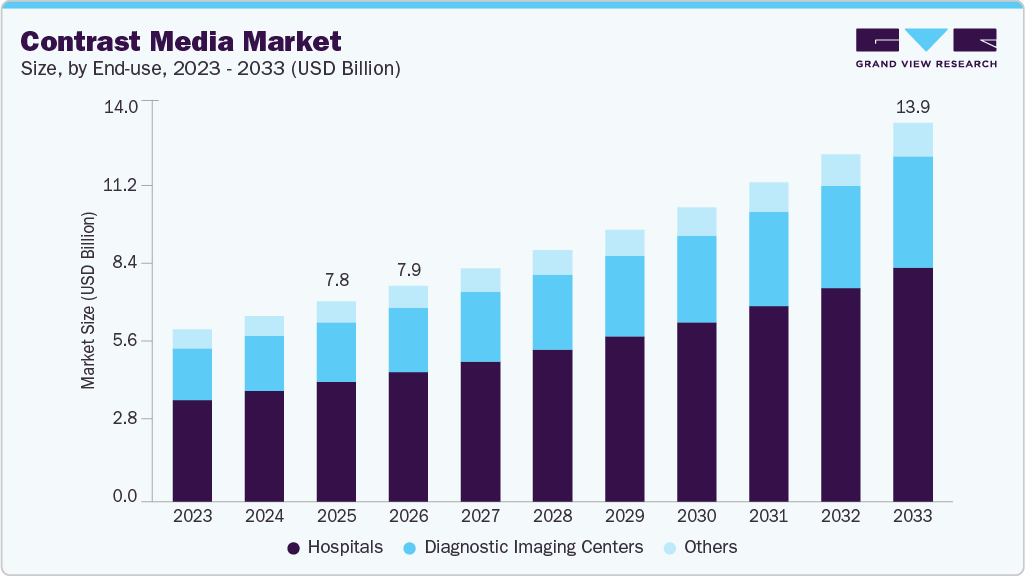

The global contrast media market size was estimated at USD 7.31 billion in 2025 and is projected to reach USD 13.86 billion by 2033, growing at a CAGR of 8.39% from 2026 to 2033. The demand for contrast media is rising owing to the growing need for medical imaging and the rising burden of chronic disorders.

Key Market Trends & Insights

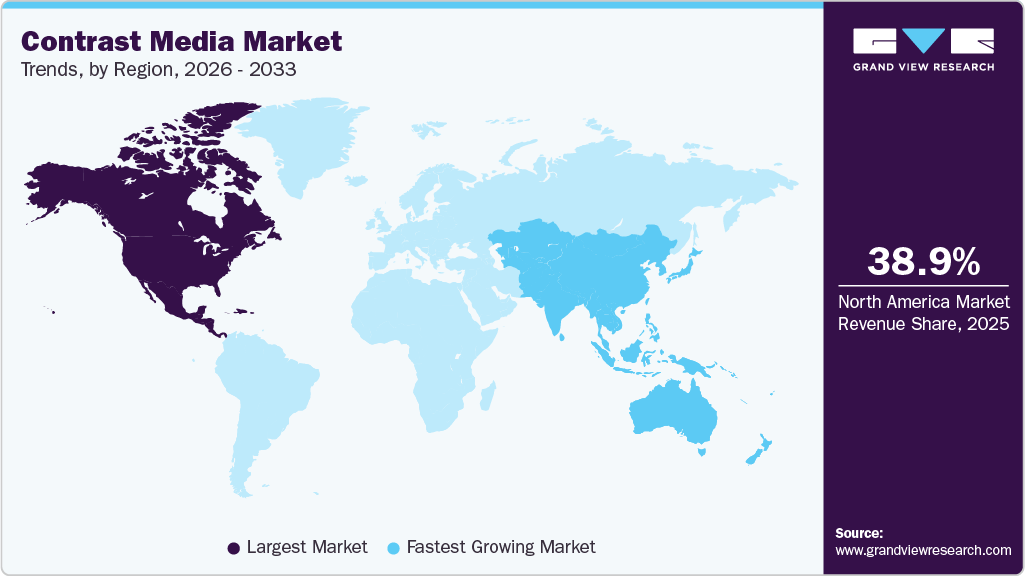

- By region, North America dominated the contrast media market with the largest revenue share of 38.92% in 2025.

- By modality, the X-ray/CT segment led the market with the largest revenue share in 2025.

- Based on product, the microbubble contrast media segment is anticipated to grow fastest over the forecast period.

- Based on end use, the hospitals segment led the market with the largest revenue share in 2025.

- By application, the neurological disorder segment led the market with the largest revenue share in 2025.

- Based on route of administration, the intravenous segment is anticipated to grow fastest over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 7.31 Billion

- 2033 Projected Market Size: USD 13.86 Billion

- CAGR (2026-2033): 8.39%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

High volume of imaging procedures, such as ultrasound and MRI scans, is anticipated to support the market growth. The growing global demand for medical imaging is a key factor driving the expansion of the contrast media market. Medical imaging plays a crucial role in the early detection, accurate diagnosis, and effective treatment planning of various health conditions. Millions of patients undergo diagnostic procedures such as MRI, CT scans, and X-rays every year. According to a study published by the National Library of Medicine in October 2023, approximately 40 million MRI scans are performed annually in the U.S. alone. The increasing volume of imaging procedures worldwide is expected to significantly boost the demand for contrast media, essential for enhancing the visualization of internal body structures during these examinations.

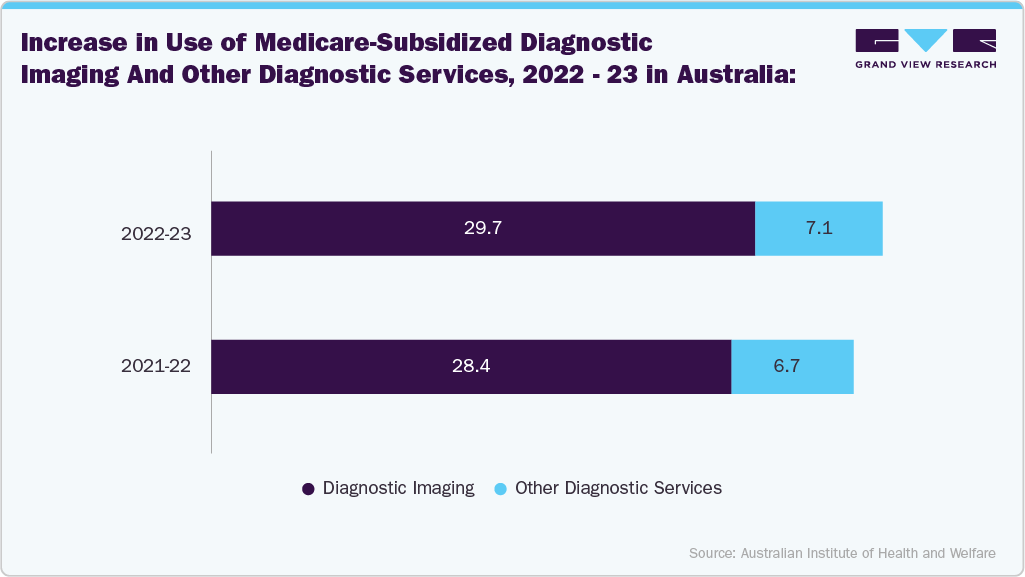

Beyond the U.S., other countries are also experiencing a rising demand for medical imaging procedures. According to data published by the Australian Institute of Health & Welfare (AIHW) in July 2024, 10.2 million Australians accessed Medicare-subsidized diagnostic imaging services in 2022-23, while approximately 4.0 million used other diagnostic services. This upward trend is expected to continue in the coming years, further contributing to the growing global demand for contrast media used in diagnostic imaging.

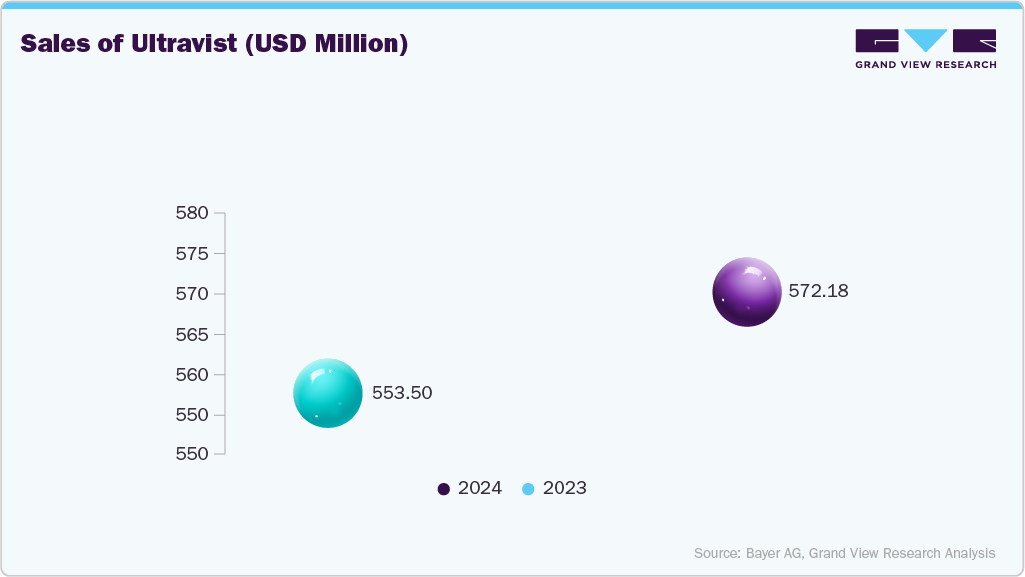

Furthermore, the demand for iodinated contrast media is rising significantly, driven by the growing number of imaging procedures requiring enhanced visualization. Several iodinated contrast agents are experiencing strong revenue growth, reflecting increased clinical adoption. For example, in 2024, Bayer AG reported a notable revenue increase from Ultravist, its iopromide-based X-ray contrast agent used for both intra-arterial and intravenous applications. This surge in product demand underscores the expanding utilization of iodinated contrast media in radiology, positioning them as a critical driver in the growth of the global contrast media market.

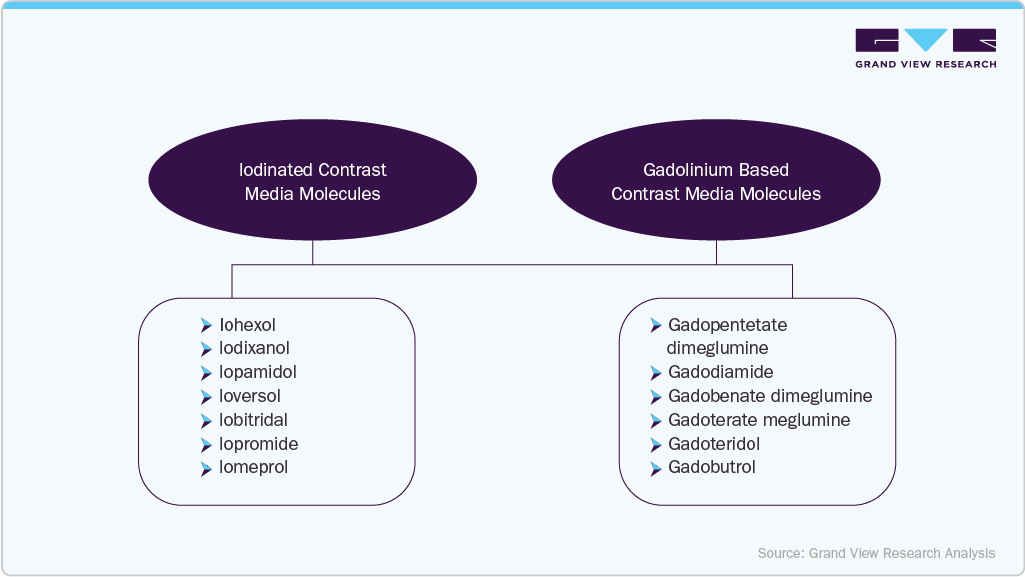

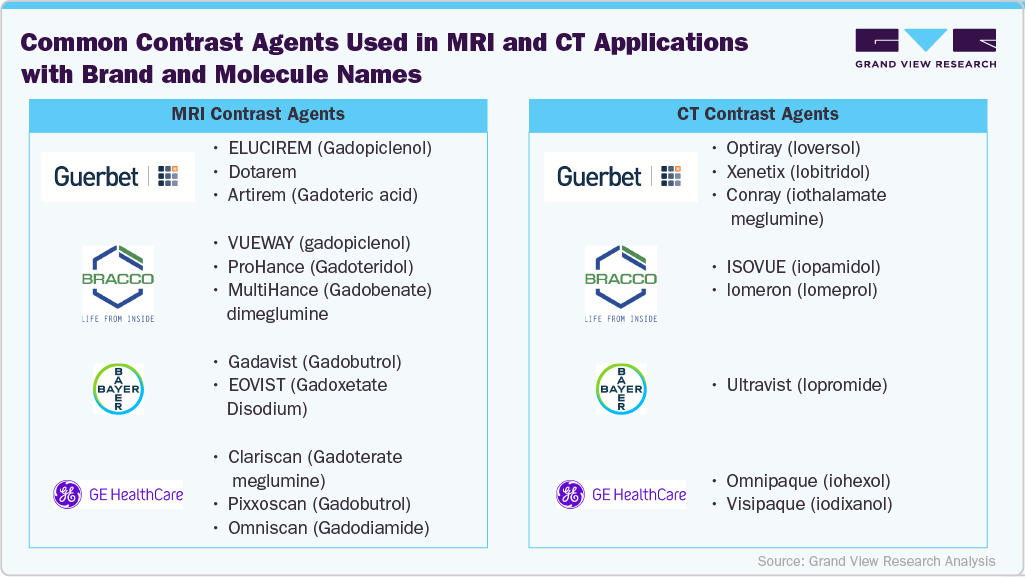

The availability of diverse molecular formulations among gadolinium-based and iodinated contrast agents drives market growth. This variety enables tailored imaging tailored to patient needs and clinical requirements, enhancing diagnostic accuracy and safety. For instance, gadolinium agents are widely used in MRI applications, while iodinated agents are suitable for CT procedures. Continued R&D into advanced contrast media with improved safety and efficacy further supports market expansion across diagnostic applications like oncology, cardiology, and neurology.

The pictorial representation below highlights commonly used contrast agents in MRI and CT applications, along with their respective brand names and molecular compositions.

Key Opinion Leaders

Company Name

KOLs

Growth Opportunities

Dr Paul Evans, head of global R&D at GE HealthCare’s Pharmaceutical Diagnostics business segment

“These are encouraging Phase I results for this manganese-based contrast agent, and we look forward to completing the next steps in the clinical development process. This is part of our pipeline of products aiming to improve patient outcomes across care pathways.”

- Emerging Manganese-Based Contrast Agents

- Focus on Clinical Development

Lindsey Thomas, senior vice president of Pharmaceutical Marketing at Fresenius Kabi USA and the company’s representative on the End Drug Shortage Alliance Board of Directors

“The U.S. availability of Iodixanol Injection, USP is the first offering from our generic radiology portfolio. We are doing everything we can to accelerate product availability to help our customers during this acute contrast media agent shortage, including air shipping product. We are also actively working to bring additional affordable contrast agents to U.S. clinicians to help ensure patient access to essential diagnostic imaging procedures.”

- Expansion of Generic Radiology Portfolio

- Addressing Supply Chain Shortages

- Growing Demand for Affordable Alternatives

Mark Hibberd, Chief Medical Officer, GE HealthCare Pharmaceutical Diagnostics

“This extension to our portfolio means we will be able to offer two leading macrocyclic molecules-Clariscan (gadoteric acid) and Pixxoscan (gadobutrol)-to our customers in a number of European countries, offering radiology departments even more choice to suit their diagnostic needs. We continue to innovate and invest in our contrast media portfolio to deliver for healthcare professionals and patients and to meet future demand.”

- Geographic Market Penetration

- Portfolio Expansion with Macrocyclic Molecules

Source: Grand View Research Analysis

Market Concentration and Characteristics

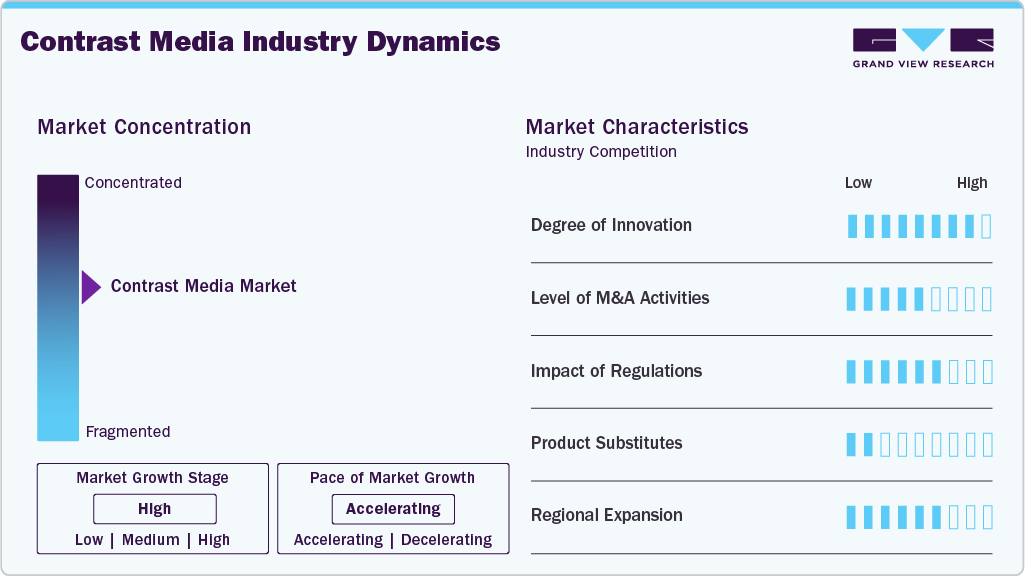

The market growth stage is high, and the pace is accelerating. The contrast media market is characterized by strong growth driven by rising demand for medical imaging, the launch of novel products, and expanding production capacities.

- Industry players and researchers are increasingly emphasizing the development of advanced contrast media, with several innovative products currently undergoing clinical trials. For example, in October 2024, GE HealthCare announced encouraging Phase I results for its manganese-based macrocyclic MRI contrast agent. The first-in-human trial demonstrated that the agent was well tolerated, with no severe adverse events, dose-limiting toxicities, or clinically significant findings reported. These positive clinical outcomes are expected to stimulate further innovation and growth in the contrast media market.

“GE HealthCare’s manganese-based contrast agent could offer benefits such as reduced risk of tissue deposition and improved safety for certain vulnerable patient populations compared to gadolinium-based agents, while also providing comparable imaging capabilities and potentially lower environmental impact.” Said Robert McDonald, radiologist at Mayo Clinic and contrast media safety committee board member for the American College of Radiology.

-

Regulation of contrast media involves strict oversight to ensure the safety and effectiveness of substances used to enhance medical imaging. Classified as drugs, contrast agents are regulated by authorities such as the U.S. Food and Drug Administration (FDA) and Health Canada. These regulations apply across various imaging modalities, including X-ray, CT, MRI, and ultrasound. Additionally, all injectable contrast agents, including intravenous (IV) formulations, are considered prescription-only medicines (POMs) and are subject to the same regulatory restrictions and controls as other POMs.

-

Mergers and acquisitions are a key strategic approach in the contrast media industry. They allow companies to broaden their product portfolios, drive innovation, and enhance their market position. Notable players adopting this strategy include Lantheus Holdings, Inc. and Bracco, among others.

-

Contrast media companies are increasingly focusing on regional expansion to enhance market access and meet the growing demand for contrast agents. A key part of this strategy involves securing marketing authorizations from various regulatory bodies. For example, in September 2022, Guerbet received U.S. FDA approval for Elucirem (gadopiclenol), a gadolinium-based macrocyclic contrast agent (GBCA), for use in contrast-enhanced magnetic resonance imaging (MRI).

Modality Type Insights

The X-ray/Computed Tomography (CT) segment accounted for the largest share of the contrast media market, with 69.17% of total revenue in 2025. The high volume of global CT and X-ray examinations primarily drives this dominant position. For instance, data from the NHS UK revealed that in January 2023 alone, Plain Radiography (X-ray) procedures reached approximately 1.65 million, while Computerized Axial Tomography (CT) scans accounted for around 0.52 million.

CT imaging plays a critical role in accurately diagnosing a broad spectrum of diseases by offering detailed internal visualization. This modality's effectiveness is enhanced through the use of contrast agents-particularly iodinated and barium-based media, which improve image clarity and diagnostic precision. The wide availability of advanced contrast agents such as Optiray, Omnipaque, and Ultravist further supports the growth of this segment.

The ultrasound segment is projected to register the fastest growth rate in the contrast media market over the forecast period. This growth is primarily driven by rising investments in the development and production of contrast-enhanced ultrasound (CEUS) products. For instance, in November 2024, Bracco revealed plans to triple the production capacity of its innovative ultrasound contrast agent at its Geneva facility.

This significant investment focuses on scaling up the production of CEUS microbubbles, which are integral to enhancing ultrasound imaging quality. The increasing adoption of CEUS in clinical settings-owing to its safety profile, cost-effectiveness, and real-time imaging capabilities-is expected to accelerate segment expansion further. As healthcare providers continue to recognize CEUS's diagnostic advantages, the ultrasound segment is well positioned for substantial growth over the forecast period.

Product Insights

The iodinated contrast media segment held the largest revenue share of the contrast media market in 2025. This dominance can be attributed to the widespread availability and versatility of iodinated contrast agents, including iohexol, iodixanol, iopamidol, and others. These agents are essential for enhancing the visualization of various anatomical structures, such as the gastrointestinal tract, internal organs, arteries and veins, soft tissues, and the brain.

Iodinated contrast media are used across numerous clinical indications, including neurological, nephrological, gastrointestinal, cardiovascular, musculoskeletal, and oncological disorders. Their broad applicability increases their demand in diagnostic imaging. Furthermore, approvals from regulatory authorities for different applications and modalities support this segment's growth. For instance, in June 2023, Bayer announced that the U.S. FDA had approved its iodine-based contrast agent Ultravist (iopromide) for use in contrast-enhanced mammography (CEM). Regulatory approvals like these are expected to further fuel the growth of the iodinated contrast media segment in the coming years.

The microbubble contrast media segment is anticipated to witness the fastest growth rate over the forecast period. Microbubble contrast media are minute bubbles of an injectable gas. They are most often administered for ultrasound imaging of the heart. Contrast agents for ultrasound imaging have been developed to visualize microcirculation in tissue. They enhance the echogenicity of blood and improve the visualization and assessment of tissue vascularity, large vessels, and cardiac cavities. Microbubble contrast media can reflect ultrasound waves, causing structures to appear brighter on ultrasound. Contrast agents for ultrasound imaging can be used in various healthcare settings (CT suites, operating rooms, echo labs, and others) and are the first-line imaging technique for several indications. Microbubble contrast media is a useful option for patients allergic to CT or MRI contrast media or for patients with kidney failure.

Application Insights

The neurological disorder segment dominated the contrast media market with the largest revenue share in 2025. This dominance is attributed to the high prevalence of neurological disorders. According to the data published by the American Brain Foundation in July 2024, over 1 in 3 individuals around the world are affected by neurological conditions. Magnetic Resonance Imaging (MRI) plays a critical role in diagnosing central nervous system (CNS) disorders, offering superior imaging of neural structures compared to other modalities. Gadolinium-based contrast agents (GBCAs), such as OMNISCAN (GE Healthcare), Dotarem (Guerbet), and Prohance, are widely used to enhance diagnostic clarity for the diagnostic evaluation of the CNS. The broad clinical utility and availability of these agents are key drivers of segment growth.

The cardiovascular disorders segment is projected to witness the fastest growth rate in the contrast media market over the forecast period. This growth is primarily driven by the rising global burden of cardiovascular diseases and the increasing use of contrast-enhanced imaging techniques for accurate diagnosis and assessment. Among these, contrast-enhanced ultrasound (CEUS) or echocardiography is one of the most widely adopted modalities for imaging the cardiovascular system in adult and pediatric patients.

Ultrasound contrast agents such as Optison, Definity, and Lumason are key in enhancing image clarity, particularly in patients with suboptimal echocardiograms. These agents are commonly used to opacify the left ventricle and improve the left ventricular endocardial border delineation, which is crucial for evaluating cardiac structure and function. The growing adoption of these agents, along with advancements in CEUS technology and broader clinical indications, is expected to significantly drive the growth of this segment in the coming years.

End Use Insights

The hospital segment dominated the contrast media market, accounting for the largest revenue share in 2025, and is anticipated to grow the fastest over the forecast period. This dominance is primarily driven by the high volume of diagnostic imaging procedures conducted in hospital settings, including CT scans, MRIs, and ultrasound examinations that frequently require contrast agents. Hospitals are typically equipped with advanced imaging infrastructure and staffed by specialized radiologists, making them the primary point of care for complex and emergency cases requiring detailed diagnostic imaging. Additionally, the growing number of hospital admissions, expansion of radiology departments, and increasing investments in imaging technology further support the segment's dominance.

The diagnostic imaging centers segment is expected to witness significant growth in the contrast media market from 2025 to 2033. This growth is driven by the increasing demand for outpatient imaging services, rising healthcare cost containment efforts, and growing patient preference for quicker, more accessible diagnostic solutions outside of hospital settings. Imaging centers often offer shorter wait times, competitive pricing, and specialized services, making them an attractive option for patients and healthcare providers.

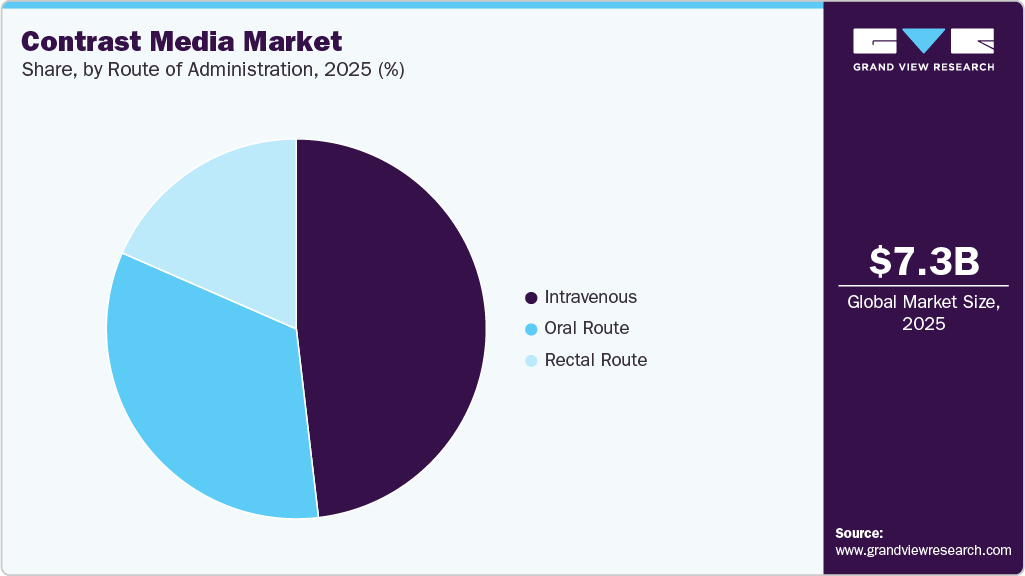

Route of Administration Insights

The intravenous segment held the largest revenue share of the contrast media market in 2025. This dominance is primarily attributed to the widespread use of intravenous administration for delivering contrast agents during various diagnostic imaging procedures, including CT and MRI scans. Intravenous contrast delivery allows for rapid agent distribution throughout the bloodstream, enhancing the visualization of blood vessels, organs, and soft tissues with high precision. This segment is also anticipated to grow fastest over the forecast period.

Several contrast agents widely used across hospitals and diagnostic centers such as Ultravist (iopromide) by Bayer, Visipaque (iodixanol) by GE Healthcare, and Iomeron (iomeprol) by Bracco are administered intravenously. These agents are commonly indicated for various conditions, including cardiovascular, neurological, gastrointestinal, and oncological disorders. The clinical effectiveness, fast action, and broad applicability of intravenous contrast media continue to drive their preference among healthcare professionals, reinforcing the segment's dominance.

The rectal route segment is projected to experience significant growth in the contrast media market from 2025 to 2033. This growth is driven by the increasing use of rectally administered contrast agents in gastrointestinal imaging procedures, particularly for evaluating conditions such as colorectal disorders and obstructions. Products like Telebrix Gastro and Micropaque from Guerbet are available for such applications. The effectiveness of this route in enhancing GI visualization and the growing burden of GI disorders are expected to support its increasing adoption in diagnostic practices.

Regional Insights

The North America contrast media market held the largest revenue share of 38.92% in 2025. This dominance was driven by the presence of major companies such as GE Healthcare, Bracco Diagnostics, Inc., Bayer, and Guerbet, among others. In addition, growing approvals for contrast agents via the FDA and Health Canada also supported the regional expansion. For example, in March 2024, Lantheus Holdings, Inc. announced that the Health Canada has approved the supplemental new drug application (sNDA) for DEFINITY (Perflutren Lipid Microsphere) as an ultrasound enhancing agent specifically for use in pediatric patients with suboptimal echocardiograms.

U.S. Contrast Media Market Trends

The U.S. contrast media market is witnessing strong growth, supported by rising diagnostic imaging volumes across CT, MRI, and ultrasound procedures, driven by an aging population and increasing prevalence of cardiovascular diseases, cancer, and neurological disorders. Iodinated contrast media continue to dominate CT imaging due to their widespread use in angiography and interventional procedures, while growing emphasis on patient safety is accelerating the adoption of non-ionic contrast media, which offer improved tolerability and reduced adverse reactions. Technological advancements in imaging systems, increasing use of contrast-enhanced ultrasound, and a shift toward outpatient and ambulatory imaging centers are further shaping market trends, while ongoing innovation focuses on enhancing image quality, safety, and targeted diagnostic applications.

Europe Contrast Media Market Trends

The Europe contrast media market is expected to experience significant growth in the coming years, driven by a well-developed healthcare system, rising prevalence of chronic diseases, and increasing demand for advanced diagnostic imaging. Growing incidences of cancer, cardiovascular, and neurological disorders have led to greater reliance on contrast-enhanced imaging procedures such as CT, MRI, and ultrasound. According to the World Health Organization (WHO), by 2030, approximately 5.4 million people are expected to be diagnosed with cancer, and around 2.5 million individuals are projected to die from the disease in the WHO European Region.

The UK contrast media market is expected to grow substantially in the coming years, driven by increasing demand for diagnostic imaging procedures and the rising prevalence of chronic diseases. A key indicator of this trend is the country's high volume of imaging activity. According to NHS data, approximately 43.4 million imaging tests were performed in England between February 2022 and January 2023. This test includes X-rays, CT scans, MRIs, and ultrasounds, which require using contrast agents to enhance diagnostic accuracy.

The France contrast media market isexpected to witness rapid growth over the coming years, fueled by the increasing burden of chronic diseases and the rising strategic focus of industry players on the French healthcare sector. Industry players, such as Bracco, are actively conducting innovative pilot programs in France and Germany to recover residues from gadolinium-based and iodinated contrast agents. These sustainability and recycling initiatives strongly emphasize environmental responsibility and resource optimization. Such efforts align with regulatory priorities and offer companies a competitive advantage in the evolving and environmentally conscious France market.

Asia Pacific Contrast Media Market Trends

The Asia Pacific contrast media market is expected to register the fastest growth during the forecast period, driven by a combination of critical factors. Rapidly expanding healthcare infrastructure across emerging economies like China, India, and Southeast Asian countries is significantly boosting access to advanced diagnostic imaging technologies. Rising incidence of chronic diseases such as cancer, cardiovascular, and neurological conditions is increasing the demand for accurate and early diagnosis, further fueling the use of contrast agents. According to the International Agency for Research on Cancer (IARC), the number of cancer cases in Australia and New Zealand (ANZ) is projected to rise from 270,155 in 2025 to 298,558 by 2030.

The contrast media market in India is anticipated to witness lucrative growth. This growth is driven by the rising prevalence of chronic diseases, the growing demand for advanced diagnostic imaging, and expanding healthcare infrastructure. In addition, increasing awareness about early diagnosis, coupled with government initiatives and private investments in imaging centers, is boosting market growth.

The China contrast media market is anticipated to grow significantly over the forecast period. This growth is driven by a rapidly aging population, increasing prevalence of chronic diseases, and strong government investment in healthcare infrastructure. Rising demand for advanced diagnostic imaging technologies, such as CT and MRI, and expanding access to medical services in urban and rural areas, fuel market growth.

Latin America Contrast Media Market Trends

The contrast media market in the Latin America is experiencing steady growth, driven by expanding healthcare infrastructure and rising demand for diagnostic imaging. In November 2024, Beijing Beilu Pharmaceutical Co., Ltd. received GMP certification from Brazil’s ANVISA for its contrast agent production line, underscoring increasing manufacturing capacity and quality assurance in the region. Countries like Brazil and Argentina are driving the market growth, supported by rising government investment in public health and the adoption of advanced imaging technologies such as CT and MRI. The growing burden of chronic diseases and improved access to healthcare services further boost the use of contrast agents.

Middle East and Africa Contrast Media Market Trends

The Middle East and Africa contrast media market is anticipated to witness substantial growth. This growth is driven by expanding healthcare infrastructure, particularly in GCC countries and South Africa, as well as increased public and private healthcare spending. The rising prevalence of chronic conditions such as cancer and cardiovascular conditions is boosting demand for advanced diagnostic imaging.

The contrast media market in Saudi Arabia is poised for strong growth, driven by public and private healthcare investments and expanding imaging infrastructure. In March 2023, Sajaya Medical Care Services entered a radiology partnership with Bayer International and Scientific and Medical Equipment House, highlighting the region’s emphasis on advanced imaging technologies. Such industry collaborations are expected to support country market growth.

Key Contrast Media Company Insights

Bracco S.p.A., Fresenius Kabi USA, LLC, Trivitron Healthcare, Bayer AG, GE HealthCare, Guerbet, iMAX, Lantheus, Beijing Beilu Pharmaceutical Co., Ltd., GRUPO JUSTE, JB Pharma, Jodas Expoim Pvt. Ltd., Livealth, Blue Jet Healthcare, Arco Lifesciences (I) Pvt. Ltd, and Voyageur Pharmaceuticals Ltd are some major players in the contrast media market. Companies are expanding their portfolios of contrast media and increasing their production capacities to meet the growing demand. Moreover, industry players are also launching novel agents to gain a competitive advantage.

Key Contrast Media Companies:

The following key companies have been profiled for this study on the contrast media market.

- Bracco S.p.A.

- Fresenius Kabi USA, LLC

- Trivitron Healthcare

- Bayer AG

- GE HealthCare

- Guerbet

- Beijing Beilu Pharmaceutical Co., Ltd.

- iMAX

- Lantheus Holdings, Inc.

- GRUPO JUSTE

- Voyageur Pharmaceuticals Ltd

- JB Pharma

- Jodas Expoim Pvt. Ltd.

- Livealth

- Blue Jet Healthcare.

- Arco Lifesciences (I) Pvt. Ltd.

Recent Developments

-

In January 2025, Bayer reported positive topline results from the Phase III clinical development program for the new MR contrast agent gadoquatrane. These studies assessed the efficacy and safety of gadoquatrane. Gadoquatrane met the main secondary and primary endpoints in these studies.

-

In November 2024, Beijing Beilu Pharmaceutical Co., Ltd. received GMP certification from Brazil’s ANVISA for its contrast agent production line. This certification enables the company to enter the Brazilian market successfully and supports further expansion into Brazil and other international markets.

-

In October 2024, GE HealthCare announced encouraging Phase I results for its manganese-based macrocyclic MRI contrast agent. The first-in-human trial demonstrated that the agent was well tolerated, with no severe adverse events, dose-limiting toxicities, or clinically significant findings reported.

Contrast Media Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 7.89 billion

Revenue forecast in 2033

USD 13.86 billion

Growth rate

CAGR of 8.39% from 2026 to 2033

Base year for estimation

2025

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, modality type, application, route of administration, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Bracco S.p.A.; Fresenius Kabi USA, LLC; Trivitron Healthcare; Bayer AG; GE HealthCare; Beijing Beilu Pharmaceutical Co., Ltd.; JB Pharma; Guerbet; iMAX; Lantheus Holdings, Inc.; GRUPO JUSTE; Voyageur Pharmaceuticals Ltd; Jodas Expoim Pvt. Ltd.; Livealth;Blue Jet Healthcare.; Arco Lifesciences (I) Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Contrast Media Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global contrast media market report based on product, modality type, application, route of administration, end use, and region:

-

Modality Outlook (Revenue, USD Million, 2021 - 2033)

-

Ultrasound

-

Magnetic Resonance Imaging

-

X-ray/Computed Tomography

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Microbubble

-

Gadolinium-Based

-

Iodinated

-

Barium-Based

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Cardiovascular Disorders

-

Neurological Disorders

-

Gastrointestinal Disorders

-

Cancer

-

Nephrological Disorders

-

Musculoskeletal Disorders

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2021 - 2033)

-

Intravenous

-

Oral Route

-

Rectal Route

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Diagnostic Imaging Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some of the players operating in the contrast media market are Bracco S.p.A., Fresenius Kabi USA, LLC, Trivitron Healthcare, Bayer AG, GE HealthCare, Guerbet, iMAX, Lantheus, Beijing Beilu Pharmaceutical Co., Ltd., GRUPO JUSTE, JB Pharma, Jodas Expoim Pvt. Ltd., Livealth, Blue Jet Healthcare, Arco Lifesciences (I) Pvt. Ltd., and Voyageur Pharmaceuticals Ltd

b. Key factors that are driving the contrast media market growth include the increasing demand for medical imaging and the growing burden of chronic disorders.

b. The global contrast media market size was estimated at USD 7.31 billion in 2025 and is expected to reach USD 7.89 billion in 2026.

b. The global contrast media market is expected to grow at a compound annual growth rate of 8.39% from 2026 to 2033 to reach USD 13.86 billion by 2033.

b. North America dominated the contrast media market with a share of 38.92% in 2025. This is attributable to the presence of well-established healthcare facilities, the availability of advanced technologies, and the demand for diagnostic procedures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.