- Home

- »

- Plastics, Polymers & Resins

- »

-

Contract Packaging Market Size, Industry Report, 2030GVR Report cover

![Contract Packaging Market Size, Share & Trends Report]()

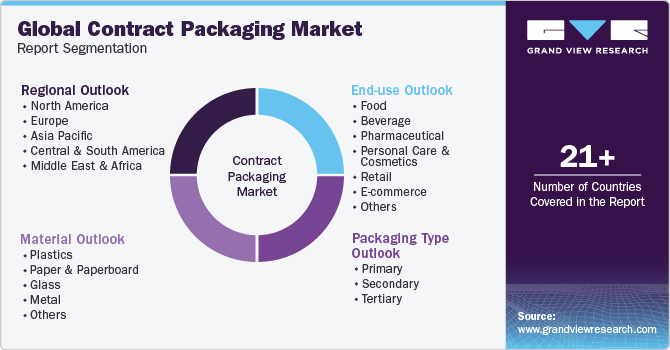

Contract Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Plastics, Paper & Paperboard, Glass, Metal), By Packaging Type (Primary, Secondary, Tertiary), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-261-1

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Contract Packaging Market Summary

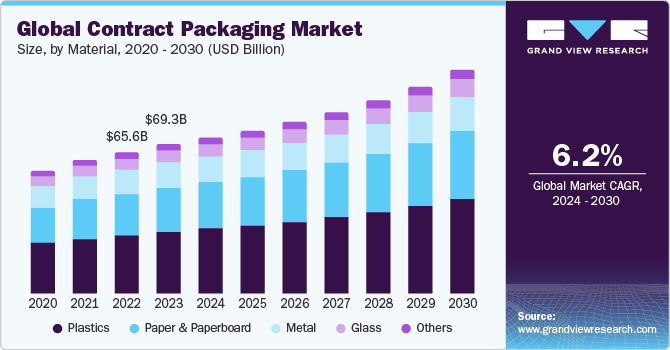

The global contract packaging market size was estimated at USD 69.35 billion in 2023 and is projected to reach USD 103.95 billion by 2030, growing at a CAGR of 6.2% from 2024 to 2030. The growing outsourcing trend among companies across various industries is fueling the demand for contract packaging solutions globally.

Key Market Trends & Insights

- The North America contract packaging market dominated the global industry and accounted for the largest revenue share of over 36.0% in 2023.

- Based on material, the plastics segment dominated the global industry in 2023 and accounted for the largest revenue share of over 41.0%.

- Based on packaging type, the primary packaging type segment dominated the market and accounted for the largest revenue share of over 76.0% in 2023.

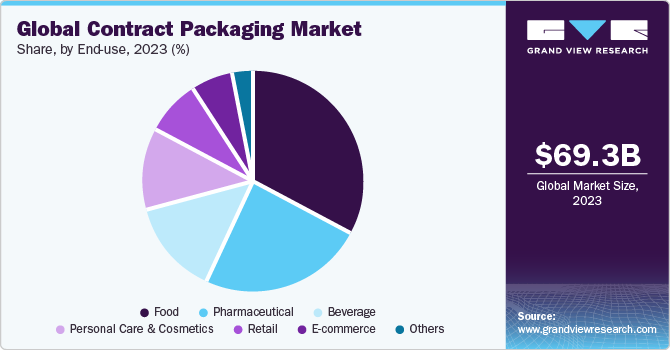

- Based on end-use, the food end-use segment dominated the market and accounted for the largest revenue share of over 32.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 69.35 Billion

- 2030 Projected Market Size: USD 103.95 Billion

- CAGR (2024-2030): 6.2%

- North America: Largest market in 2023

Furthermore, high demand for customizable packaging formats is anticipated to boost market growth. An increasing outsourcing trend in the global packaging industry is positively influencing the global market. Many companies, particularly in the food & beverage, pharmaceuticals, cosmetics, and consumer goods industries, are increasingly outsourcing their packaging needs to contract packaging organizations.

This outsourcing trend has been fueled by the desire to reduce operational costs, improve efficiency, and access specialized packaging expertise and technologies. Moreover, companies often face fluctuations in demand for their products, making it challenging to maintain in-house packaging capabilities efficiently. Contract packagers offer flexibility in scaling packaging operations according to demand, allowing companies to avoid overcapacity or undercapacity in their own facilities. Hence, fluctuating demand and production requirements are anticipated to benefit the overall market. Contract packaging companies invest in highly automated packaging equipment, technologies, and processes to stay competitive and meet diverse client requirements.

Companies can benefit from these advanced capabilities without having to make substantial capital investments. For instance, in May 2023, Linney made a significant investment in an automated fulfillment and co-packing system to support e-commerce growth. This move is aimed at enhancing efficiency and order processing speed while aligning with Linney's environmental, social, and governance (ESG) goals by reducing energy consumption. Therefore, access to advanced packaging technologies is expected to drive market growth during the forecast period. Contract packaging service providers can expand geographically through mergers & acquisitions and enter the market by providing localized packaging solutions & leveraging the contract packager's established infrastructure & knowledge of local regulations and market preferences.

For instance, in October 2023, Sharp Services, LLC acquired Berkshire Sterile Manufacturing, a Massachusetts-based fill-finish contract development and manufacturing organization (CDMO) specialized in sterile filling of vials, syringes, and cartridges for the biotech and pharmaceutical industries. This acquisition enables Sharp Services, LLC to offer fully integrated small- to medium-scale sterile injectable services, complementing its existing clinical supply, packaging, and distribution solutions. The deal brings together Sharp’s expertise in commercial pharmaceutical packaging with BSM’s sterile manufacturing capabilities, allowing them to provide global, integrated CDMO services to biopharma customers.

Market Concentration & Characteristics

Prominent contract packaging solutions companies operating in industry include WestRock Company, Sepha, Peoria Production Solutions, ActionPak, Co-Pak, Packservice Group, MDI, Hollingsworth, Jonco Industries, ProStar, Jam Jams Group, Vynx Private Limited, TPC Packaging Solutions, Econo-Pak, WePack, Elis Packaging Solutions, Inc., Pacmoore Products Inc, Export Corp., Hanchett Paper Company, Deluxe Packaging, and Stamar Packaging.

Companies are increasingly striving to incorporate technologies that can digitalize their contract packaging operations and services. For instance, in March 2024, Wepack partnered with Nulogy to digitalize its contract packing operations. This collaboration aims to enhance efficiency, improve profit margins, and drive growth by optimizing the end-to-end contract packaging workflow. Nulogy's platform provides purpose-built functionality for digitizing and optimizing operations, enabling co-pack providers to increase efficiency and standardize workflows across multiple sites. We Pack Logistics, a contract packaging and warehousing services provider, chose Nulogy to manage complex orders, gain visibility over costs, automate processes, and standardize workflows across their sites to support business growth. This partnership signifies a strategic move by We Pack Logistics to upscale its contract packaging operations and leverage technology to meet evolving customer needs in the packaging industry.

Material Insights

Based on materials, the global industry has been further divided into plastics, paper & paperboard, glass, metal, and other materials. The plastics segment dominated the global industry in 2023 and accounted for the largest revenue share of over 41.0%. Plastic materials are generally less expensive compared to their alternatives, such as glass or metal, which makes them an attractive and suitable choice for contract packagers and their clients, especially for mass-market products.

The paper & paperboard material segment is expected to witness robust growth at a CAGR of 6.7% from 2024 to 2030. This positive outlook is due to the growing demand for eco-friendly and sustainable packaging solutions in the packaging industry. Paper & paperboard are biodegradable and more environmentally friendly than plastics, as they are derived from renewable sources, such as bamboo, bagasse, cereal straw, cotton linters, and other renewable sources.

Packaging Type Insights

Based on packaging type, the global market has been further categorized into primary, secondary, and tertiary. The primary packaging type segment dominated the market and accounted for the largest revenue share of over 76.0% in 2023. The segment is estimated to expand further at the fastest CAGR of 6.5% from 2024 to 2030 retaining its leading position in the market. Primary packaging plays a crucial role in branding, product differentiation, and marketing. It is the first point of interaction between the product and the consumer, and its design, labeling, and aesthetics can significantly influence consumer perception and purchasing decisions.

Furthermore, the costs of primary packaging materials may vary as they often represent a smaller portion of the overall packaging cost compared to secondary or tertiary packaging, making them relatively cost-effective for contract packagers. Moreover, secondary and tertiary packaging are important for transportation, storage, and display purposes, and are often considered as supporting elements to the primary packaging, which directly interfaces with the product itself during packaging.

End-use Insights

Based on end-uses, the global market has been further segmented into food, beverage, pharmaceutical, personal care & cosmetics, retail, e-commerce, and other end-uses. The food end-use segment dominated the market and accounted for the largest revenue share of over 32.0% in 2023 owing to the high demand for packaged and convenience foods across the globe. On the other hand, the pharmaceutical end-use segment is expected to grow at the fastest rate of 6.8% from 2024 to 2030.

Many pharmaceutical companies opt to outsource their packaging operations to co-packaging companies to focus on their core competencies, such as R&D and drug manufacturing. This trend increased the demand for contract packaging services in the pharmaceutical sector. In the personal care & cosmetics sector, packaging plays a crucial role in branding and attracting consumers. Contract packaging organizations offer expertise in providing creative packaging design, and material selection, and enabling companies to enhance their brand identity and shelf appeal.

Regional Insights

The North America contract packaging market dominated the global industry and accounted for the largest revenue share of over 36.0% in 2023. Many leading global brands and companies across various industries, such as food and beverages, pharmaceuticals, cosmetics, and consumer goods, have their headquarters or significant operations spanned across North America. These companies often outsource their packaging needs to contract packagers to streamline operations and focus on their core competencies. Hence, the presence of major brands and companies in North America is benefitting the regional market.

U.S. Contract Packaging Market Trends

The contract packaging market in the U.S. is growing due to an increase in the expansion activities undertaken by the co-packing companies operating in the country. For instance, in February 2024, Action-Pak Inc., a contract filling company based in New York, U.S. expanded its services to include complete private label manufacturing of liquid and powder products. This new offering allows for the creation of private-label products, such as powder stick packs, which are convenient single-serving packets containing various powders, such as protein powder, energy supplements, instant coffee, or tea.

The Canada contract packaging market is expected to benefit from the presence of a well-established and thriving pharmaceutical industry. The Canadian pharmaceutical industry consists of many major pharmaceutical companies having operations or manufacturing facilities in the country. This creates a significant demand for contract packaging services to support the production and distribution of drugs and medical devices.

Asia Pacific Contract Packaging Market Trends

The contract packaging market in Asia Pacific will have significant growth in the coming years. Many countries in this region offer lower labor costs and more cost-effective manufacturing processes compared to developed regions, such as North America and Europe. This cost advantage has attracted many companies to outsource their packaging operations to contract packagers in Asia Pacific. Moreover, the region has experienced rapid industrialization and economic growth in recent decades, leading to the establishment of numerous manufacturing facilities and the expansion of various industries. This growth has accelerated the demand for efficient, reliable, and specialized packaging solutions, thus triggering market growth.

The China contract packaging market is growing due growing middle-class population with a preference for convenience and pre-packaged goods. This outlook is driving the need for specialized packaging solutions, thus accelerating the demand for contract packaging services in the country. Moreover, China's historical transformation from an agrarian society to a manufacturing powerhouse, skilled and specialized labor force, specialized industrial zones catering to different manufacturing needs, world-class infrastructure, and supportive government policies all play a significant role in its dominance in global manufacturing and packaging.

Europe Contract Packaging Market Trends

The contract packaging market in Europe held a substantial revenue share in 2023 owing to the presence of prominent companies and service providers. Countries, including Germany, the UK, France, and Italy have well-established contract packaging industries with key players offering comprehensive services. These players opt for expansion strategies to increase their geographical presence and improve contract packaging product portfolios to meet the increasing regional demand. For instance, in July 2022, Sharp Services, LLC, a global company in contract packaging and clinical supply services, expanded its clinical services operations at its EU Heerenveen facility in the Netherlands. The expansion includes the addition of labelling and secondary packaging services to support clinical trials, alongside existing storage and distribution capabilities. This development allowed the company to offer a full suite of clinical services, including secondary packaging under various temperature conditions.

The UK contract packaging market growth is primarily driven by the increasing efforts made by contract packaging solutions manufacturers to develop and launch automated packaging lines to enhance production capacity. For instance, in October 2023, Calleva Nutrition, a UK-based contract packaging manufacturer specializing in nutraceutical & food products, installed a highly automated, horizontal fill-and-seal packaging line. This installation signifies a step towards enhancing their production capabilities.

Central & South America Contract Packaging Market Trends

The contract packaging market in Central & South America is projected to expand at a moderate CAGR from 2024 to 2030. The pharmaceutical and consumer goods industries in the region are experiencing significant growth, driven by factors, such as increasing disposable incomes, urbanization, and healthcare awareness. This growth has led to a higher demand for contract packaging services.

The Brazil contract packaging market is expected to register a healthy growth rate over the forecast period. Brazil has a well-established and diverse manufacturing sector, particularly in industries, such as food & beverages, pharmaceuticals, and cosmetics, which heavily rely on contract packaging services. Hence, this positive outlook is estimated to bolster market demand across the country.

Middle East & Africa Contract Packaging Market Trends

The contract packaging market in Middle East & Africa market dynamics are influenced by the expansion of manufacturing facilities in the region. Many multinational companies have established manufacturing facilities in this region, attracted by factors, such as favorable trade agreements, access to raw materials, and lower labor costs. These companies often rely on contract packagers to handle their packaging needs, contributing to the growth of the contract packaging market.

The South Africa contract packaging market growth can be ascribed to the presence of a well-developed and sophisticated pharmaceutical industry, with many major international pharmaceutical companies having operations in the country. This has created a strong demand for contract packaging services from these companies, thus benefitting the local market.

Key Contract Packaging Company Insights

Key players in the contract packaging market are implementing diverse strategies, including expansions, mergers and acquisitions, and geographic expansions, to enhance their market presence and stimulate growth.

-

In March 2024, PoppyPac, a UK-based, flexible packaging contract manufacturer, invested 675,000 USD in a new facility to add filling lines and boost production following a new contract win with an existing customer. This investment allowed them to increase supply to the market and expand their business. The company recruited additional operators, team leaders, and engineers to support the project and meet the growing demand across various product lines. In addition, PoppyPac’s strategic investments aim to drive sustainability-driven growth by expanding into new markets and market segments, with plans for production plants in India, MENA countries, and the U.S.

-

In September 2023, Kinaxia Logistics Ltd., significantly expanded its contract packing operations by increasing the size of its cleanroom facilities at its site in Trafford Park, Manchester, UK. This expansion includes the creation of two additional cleanrooms, bringing the total to three cleanrooms spanning 5,000 sq ft. These cleanrooms are equipped with air filtration systems to maintain a controlled environment for packing food, drink, and pharmaceutical items. The company aims to enhance efficiency and scalability in its co-packing business through the installation of a Nulogy cloud-based software system. This system provides real-time reporting on production line efficiency and availability, contributing to improved production performance.

Key Contract Packaging Companies:

The following are the leading companies in the contract packaging market. These companies collectively hold the largest market share and dictate industry trends.

- WestRock Company

- Sepha

- Peoria Production Solutions

- ActionPak

- Co-Pak

- Packservice Group

- MDI

- Hollingsworth

- Jonco Industries

- ProStar

- Jam Jams Group

- Vynx Private Limited

- TPC Packaging Solutions

- Econo-Pak

- WePack

- Elis Packaging Solutions, Inc.

- Pacmoore Products Inc

- Export Corporation

- Hanchett Paper Company

- Deluxe Packaging

- Stamar Packaging

Contract Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 72.46 billion

Revenue forecast in 2030

USD 103.95 billion

Growth rate

CAGR of 6.2% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, packaging type, end-use, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

WestRock Company; Sepha; Peoria Production Solutions; ActionPak; Co-Pak; Packservice Group; MDI; Hollingsworth; Jonco Industries; ProStar; Jam Jams Group; Vynx Pvt. Ltd.; TPC Packaging Solutions; Econo-Pak; WePack; Elis Packaging Solutions Inc.; Pacmoore Products Inc; Export Corp.; Hanchett Paper Company; Deluxe Packaging; Stamar Packaging

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Contract Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global contract packaging market report on the basis of material, packaging type, end-use, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Plastics

-

Paper & Paperboard

-

Glass

-

Metal

-

Others

-

-

Packaging Type Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Primary

-

Secondary

-

Tertiary

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Food

-

Beverage

-

Pharmaceutical

-

Personal Care & Cosmetics

-

Retail

-

E-commerce

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global contract packaging market was estimated at around USD 69.35 billion in the year 2023 and is expected to reach around USD 72.46 billion in 2024.

b. The global contract packaging market is expected to grow at a compound annual growth rate of 6.2% from 2024 to 2030 to reach around USD 103.95 billion by 2030.

b. Food emerged as a dominating end-use segment with a value share of around 32.0% in the year 2023 due to the rising demand for packaged and convenience foods across the globe.

b. The key player in the contract packaging market includes WestRock Company, Sepha, Peoria Production Solutions, ActionPak, Co-Pak, Packservice Group, MDI, Hollingsworth, Jonco Industries, ProStar, Jam Jams Group, Vynx Private Limited, TPC Packaging Solutions, Econo-Pak, WePack, Elis Packaging Solutions, Inc., Pacmoore Products Inc, Export Corporation, Hanchett Paper Company, Deluxe Packaging, and Stamar Packaging.

b. The growing outsourcing trend among companies across various industries, including food, beverage, pharmaceutical, personal care & cosmetics, retail, and e-commerce are fueling the demand for contract packaging solutions globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.