- Home

- »

- Sensors & Controls

- »

-

Contraband Detector Market Size And Share Report, 2030GVR Report cover

![Contraband Detector Market Size, Share & Trends Report]()

Contraband Detector Market (2024 - 2030) Size, Share & Trends Analysis Report By Screening Type (Human, Automotive), By Deployment Type (Fixed, Portable), By Technology, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-395-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Contraband Detector Market Summary

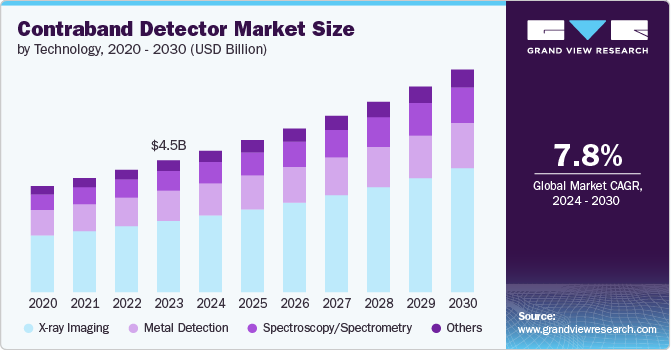

The global contraband detector market size was estimated at USD 4.48 billion in 2023 and is projected to reach USD 7.56 billion by 2030, growing at a CAGR of 7.8% from 2024 to 2030. The market is experiencing significant growth due to increasing global security concerns.

Key Market Trends & Insights

- North America dominated the market and accounted for a 33.20% share in 2023.

- The contraband detector market in Asia Pacific is anticipated to register the fastest CAGR over the forecast period.

- Based on technology, the X-ray imaging segment led the market, accounting for 54.12% of the global revenue in 2023.

- Based on screening type, the human screening segment accounted for the largest market revenue share in 2023.

- Based on deployment type, the fixed segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 4.48 Billion

- 2030 Projected Market Size: USD 7.56 Billion

- CAGR (2024-2030): 7.8%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

With rising incidences of terrorism, smuggling, and illegal trafficking, governments and organizations worldwide are investing heavily in advanced security technologies to protect public spaces, borders, and critical infrastructure. This increased focus on security drives demand for sophisticated detection systems that effectively identify hidden threats.

Enhanced security protocols in airports, seaports, and public venues require state-of-the-art contraband detection solutions. The need for better prevention measures has led to developing and deploying more sophisticated technologies. As a result, there is a growing market for detectors that can accurately and efficiently identify contraband items. This trend is further supported by increased funding for security upgrades and modernization efforts globally.

Innovations in detection technology, such as improvements in X-ray imaging, millimeter wave scanners, and spectroscopy, have enhanced the ability to detect a wide range of contraband materials with greater precision. These advancements allow faster and more reliable detection, which is crucial for maintaining security in high-traffic areas like airports and train stations. The continuous evolution of technology also means that new and more effective detection methods are regularly introduced to the market. Companies invest in research and development to create cutting-edge solutions to address emerging threats. This technological progress drives market expansion by offering more effective and efficient detection options. The result is a growing adoption of advanced contraband detection technologies across various sectors.

The expansion of global trade and travel is also fueling the market growth. As international trade increases and global travel becomes more frequent, the need for effective screening and security measures at borders, ports, and transport hubs becomes more critical. The movement of goods and people across borders presents opportunities for illegal activities, making robust detection systems essential for maintaining security. This increased activity in trade and travel generates a higher demand for comprehensive security solutions to manage the flow of goods and ensure safety. Moreover, the growth in e-commerce and parcel deliveries has heightened the need for effective cargo and package screening solutions. The expanding global economy and increased security requirements drive the demand for advanced contraband detection technologies. Consequently, the market for these solutions is expected to grow as security needs evolve with global trends.

Technology Insights

X-ray imaging led the market, accounting for 54.12% of the global revenue in 2023 due to its proven effectiveness and extensive use across multiple industries. X-ray imaging is a proven technology that provides detailed and high-resolution images of packages, luggage, and cargo contents. This capability allows for clearly identifying a wide range of contraband items, such as weapons, explosives, and drugs, by revealing hidden objects and anomalies. The versatility of X-ray systems makes them suitable for use in numerous settings, including airports, seaports, and border crossings, where they ensure security. Their ability to quickly and efficiently screen large volumes of items underlines their importance in high-traffic environments, driving their dominance in the market.

The spectroscopy/spectrometry segment is projected to grow significantly over the forecast period. spectroscopy/spectrometry technologies have seen remarkable advancements in recent years, enhancing their sensitivity, accuracy, and speed. Modern spectroscopic techniques can identify and analyze the composition of substances at a molecular level, making them highly effective for detecting contraband. These advancements have improved the reliability and efficiency of these technologies, driving their increased adoption in various security applications. spectroscopy/spectrometry offers superior detection capabilities compared to traditional methods. They can precisely identify complex chemical compounds and materials like explosives and narcotics, making them especially valuable for accurate cargo screening and forensic analysis detection, which drives their growing popularity.

Screening Type Insights

The human screening segment accounted for the largest market revenue share in 2023. The increasing focus on security in public places, such as airports, government buildings, and high-traffic venues, drives significant investment in human screening technologies. These systems, including metal detectors and millimeter wave scanners, are crucial for identifying potential threats to individuals. The need to ensure safety and prevent illegal activities in sensitive areas contributes to the dominant market share of human screening solutions. Human screening solutions are often integrated into security frameworks at airports, border control stations, and other high-security locations. Their compatibility with current security systems ensures that these technologies remain critical in maintaining safety. The ease of integration and their role in comprehensive security setups support their large market revenue share.

The baggage and cargo screening segment is expected to grow significantly during the forecast period, driven by rising global trade and increased travel, which demand higher security standards. Advances in screening technologies, including more sophisticated X-ray imaging and spectroscopy systems, enhance the ability to detect contraband with greater accuracy and efficiency. Increased security concerns and stringent regulatory requirements for inspecting cargo and luggage further fuel the demand for these advanced solutions. The continuous evolution of technology improves screening capabilities and adapts to emerging threats. Moreover, expanding e-commerce and international shipping amplifies the need for robust cargo inspection systems. Consequently, these factors collectively contribute to the predicted substantial growth of the baggage and cargo screening market.

Deployment Type Insights

The fixed segment accounted for the largest market revenue share in 2023. This segment's prominence is largely due to its deployment at high-traffic and strategic locations such as airports, border checkpoints, and secure facilities. Fixed detectors offer continuous and high-capacity screening, which is crucial for handling large volumes of traffic efficiently. Their stationary nature allows for advanced and stable detection technologies, increasing accuracy and reliability. Moreover, the growing emphasis on robust security measures has driven the demand for these systems. As a result, fixed contraband detectors are increasingly favored for their effectiveness in maintaining stringent security standards.

Portable is projected to grow significantly over the forecast period. This growth is driven by the increasing need for flexible and mobile security solutions that can be deployed in various locations and scenarios. Portable contraband detectors offer the advantage of easy transportability, making them ideal for field operations, temporary installations, and on-the-go inspections. As security challenges become more dynamic and varied, the versatility of portable detectors becomes a valuable asset. Moreover, technological advancements are enhancing these portable units' performance and reliability. The growing demand for adaptable and immediate security solutions will likely contribute to the Portable segment's substantial expansion in the coming years.

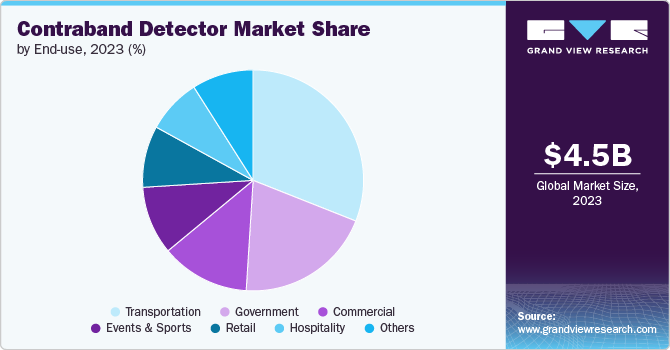

End-use Insights

Transportation accounted for the largest market revenue share in 2023. This dominance is due to the critical need for robust security measures in transportation hubs such as airports, seaports, and railway stations, where high volumes of passengers and cargo are processed daily. Effective contraband detection in these environments is essential for preventing illegal activities and ensuring public safety. The increasing global emphasis on security and regulatory compliance has led to substantial investments in advanced detection technologies for transportation infrastructure. Furthermore, transportation networks' high traffic and potential security risks contribute to the segment’s significant revenue share. As global travel and trade continue to expand, the demand for sophisticated contraband detection solutions in the transportation sector is expected to remain strong.

The government segment is projected to grow significantly over the forecast period. This anticipated growth is driven by increasing investments in national security and public safety measures, with governments worldwide focusing on enhancing their counter-terrorism and law enforcement capabilities. Government agencies increasingly deploy advanced contraband detection technologies to secure borders, critical infrastructure, and sensitive locations. The rising threat of smuggling and illegal trafficking further fuels the demand for sophisticated detection systems. Moreover, government budgets are allocated to upgrade and maintain state-of-the-art security solutions. As security challenges evolve, the Government segment is expected to grow as nations prioritize implementing effective and advanced contraband detection technologies.

Regional Insights

North America dominated the market and accounted for a 33.20% share in 2023. Major transportation hubs, including airports and seaports, handle large volumes of passengers and cargo, making them critical points for security. The need to effectively screen and monitor these high-traffic areas drives significant demand for advanced contraband detection systems. This demand ensures that North America remains a key player in deploying and utilizing sophisticated security technologies. North America is home to several leading companies and manufacturers in the contraband detection industry. These key players invest heavily in research and development, producing advanced technologies that enhance the effectiveness and reliability of detection systems.

U.S. Contraband Detector Market Trends

The contraband detector market in the U.S. is expected to grow significantly over the forecast period.Increasing national security and public safety concerns are pushing for more stringent measures to prevent illegal activities. The U.S. government and private sectors prioritize advanced security solutions to address these concerns, leading to greater demand for contraband detection technologies. The significant volume of passengers and cargo processed at U.S. transportation hubs necessitates efficient and reliable detection systems. As travel and trade continue to increase, the need for sophisticated contraband detectors to manage and secure these busy areas becomes even more critical.

Europe Contraband Detector Market Trends

The contraband detector market in Europe is expected to grow significantly over the forecast period. European countries are implementing stricter regulatory measures to enhance border security and prevent illegal activities. These regulations drive the adoption of advanced contraband detection systems to ensure compliance and improve security at entry points. There is a growing emphasis on integrating advanced technologies such as AI, machine learning, and high-resolution imaging into contraband detectors. These innovations improve the accuracy and efficiency of detecting illicit items and streamline the screening process.

Asia Pacific Contraband Detector Trends

The contraband detector market in Asia Pacific is anticipated to register the fastest CAGR over the forecast period. As transportation infrastructure expands, such as constructing new airports, seaports, and railways, these facilities handle a larger volume of cargo and passengers. Higher traffic volumes necessitate efficient and reliable contraband detection systems to ensure security and streamline operations. Expanded infrastructure facilitates more significant international trade and economic activity. With increased trade, there is a higher risk of smuggling and trafficking. Advanced detection technologies are required to manage these risks and safeguard against illegal activities while maintaining the flow of legitimate trade.

Key Contraband Detector Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations, as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in March 2024, Decision Sciences, a U.S.-based provider of advanced contraband detection systems, developed a groundbreaking Discovery system utilizing unique Charged Particle (Muon) Tomography technology to detect contraband and anomalies without generating harmful radiation. Decision Sciences completed proof-of-concept trials for an AI/ML advancement in human detection and plans to deploy it, significantly enhancing global efforts against human trafficking.

Key Contraband Detector Companies:

The following are the leading companies in the contraband detector market. These companies collectively hold the largest market share and dictate industry trends.

- Berkeley Varitronics Systems, Inc.

- Decision Sciences

- Leidos

- Metrasens

- Nuctech Company Limited

- OSI Systems, Inc.

- PKI Electronic Intelligence

- Smiths Detection Group Ltd

- Vidisco Ltd.

- Walaris

Recent Developments

-

In April 2024, Smiths Detection Group Ltd., a UK-based manufacturer of sensors and detection technologies, announced the launch of the SDX 10060 XDi, an X-ray Diffraction (XRD) technology scanner, to enhance and automate the detection of narcotics and contraband at international airports, customs control points and express forwarding facilities. This innovative scanner uses AI to optimize detection capabilities, significantly improving accuracy and efficiency in identifying illicit substances without requiring manual inspection.

-

In September 2023, Walaris, a developer of a drone detection system in the U.S., developed the AirScout UAV detection system. This system uses advanced AI and multispectral cameras to combat drone-based contraband smuggling in prisons. This technology, effective in various conditions, has been successfully deployed in over 20 prisons in the U.S. and Europe, with more installations planned.

-

In May 2023, The Department of Homeland Security's Science and Technology Directorate is collaborating with the Department of Energy's Pacific Northwest National Laboratory to enhance portable drug detectors' ability to identify narcotics like fentanyl by providing reference data to OEMs in exchange for updated detection libraries. This initiative, which includes rigorous testing and evaluation, aims to improve detection systems used by first responders and will culminate in a public report detailing the results.

-

In March 2023, Smiths Detection and GRASP Innovations are collaborating to integrate GRASP's sensor technology into Smiths Detection's security checkpoints as part of the Ada Initiative, enhancing passenger flow data and operational efficiency. The partnership aims to improve safety and streamline operations at security checkpoints.

Contraband Detector Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.81 billion

Revenue forecast in 2030

USD 7.56 billion

Growth rate

CAGR of 7.8% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, screening type, deployment type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Berkeley Varitronics Systems, Inc.; Decision Sciences; Leidos; Metrasens; Nuctech Company Limited; OSI Systems, Inc.; PKI Electronic Intelligence; Smiths Detection Group Ltd.; Vidisco Ltd.; Walaris

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Contraband Detector Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global contraband detector market report based on technology, screening type, deployment type, end-use and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

X-ray Imaging

-

Metal Detection

-

Spectroscopy/Spectrometry

-

Others

-

-

Screening Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Human Screening

-

Baggage And Cargo Screening

-

Automotive Screening

-

-

Deployment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed

-

Portable

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Government

-

Transportation

-

Retail

-

Hospitality

-

Events & Sports

-

Commercial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global contraband detector market size was estimated at USD 4.48 billion in 2023 and is expected to reach USD 4.81 billion in 2024.

b. The global contraband detector market is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030 to reach USD 7.56 billion by 2030.

b. North America dominated the contraband detector market with a share of 33.2% in 2023. This is attributable to the region’s advanced security infrastructure, high levels of investment in border and transportation security, and increasing demand for sophisticated detection technologies.

b. Some key players operating in the contraband detector market include Berkeley Varitronics Systems, Inc., Decision Sciences, Leidos, Metrasens, Nuctech Company Limited, OSI Systems, Inc., PKI Electronic Intelligence, Smiths Detection Group Ltd, Vidisco Ltd., Walaris.

b. Key factors that are driving the market growth include advancements in detection technology, rising security concerns, and increased government spending on border and transportation security.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.