Continuous Positive Airway Pressure (CPAP) Devices Market Size, Share & Trends Analysis Report By Connectivity (Connected, Non-Connected), By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-482-9

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

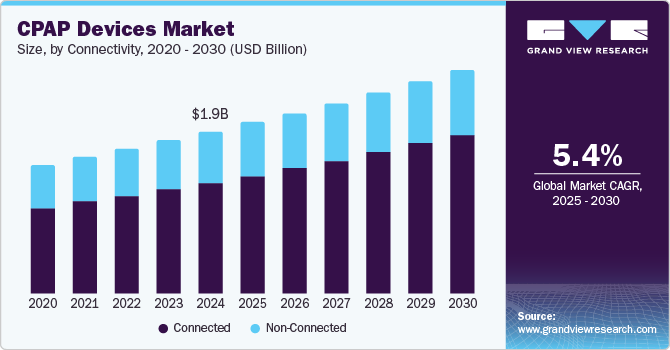

The global continuous positive airway pressure (CPAP) devices market size was estimated at USD 1.90 billion in 2024 and is expected to grow at a CAGR of 5.45% from 2025 to 2030. The increasing prevalence of sleep apnea, the growing emphasis on preventive healthcare, and the rapidly advancing healthcare infrastructure in emerging economies. The rising supportive initiatives by government and private organizations for Continuous Positive Airway Pressure (CPAP) devices is a notable trend expected to fuel market growth.

Furthermore, the rise in preference for home-based healthcare solutions and remote monitoring capabilities are boosting market growth. As healthcare systems shift care delivery from hospitals to patients' homes, there is a growing interest in leveraging sleep apnea devices for home-based noninvasive ventilation therapy. CPAP devices offer a cost-effective and convenient alternative to traditional hospital-based care, allowing patients to receive respiratory support in their homes. Home care settings allow patients to use CPAP devices in a familiar environment, which enhances comfort and adherence to therapy. This is particularly significant for individuals requiring long-term management of sleep apnea, as they can integrate the device into their daily routines without the stress of hospital visits.

Government Health Departments and non-profit organizations often run public awareness campaigns to educate people about sleep apnea and the importance of seeking treatment. For instance, in the U.S., the CDC has included sleep apnea in its broader public health messaging about sleep hygiene and chronic disease management. Similarly, in the UK, the National Health Service (NHS) promotes sleep health awareness and encourages people to seek diagnostic testing for sleep apnea. In addition, World Sleep Day, organized by the World Sleep Society, is an annual global event aimed at raising awareness of sleep disorders, including sleep apnea. The event garners significant media attention and support from healthcare organizations, further driving the use of CPAP therapy.

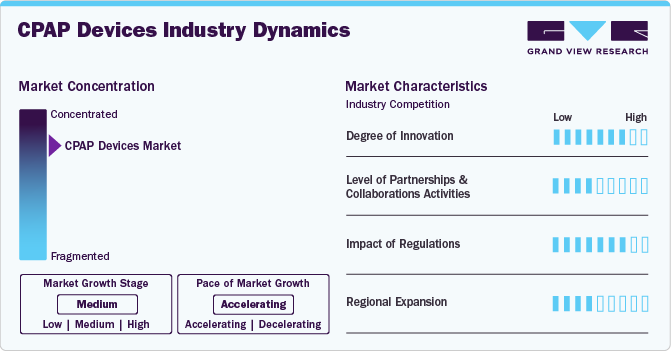

Market Consantration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including impact of regulations, degree of innovation, industry competition, regional expansion, and level of partnerships & collaborations activities. The CPAP devices market is consolidated, with the presence of limited providers dominating the market. The degree of innovation is high, and the level of partnerships & collaborations activities is moderate. The regional expansion is low and the impact of regulations on the industry is high.

The degree of innovation in the industry is high. There is a growing demand for more user-friendly and effective solutions for sleep apnea treatment. Technological advancements play a crucial role, with companies continuously seeking to enhance device functionality and patient comfort. Moreover, substantial research and development investments are expected to drive market growth. For instance, in March 2024, React Health launched the Luna TravelPAP, a lightweight and small travel-positive airway pressure device. The device features a pressure range of 4-20 hPA, a ramp time of 0-60 minutes, and operates at a sound level of less than 30 dBA.

The industry's level of partnerships & collaborations is moderate. This is due to the specialized nature of the market, where companies often possess unique technologies. While these alliances are crucial for expanding product portfolios and geographic reach, the competitive landscape and intellectual property concerns sometimes limit the extent of collaboration. For instance, in September 2023, Nyxoah SA, a medical technology company, partnered with ResMed Germany to expand OSA therapy penetration and awareness in the German market.

The impact of regulations on the market is high due to the stringent safety and efficacy standards required for medical device approval. These regulations ensure patient safety but also increase the time and cost associated with bringing new devices to market.

The level of regional expansion in the industry is low due to stringent regulatory barriers across different regions, a significant disparity in healthcare infrastructure between developed and developing countries, the high cost associated with advanced CPAP devices technologies, and limited reimbursement policies further constrain market growth in low-income regions.

Connectivity Insights

The connected CPAP devices segment held the largest revenue share of over 68.00% in 2024 and is anticipated to grow at the fastest growth rate over the forecast year. The growth of this segment is due to the revolution in sleep apnea management through enhanced technology integration for real-time monitoring and personalized care, driving user compliance and effectiveness. This sector's growth is propelled by technological innovations, the rising incidence of sleep apnea, and an aging population, with products like ResMed's AirSense 10 and 11 leading the market through advanced connectivity and mobile health features.

The non-connected device segment is anticipated to grow at a significant CAGR over the forecast year. This growth is due to their simplicity, cost-effectiveness, and ease of use, catering, especially to tech-averse users and those seeking immediate, uncomplicated sleep apnea solutions. Their affordability and straightforward operation make them appealing to budget-conscious individuals and those with limited internet access, emphasizing user-friendly design over advanced connectivity features.

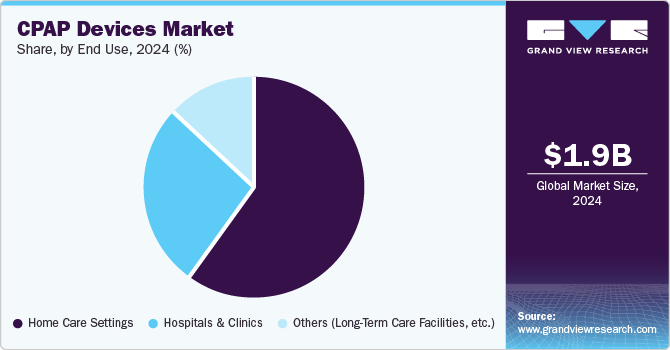

End Use Insights

The home care settings segment held the largest revenue share of over 59.00% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. The growth of this segment can be attributed to the rising prevalence of OSA and advancements in CPAP technology are driving the adoption of homecare CPAP therapy, offering cost-effective, comfortable, and convenient solutions for patients.

Moreover, enhanced device features, insurance coverage, and a growing elderly population in need of sleep management solutions contribute to this trend. For instance, in July 2024, SleepRes launched the Kairos PAP (KPAP) Algorithm. This algorithm modifies the pressure delivered by CPAP devices to enhance comfort without compromising efficacy. Unlike traditional CPAP, which maintains continuous pressure, KPAP allows for a reduction in pressure during most of the breathing cycle, making it feel more natural for users. This innovation is expected to be available in the U.S. market by 2025.

Hospitals & clinics segment is anticipated to grow significantly over the forecast year. The growth is attributed to the rising prevalence of respiratory diseases and the aging population are key drivers for the increasing demand for CPAP devices in hospitals. Innovations in CPAP technology and the development of advanced systems, such as the infrastructure-independent SAANS for neonates and the comfort-focused V̇-Com for adults with sleep apnea, are enhancing patient compliance and expanding market growth. The COVID-19 pandemic further underscored the critical need for non-invasive ventilation, accelerating the adoption of CPAP devices in critical care.

Regional Insights

North America held the largest revenue share of 42.29% in 2024. This is due to the increasing prevalence of respiratory conditions, such as Chronic Obstructive Pulmonary Disease (COPD), respiratory failure, and sleep apnea is driving the CPAP devices market in the region. According to an article published by the American Lung Association in September 2024, over 35 million individuals in the U.S. suffer from chronic lung diseases, including COPD and asthma.

U.S. Continuous Positive Airway Pressure (CPAP) Devices Market Trends

U.S. CPAP devices market held the largest regional share in 2024. This is due to the increasing prevalence of respiratory diseases, such as COPD, respiratory failure, and obstructive sleep apnea, in the U.S. is driving the demand for PAP devices. According to a study published in the Journal of Pulmonary Therapy in July 2022, the most common respiratory symptoms, such as shortness of breath and active cough, affect over 17% of adult citizens. Moreover, the advanced healthcare infrastructure and high investment in R&D in the country have enabled manufacturers to develop and launch the latest technologies in respiratory devices, making them more efficient, portable, & user-friendly.

Europe Continuous Positive Airway Pressure (CPAP) Devices Market Trends

The growth of CPAP devices market in Europe is driven by the rising prevalence of COPD and rising prevalence of sleep apnea among the European population, attributed to aging demographics, increasing obesity rates, and lifestyle factors such as smoking and alcohol consumption in European countries. For instance, the European Respiratory Society journal reported that in 2020, an estimated 36.6 million people in Europe were suffering from COPD. By 2050, it is projected that 49.5 million people will have COPD, with a prevalence rate of 9.3%.

The CPAP devices market in the UK is expected to witness the fastest growth over the forecast period owing to the high demand for CPAP devices is anticipated to drive the market owing to the rising prevalence of chronic respiratory diseases in the country. According to an article published by the Sleep Apnea Trust in 2023, up to 10 million people in the UK suffer from the most prevalent type of OSA. Among these, around 4 million people suffer from either moderate or severe OSA. Thus, the increasing prevalence of respiratory disorders in the country is expected to fuel market growth over the forecast period.

The Germany CPAP devices market held the largest regional share in 2024, due to the rising number of sleep apnea patients and the availability of reimbursement coverage in Germany are contributing to market growth. In addition, enhanced patient compliance and a high prevalence of respiratory diseases are expected to have a positive impact on the CPAP devices market. For instance, in October 2023, as per the Springer Nature article, the prevalence of Obstructive sleep apnea (OSA) in Germany was around 30% in men and 13% in women. Thus, the presence of a large patient pool is expected to increase the demand for CPAP devices and drive the market in Germany.

Asia Pacific Continuous Positive Airway Pressure (CPAP) Devices Market Trends

The CPAP devices market in Asia Pacific is expected to witness the fastest growth over the forecast period owing to the rising incidence of chronic disorders is anticipated to directly contribute to the growing prevalence of OSA. According to an article by Elsevier B.V. in June 2020, the overall prevalence of obstructive sleep apnea (OSA) in the sample was found to be 80.5%. Among these cases, 24.3% were classified as mild OSA, 23.9% as moderate OSA, and 32.3% as severe OSA. Notably, only 17.3% of individuals had received a prior diagnosis of OSA before undergoing bariatric evaluation. Moreover, the increasing hospitalization rate and the high incidence of COPD is anticipated to boost market growth.

The CPAP devices market in China dominated with the largest share in 2024, the high prevalence of respiratory diseases in China, increasing applications in home care settings, continuing demographic & economic trends, and rapid technological advancements are among the major factors contributing to market growth. Chronic respiratory diseases are a leading cause of death in China. For instance, in November 2023, the WHO stated that China has almost 100 million people living with chronic obstructive pulmonary disease (COPD) and accounts for almost 25% of all COPD cases globally.

The India CPAP devices market is anticipated to grow at the fastest CAGR over the forecast period, owing to an increase in the number of government initiatives, the introduction of Make in India & Aatmanirbhar Bharat programs, and the implementation of a production-linked incentive scheme are among the factors expected to boost the demand for respiratory devices in the country over the forecast period. In addition, with the rising prevalence of chronic respiratory diseases, players are adopting various growth strategies, including mergers, acquisitions, & launch of new products, to increase their market share.

Latin America Continuous Positive Airway Pressure (CPAP) Devices Market Trends

The CPAP devices market in Latin America is expected to grow significantly over the forecast period due to an increase in the incidence of stroke and the high prevalence of hypertension. In addition, COPD is the most common disease in the geriatric population; most Latin Americans show some symptoms of the disease by the age of 40. For instance, according to the document titled “Ageing in Latin America and the Caribbean: Inclusion and Rights of Older Persons,” there are currently 88.6 million people aged 60 and over living in the region, accounting for 13.4% of the total population. This proportion is expected to increase to 16.5% by 2030 due to the rapidly aging population in the region.

The CPAP devices market in Brazil is anticipated to grow significantly due to the increasing prevalence of obesity is one of the major factors contributing to OSA cases. According to an article published by Agencia Brasil, in 2022, 14.2% of children in Brazil were overweight, three times more than the global average of 5.6%. For adolescents, the percentage stood at 31.2. Moreover, the increasing elderly population in the country is anticipated to boost market growth.

Middle East & Africa Continuous Positive Airway Pressure (CPAP) Devices Market Trends

The CPAP devices market in Middle East & Africa is expected to grow significantly due to the increasing prevalence of respiratory diseases and high tobacco consumption to support market growth. Moreover, people prefer home healthcare settings over hospital & ambulatory care services due to a rise in the number of product launches and high R&D investment for respiratory care devices is contributing to the expansion of this market.

The CPAP devices market in Saudi Arabia is anticipated to grow at the fastest CAGR over the forecast period owing to the rapidly growing population and rising prevalence of lifestyle-related risk factors for sleep apnea, such as obesity and sedentary lifestyles, which contribute to the increasing prevalence of sleep disorders in Saudi Arabia. According to the Saudi National Health Survey (SNHS), in 2023, 23.9% of people were found to be obese (with a BMI of ≥30). In addition, the consumption rates of vegetables and fruits among adults aged 15 and above were 36.5% and 24.8%, respectively.

Key Continuous Positive Airway Pressure Devices Company Insights

The market is highly consolidated, with large players and emerging players operating in this space adopting various strategies such as collaborations, acquisitions, partnerships, and launching new devices. Some emerging players in the market include Transcend Inc. (Somnetics International, Inc.) and React Health (3B Medical).

Key Continuous Positive Airway Pressure Devices Companies:

The following are the leading companies in the continuous positive airway pressure devices market. These companies collectively hold the largest market share and dictate industry trends.

- ResMed

- Koninklijke Philips N.V.

- Fisher & Paykel Healthcare Limited

- Medical Depot, Inc. dba Drive DeVilbiss Healthcare

- React Health (3B Medical)

- Transcend Inc. (Somnetics International, Inc.)

- Wellell Inc. (Apex Medical)

- BMC

Recent Developments

-

In June 2024, React Health, a manufacturer and distributor of sleep & respiratory devices, introduced the IntelliPAP feature for its V+Pro, V*Home, V+C, and VC+Pro ventilators. This feature enables physicians to automatically adjust PEEP levels during noninvasive ventilation for patients with respiratory insufficiency and OSA in response to detected sleep-disordered breathing events.

-

In July 2023, ResMed acquired Somnoware, a leader in sleep and respiratory care diagnostics software. This acquisition enhanced the company’s existing product portfolio.

-

In November 2022, ResMed opened its advanced manufacturing facility in Singapore. This strategy helped the company expand its AirSense 11 device and mask production.

-

In December 2021, Koninklijke Philips N.V. updated its testing and research program related to the CPAP, BiPAP, and mechanical ventilator recall notification.

Continuous Positive Airway Pressure (CPAP) Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.01 billion |

|

Revenue forecast in 2030 |

USD 2.62 billion |

|

Growth rate |

CAGR of 5.45% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Volume in 000`units, revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Connectivity, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait |

|

Key companies profiled |

ResMed; Koninklijke Philips N.V.; Fisher & Paykel Healthcare Limited; Medical Depot, Inc. dba Drive DeVilbiss Healthcare; React Health (3B Medical); Transcend Inc. (Somnetics International, Inc.); Wellell Inc. (Apex Medical); BMC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Continuous Positive Airway Pressure (CPAP) Devices Market Report Segmentation

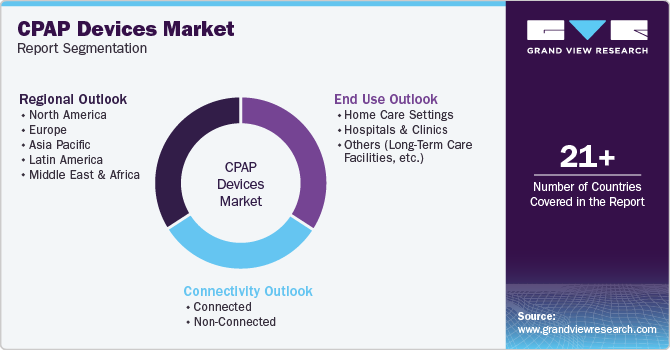

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Continuous Positive Airway Pressure (CPAP) devices market report based on connectivity, end use, and region:

-

Connectivity Outlook (Volume, 000`Units; Revenue, USD Million, 2018 - 2030)

-

Connected

-

Bluetooth-Connected CPAP

-

Wi-Fi & Cellular Connected CPAP

-

Hybrid-Connected

-

-

Non-Connected

-

-

End Use Outlook (Volume, 000`Units; Revenue, USD Million, 2018 - 2030)

-

Home Care Settings

-

Hospitals & Clinics

-

Others (Long-Term Care Facilities, etc.)

-

-

Regional Outlook (Volume, 000`Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global continuous positive airway pressure devices market size was estimated at USD 1.90 billion in 2024 and is expected to reach USD 2.01 billion in 2025.

b. The global continuous positive airway pressure devices market is expected to grow at a compound annual growth rate of 5.45% from 2025 to 2030 to reach USD 2.62 billion by 2030.

b. North America dominated the continuous positive airway pressure devices market with a share of 42.29% in 2024. This is attributable to the increasing prevalence of respiratory conditions, such as Chronic Obstructive Pulmonary Disease (COPD), respiratory failure, and sleep apnea is driving the CPAP devices market.

b. Some key players operating in the continuous positive airway pressure devices market include ResMed, Koninklijke Philips N.V., Fisher & Paykel Healthcare Limited, Medical Depot, Inc. dba Drive DeVilbiss Healthcare, React Health (3B Medical), Transcend Inc. (Somnetics International, Inc.), Wellell Inc. (Apex Medical), BMC.

b. Key factors that are driving the market growth includes the increasing prevalence of sleep apnea, the growing emphasis on preventive healthcare, and the rapidly advancing healthcare infrastructure in emerging economies. In addition, the rising supportive initiatives by government and private organizations for CPAP devices is a notable trend expected to fuel market growth

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."