Continuous Manufacturing For Small Molecule APIs Market Size, Share & Trends Analysis Report By Equipment (Reactors, Crystallizers, Filtration Systems), By Unit Operation, By Type, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-472-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

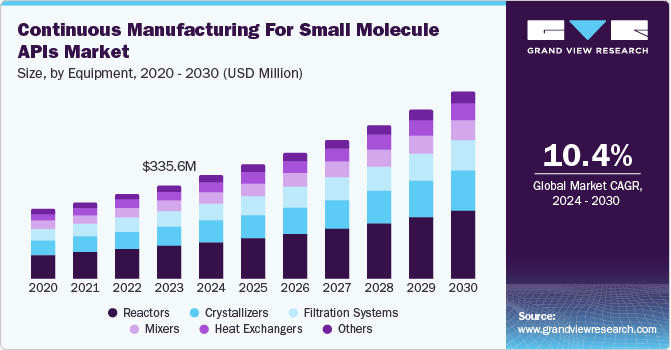

The global continuous manufacturing for small molecule APIs market size was valued at USD 335.6 million in 2023 and is projected to grow at a CAGR of 10.42% from 2024 to 2030. This growth is propelled by the rising prevalence of chronic diseases, supportive regulatory frameworks, technological advancements, sustainability initiatives, and the shift toward personalized medicine. According to the World Health Organization (WHO), chronic diseases are responsible for nearly 71% of all deaths worldwide, with numbers projected to rise as the population ages and lifestyles change. This increasing disease burden drives demand for effective pharmaceuticals, particularly small molecule APIs, which are often used in a wide array of treatments.

The demand for more efficient and flexible production processes in the pharmaceutical industry is significantly driving market growth. Traditional batch manufacturing methods involve multiple steps, lengthy production time, and higher operational costs due to downtime, material waste, & labor-intensive processes. Continuous manufacturing addresses these challenges by providing a streamlined, end-to-end process that reduces the time to market, minimizes waste, and improves resource utilization. This drives pharmaceutical companies to lower production costs, improve operational flexibility, and enhance the ability to respond quickly to changes in market demand or supply chain disruptions.

In August 2023, an article from the International Society for Pharmaceutical Engineering (ISPE) highlighted various case studies demonstrating the successful implementation of continuous manufacturing in small molecule active pharmaceutical ingredients (APIs). For instance, companies such as Pfizer, Eli Lilly, GSK, and Amgen have effectively transitioned from batch to continuous processes, significantly enhancing their production efficiency, reducing costs, and meeting regulatory requirements more swiftly.

Furthermore, the development of modular and flexible manufacturing platforms is encouraging the adoption of continuous manufacturing. These platforms could be scaled up or down and reconfigured easily, which is particularly valuable for small molecule APIs that may require production in varying quantities. Such technological improvements provide the pharmaceutical industry with greater flexibility and scalability in production, ultimately driving the market for continuous manufacturing in small molecule APIs. In March 2024, an article by CHE Manager highlighted that Novartis and MIT partnered through the Novartis-MIT Center for Continuous Manufacturing to develop a pilot plant capable of transforming raw materials into tablets within 2 days-a significant reduction from the 200 days required in traditional batch processing. This breakthrough was achieved using an innovative manufacturing platform known as Integrated Continuous Manufacturing (ICM), which was later commercialized by continuous pharmaceuticals after being developed at MIT.

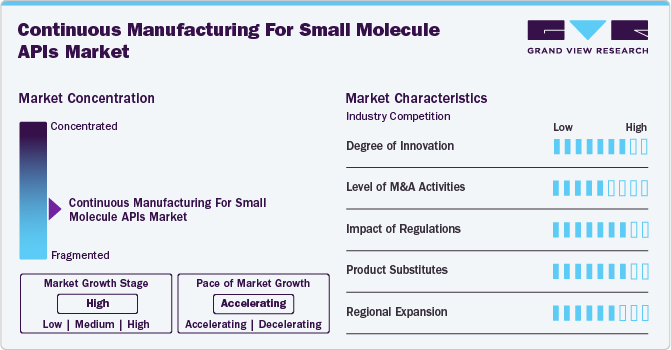

Market Concentration & Characteristics

The continuous manufacturing market for small molecule APIs is characterized by a high degree of innovation, driven by the need for efficiency, scalability, and quality. Innovative technologies, such as continuous flow synthesis and integrated process analytical technologies (PAT), are increasingly adopted to streamline production and enhance product consistency.

Mergers and acquisitions (M&A) activity in the continuous manufacturing sector is robust, driven by the need for strategic partnerships and enhanced capabilities. Recent trends indicate that pharmaceutical companies are actively seeking to acquire innovative firms with advanced manufacturing technologies to stay competitive. For instance, in July 2023, Heraeus Precious Metals and Evonik Industries announced a collaboration aimed at enhancing their services for highly potent active pharmaceutical ingredients (HPAPIs). This partnership seeks to create a fully integrated offering that spans from pre-clinical development to commercial manufacturing, facilitating smoother transitions between small- and large-scale production across their facilities.

Regulatory frameworks significantly impact the market. In regions like the US and Europe, agencies such as the FDA and EMA have introduced guidelines that encourage the adoption of continuous manufacturing technologies. For instance, the FDA's 2015 Process Validation Guidance emphasizes a lifecycle approach that aligns well with continuous manufacturing practices. Moreover, the International Council for Harmonisation (ICH) has initiated efforts to standardize regulatory practices globally, facilitating smoother approvals for continuous processes.

The regional expansion of the market is gaining traction, particularly in Asia and Latin America. In countries such as China and India, increasing government support and initiatives to boost domestic manufacturing capabilities are driving growth. In May 2023, Global Healthcare Opportunities (GHO Capital Partners LLP) and Partners Group announced supporting Sterling’s accelerated growth plans, focusing on expanding production capacity across the UK, Europe, and the U.S.

Equipment Insights

Reactors dominated the market with a substantial share of 35.2% in 2023 and are expected to grow at the fastest CAGR of 11.0% during the forecast period. The growing adoption of continuous flow chemistry drives demand for advanced reactors. Reactors facilitate the continuous synthesis of small molecule APIs by allowing the uninterrupted flow of raw materials and reagents, resulting in consistent product quality and reduced processing times. It enables real-time reactions under controlled conditions, enhancing yield and purity. The modular nature of continuous reactors allows for quick adjustments to formulations, catering to changing market demands. Transitioning from laboratory to commercial production becomes easier with reactors designed for continuous flow, minimizing bottlenecks.

The trend toward adopting continuous manufacturing methods, including the use of reactors, is accelerating. Key drivers include regulatory bodies such as the FDA are encouraging the adoption of CM technologies, recognizing their potential to enhance product quality and consistency. Continuous manufacturing often results in lower waste generation and energy consumption, aligning with industry goals for greener production methods. Innovations in reactor design, such as microreactors and flow chemistry, are enhancing process efficiency and enabling complex syntheses that were previously difficult to achieve. The demand for reactors in the continuous manufacturing of small molecule APIs is on the rise. As pharmaceutical companies increasingly recognize the advantages of CM, investment in this segment is expected to grow significantly.

Unit Operation Insights

The synthesis segment held the largest revenue share of 39.1% in 2023 and is expected to grow at the fastest CAGR of 11.2% during the forecast period, driven by technological advancements, efficiency gains, and a shift toward sustainable practices, positioning it for continued expansion in the coming years. Continuous flow synthesis revolutionizes pharmaceutical research by allowing for combinatorial synthesis and the integration of various reaction steps within a single flow reactor. This approach is more efficient than traditional batch methods, enhancing synthetic capabilities and optimizing commercially relevant processes.

The continuous flow method not only streamlines the synthesis of high-volume pharmaceuticals but also standardizes the process, reducing downstream complications. Each step of the synthesis can be meticulously optimized using quality reagents, culminating in efficient final purification. For instance, the synthesis of the tyrosine kinase inhibitor Gleevec showcases the effectiveness of this method. It involves a series of reactions-amide formation, nucleophilic substitution, and Buchwald-Hartwig coupling-all performed in a continuous flow setup.

Type Insights

The generic API’s segment dominated the market, capturing a substantial revenue share in 2023. Generic APIs are chemically identical to innovative APIs; however, they are produced after the original product’s patent expires. The primary focus for manufacturers of generic APIs is cost-efficiency, quality, and speed to market. Continuous manufacturing plays a crucial role in reducing production costs, improving consistency, and enhancing scalability, which is critical for the competitive generic drug market. The demand for generic API is growing due to rising demand for affordable medications, particularly in emerging markets. As patents for many leading drugs expire, generic drug manufacturers have a growing opportunity to utilize continuous manufacturing to increase production capacity.

Continuous manufacturing plays a critical role in the development of the generic API segment by streamlining production processes, reducing manufacturing costs, and enhancing product quality. The increasing demand for generic APIs is being fulfilled with the help of CMOs that allow production at cost-effective prices. For instance, Lupin Limited has adopted continuous manufacturing to produce generic APIs. The company has deployed a Continuous Flow Reactor at its Ankleshwar plant in India and completed process validation for the same. The company’s goal is to reduce production costs and increase process efficiency, which has allowed it to supply generic drugs at competitive prices globally.

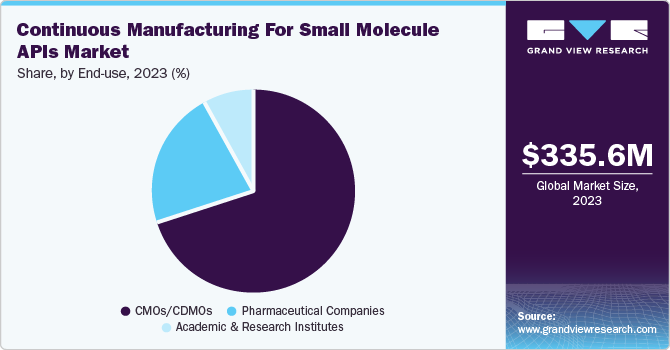

End Use Insights

The CMO/CDMO segment dominated the market, capturing a substantial revenue share of 70.2% and is also anticipated to achieve the fastest CAGR of 11.0% during the forecast period. CMOs and CDMOs are integral to the continuous manufacturing ecosystem, as they offer pharmaceutical companies specialized manufacturing services, including API production. These organizations provide flexibility, capacity, and expertise that many companies may lack in-house. With continuous manufacturing, CMOs/CDMOs are increasingly focusing on adopting this technology to meet the growing demand for faster, more efficient, and cost-effective drug production.

Moreover, contract manufacturers are increasingly adopting continuous manufacturing techniques to stay competitive in a rapidly evolving market. This transition enables them to produce APIs with greater consistency and lower batch variability, which are critical factors in maintaining regulatory compliance and ensuring product efficacy. Governments are also encouraging innovation and investment in advanced manufacturing capabilities. In January 2024, The Taipei Times article highlighted that the Japanese government intends to enhance the local small-molecule drug CDMO industry by collaborating with companies to jointly develop a crucial technology platform. According to the ministry's statement, the key technology platforms would feature a high entry barrier and will include active pharmaceutical ingredient (API) intermediates, continuous manufacturing processes, specialized delivery solutions, and dosage forms for small molecules.

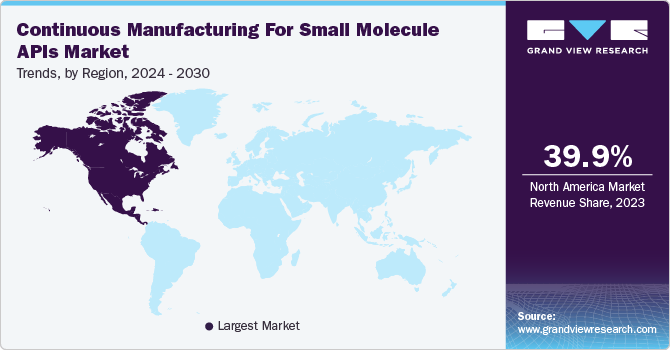

Regional Insights

North America continuous manufacturing for small molecule APIs market is experiencing robust growth, driven by several key market factors. One of the primary drivers is the rising demand for more efficient and cost-effective pharmaceutical production processes. Continuous manufacturing, with its ability to streamline production, reduce waste, and minimize downtime, has gained strong traction among pharmaceutical companies looking to enhance operational efficiency.

U.S. Continuous Manufacturing For Small Molecule APIs Market Trends

The continuous manufacturing for small molecule APIs market in the U.S. is characterized by a highly competitive landscape driven by the presence of both established pharmaceutical giants and innovative technology providers. Major pharmaceutical companies, such as Pfizer, Eli Lilly, Merck, and others, have been at the forefront of adopting continuous manufacturing techniques to improve efficiency, reduce production costs, and meet the growing demand for faster drug development. The market is witnessing increased mergers & partnerships as companies seek to leverage each other’s technological advancements and expertise to gain a competitive edge. In October 2020, Sterling Pharma Solutions invested USD 1.5 million into a phased expansion of its U.S. facility in North Carolina. This investment followed the acquisition of the former CiVentiChem site earlier that year.

Europe Continuous Manufacturing For Small Molecule APIs Market Trends

The continuous manufacturing for small molecule APIs market in Europe is witnessing substantial growth. Europe is one of the early adopters of automation in manufacturing. The Centre for Process Innovation (CPI), UK, is one of the institutions that have adopted continuous manufacturing processes. It has worked with Novasep to develop a continuous manufacturing process for protein purification. In addition, CPI is working with GEA Group, Siemens Plc, and others to develop new continuous manufacturing processes. Such industrial collaborations are anticipated to contribute to the increasing use of continuous manufacturing processes in the country.

The continuous manufacturing for small molecule APIs market in the UK is experiencing significant growth, driven by the demand for efficiency, cost reduction, and enhanced product quality. Key trends include increased adoption of continuous flow processes, which enable real-time monitoring and optimization, thereby minimizing waste and improving scalability. Additionally, regulatory support is fostering innovation as companies seek to streamline production methods. Collaborations between pharmaceutical firms and technology providers are also rising, facilitating the integration of advanced technologies like AI and automation. In January 2024, Sterling Pharma Solutions announced the results of a pilot project evaluating new ultra-low charge ammonia chilling technology. A 150kW chiller was installed at its API manufacturing plant in Cramlington, UK, and after a 15-month trial, it demonstrated a 65% reduction in energy costs compared to conventional chillers. Sterling now plans to implement this technology across its global network

Asia Pacific Continuous Manufacturing For Small Molecule APIs Market Trends

The continuous manufacturing for small molecule APIs market in the Asia Pacific region is expanding rapidly due to the high rate of adoption of continuous manufacturing technologies within the region. The burgeoning pharmaceutical market is a key driver of this trend, with numerous companies establishing continuous manufacturing lines and facilities across various Asian countries. As the pharmaceutical industry continues to expand, this market is expected to grow correspondingly. Countries such as India and China are at the forefront of the adoption of continuous manufacturing. The Contract Development and Manufacturing Organizations (CDMO) are adopting continuous manufacturing processes in the country.

China continuous manufacturing for small molecule APIs market is rapidly expanding, driven by several key factors. Increased government support and regulatory reforms are encouraging innovation and investment in modern manufacturing techniques. China has 230 (13%) API manufacturing facilities for regulated drug products. This number indicates the increasing number of manufacturing plants in the country. The demand for cost-effective and efficient production methods is rising as companies aim to enhance productivity and reduce time-to-market. Additionally, advancements in technology, such as real-time monitoring and automation, are facilitating smoother operations. In June 2023, Corning launched its Lab Reactor System 2 in China, designed to enhance the flow chemistry industry. This new system promises to improve laboratory processes by offering greater flexibility and efficiency in chemical reactions. The Lab Reactor System 2 aims to streamline research and development activities, facilitating better scalability and reproducibility in chemical manufacturing.

Latin America Continuous Manufacturing For Small Molecule APIs Market Trends

The continuous manufacturing for small molecule APIs market in Latin America is expanding due to the increasing healthcare needs and population growth. Countries such as Brazil and Argentina are the largest pharmaceutical markets in the Latin America region, and the use of continuous manufacturing techniques is observed less in the country. With its high potential for growth, the pharmaceutical market in Brazil has shown significant progress in recent years, leading to the adoption of new manufacturing technologies such as continuous manufacturing processes.

Brazil continuous manufacturing for small molecule APIs market is gaining momentum, driven by increasing demand for efficiency and quality in pharmaceutical production. Key trends include the adoption of innovative technologies, such as process intensification and real-time analytics, which enhance productivity and reduce costs. Regulatory agencies are also becoming more supportive of modern manufacturing approaches, fostering a conducive environment for investment.

Middle East & Africa Continuous Manufacturing For Small Molecule APIs Market Trends

The continuous manufacturing for small molecule APIs market in the Middle East and Africa is expanding significantly due to the entry of both local and international players. Companies are investing in advanced technologies to capture market share and meet the region's growing pharmaceutical needs. In addition, with a broad range of complementary and direct investments, the pharmaceutical industry is anticipated to witness considerable growth in the coming years. Furthermore, Africa has the fifth highest worldwide pharmaceutical expenditure per capita.

Saudi Arabia continuous manufacturing for small molecule APIs market is experiencing notable growth, driven by government initiatives aimed at diversifying the economy and enhancing the pharmaceutical sector. Key trends include the adoption of advanced manufacturing technologies that improve efficiency, reduce production costs, and ensure high-quality outputs. Regulatory reforms are fostering a more favorable environment for innovation, while investments in local manufacturing capabilities are increasing. Furthermore, the emphasis on sustainability and local production aligns with the country's Vision 2030 goals, positioning Saudi Arabia as a significant player in the regional pharmaceutical market and attracting foreign investments.

Key Continuous Manufacturing For Small Molecule APIs Company Insights

The continuous manufacturing for small molecule APIs market is dominated by several major pharmaceutical companies that collectively account for a significant market share. These leading players established themselves through extensive research and development efforts, resulting in the introduction of innovative treatment options. They also expanded their Equipment portfolios through strategic collaborations, mergers, and acquisitions.

Key Continuous Manufacturing For Small Molecule APIs Companies:

The following are the leading companies in the continuous manufacturing for small molecule APIs market. These companies collectively hold the largest market share and dictate industry trends.

- Pfizer Inc.

- GSK plc. (GlaxoSmithKline)

- Vertex Pharmaceuticals Incorporated

- Janssen (a subsidiary of Johnson & Johnson)

- Abbvie Inc.

- Sterling Pharma Solutions

- Evonik Industries AG

- Cambrex Corporation

- Patheon (part of Thermo Fisher Scientific)

- Hovione

- Lonza

- Phlow

- Asymchem

- GEA Group AG

- Thermo Fisher Scientific

- Corning Incorporated

- Coperion GmbH

- Continuus Pharmaceuticals

- Chemtrix

- Vapourtec Ltd

- Ehrfeld Mikrotechnik GmbH

- NiTech Solutions Ltd

Recent Developments

-

In June 2024, Vertex Pharmaceuticals presented data on TRIKAFTA (tezacaftor/ivacaftor/elexacaftor/ and ivacaftor), known as KAFTRIO in the EU and UK, at the 47th ECFS Conference in Glasgow from June 5-8, 2024.

-

In November 2023, Vertex Pharmaceuticals announced that the EMA validated a Type II variation application for KAFTRIO (ivacaftor/tezacaftor/elexacaftor) in combination with ivacaftor.

-

In October 2023, Sterling Pharma Solutions announced the completion of its acquisition of NewChem Technologies, a UK-based contract service provider specializing in organic chemistry. NewChem supplies clients across various industries, including pharmaceuticals, diagnostics, veterinary science, biotechnology, and chemicals. This acquisition strengthens Sterling’s service offerings and expands its reach in these key sectors.

Continuous Manufacturing For Small Molecule APIs Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 370.41 million |

|

Revenue forecast in 2030 |

USD 671.52 million |

|

Growth rate |

CAGR of 10.42% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Equipment, unit operation, type, end use, and region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Sweden, Denmark, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, Saudi Arabia, South Africa, UAE, Kuwait |

|

Key companies profiled |

Pfizer Inc.; GSK plc. (GlaxoSmithKline); Vertex Pharmaceuticals Incorporated; Janssen (a subsidiary of Johnson & Johnson); Abbvie Inc.; Sterling Pharma Solutions; Evonik Industries AG; Cambrex Corporation; Patheon (part of Thermo Fisher Scientific); Hovione; Lonza; Phlow; Asymchem; GEA Group AG; Thermo Fisher Scientific; Corning Incorporated; Coperion GmbH; Continuus Pharmaceuticals; Chemtrix; Vapourtec Ltd; Ehrfeld Mikrotechnik GmbH; NiTech Solutions Ltd |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Continuous Manufacturing For Small Molecule APIs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global continuous manufacturing for small molecule APIs market report based on equipment, unit operation, end use, type, and region.

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Reactors

-

Crystallizers

-

Filtration Systems

-

Mixers

-

Heat Exchangers

-

Others (Dryers, etc.)

-

-

Unit Operation Outlook (Revenue, USD Million, 2018 - 2030)

-

Synthesis

-

Separation & Purification

-

Drying

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Generic APIs

-

Innovative APIs

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

CMOs/CDMOs

-

Pharmaceutical Companies

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global continuous manufacturing market for small molecule APIs, market size was estimated at USD 335.66 million in 2023 and is expected to reach USD 370.41 million in 2024.

b. The global continuous manufacturing market for small molecule API, is expected to grow at a compound annual growth rate of 10.42% from 2024 to 2030 to reach USD 671.52 million by 2030.

b. North America continuous manufacturing market for small molecule API, dominated the overall global market and accounted for the 39.97% revenue share in 2023 due to rising demand for more efficient and cost-effective pharmaceutical production processes.

b. Some key players operating in the primary immunodeficiency disorders market include Pfizer Inc.; GSK plc. (GlaxoSmithKline); Vertex Pharmaceuticals Incorporated; Janssen (a subsidiary of Johnson & Johnson); Abbvie Inc.; Sterling Pharma Solutions; Evonik Industries AG; Cambrex Corporation; Patheon (part of Thermo Fisher Scientific); Hovione; Lonza; Phlow; Asymchem; GEA Group AG; Thermo Fisher Scientific; Corning Incorporated; Coperion GmbH; Continuus Pharmaceuticals; Chemtrix; Vapourtec Ltd; Ehrfeld Mikrotechnik GmbH; and NiTech Solutions Ltd.

b. Key factors that are driving the continuous manufacturing market for small molecule API growth include rapid growth in the global pharmaceutical industry, growing role of flow chemistry in API manufacturing, growing adoption and improved efficiency & productivity, and emergence as a green, sustainable and profitable process technology.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."