- Home

- »

- IT Services & Applications

- »

-

Continuous Delivery Market Size, Share, Growth Report 2030GVR Report cover

![Continuous Delivery Market Size, Share, & Trends Report]()

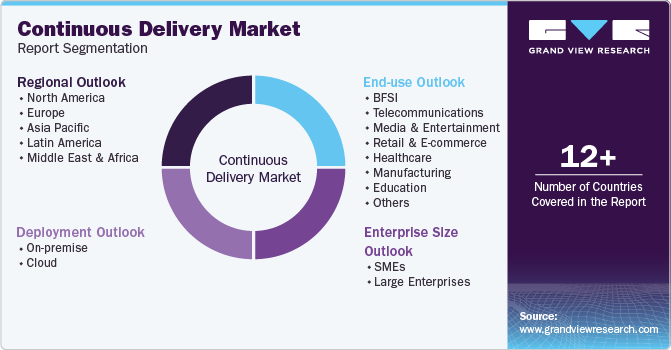

Continuous Delivery Market (2024 - 2030) Size, Share, & Trends Analysis Report By Deployment (On-premise, Cloud), By End-use (BFSI, Telecommunications), By Enterprise Size, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-468-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Continuous Delivery Market Summary

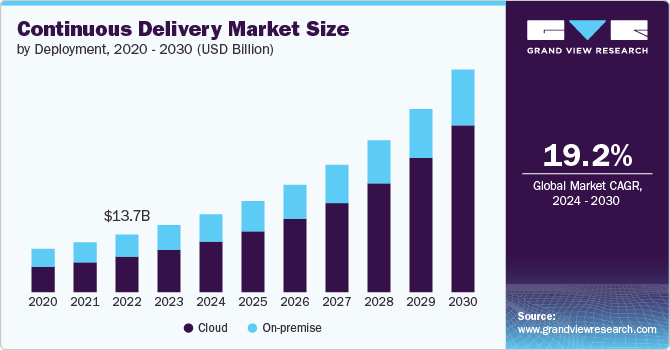

The global continuous delivery market size was estimated at USD 3.67 billion in 2023 and is estimated to reach USD 12.25 billion by 2030, growing at a CAGR of 19.2% from 2024 to 2030. One of the primary drivers is the increasing demand for faster software development cycles. In a competitive environment, businesses are pressured to release new features, updates, and improvements more frequently to meet customer expectations and gain a competitive edge.

Key Market Trends & Insights

- The continuous delivery market in North America held a share of 36.0% in 2023.

- The continuous delivery market in the U.S. is expected to grow significantly from 2024 to 2030.

- By deployment, the cloud segment accounted for the largest market share of 63.3% in 2023.

- By enterprise size, the large enterprises segment accounted for the largest market share of 57.9% in 2023.

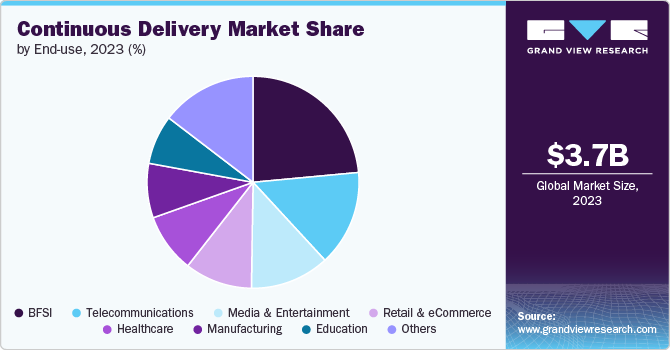

- By end-use, the BFSI segment accounted for the largest market share of 23.5% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.67 Billion

- 2030 Projected Market Size: USD 12.25 Billion

- CAGR (2024-2030): 19.2%

- North America: Largest market in 2023

Continuous delivery enables organizations to automate their software development and deployment processes, allowing faster and more reliable releases. This capability is especially crucial for companies operating in dynamic markets, such as technology, finance, and retail, where agility and innovation are key to staying ahead.Organizations across various industries embrace digital transformation initiatives to improve operational efficiency, enhance customer experiences, and streamline business processes. Continuous delivery plays a pivotal role in these efforts by enabling faster, more frequent software updates and innovations. As businesses adopt new digital technologies, the need for reliable and automated software development pipelines grows, making continuous delivery essential for supporting this transformation.

Moreover, the rise of DevOps practices has contributed to expanding the continuous delivery market. DevOps emphasizes the collaboration between development and operations teams, promoting automation, continuous integration, and continuous deployment. Continuous delivery is a core component of DevOps, as it allows for smooth and automated code releases. As DevOps adoption continues to grow across industries, so does the demand for continuous delivery solutions that support efficient workflows and improved software quality.

The increasing focus on reducing human error and enhancing software reliability drives the growth of the continuous delivery market. Automated processes reduce the risk of mistakes that can occur during manual software deployments, improving the overall reliability of applications. This is particularly important for industries such as healthcare, finance, and manufacturing, where software failures can have significant consequences. By investing in continuous delivery solutions, organizations can improve the consistency and stability of their software releases.

The shift towards microservices architecture is another important driver of the continuous delivery market. Microservices enable organizations to build applications as a collection of small, independent services that can be developed, deployed, and scaled individually. This approach allows for more agile and efficient development processes, which aligns perfectly with continuous delivery principles. As more organizations move towards microservices to improve scalability and maintainability, the demand for continuous delivery solutions that support this architecture increases.

Deployment Insights

The cloud segment accounted for the largest market share of 63.3% in 2023. The increased adoption of hybrid and multi-cloud strategies is driving the segment growth. Businesses increasingly use multiple cloud providers to balance workloads, avoid vendor lock-in, and enhance system reliability. Continuous delivery tools that support hybrid and multi-cloud environments enable organizations to build, test, and deploy applications across different cloud infrastructures seamlessly. This flexibility enhances the agility and resilience of software delivery pipelines, which is crucial in today’s rapidly evolving business environment.

The on-premise segment is anticipated to grow significantly over the forecast period due to data security and privacy concerns. Many organizations prefer to keep their software development and deployment environments within their data centers, particularly in highly regulated industries like healthcare, finance, and government. On-premise solutions allow businesses to control their data fully, mitigating the risk of exposing sensitive information in public cloud environments. Continuous delivery solutions deployed on-premise enable these organizations to automate their pipelines while ensuring strict compliance with regulatory standards and data protection laws.

Enterprise Size Insights

The large enterprises segment accounted for the largest market share of 57.9% in 2023. Compliance and regulatory demands are important factors driving the adoption of continuous delivery in large enterprises. Many large companies, particularly those in industries such as finance, healthcare, and government, are subject to stringent regulations that require strict control over software development processes. Continuous delivery platforms allow these organizations to integrate automated compliance checks and security testing throughout the development pipeline, ensuring that all software releases meet regulatory standards before deployment. This reduces the risk of non-compliance while maintaining the speed and efficiency of the delivery process.

The SMEs segment is anticipated to grow significantly over the forecast period. The rise of cloud-native and SaaS business models pushes SMEs toward continuous delivery. Many SMEs are adopting cloud-native applications and software-as-a-service (SaaS) platforms, which require frequent updates and seamless deployments to meet evolving customer needs. Continuous delivery supports these business models by enabling rapid, automated updates without service disruptions. This ensures that SMEs can deliver the latest features and improvements to their customers in real time, helping them retain and attract users in a competitive market.

End-use Insights

The BFSI segment accounted for the largest market share of 23.5% in 2023, owing to the demand for digital transformation in the financial sector. As customer expectations shift toward digital banking, mobile applications, and online financial services, BFSI organizations need to develop and deploy software faster to meet these needs. Continuous delivery enables financial institutions to automate their development pipelines, allowing for rapid and reliable releases of new features, security updates, and customer-facing applications. This is crucial for staying competitive in a market where digital convenience is now a top priority for consumers.

The education segment is anticipated to grow at a significant CAGR over the forecast period. The rise of e-learning and online education platforms fuels the demand for continuous delivery solutions. With the growing popularity of remote learning, educational platforms need to scale quickly and accommodate a large number of users. Continuous delivery allows for rapid iteration and continuous improvement of these platforms, ensuring they meet evolving educational standards and provide a stable, high-performance environment. Institutions and ed-tech companies increasingly rely on DevOps practices, including continuous integration and delivery (CI/CD), to stay competitive and deliver real-time solutions to learners globally.

Regional Insights

The continuous delivery market in North America held a share of 36.0% in 2023. One of the most significant trends in North America is the widespread adoption of cloud-native technologies. Organizations across industries are shifting to cloud platforms like AWS, Microsoft Azure, and Google Cloud, which offer built-in support for continuous delivery practices. As businesses prioritize scalability, flexibility, and cost-efficiency, the demand for CI/CD pipelines integrated with cloud infrastructure continues to grow. This trend is particularly pronounced in industries such as finance, healthcare, and education, where digital transformation initiatives are key to maintaining competitiveness.

U.S. Continuous Delivery Market Trends

The continuous delivery market in the U.S. is expected to grow significantly from 2024 to 2030. With the growing concern over data security and regulatory compliance, U.S. companies are integrating security practices into their continuous delivery pipelines. This trend, often called DevSecOps, ensures that security is a shared responsibility across all development and delivery stages. Automated security checks, vulnerability scanning, and compliance validation are becoming standard parts of CI/CD workflows, helping organizations avoid security breaches and meet regulatory requirements.

Europe Continuous Delivery Market Trends

The continuous delivery market in Europe is growing significantly at a CAGR of 18.8% from 2024 to 2030. European enterprises are increasingly integrating AI and machine learning (ML) into their CD pipelines to enhance operational efficiency, reduce manual errors, and speed up decision-making. AI-driven analytics are used for predictive maintenance, identifying potential issues before they occur, and optimizing workflows. This trend is especially prominent in telecom, financial services, and automotive industries, where real-time data and automated processes are essential for competitive advantage.

Asia Pacific Continuous Delivery Market Trends

Asia Pacific is growing significantly at a CAGR of 21.1% from 2024 to 2030 due tomobile-first development, especially in countries with large mobile user bases, such as India, Indonesia, and the Philippines. Continuous delivery is crucial for mobile application developers who need to release frequent updates and ensure seamless user experiences across a wide range of devices. The ability to rapidly deploy and update mobile apps without disrupting the user experience is a key benefit of CD practices, and this trend is likely to grow as the region's mobile market continues to expand.

Key Continuous Delivery Company Insights

Key players in the online survey software market include Microsoft, Google, Broadcom, and IBM. The companies focus on various strategic initiatives to gain a competitive advantage over their rivals, including new product development, partnerships and collaborations, and agreements.

Key Continuous Delivery Companies:

The following are the leading companies in the continuous delivery market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft

- Google LLC

- CloudBees, Inc.

- Clarive Software

- Atlassian

- Flexagon LLC

- Accenture

- IBM

- Xebia

- Broadcom

Recent Developments

-

In November 2023, Broadcom completed the acquisition of Clarive Software, a U.S.-based software company, to bolster its software delivery capabilities. Broadcom aims to support enterprise customers in building and modernizing their private and hybrid cloud environments. A key part of this strategy is Broadcom’s investment in VMware Cloud Foundation, a software stack that underpins private and hybrid cloud infrastructures. This acquisition is expected to reinforce Broadcom's standing in the continuous delivery market.

-

In November 2023, Atlassian announced significant updates to Jira Software and Bitbucket to enhance continuous integration and delivery capabilities. These updates include improved integration between Jira and Bitbucket, allowing teams to link pull requests directly to Jira issues and facilitating better traceability and collaboration throughout the development process.

Continuous Delivery Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.28 billion

Revenue forecast in 2030

USD 12.25 billion

Growth rate

CAGR of 19.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Microsoft; Google; CloudBees, Inc.; Clarive Software; Atlassian; Flexagon LLC; Accenture; IBM; Xebia; Broadcom

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Continuous Delivery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global continuous delivery market report based on deployment, enterprise size, end-use, and region:

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Telecommunications

-

Media And Entertainment

-

Retail And E-commerce

-

Healthcare

-

Manufacturing

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global continuous delivery market size was estimated at USD 3.67 billion in 2023 and is expected to reach USD 4.28 billion in 2024.

b. The global continuous delivery market is expected to grow at a compound annual growth rate of 19.2% from 2024 to 2030 to reach USD 12.25 billion by 2030.

b. The cloud segment accounted for the largest market share of 63.3% in 2023. The increased adoption of hybrid and multi-cloud strategies is driving growth of the segment. Businesses are increasingly using multiple cloud providers to balance workloads, avoid vendor lock-in, and enhance system reliability.

b. Some key players operating in the continuous delivery market include Microsoft, Google, CloudBees, Inc., Clarive Software, Atlassian, Flexagon LLC, Accenture, IBM, Xebia, and Broadcom

b. Businesses are under pressure to release new features, updates, and improvements more frequently to meet customer expectations and gain a competitive edge due to competitive environment. Continuous delivery enables organizations to automate their software development and deployment processes, allowing for faster and more reliable releases. This capability is especially crucial for companies operating in dynamic markets, such as technology, finance, and retail, where agility and innovation are key to staying ahead.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.