- Home

- »

- Medical Devices

- »

-

Continence Care Market Size, Share & Trends Report, 2030GVR Report cover

![Continence Care Market Size, Share & Trends Report]()

Continence Care Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Urinary Catheters & Catheter Maintenance/Care), By Application (Diabetes, Strokes), By Areas Of Incontinence, By End-use, By Bag Usage, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-116-9

- Number of Report Pages: 221

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Continence Care Market Summary

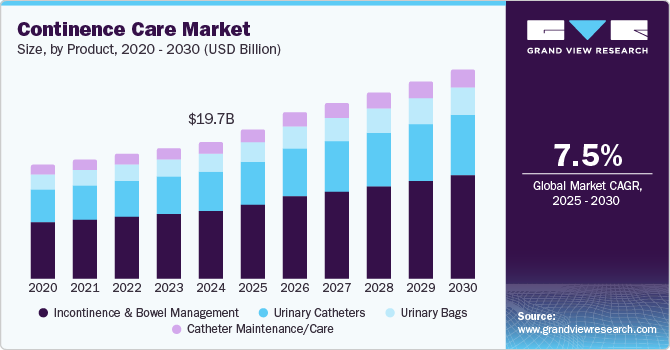

The global continence care market size was valued at USD 19.68 billion in 2024 and is projected to reach USD 30.34 billion by 2030, growing at a CAGR of 7.5% from 2025 to 2030. This growth can be attributed to the rising prevalence of urinary incontinence, the growing geriatric population base, rising technological advancements, and the increasing demand for minimally invasive procedures.

Key Market Trends & Insights

- The Europe region dominated the market with the largest revenue share of 38.1% in 2024.

- By product, incontinence and bowel management held the largest market share of around 50.27% in 2024.

- By application, diabetes held the largest market share of around 27.94% in 2024.

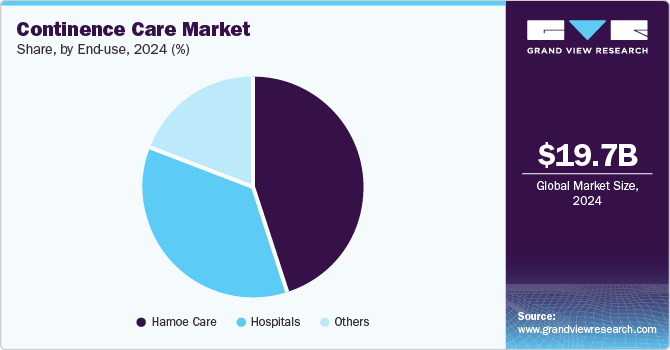

- By end use, Home care held the largest market share of around 44.68% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 19.68 Billion

- 2030 Projected Market Size: USD 30.34 Billion

- CAGR (2025-2030): 7.49%

- Europe: Largest Market in 2024

The elderly population is significantly vulnerable to facing bladder issues, including conditions such as Chronic Kidney Disease (CKD), urinary retention, leakage, urinary retention, and urinary incontinence (UI). According to the World Population Prospects 2022, the global elderly population share is expected to reach around 16% of the total population in 2050, increasing from 10% in 2022.

Urinary Incontinence (UI) is a growing health issue with significant economic and social consequences. The rising prevalence of urological disorders such as benign prostatic hyperplasia (BPH), urinary retention, cystitis, and kidney stones, can lead to bladder dysfunction. Similarly, various factors can lead to incontinence, with one leading cause in men being an enlarged prostate, a condition associated with aging known as BPH. Similarly, there is a growing need for continence care products designed to manage and address urinary issues. Additionally, the rising incidents of hypertension and diabetes are key contributors to UI, further fueling the demand for these care products. According to the World Health Organization, in 2023, around 1.28 billion people aged between 30 to 79 years suffer from hypertension, with around two-thirds of them living in low and middle-income countries.

Moreover, advancements in technology have led to the development of urinary catheters that prioritize patient comfort, enhance infection resistance, and simplify usability, effectively addressing issues related to patient discomfort and the risk of infections. As the healthcare sector evolves, the development of advanced urinary catheters is expected to rise, thereby introducing innovations aimed at improving patient outcomes and overall urological care. For instance, in August 2024, Watkins-Conti launched its Yōni.Fit, an FDA-cleared device for managing stress urinary incontinence in women, is available by prescription in Oklahoma. This non-surgical solution aims to enhance women's pelvic health and is designed for easy self-administration, providing a new treatment option for many affected women. The development of such products is expected to increase the adoption of continence care products in the adult population, which is expected to drive market growth over the forecast period.

Furthermore, the increasing demand for minimally invasive procedures is a significant factor driving market growth, especially in the treatment of urinary incontinence. These procedures provide several benefits compared to traditional surgical options, including shorter recovery periods, lower risk of complications, and reduced postoperative discomfort. Similarly, more patients are choosing these methods to manage urinary incontinence, leading to a rise in demand for continence care products and services associated with these treatments. The advancement of implants and minimally invasive techniques aimed at treating urinary incontinence is crucial. Devices such as bulking agents and urethral slings help support the urethra and increase its closure pressure, thereby minimizing urinary leakage. The placement of these devices typically involves minimally invasive techniques such as laparoscopy or cystoscopy, further contributing to the growth of the continence care market.

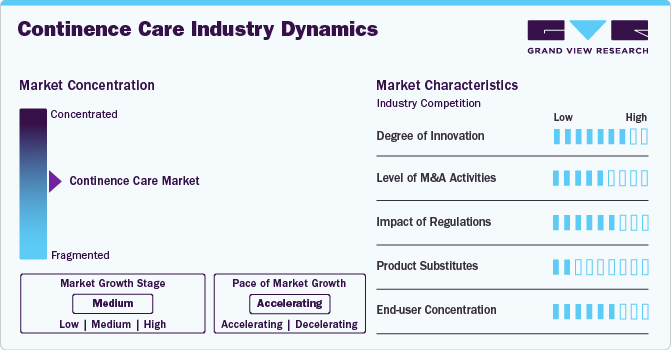

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of growth is accelerating. The continence care market is characterized by a high degree of growth due to the increasing prevalence of urinary incontinence and the growing geriatric population.

The market is experiencing a significant surge in innovation, driven by various factors that enhance product effectiveness and user experience. The demographic shift has led to a growing demand for more comfortable and effective products, encouraging manufacturers to invest in advanced technologies. Companies are also focusing on developing specialized products tailored to specific needs, such as male external catheters and slim absorbent underpants for light incontinence. For instance, in July 2024, Hyderabad-based company Mexple launched UroMen and UroWomen urine collection kits to enhance patient care in the incontinence category. These innovative kits prioritize comfort and functionality, reducing skin irritation and odor while being discreet. Made from silicone, they are reusable and easy to clean, improving user experience significantly. Development of such products by emerging and established market players is contributing to the high degree of innovation in the market.

Regulations play a crucial role in the continence care market. Stringent regulations ensure product safety and efficacy, which increases consumer trust and encourages market growth. Regulatory bodies such as the FDA and EMA implement stringent safety standards that require extensive testing and compliance with manufacturing practices. This oversight can enhance product quality and reduce adverse health outcomes, thereby benefiting patients and healthcare providers. Furthermore, favorable reimbursement policies from government programs such as Medicare and Medicaid significantly increase the accessibility of continence care products. However, the regulatory process can be time-consuming and costly for manufacturers, negatively impacting innovation and market entry for smaller companies.

The market is poised to experience robust mergers and acquisitions (M&A) activity as companies seek to expand their product portfolios, leverage synergies, and enter new markets. Established players are acquiring smaller innovators to gain access to cutting-edge technologies, while strategic collaborations are emerging to enhance distribution networks. For instance, in February 2023, KKR announced the acquisition of Clinisupplies, a key manufacturer of continence care products, from Healthium. This strategic move aims to strengthen KKR's presence in the healthcare sector, particularly within chronic medical care devices.

The threat of substitutes for the continence market is significantly low. Products such as catheters, urinary bags, and absorbent pads are designed to meet the unique needs of individuals suffering from incontinence that general alternatives cannot match, ensuring their regular use among patients and providers. The growing awareness and acceptance of incontinence as a common medical issue have led to increased demand for effective management solutions, further increasing demand for continence care products. In addition, supportive reimbursement policies from government and healthcare organizations enhance the accessibility and affordability of these products, further increasing the adoption of these products over their alternatives.

Key players operating in the market are increasingly adopting regional expansion strategies to enhance their market presence and address the growing demand. For instance, in July 2024, Convatec launched the GentleCath Air for Women in the UK and Italy following its successful introduction in France. This innovative catheter features FeelClean Technology, designed to minimize urethral damage and reduce urinary tract infection risks. The product emphasizes discretion and ease of use, resembling a cosmetic item. Positive feedback from users and healthcare professionals reflects its growing acceptance in the market, with plans for a U.S. launch in September 2024.

Product Insights

Incontinence and bowel management held the largest market share of around 50.27% in 2024. Products such as male external catheters, female incontinence devices, and transanal irrigation systems are witnessing significant demand due to their effectiveness in managing these conditions. Male external catheters, often made from silicone, provide a non-invasive solution for urinary incontinence by channeling urine into a collection bag. This method enhances comfort and significantly reduces the risk of skin irritation and urinary tract infections, making it a preferred choice for many men facing incontinence issues.

Similarly, specialized products are designed to address the unique anatomical needs of women, offering effective management of urinary leakage. This rising demand for incontinence and bowel management products, coupled with the increasing efforts by market players to increase the accessibility of these products, is contributing to segment growth. For instance, in April 2024, Medline partnered with Consure Medical to exclusively distribute the QiVi MEC male external urine management device to reduce catheter-associated urinary tract infections (CAUTIs) and incontinence-associated dermatitis (IAD). This innovative device enhances patient care by providing a non-absorbing pouch that keeps skin dry and minimizes complications associated with traditional methods.

The catheter maintenance/care segment is expected to grow at the fastest CAGR of 8.73 % during the forecast. This growth can be attributed to the increasing awareness and emphasis on infection prevention, particularly catheter-associated urinary tract infections (CAUTIs). As healthcare providers are focused on enhancing patient outcomes, products designed for catheter maintenance are witnessing a rise in demand. Moreover, the growing prevalence of chronic conditions that require catheterization, such as urinary incontinence and neurogenic bladder disorders, is driving demand for effective catheter care solutions. As more patients require long-term catheterization, the need for reliable maintenance products significantly increases. Moreover, patients are shifting toward home healthcare, which increases the demand for user-friendly and effective maintenance solutions that can be easily managed by caregivers or patients themselves.

Application Insights

Diabetes held the largest market share of around 27.94% in 2024 and is expected to witness the fastest growth over the forecast period owing to the rising prevalence of diabetes globally, which has been linked to various urinary complications, including incontinence. Diabetic patients often experience bladder dysfunction due to nerve damage caused by prolonged high blood sugar levels, leading to conditions such as overactive bladder (OAB) and urinary incontinence. According to the International Diabetes Federation, around 537 million of the global population was living with diabetes in 2021. Moreover, this number is expected to increase to 643 million in 2030 and reach 783 million in 2045. This rising prevalence of diabetes globally, coupled with the growing geriatric population vulnerable to diabetes, significantly increases the demand for catheter care products, further contributing to the segment growth over the forecast period.

Stroke is expected to witness significant growth over the forecast period. This can be attributed to the high prevalence of stroke globally. Following a stroke, many individuals experience disruptions in the neurological pathways that control bladder function, leading to various forms of incontinence, such as urgency and functional incontinence. According to the Global Stroke Fact Sheet 2022 by the World Stroke Organization (WSO), there are more than 22.2 million strokes globally each year, with 1 in every 4 people over the age of 25 years having threat of stroke throughout their lifetime. As more individuals survive strokes owing to advances in medical care, the demand for specialized continence products and services is expected to rise. Moreover, healthcare providers are recognizing the importance of addressing incontinence as a critical aspect of post-stroke rehabilitation, which can enhance recovery and improve patient satisfaction. This growing focus among healthcare professionals is further expected to fuel the segment growth over the forecast period.

Area Of Incontinence Insights

The female segment held the largest market share in 2024 and is expected to witness the fastest growth over the forecast period. This can be attributed to the high prevalence of urinary incontinence among women. Factors such as pregnancy, childbirth, menopause, and surgical procedures such as hysterectomy significantly increase the risk of incontinence in females. These physiological changes lead to a higher incidence of conditions such as stress and mixed incontinence, which are significantly common among women. Furthermore, the increasing access to continence care for women owing to technological advancements, such as the emergence of telehealth and initiatives by various market players, is further contributing to the segment growth. For instance, in July 2024, Axena Health launched telehealth services for women seeking treatment for urinary incontinence, offering the Leva Pelvic Health System. This initiative connects patients with clinicians for evaluations and prescriptions, addressing the shortage of OB-GYNs and improving access to effective, non-invasive care for over 28 million women in the U.S.

The male segment is expected to witness significant growth owing to the increasing prevalence of urinary incontinence and related conditions among men. Factors such as aging, prostate issues, and other urological disorders significantly contribute to this trend. As men age, they become more vulnerable to conditions such as benign prostatic hyperplasia (BPH) and prostate cancer, which can lead to urinary incontinence. According to the World Cancer Research Fund (WCRF) International, around 1,467,854 men were diagnosed with prostate cancer in 2022. This shift is driving demand for specialized continence care products designed specifically for men, such as external catheters and absorbent products specialized to their needs.

Bag Usage Insights

Sterile bags held the largest market share in 2024 and are expected to witness the fastest growth over the forecast period, owing to their critical role in infection prevention. These bags are specifically designed to minimize the risk of contamination when collecting urine, which is essential for individuals using catheters or other urinary devices. By maintaining a sterile environment, these bags significantly reduce the chances of urinary tract infections (UTIs) and other complications that can arise from improper handling of bodily fluids. As healthcare providers and patients increasingly prioritize hygiene in continence management, the demand for sterile bags has increased, driving their adoption in different healthcare facilities.

Non-sterile bags are expected to witness significant growth driven by their widespread use across various care settings and everyday needs. Non-sterile bags are used in a broad range of continence management situations in homecare and long-term care facilities. Moreover, their ease of use and lower cost make them more adaptable for both healthcare providers and individuals who require continence support more frequently. Additionally, non-sterile bags offer sufficient reliability and function for most patients, as they meet the fundamental needs of continence management without the added expenses associated with sterilization processes.

End-use Insights

Home care held the largest market share of around 44.68% in 2024 and is expected to witness the fastest growth, owing to the shifting patient preferences toward more privacy, comfort, and ease of management. At-home solutions allow for self-care routines that can be integrated seamlessly into daily life, reducing the need for frequent clinic or hospital visits. Moreover, it also allows users to customize their routines with a choice of products, such as absorbent pads, catheters, and drainage bags, which they can manage independently or with the help of a caregiver. Home usage is especially beneficial for users who require a consistent environment to manage their continence care needs without the challenges associated with healthcare facilities. Moreover, the rise in remote healthcare and virtual support has further contributed to the advantages of home continence care.

Hospitals are expected to witness significant growth owing to their comprehensive patient care environment. As primary care providers for severe and acute cases, hospitals serve patients with high levels of dependence, who may have incontinence issues as secondary conditions. Patients admitted for surgeries, serious injuries, and chronic diseases frequently require continence care solutions, especially for post-operative care. Moreover, hospitals have a well-trained staff that offers specialized care for such needs, adopting various continence care devices that enhance patient comfort while reducing risks of associated infections.

Regional Insights

North America continent care market accounted for a significant share of the global industry owing to the presence of key manufacturers, increased awareness, and advancements in care solutions. An aging population, particularly in the U.S. and Canada, has significantly contributed to this growth, as the elderly are more vulnerable to incontinence issues. According to the National Council on Aging, Inc. (NCOA), around 57.8 million people in the U.S. were aged 65 years and above in the U.S. in 2022. This demographic shift has intensified the demand for effective continence care products such as catheters, absorbent products, and urine bags, particularly for individuals seeking at-home solutions.

U.S. Continence Care Market Trends

The continence care market in the U.S. is driven by the aging population, increased prevalence of urinary incontinence, and technological advancements in products. The U.S. is witnessing a significant rise in awareness about continence care and home healthcare owing to its advantages over other healthcare settings. Moreover, the companies operating in the country are significantly investing investments in innovative continence care devices to address the rising demand for continence care. For instance, in August 2023, the FDA granted de novo approval for Bluewind Medical Ltd.'s Revi system, designed to treat urgency incontinence with or without urinary urgency. This device stimulates the tibial nerve rather than the sacral nerves, which is the approach used by other neuromodulation devices. This approval is a significant advancement in the treatment options available for patients suffering from this condition.

Canada continence care market is driven by an aging population, increased awareness, and improved access to innovative products. For instance, in November 2021, NorthShore, a manufacturer of adult incontinence products, announced the expansion of its operations into Canada. This strategic move responds to the increasing demand for high-quality incontinence solutions among Canadian consumers. NorthShore plans to offer its complete range of products, including absorbent underwear and pads, ensuring that Canadians have access to reliable and effective options for managing incontinence. Such a rising presence of global market players in the country is further increasing the accessibility of advanced care products, thereby contributing to market growth.

Europe Continence Care Market Trends

The continence care market in Europe is witnessing significant growth driven by the region’s aging population, government initiatives, increasing awareness about continence care, and increasing technological advancements in continence care products. The countries in the region, such as Germany, Italy, and France have some of the world’s highest elderly population percentages. As incontinence is more prevalent among older adults, the demand for continence care products has significantly increased in this region.

The UK continence care market is driven by an aging population and rising awareness of continence care solutions. The UK is witnessing a significant demographic shift toward an older population, which has intensified demand for continence care products, as conditions such as urinary incontinence, neurogenic bladder, and prostate issues become more prevalent with increasing age. For instance, according to the UK Office for National Statistics, around 3.3 million people aged 65 years and above live in England and Wales. Moreover, the NHS and private care providers are addressing this rising need by prioritizing access to high-quality continence care, significantly increasing the availability of products such as catheters, absorbent products, and bags, especially for home-based use.

The continence care market in Germany is witnessing significant growth, driven by a geriatric population, increasing awareness of continence care, and advancements in product innovation. In October 2021, CATHETRIX launched Foley/Safe 2.0, an advanced catheter stabilizer designed to prevent urinary tract infections (UTIs) and accidental Foley catheter extractions. This second-generation product offers enhanced protection by cutting the sterile fluid tube when excessive force is applied, allowing safe catheter removal. With FDA and CE Mark clearances, Foley/Safe 2.0 debuted at the MEDICA 2021 trade show in Dusseldorf, Germany. Such efforts by market players to increase their presence in the country are contributing to market growth.

Asia Pacific Continence Care Market Trends

The continence care market in Asia Pacific is driven by an aging population, increasing disposable and affordability, and increasing awareness of urinary incontinence management. Countries such as Japan, China, and India are witnessing demographic shifts, with a growing proportion of elderly citizens who often face various health challenges, including incontinence. Additionally, increasing awareness and education about continence issues is encouraging individuals to adopt products that enhance their quality of life. Governments and healthcare providers are also focusing on improving healthcare accessibility, which is further contributing to the increasing demand for these products in the region.

China continence care market is driven by the country's rapidly aging population, which has led to an increased prevalence of urinary incontinence among older adults. According to the WHO, the elderly population of China aged 60 years and above is expected to reach 28% of its total population by 2040. This increasing geriatric population of the country is encouraging manufacturers to invest in innovative solutions aimed at meeting the unique needs of this population. Furthermore, increasing awareness about the importance of continence care is further increasing the adoption of these products in the country, thereby driving market growth.

Latin America Continence Care Market Trends

The continence care market in Latin America is experiencing significant growth, primarily driven by the developing healthcare infrastructure, increasing awareness about continence care, increasing disposable income, and accessibility of these products. Countries in the region, such as Brazil and Argentina, are significantly increasing their investments in the healthcare sector, significantly increasing the access and affordability of continence care in the region.

Middle East And Africa Continence Care Market Trends

The continence care market in the Middle East and Africa (MEA) is driven by the development of the healthcare system, increased awareness, and increasing availability of continence care products in the region. Moreover, the rising efforts by various organizations to increase awareness about urinary continence and other related conditions are further contributing to the market growth. For instance, in June 2022, The Arab Association of Urology signed a Memorandum of Understanding (MoU) with Saja Pharmaceuticals to enhance collaboration in urological health. This partnership aims to address various urological issues, including urinary incontinence, by promoting research and development of innovative treatments.

Saudi Arabia continence care market is driven by technological advancements and rising initiatives by market players to increase their presence in the country, which is significantly increasing the accessibility of continence care products in the country. For instance, in February 2023, ProvenMed, a UAE-based company, partnered with Gulf Medical Company to distribute ActivGo, the world’s first infection-preventative urinary incontinence device for men, across Saudi Arabia. Supported by the MBRIF Innovation Accelerator, ProvenMed enhances patient care with accessible, infection-preventative solutions, improving the quality of life for Saudi incontinence patients.

Key Continence Care Company Insights

Key market players are adopting various strategic initiatives such as launches, partnerships, collaborations, mergers & acquisitions, approvals, expansion and others to increase their presence in the global continence care market. These advancements in the care market are anticipated to boost market growth over the forecast period.

Key Continence Care Companies:

The following are the leading companies in the continence care market. These companies collectively hold the largest market share and dictate industry trends.

- Coloplast Group

- B. Braun SE

- Hollister Incorporated

- ConvaTec Group Plc

- BD (Becton, Dickinson and Company)

- Wellspect HealthCare

- Salts Healthcare Ltd.

- Welland Medical Ltd.

- Essity Aktiebolag

- KCWW (Kimberly-Clark Corporation)

- Attends Healthcare Products, Inc.

- ABENA

- Teleflex Incorporated

- Boston Scientific Corporation

- Ontex Healthcare

- Paul Hartmann AG

- First Quality Enterprises, Inc.

- Medline Industries, Inc.

- Cardinal Health

Recent Developments

-

In August 2024, Convatec announced the launch of its free digital app in the U.S. to assist new intermittent catheter users and their healthcare professionals.

-

In July 2024, Convatec announced the launch of GentleCath Air for Women featuring FeelClean Technology in the UK and Italy, following its successful introduction in France.

-

In May 2024, Coloplast launched the Luja Female intermittent catheter, designed for complete bladder emptying in one flow to reduce urinary tract infection (UTI) risks. Featuring Micro-hole Zone Technology, it is eco-friendly, using 28% less plastic and having a lower carbon footprint.

-

In October 2023, Clinisupplies acquired the Aquaflush transanal irrigation (TAI) portfolio from Renew Medical, enhancing its continence care offerings. This acquisition aims to support patients with chronic bowel issues and expand Clinisupplies' product range.

-

In August 2022, Nexwear acquired Lily Bird, a brand focused on incontinence products for women. This merger aims to enhance product innovation and customer service by combining their strengths.

Continence Care Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.71 billion

Revenue forecast in 2030

USD 30.34 billion

Growth Rate

CAGR of 7.49% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in units; revenue in USD million/billion, and CAGR from 2025 to 2030

Regional scope

North America, Europe, Asia Pacific, Latin America, & MEA

Country scope

U.S., Canada, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Report coverage

Volume & revenue forecasts, competitive landscape, growth factors, and trends

Key companies profiled

Coloplast Group; B. Braun SE; Hollister Incorporated; ConvaTec Group Plc; BD (Becton, Dickinson and Company); Wellspect HealthCare; Salts Healthcare Ltd.; Welland Medical Ltd.; Essity Aktiebolag; KCWW (Kimberly-Clark Corporation); Attends Healthcare Products, Inc.; ABENA; Teleflex Incorporated; Boston Scientific Corporation; Ontex HealthcarePaul Hartmann AG; First Quality Enterprises, Inc.; Medline Industries, Inc.; Cardinal Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Continence Care Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global continence care market report on the basis of product, application, area of incontinence, bag usage, end-use, and region:

-

Product Outlook (Volume Unit; Revenue USD Million, 2018 - 2030)

-

Urinary Catheters

-

Intermittent Self-Catheterization (ISC)

-

Standard Catheters

-

Premium/Lifestyle Catheters

-

-

Indwelling/Foley Catheters

-

Coated Catheters

-

Uncoated Catheters

-

-

Intermittent Catheter Sets

-

Female

-

Male

-

-

Intermittent Catheters Dry

-

-

Catheter Maintenance/Care

-

Urinary Bags

-

Pediatric Urine Bags

-

Night (Bed) Bags

-

By Usability

-

Sterile

-

Non-sterile

-

-

By Size

-

250 ml

-

350 ml

-

500 ml

-

1.5 L

-

2 L

-

4 L

-

Others

-

-

-

Bag Accessories

-

Leg Urine Bags

-

By Usability

-

Sterile

-

Non-sterile

-

-

By Size

-

350 ml

-

750 ml

-

500 ml

-

1.5 L

-

1 L

-

2 L

-

Others

-

-

-

-

Incontinence And Bowel Management

-

Non-Absorbent

-

Male External Catheters Silicone

-

Female External Catheters

-

Female Incontinence Device

-

Irrigation Pump/Transanal Irrigation

-

-

Absorbent

-

Underwear & Briefs

-

Pads/Diapers

-

Female

-

Male

-

-

Others

-

-

-

-

Application Outlook (Volume Unit; Revenue USD Million, 2018 - 2030)

-

Diabetes

-

Strokes

-

BPH

-

Alzheimer

-

Cerebral Palsy

-

Parkinson

-

Prostate Cancer

-

Spinal Cord Injury

-

Bladder Cancer

-

Ovarian Cancer

-

Multiple Sclerosis

-

Spina Bifida

-

Others

-

-

Area of Incontinence Outlook (Volume Unit; Revenue USD Million, 2018 - 2030)

-

Male

-

Stress Urinary Incontinence

-

Urge/OAB (Overactive Bladder)

-

Overflow

-

Functional

-

Mixed

-

Reflex

-

Severe Incontinence

-

-

Female

-

Stress Urinary Incontinence

-

Urge/OAB (Overactive Bladder)

-

Overflow

-

Functional

-

Mixed

-

Reflex

-

Severe Incontinence

-

-

-

Bag Usage Outlook (Volume Unit; Revenue USD Million, 2018 - 2030)

-

Sterile Bags

-

Non-sterile Bags

-

-

End Use Outlook (Volume Unit; Revenue USD Million, 2018 - 2030)

-

Home Care

-

Rehabilitation Centers

-

Nursing Homes

-

Others

-

- Hospitals

- Others

-

-

Regional Outlook (Volume Unit; Revenue USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

Belgium

-

Netherlands

-

Ireland

-

Greece

-

Poland

-

Switzerland

-

Austria

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global continence care market is expected to grow at a compound annual growth rate of 7.49% from 2025 to 2030 to reach USD 30.35 billion by 2030.

b. The global continence care market size was estimated at USD 19.68 billion in 2024 and is expected to reach USD 21.71 billion in 2025

b. Europe dominated the global continence care market with a share of 38.11% in 2024, owing to an increasing number of people living with bladder problems coupled with the rising geriatric population is boosting the demand for continence care products in Europe.

b. Some key players operating in the continence care market include Coloplast Group; B. Braun SE; Hollister Incorporated; ConvaTec Group Plc; BD (Becton, Dickinson and Company); Wellspect HealthCare; Salts Healthcare Ltd.; Welland Medical Ltd.; Essity Aktiebolag; KCWW (Kimberly-Clark Corporation); Attends Healthcare Products, Inc.; ABENA; Teleflex Incorporated; Boston Scientific Corporation; Ontex HealthcarePaul Hartmann AG; First Quality Enterprises, Inc.; Medline Industries, Inc.; Cardinal Health.

b. The growth of the continence care market is due to various factors such as technological advancements, the rising geriatric population, increasing prevalence of various chronic disorders such as bladder cancer, Spina Bifida, Spinal Cord Injury, Cerebral Palsy, and others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.