Contextual Advertising Market Size, Share & Trends Analysis Report By Type (Activity-based, Location-based), By Deployment (Mobile Devices, Desktops), By Industry Vertical (BFSI, IT & Telecommunication), By Approach, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-266-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Contextual Advertising Market Size & Trends

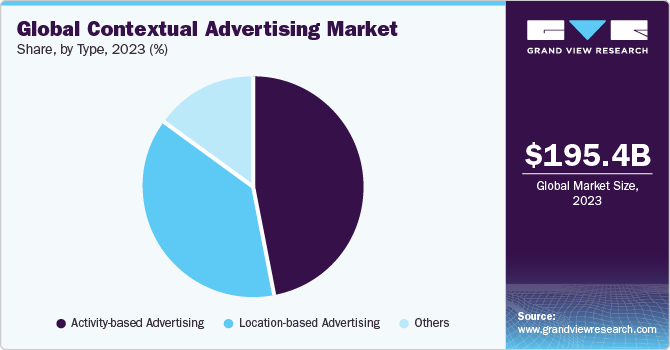

The global contextual advertising market size was estimated at USD 195.44 billion in 2023 and is projected to grow at a CAGR of 13.3% from 2024 to 2030. Contextual advertising allows advertisers to target their audience based on specific keywords, topics, or interests. This targeted approach increases the relevance of ads to users, leading to higher engagement and conversion rates. The ongoing digital transformation across industries is driving increased spending on digital advertising, including contextual advertising. As businesses encourage online channels for marketing and customer engagement, the demand for contextual ad solutions continues to grow. Contextual advertising and machine learning (ML) algorithms drive contextual advertising by enabling real-time analysis of vast data, identifying patterns, and optimizing ad placements for maximum effectiveness.

These technologies leverage user behavior, demographics, and contextual cues to create highly targeted campaigns that resonate with specific audience segments. By continuously learning from campaign outcomes, Contextual advertising algorithms refine targeting strategies, adjust bidding, and predict user behavior, resulting in improved engagement, conversion rates, and overall campaign performance. Innovative tools and platforms dedicated to contextual targeting, semantic analysis, and content understanding are revolutionizing how advertisers approach digital advertising, enabling them to craft more relevant and impactful ad experiences.

These advanced tools utilize sophisticated algorithms and contextual advertising technologies to analyze the context of web pages, videos, or apps in real time, allowing dynamic ad placements that align seamlessly with the surrounding content. Consumers have expectations for personalized and relevant ad experiences. Contextual advertising meets this demand by strategically delivering ads aligning with users' interests, behaviors, and preferences. Advertisers can use contextual data and sophisticated targeting algorithms to create more tailored and meaningful ad campaigns that resonate with their target audience. It drives higher engagement and conversion rates and increases customer satisfaction.

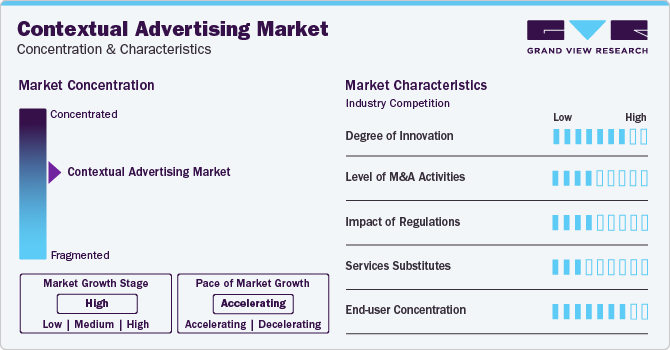

Market Concentration & Characteristics

Innovation plays a crucial role in shaping the global industry. Advancements in contextual advertising, ML, and data analytics have transformed how ads are targeted and personalized based on user context. Companies invest heavily in innovation to gain a competitive edge by offering more effective targeting solutions, real-time bidding platforms, and enhanced ad formats.

The degree of innovation can contribute to industry concentration, as companies with cutting-edge technologies may dominate the market. Regulatory frameworks like GDPR in Europe and CCPA in California have profoundly influenced the operational landscape of contextual advertising by emphasizing data privacy, consent, and user rights. Stricter regulations regarding data collection and processing have necessitated significant changes in ad tech companies' data practices and targeting methods. Compliance with these regulations entails substantial costs, including investment in technology, personnel, and legal resources. Regulatory pressures can contribute to industry concentration by favoring companies capable of navigating complex compliance landscapes and implementing robust privacy practices.

Service substitutes, such as ad blockers, and alternative advertising models like native advertising, influencer marketing, and sponsored content have significantly impacted the overall industry. Ad blockers have diminished the effectiveness of traditional display ads, compelling advertisers to seek out other channels or formats that are less susceptible to ad blocking. This shift towards diversification in advertising strategies has led to a redistribution of spending across different platforms and ad formats, challenging the dominance of certain players and creating opportunities for innovative approaches to reach target audiences effectively.

End-use concentration refers to the distribution of advertising budgets across various industries or sectors. Industries, such as e-commerce, travel, and finance, allocate a significant portion of their marketing budgets to contextual advertising due to its effectiveness in targeting relevant audiences. End-use concentration can influence industry dynamics, with sectors driving higher demand for contextual ads experiencing more competition and innovation.

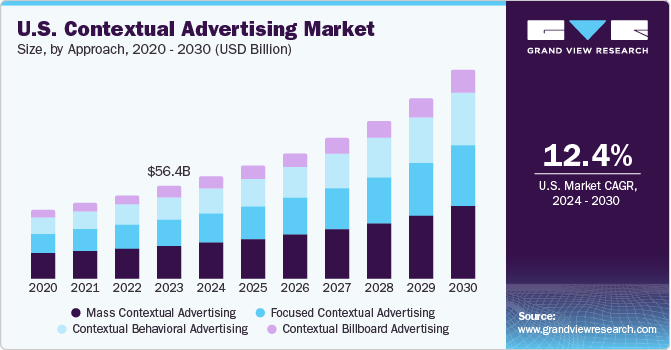

Approach Insights

The mass contextual advertising segment held the highest revenue share of 36.3% in 2023. Mass contextual advertising leverages large-scale data processing and analysis capabilities, allowing advertisers to reach a broad audience efficiently. Advancements in contextual advertising, machine learning, and data analytics have enhanced the capabilities of mass contextual advertising platforms. These technologies enable a better understanding of user context, preferences, and behavior, leading to more precise ad targeting and improved campaign performance.

Mass contextual advertising platforms often provide tools for advertisers to customize and optimize their campaigns based on specific goals and target demographics. Contextual behavioral advertising is expected to be the fastest-growing segment from 2024 to 2030. As consumers increasingly expect personalized experiences online, contextual behavioral advertising addresses this demand by delivering ads that align with their interests and preferences. Companies are adopting contextual behavioral advertising to stay competitive.

Deployment Insights

The mobile devices segment held the highest market share in 2023. The widespread adoption and usage of mobile devices, including smartphones and tablets, have contributed significantly to the segment's growth. Consumers spend significant time on mobile devices, creating multiple opportunities for advertisers to reach them through contextual ads. Mobile devices enable precise location tracking, allowing advertisers to implement location-based targeting strategies. By leveraging location data, advertisers can deliver highly relevant and contextually aware ads to users based on their real-time geographic location, improving ad engagement and effectiveness. Ad tech platforms and publishers have developed mobile-optimized ad formats that enhance user experience and engagement on mobile devices.

Formats, such as native, video, and interactive ads, are designed to perform well on mobile screens, driving higher click-through rates and conversions. The desktops segment is expected to register the fastest CAGR from 2024 to 2030. They are often preferred for business-related activities, professional tasks, and productivity tools. Advertisers targeting professionals, corporate clients, or B2B audiences leverage desktop-focused advertising strategies to reach decision-makers and influencers within organizations. Desktops are preferred for e-commerce transactions, online payments, and complex purchasing decisions. Advertisers in retail, finance, and travel sectors focus on desktop advertising to capture users during critical stages of the purchase journey, leading to higher conversion rates and revenue.

Industry Vertical Insights

The retail & consumer goods segment held the highest revenue share in 2023. The rapid growth of e-commerce platforms and online retailing drives increased advertising spending from retailers and consumer goods companies. Digital advertising, including contextual advertising, plays a vital role in promoting products, driving traffic to online stores, and enhancing the overall shopping experience for consumers. Retailers and consumer goods companies use data analytics, customer insights, and AI-driven technologies to optimize contextual advertising campaigns. Data-driven strategies improve ad relevancy, audience targeting accuracy, and campaign performance metrics, leading to increased ad spend in this segment.

The media & entertainment segment is expected to grow at the fastest CAGR from 2024 to 2030. The industry’s shift towards digital platforms, streaming services, and online content consumption creates opportunities for contextual advertising. Advertisers target audiences based on content preferences, viewing habits, and user interactions across digital media channels, enhancing ad relevance and engagement. Contextual advertising enables media and entertainment companies to deliver personalized content experiences to viewers. Advertisers leverage data analytics and AI algorithms to serve contextually relevant ads, promotions, and recommendations, improving user satisfaction and retention.

Type Insights

The activity-based advertising segment held the highest market share in 2023. Activity-based advertising generates valuable behavioral insights into user preferences, interests, and purchase intent. Advertisers can leverage these insights to tailor their ad creatives, messaging, and targeting strategies, optimizing campaign performance and driving segment growth. Activity-based advertising can be integrated across multiple channels and devices, allowing advertisers to engage with users seamlessly across the web, mobile apps, social media, and other digital touchpoints. This cross-channel integration enhances reach and visibility while maintaining consistency in messaging and targeting.

Location-based advertising is expected to be the fastest-growing segment from 2024 to 2030. Businesses can reach their target audience by focusing on demographics and consumer behavior. Businesses can specifically alter their marketing message by considering the location factor for the product. The widespread adoption of smartphones and other mobile devices has significantly contributed to the growth of location-based advertising. Advertisers can deliver location-specific offers, promotions, and recommendations that resonate with users, driving higher engagement & conversion rates. The combination of mobile device proliferation, improved geotargeting technologies, personalization, enhanced user experience, local business targeting, performance measurement, and privacy compliance drives the segment's growth.

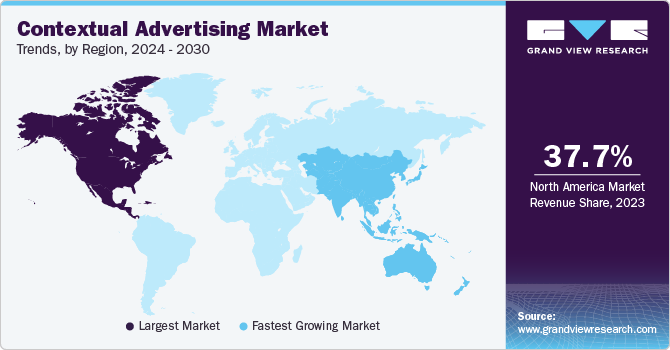

Regional Insights

The North America contextual advertising market held the highest revenue share of 37.7% in 2023. The ongoing digital transformation across industries has led to an increase in online content consumption. It includes websites, blogs, social media platforms, and other digital channels where contextual ads can be displayed. As more businesses and consumers engage online, the demand for contextual advertising solutions rises.

U.S. Contextual Advertising Market Trends

The contextual advertising market in the U.S. accounted for a revenue share of 28.8% in 2023. The U.S. possesses advanced technology infrastructure, including high-speed internet and widespread mobile connectivity. This infrastructure enables the efficient delivery of contextual ads across various digital platforms and devices, catering to a broad audience. Many leading technology companies and digital platforms, such as Google, Facebook, Amazon, and Microsoft, have a strong presence in the United States. These companies offer robust contextual advertising solutions, advanced targeting capabilities, and vast ad inventory, attracting advertisers and driving market share.

Asia Pacific Contextual Advertising Market Trends

The Asia Pacific contextual advertising market is expected to grow at the fastest CAGR from 2024 to 2030. The growing e-commerce sector in countries like China, India, and Southeast Asia is increasing the demand for digital advertising. Contextual advertising plays a crucial role in targeting relevant audiences based on their online behavior, preferences, and purchase intent, thereby driving sales for e-commerce businesses. The growth of e-commerce in Japan creates opportunities for contextual advertising, particularly in targeting consumers based on their online shopping behavior, preferences, and purchase history. Contextual ads on e-commerce platforms and related websites are highly relevant and influential in driving conversions.

The contextual advertising market in India is expected to grow significantly over the forecast period. India has a large consumer base of smartphone users, driving advertisers to focus on mobile platforms for contextual advertising campaigns. Mobile apps, social media platforms, and mobile-friendly websites are key channels for contextual ad placements. The growth of small and medium enterprises (SMEs) in India has increased competition in the advertising space. Contextual advertising offers SMEs a cost-effective way to reach their target audiences and compete with larger players.

The China contextual advertising market will witness considerable growth in the coming years. The advancement of big data analytics and artificial intelligence (Contextual Advertising) technologies has revolutionized the advertising industry. In China, companies are leveraging these technologies to analyze large amounts of user data, understand consumer behavior, and deliver highly relevant ads in real time, improving the effectiveness of contextual advertising campaigns.

Latin America Contextual Advertising Market Trends

The contextual advertising market in Latin America is projected to have lucrative growth in the years to come. The digital transformation across Latin America, including increased internet penetration, smartphone adoption, and social media usage, drives the demand for digital advertising solutions. Contextual advertising leverages user data and behavioral insights to deliver targeted and relevant ads, making it a valuable strategy for brands to reach their target audiences. Adherence to data privacy regulations, such as Brazil’s LGPD (Lei Geral de Proteção de Dados) and similar frameworks in other Latin American countries, influences the implementation of contextual advertising strategies. Advertisers prioritize compliance with data protection laws while leveraging user data for personalized advertising.

Key Contextual Advertising Company Insights

Some of the key companies operating in the contextual advertising market are Google LLC, and Facebook Inc.

-

Google LLC offers a comprehensive suite of contextual advertising solutions through its Google Ads platform. With Google Ads, advertisers can create highly targeted and relevant ad campaigns that reach their desired audience based on contextual factors, such as keywords, search queries, website content, and user demographics. The platform provides various ad formats, including text ads, display ads, and video ads, allowing advertisers to effectively showcase their products or services across Google's extensive network, which includes Google Search, YouTube, Gmail, and partner websites

-

Facebook Inc. offers contextual advertising solutions through its robust platform, allowing businesses to create highly targeted and personalized ad campaigns. Facebook enables advertisers to reach their ideal audiences with precision by providing a wealth of user data and contextual signals, such as interests, demographics, behaviors, and online activities. With advanced targeting options, including keyword targeting, audience segmentation, and content analysis, advertisers can tailor their ad content to align with the interests and preferences of their target customers

Key Contextual Advertising Companies:

The following are the leading companies in the contextual advertising market. These companies collectively hold the largest market share and dictate industry trends.

- Google LLC

- Facebook Inc.

- Act-On Software Inc.

- Adobe Systems

- Millennial Media LLC

- Twitter, Inc.

- Yahoo

- Amobee Inc.

- Amazon.com Inc.

- Media.net

Recent Developments

-

In March 2024, Adobe and Microsoft announced a strategic partnership to integrate new generative AI capabilities into Microsoft 365 applications, specifically targeting marketers. This collaboration combines Adobe's expertise in digital marketing solutions and AI technologies with Microsoft's robust productivity tools and cloud infrastructure suite. The partnership aims to empower marketers by providing them with advanced AI-powered features within familiar Microsoft 365 applications, such as Outlook, Word, Excel, and PowerPoint. These new generative AI capabilities enable marketers to create personalized content, design compelling campaigns, analyze customer insights, and optimize marketing strategies seamlessly within their workflow

-

In March 2022, Google announced an expansion with the Privacy Sandbox initiative, a strategic effort focused on creating advertising solutions that prioritize user privacy while addressing growing concerns around data protection. This expansion signifies Google's commitment to developing innovative advertising technologies that respect user privacy preferences, such as limiting the use of third-party cookies and enhancing user control over their data. By broadening the scope of the Privacy Sandbox initiative, Google aims to foster a more privacy-centric approach to digital advertising, ensuring a balance between personalized ad experiences and user privacy rights

-

In March 2022, Microsoft Advertising introduced "Responsive Search Ads," an innovative advertising format designed to enhance relevance and performance by dynamically adapting ad copy according to the context of user searches. This new feature enables advertisers to create more tailored and engaging ad experiences for their target audiences, ultimately improving campaign effectiveness and better overall results

-

In August 2021, Amazon Advertising significantly expanded its sponsored display capabilities, allowing advertisers to precisely target audiences by leveraging a spectrum of user data, such as shopping behaviors, product interests and related product views. This expansion marked a strategic move by Amazon to empower advertisers with enhanced tools for reaching their desired customer segments more effectively

-

In May 2023, Adobe revealed a vision for the future of its Creative Cloud suite, mainly focusing on Photoshop, with the introduction of generative AI as a creative co-pilot. This innovative development represents a significant leap in empowering creatives by integrating AI-driven tools directly into Photoshop, one of the industry's leading design and editing software. The generative AI capabilities act as a virtual assistant, aiding users in generating ideas, exploring design variations, automating repetitive tasks, and providing intelligent suggestions during the creative process

Contextual Advertising Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 217.73 billion |

|

Revenue forecast in 2030 |

USD 468.17 billion |

|

Growth rate |

CAGR of 13.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Approach, type, deployment, industry vertical, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Germany; UK; France; China; Japan; India; Brazil; Mexico; UAE; KSA; South Africa |

|

Key companies profiled |

Google LLC; Facebook Inc.; Act-On Software Inc.; Adobe Systems; Millennial Media LLC; Twitter, Inc.; Yahoo; Amobee Inc.; Amazon.com Inc.; Media.net |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Contextual Advertising Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global contextual advertising market report based on approach, type, deployment, industry vertical, and region:

-

Approach Outlook (Revenue, USD Billion, 2017 - 2030)

-

Mass Contextual Advertising

-

Focused Contextual Advertising

-

Contextual Behavioral Advertising

-

Contextual Billboard Advertising

-

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Activity-based Advertising

-

Location-based Advertising

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Mobile Devices

-

Desktops

-

Digital Billboards

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

Retail & Consumer Goods

-

Media & Entertainment

-

IT & Telecommunication

-

Automotive & Transportation

-

Banking, Financial Services, & Insurance (BFSI)

-

Healthcare

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global contextual advertising market size was estimated at USD 195.44 billion in 2023 and is expected to reach USD 217.73 billion in 2024

b. The global contextual advertising market is expected to grow at a compound annual growth rate of 13.3% from 2024 to 2030 to reach USD 468.17 billion by 2030

b. U.S. dominated the contextual advertising market with a share of 28.8% in 2023. Factors such as advanced technology infrastructure, including high-speed internet, widespread mobile connectivity are propelling market growth in the region.

b. Some key players operating in the contextual advertising market include Google LLC, Facebook Inc., Act-On Software Inc, Adobe Systems, Millennial Media LLC, Twitter, Inc., Yahoo, Amobee Inc., Amazon.com Inc, Media.net

b. Factors such as ongoing digital transformation and technological innovations are driving the market growth

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."