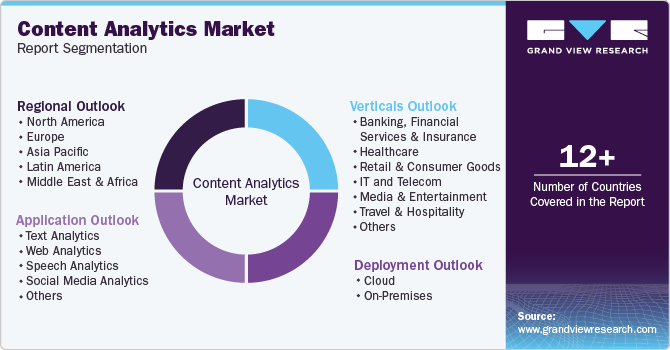

Content Analytics Market Size, Share & Trends Analysis Report By Deployment (Cloud, On-Premises), By Application (Text Analytics, Web Analytics), By Verticals, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-007-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Content Analytics Market Size & Trends

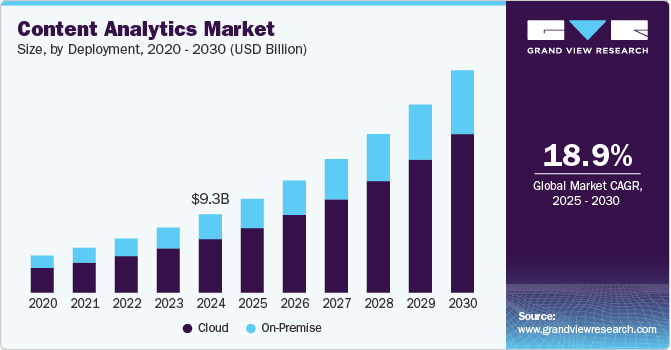

The global content analytics market size was estimated at USD 9.31 billion in 2024 and is projected to grow at a CAGR of 18.9% from 2025 to 2030. The market is experiencing growth as organizations increasingly recognize the value of analyzing unstructured data for strategic insights. Content analytics tools allow businesses to process vast amounts of data from emails, documents, social media, and multimedia, helping them uncover trends, behaviors, and patterns that were previously difficult to identify.

The rising demand for personalized customer experiences, operational efficiencies, and competitive advantage drives this shift toward data-driven decision-making. Businesses are using content analytics to gain deeper insights into customer preferences, market trends, and operational performance. As a result, industries such as retail, healthcare, and finance are investing heavily in content analytics solutions to enhance their offerings. The demand for real-time analysis and faster decision-making capabilities further fuels the market growth. As companies amass more data, the need for sophisticated tools to extract actionable insights is more crucial than ever.

A significant contributor to the growth of the market for content analytics is the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML). These technologies allow content analytics platforms to process and analyze data with greater speed and accuracy, enabling businesses to automate tasks that were once manual and time-consuming. AI-powered natural language processing (NLP) and machine learning algorithms help extract valuable insights from unstructured data, such as customer sentiment, emerging trends, and predictive analytics. This has transformed how companies approach marketing, customer service, and operational efficiency. The ability to harness and interpret vast volumes of data gives businesses a competitive edge in identifying opportunities and mitigating risks. Moreover, AI and ML-driven content analytics reduce the reliance on manual data processing, making the insights more accessible and actionable for organizations of all sizes.

Real-time analytics is becoming increasingly important as organizations strive for faster decision-making and agility in response to changing market conditions. Businesses are looking for content analytics platforms that can process data in real time, enabling them to act on insights immediately rather than waiting for batch reports. Real-time content analytics is being utilized for use cases such as fraud detection, personalized customer interactions, and dynamic content recommendations. The ability to analyze data as it is generated helps businesses stay ahead of emerging trends and adjust their strategies quickly. This trend is supported by advances in cloud computing and edge computing technologies, which provide the necessary infrastructure for real-time processing at scale.

Deployment Insights

The cloud segment held the dominant share of 68.5% in 2024. The cloud segment dominated the market due to its scalability, flexibility, and ease of deployment. Businesses prefer cloud-based platforms because they eliminate the need for heavy infrastructure investments and offer seamless integration with other cloud services. Cloud-based content analytics also enables real-time data processing, which is crucial for businesses seeking faster insights and decision-making. As companies embrace remote work and digital transformation, the cloud provides the necessary infrastructure to analyze vast amounts of data from various locations. Moreover, cloud solutions are constantly updated with the latest features, making them ideal for organizations looking to stay competitive in a fast-evolving market.

The On-Premises segment is benefiting organizations that prioritize control, data security, and compliance. Some businesses, especially in regulated industries such as finance and healthcare, prefer on-premises systems to ensure full control over their data and compliance with strict regulatory requirements. On-Premises platforms allow companies to customize their analytics infrastructure based on specific needs without relying on third-party providers. They also offer better control over data governance, ensuring sensitive information stays within the organization's network. While cloud solutions are growing, the demand for on-premises content analytics persists among enterprises with complex security or operational requirements.

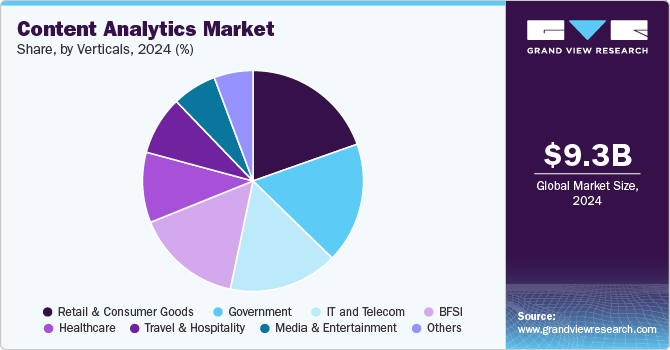

Verticals Insights

Retail and consumer goods companies dominate the market due to their extensive need for customer insights. These industries rely on analyzing consumer behavior to tailor marketing strategies, personalize shopping experiences, and enhance product offerings. Content analytics helps retail businesses optimize inventory management by predicting demand trends and preferences. The use of real-time data allows consumer goods companies to adjust to market dynamics and maintain competitiveness. Furthermore, the integration of various content analytics tools enables them to improve operational efficiency and better understand customer engagement across multiple channels.

The media and entertainment industry is experiencing rapid growth in the market due to its increasing need to analyze large volumes of digital content. This sector leverages content analytics to understand audience preferences, enabling more personalized content delivery. With the rise of streaming platforms and digital media, companies in this industry use analytics to optimize content recommendations and engagement strategies. Content analytics also aids in measuring the effectiveness of advertising campaigns, helping media companies maximize ad revenue. Moreover, it supports the creation of new content by identifying trends and predicting future consumer interests.

Application Insights

The social media analytics segment held the dominant share in 2024 due to its ability to analyze vast amounts of user-generated content. It provides insights into customer preferences, behaviors, and trends, helping businesses make informed decisions. The rise of social platforms has increased the need for monitoring brand sentiment, engagement, and competitive analysis. Social media analytics tools offer real-time data that allows companies to react quickly to market changes. Its integration with other technologies, such as AI and machine learning, further enhances its impact in the content analytics space.

Speech analytics is growing rapidly in the market due to its ability to convert voice data into actionable insights. It improves customer service by analyzing call center interactions and identifying areas for enhancement. Compliance monitoring benefits from speech analytics, as it ensures conversations adhere to regulatory standards. The technology also aids in understanding customer feedback, refining product development, and addressing common pain points. Moreover, sentiment analysis from voice data allows businesses to assess customer satisfaction and adjust their strategies accordingly.

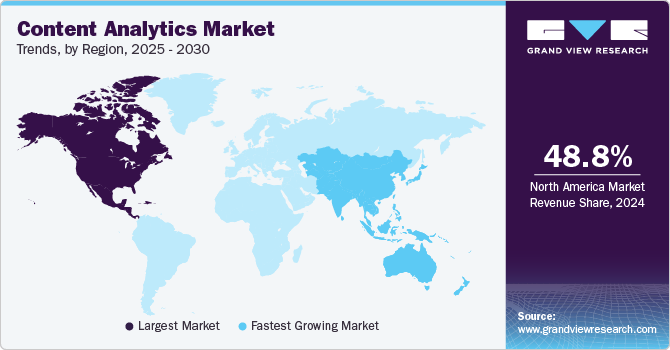

Regional Insights

North America content analytics market led the global market with a revenue share of 48.8% in 2024. North America's market is driven by advanced technological infrastructure and widespread digital transformation across industries. Canadian companies, alongside their counterparts in Mexico, are investing in content analytics to enhance customer experience and optimize business strategies. The region has a strong emphasis on integrating AI and machine learning into analytics tools, which helps businesses extract deeper insights from unstructured data. North American companies are also focused on content analytics for improving brand sentiment analysis and personalized marketing.

U.S. Content Analytics Market Trends

The content analytics market in the U.S. led the North America market with its robust technological sector and early adoption of advanced analytics tools. Businesses across industries, such as retail, healthcare, and entertainment, heavily rely on content analytics for customer insights, operational optimization, and personalized marketing strategies. The rise of e-commerce has driven demand for real-time content analysis to enhance user experiences and optimize product offerings. U.S. companies also prioritize sentiment analysis, which aids in reputation management and brand loyalty.

Europe Content Analytics Market Trends

The content analytics market in Europe is driven by the rising adoption of content analytics as businesses focus on complying with data privacy laws such as the GDPR. European companies use content analytics to understand customer behavior, improve internal processes, and drive innovation in product development. The growing emphasis on data-driven decision-making has led to increased investment in analytics technologies across sectors such as finance, telecommunications, and manufacturing.

Asia Pacific Content Analytics Market Trends

Asia-Pacific content analytics market is anticipated to experience rapid growth over the forecast period, which is driven by the digitalization of businesses and the rise of mobile internet usage. Countries such as China, Japan, and South Korea are leading the way in adopting content analytics to understand consumer preferences and improve user experiences, especially in sectors such as e-commerce and entertainment. Local governments in the region are encouraging digital transformation initiatives, which contribute to the increased use of analytics tools. In countries such as India, the growing use of social media platforms and mobile apps creates a high demand for real-time content analytics.

Key Content Analytics Company Insights

Some of the key companies in the market for content analytics include Adobe Systems Inc., Clarabridge, Inc., IBM Corporation, Microsoft, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are undertaking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Microsoft has significantly advanced its content analytics capabilities through the integration of AI and machine learning into its tools, such as Microsoft Azure and Power BI. These platforms enable businesses to process vast amounts of unstructured data, such as text, images, and social media content, for actionable insights. Microsoft’s focus on real-time analytics and cloud-based solutions allows companies to analyze content faster and more efficiently.

-

IBM Corporation has advanced its content analytics with the AI-powered platform, IBM Watson. Watson’s natural language processing (NLP) capabilities allow businesses to analyze unstructured data such as text, voice, and video for deeper insights. IBM focuses on helping organizations in sectors such as healthcare, finance, and retail make data-driven decisions by leveraging content analytics for better customer understanding and operational efficiency.

Key Content Analytics Companies:

The following are the leading companies in the content analytics market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe Systems Inc.

- Clarabridge, Inc.

- IBM Corporation

- Microsoft

- NICE Systems Ltd.

- Oracle Corporation

- OpenText Corporation

- SAS Institute, Inc.

- SAP SE

- Verint Systems, Inc.

Recent Developments

-

In September 2024, Adobe launched new generative AI tools within the Adobe Experience Cloud, including the AI Assistant Content Accelerator and Adobe Content Analytics, aimed at helping marketers create personalized content and optimize marketing performance through real-time experimentation and actionable insights. These innovations enable brands to generate tailored marketing materials for various channels while providing detailed analytics on customer engagement.

-

In June 2024, Telefonica Tech, a Telephone company in Spain, and IBM Corporation announced a collaboration agreement to develop AI, analytics, and data management solutions for enterprises, focusing on deploying the SHARK.X platform, which is an open, hybrid, and multi-cloud system. This partnership aims to enhance digital transformation in Spain by providing tools and resources for businesses, including the creation of use cases, training, and integration of advanced AI technologies.

-

In May 2024, IBM announced the launch of two new generative AI assistants: IBM Watsonx Assistant for Z, which enhances mainframe user productivity, and D&B Ask Procurement, designed to streamline procurement processes by analyzing supply chain risks and opportunities. Built on the IBM Watsonx Orchestrate platform, these AI assistants utilize advanced automation and data integration to improve decision-making and efficiency across various business functions.

-

In March 2024, Oracle Corporation introduced Oracle Analytics Server 2024, introducing new features that enhance the analytics experience for users, enabling deeper insights and improved business outcomes. Key advancements include enhanced AI and machine learning capabilities, a Semantic Modeler for governed data modeling, and watchlists for quick access to important visualizations, streamlining the entire analytics workflow.

Content Analytics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 11,158.0 million |

|

Revenue forecast in 2030 |

USD 26,484.5 million |

|

Growth rate |

CAGR of 18.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segment scope |

Technology, application, verticals, region |

|

Region scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Adobe Systems Inc.; Clarabridge; Inc.; IBM Corporation; Microsoft; NICE Systems Ltd.; Oracle Corporation; OpenText Corporation; SAS Institute, Inc.; SAP SE; Verint Systems, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Content Analytics Market Report Segmentation

This report offers revenue growth forecasts at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global content analytics market report based on deployment, application, verticals, and region:

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Text Analytics

-

Web Analytics

-

Speech Analytics

-

Social Media Analytics

-

Others

-

-

Verticals (Revenue, USD Million, 2018 - 2030)

-

Banking, Financial Services, and Insurance

-

Healthcare

-

Retail & Consumer Goods

-

IT and Telecom

-

Media & Entertainment

-

Travel & Hospitality

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global content analytics market size was estimated at USD 9.31 billion in 2024 and is expected to reach USD 11,158.0 million in 2025.

b. The global content analytics market is expected to grow at a compound annual growth rate of 18.9% from 2025 to 2030 to reach USD 26,484.5 million by 2030.

b. North America dominated the content analytics market with a share of 48.8% in 2024. This is attributable to its advanced technological infrastructure, high adoption rates of data-driven solutions, and a strong presence of key industry players.

b. Some key players operating in the content analytics market include Adobe Systems Inc., Clarabridge, Inc., International Business Machines Corporation, Microsoft, NICE Systems Ltd., Oracle Corporation, OpenText Corporation, SAS Institute, Inc., SAP SE, and Verint Systems, Inc.

b. Key factors driving market growth include increasing demand for real-time data insights, the rise of artificial intelligence and machine learning technologies, and the growing emphasis on customer experience optimization.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."