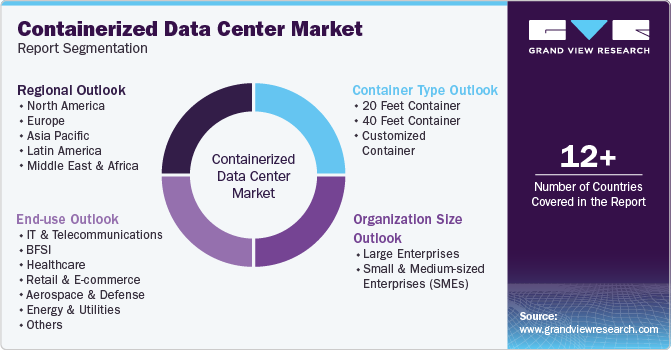

Containerized Data Center Market Size, Share & Trends Analysis Report By Container Type (20 Feet Container, 40 Feet Container, Customized Container), By Organization Size, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-010-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Containerized Data Center Market Trends

The global containerized data center market size was estimated at USD 13.59 billion in 2024 and is anticipated to grow at a CAGR of 27.4% from 2025 to 2030. The rapid surge in data traffic is a key driver of market growth. This expansion is largely fueled by the proliferation of digital devices, the Internet of Things (IoT), social media platforms, and streaming services. As these technologies become more integrated into daily life, the volume of data being created, transmitted, and processed across networks continues to grow at an unprecedented rate.

Containerized data centers, with their modular and portable design, provide the necessary capacity to manage this data influx, offering quicker deployment, improved energy efficiency, and lower operational costs. Technological advancements, cloud computing adoption, and digital services are the factors driving the growth of the data center market.

The rollout of the 5G network has enhanced data transmission speeds and brought forth new applications, leading to a surge in demand for data center infrastructure to operate the growing data traffic. The technology with enhanced speed for faster downloads, quicker access, and smoother streaming to online services generates vast amounts of data, thereby creating demand for high-speed data centers across the world. Moreover, cloud services require robust data centers to manage and host applications and computing resources. Cloud providers are focused on offering edge computing services, which require smaller data centers or edge locations near users, thereby surging demand for modular data centers. The widespread adoption of cloud services across small & medium organizations and large organizations fuels market growth.

With the shift toward decentralized data processing and the need to handle data closer to the source, containerized data centers provide an ideal solution. These centers can be easily deployed in various locations, supporting low-latency applications such as autonomous vehicles, smart cities, and real-time data analytics. The ongoing global digital transformation and increasing reliance on cloud computing further contribute to the market's expansion, as companies seek more agile and efficient ways to manage their IT resources.

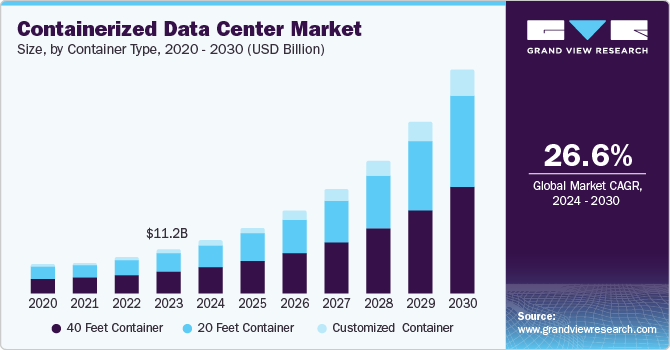

Container Type Insights

The 40 feet container segment accounted for the largest revenue share of over 49.0% in 2024. Emerging economies such as Asia Pacific and Latin America are experiencing rapid growth in digital services and require scalable data center infrastructure to support this growth. Containerized data centers are well-positioned to meet this demand as they can be easily deployed and calibrated to meet changing business needs. The 40 feet container segment is particularly favorable for emerging markets, offering a cost-effective and efficient solution.

The customized container segment is expected to grow at a CAGR of 32.2% over the forecast period. Several factors drive the demand for customized containers; various industries and use cases (e.g., edge computing, telecommunications, military, remote operations) have varying and specific requirements that standard containers may not fulfill. Moreover, customized containers can be customized to accommodate future growth and expansion by incorporating modular components and infrastructure, ensuring scalability.

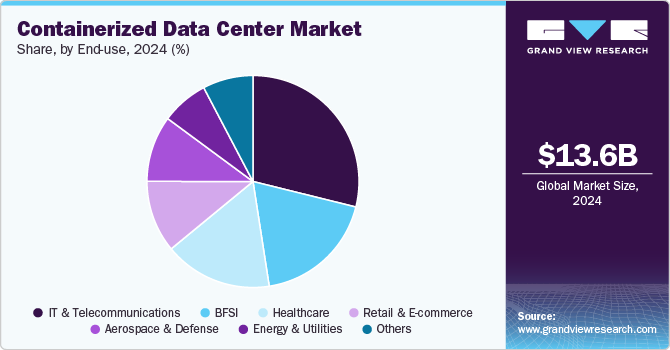

End-use Insights

The IT and telecommunications segment accounted for the largest revenue share of over 28.0% in 2024, driven by the need for rapid deployment and scalability. These modular solutions offer significant cost efficiencies and operational benefits, making them ideal for companies facing fluctuating demand amidst emerging technologies such as 5G.

The healthcare segment is expected to grow at a significant CAGR over the forecast period, driven by key trends such as rapid deployment and scalability, to manage the growing volume of medical data. These modular data centers offer enhanced data security and compliance with regulations such as HIPAA, making them suitable for secure and isolated data environments.

Organization Size Insights

The large organizations segment accounted for the largest revenue share of over 62.0% in 2024. Large organizations are increasingly integrating containerized data centers into their hybrid and multi-cloud strategies. These modular data centers enhance hybrid cloud infrastructure by enabling seamless connectivity with public cloud services and extending on-premises capabilities. This approach allows for efficient workload management across both private and public cloud environments, streamlining the data center footprint.

The SMEs segment is expected to grow at a significant CAGR over the forecast period. The growing demand for containerized data centers among small and medium-sized organizations reflects a significant trend in the data center market. These modular data centers offer a scalable and efficient solution, allowing businesses to adjust their infrastructure to meet changing needs without substantial investments in traditional data centers.

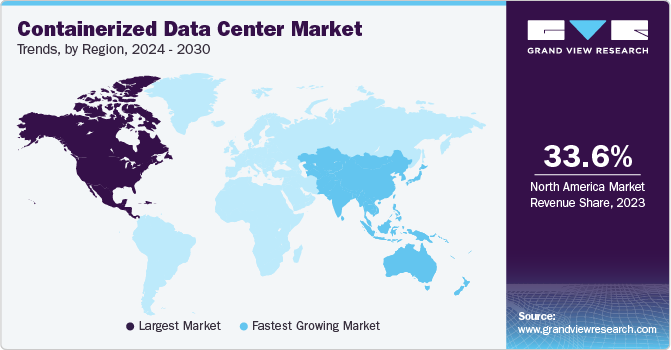

Regional Insights

The containerized data center market in North America held a share of over 34.0% in 2024. The rising digitization across various sectors is driving the regional market growth. Digitization is transforming industries in North America, such as healthcare, finance, retail, and manufacturing. Businesses are increasingly relying on digital tools and platforms to enhance their operations, customer engagement, and efficiency. This digital transformation generates vast amounts of data that must be stored, processed, and analyzed.

U.S. Containerized Data Center Market Trends

The containerized data center market in the U.S. is expected to grow significantly at a CAGR of 26.6% from 2024 to 2030. The increasing need for energy-efficient data center alternatives is driving the U.S. market growth. Many companies in the market are collaborating to reduce energy consumption, achieve carbon neutrality, and discover innovative cooling technologies.

Europe Containerized Data Center Market Trends

The containerized data center market in Europe is growing with a significant CAGR from 2025 to 2030. Governments across Europe are increasingly adopting containerized data centers for various public sector applications, particularly in research and development. Research and development projects often have fluctuating demands for computing power and data storage. Containerized data centers provide a highly scalable and flexible solution, allowing government agencies to quickly adjust their IT infrastructure in response to the changing needs of different projects.

The UK containerized data center market is expected to grow rapidly in the coming years. Companies are increasingly integrating containerized data center segments into their business operations to cater to the growing needs of businesses for scalable, efficient, and flexible IT infrastructure in the country. As organizations in the country are undergoing digital transformations, they require robust data center solutions that can keep pace with the rapid increase in data generation and processing needs. The scalability offered by containerized data centers makes it an ideal choice for such transformations, thus driving its growth among businesses in the country.

The containerized data center market in Germany held a substantial market share in 2024. Land scarcity in Germany is a significant factor driving the growth of containerized data centers. As one of Europe's most densely populated countries, Germany faces challenges in finding large, suitable plots of land for traditional data center construction.

Asia Pacific Containerized Data Center Market Trends

Asia Pacific is growing significantly at a CAGR of 28.5% from 2025 to 2030. Governments across the Asia Pacific region are widely adopting containerized data centers. Numerous smart city initiatives are underway in the Asia Pacific region, which is driving the adoption of containerized data centers. Governments are investing in smart infrastructure to enhance urban living, improve public services, and drive economic growth

The Japan containerized data center market is expected to grow rapidly in the coming years. The innovative technology landscape of Japan is driving the growth of containerized data centers in the country. The adoption of these advanced data centers reflects the country's commitment to maintaining its technological edge and addressing the evolving needs of the digital economy. Introducing new containerized data centers showcases the country’s ability to develop advanced solutions that meet the demands of modern IT infrastructure.

The containerized data center market in China held a substantial market share in 2024. The exponential growth of data generated by digital activities, social media, streaming services, and IoT devices in China creates a demand for efficient data storage and processing solutions. Containerized data centers offer a scalable and flexible infrastructure to manage this growing data volume. Their modular design allows for incremental expansion, enabling businesses to scale their IT infrastructure per their data requirements.

Key Containerized Data Center Company Insights

Some of the key companies in the containerized data center market include Alibaba Group Holding Ltd.; Cisco Systems, Inc.; Dell Inc.; Delta Power Solutions; Hewlett Packard Enterprise Development LP; Vertiv Group Corp.; and Fuji Electric Co., Ltd. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

In August 2024, NVIDIA Corporation partner Sustainable Metal Cloud (SMC), a Singapore-based AI cloud provider, to offer HyperCubes, containerized Nvidia GPU servers utilizing immersion cooling technology. These servers can reduce energy consumption by 50% compared to traditional air-cooled systems. SMC also claims that this solution is 28% more cost-effective than competing liquid-cooling options. In addition to its energy efficiency and affordability, the containerized design of HyperCubes enables quicker setup, making it easier for data centers to scale their operations efficiently.

-

In July 2024, Vertiv Group Corp. introduced the Vertiv MegaMod CoolChip, a prefabricated modular (PFM) data center solution for efficient and reliable AI computing. Equipped with liquid cooling, this solution is adaptable to the platforms of major AI compute providers and can be scaled to meet specific customer needs. By combining the quality and efficiency of offsite fabrication with cutting-edge AI-ready technologies, the MegaMod CoolChip significantly accelerates the deployment of AI digital infrastructure, reducing setup time by as much as 50%.

-

In November 2023, Vertiv Group Corp. introduced Vertiv TimberMod, a prefabricated wooden data center module. Developed as a variant of the company's Vertiv Power Module and Vertiv SmartMod families, Vertiv TimberMod marked a significant step toward sustainability in the data center industry by using mass timber instead of steel to reduce the product's carbon footprint, making it an eco-friendlier option for customers.

Key Containerized Data Center Companies:

The following are the leading companies in the containerized data center market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems, Inc.

- Dell Inc.

- Delta Power Solutions

- Fuji Electric Co., Ltd.

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Rittal GmbH & Co. KG

- Schneider Electric

- Shenzhen Kstar Science & Technology Co., Ltd.

- Vertiv Group Corp.

- ZTE Corporation

Containerized Data Center Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 16.71 billion |

|

Revenue forecast in 2030 |

USD 55.98 billion |

|

Growth rate |

CAGR of 27.4% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Base year for estimation |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report component |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Container type, organization size, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

Cisco Systems, Inc.; Dell Inc.; Delta Power Solutions; Fuji Electric Co., Ltd.; Hewlett Packard Enterprise Development LP; IBM Corporation; Rittal GmbH & Co. KG; Schneider Electric; Shenzhen Kstar Science & Technology Co., Ltd.; Vertiv Group Corp.; ZTE Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Containerized Data Center Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global containerized data center market report based on container type, organization size, end-use, and region:

-

Container Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

20 Feet Container

-

40 Feet Container

-

Customized Container

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small and Medium-sized Enterprises (SMEs)

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

IT and Telecommunications

-

BFSI

-

Healthcare

-

Retail and E-commerce

-

Aerospace & Defense

-

Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global containerized data center market size was estimated at USD 13.59 billion in 2024 and is expected to reach USD 16.71 billion in 2025.

b. The global containerized data center market is expected to grow at a compound annual growth rate of 27.4% from 2025 to 2030 to reach USD 55.98 billion by 2030.

b. The containerized data center market in North America held a share of over 34.0% in 2024. The rising digitization across various sectors is driving the growth of the containerized data center market in the region. Digitization is transforming industries in North America, such as healthcare, finance, retail, and manufacturing.

b. Some key players operating in the containerized data center market include Cisco Systems, Inc., Dell Inc., Delta Power Solutions, Fuji Electric Co., Ltd., Hewlett Packard Enterprise Development LP, IBM Corporation, Rittal GmbH & Co. KG, Schneider Electric, Shenzhen Kstar Science & Technology Co., Ltd., Vertiv Group Corp., ZTE Corporation

b. Key factors driving the market growth include the rapid surge in data traffic due to the proliferation of digital devices, the Internet of Things (IoT), social media platforms, and streaming services.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."