Contactless Biometrics Technology Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Application, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-526-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

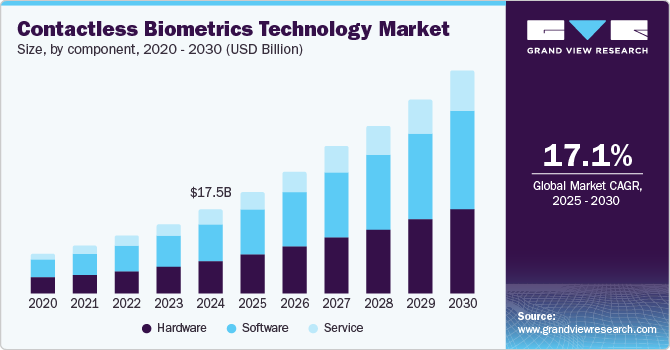

The global contactless biometrics technology market size was estimated at USD 17.5 billion in 2024 and is expected to grow at a CAGR of 17.1% from 2025 to 2030. The market has experienced significant growth in recent years due to the increasing security concerns, the need for convenient authentication methods, and the adoption of biometrics in various industries, including government, healthcare, defense, and consumer electronics. The COVID-19 pandemic accelerated the adoption of contactless biometrics technology, as it offers a hygienic and touchless way to verify identities. Facial recognition and iris scanning gained prominence in healthcare and access control.

Rising penetration of smartphones and tablets, coupled with manufacturers’ focus on facial recognition software for their smartphones as an added layer of verification to unlock their smartphones, is anticipated to drive the demand. Contactless biometrics also provides secure access to apps and authenticates payments. Moreover, the rising adoption of contactless biometrics solutions in financial institutions to secure international financial transactions is expected to drive market growth. Contactless biometrics technology allows longer run times with fewer consumables and less cleaning, minimizing maintenance costs.

A growing number of air travelers across the globe has increased the demand for more secured and advanced identification solutions at airport facilities. For instance, in April 2020, Etihad Airways announced a trial of contactless self-service technology manufactured by Elenium Automation. The solutions estimate a passenger’s vital signs to allow for touchless health screenings through voice recognition at airport kiosks. In addition, manufacturers are also focusing on advancing their existing contactless biometrics solutions by implementing temperature sensors to capture body temperature and imaging cameras.

With the advent of computerized databases and digitization, contactless biometrics verification has a high industrial adoption rate worldwide. Rising demand for secure, hygienic, and convenient authentication systems in condominiums and clubs across the globe is anticipated to drive market growth. The COVID-19 pandemic created a heightened awareness of hygiene and security. Condominiums and clubs needed to minimize physical contact to reduce the spread of the virus. As a result, there was a surge in demand for contactless access control systems that relied on technologies like facial recognition, RFID cards, or mobile apps.

However, the high cost of contactless biometrics solutions is expected to hinder the growth of the contactless biometrics’ technology market to a certain extent. Furthermore, data theft or identity theft is a major challenge for growth as it may seriously threaten the security of important information or even increase national security threats. Human face changes in texture and shape over time, and facial recognition technologies must be robust enough to accommodate changes generated from the aging process, increasing error rates in the matching systems. Other factors of error include illumination of the face, variations in pose, and expression that further limit the growth to a certain extent.

Component Insights

The software segment dominated the market with a revenue share of over 44.46% in 2024 and is expected to maintain its dominance over the forecast period. Growing adoption of cloud-based services, Artificial Intelligence (AI), and Machine Learning (ML) for contactless biometrics solutions are expected to drive the demand for software to strengthen the compatibility of devices for different applications. Based on components, the market is segmented into hardware, software, and service. The service segment is further segmented into professional services and managed services.

Growing demand for fast and secure access controls, queue-less passenger checks, seamless border crossing, and fast identification of individuals for better convenience and security is accelerating the market demand. Manufacturers are developing contactless biometric high-tech sensor systems through fast software algorithms and machine-learning methods for fast and secure identity checks. The software also allows users to integrate the latest add-on features by updating the software/application. Furthermore, various e-commerce companies such as Amazon.com, Inc. are also developing and marketing image recognition software, Amazon Rekognition, for users of the Prime Photos service. The software allows users to detect faces, objects, and scenes to organize and filter their photos.

Application Insights

The face biometrics technology segment dominated the market in 2024. Facial recognition technology is widely used for security and access control in both the public and private sectors. This included applications in airports, government facilities, and private organizations for authentication and surveillance. Moreover, the iris segment is expected to register significant growth over the forecast period. An iris-based system is accurate, fast, and convenient while eliminating payroll frauds such as buddy punching. The growing demand for iris biometrics technology within an organization to process payroll and calculate other benefits such as disability, health, and vacation is expected to drive the demand for the iris segment.

The COVID-19 pandemic pushed everyone to minimize physical contact with a common surface. Iris identification provides authentication solutions in national and civil ID programs, access control, and time attendance, among others. Furthermore, the increasing adoption of iris technology by state and local agencies for border security is further expected to drive growth. For instance, El Paso Police Department, U.S., started using biometrics technology which combines iris-scanning, facial recognition, and fingerprint identification capabilities to increase border security.

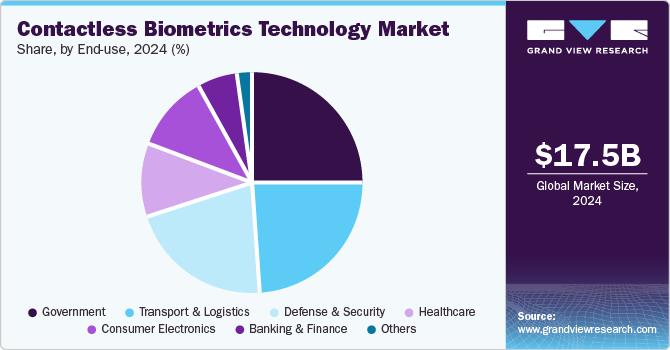

End-use Insights

The government segment dominated the market with a significant revenue share in 2024 and is expected to maintain its dominance over the forecast period. The government segment of the market refers to the application of contactless biometric systems and solutions by various government agencies and entities for a wide range of purposes. Contactless biometrics technology in the government sector is used to enhance security, streamline processes, and improve the efficiency of various government functions. For example, Contactless biometric systems, such as facial recognition and iris scanning, are used at border control points and immigration checkpoints to verify the identity of travelers and detect fraudulent documents.

The healthcare sector is expected to register considerable growth over the forecast period. The rapid technological advancements and AI-powered face and iris identification systems allow hospital facilities to track patients without using physical tracking devices. Furthermore, the emergence of real-time emotion detection, which is an application of face recognition in healthcare, is also gaining popularity. It is used to detect emotions that patients exhibit during their stay in the facility. The data is used to determine how patients are feeling and also helps to identify where the patients need more attention in case, they’re in pain.

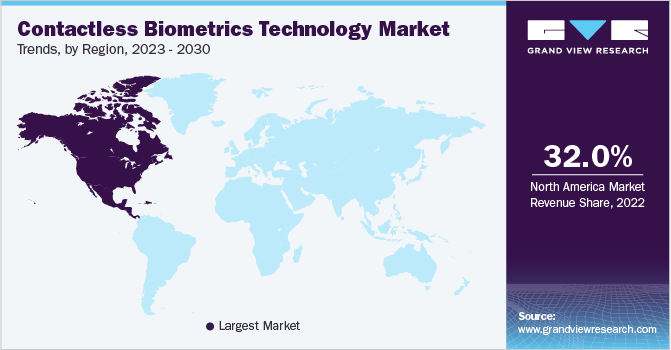

Regional Insights

North America contactless biometrics technology market dominated the market with a share of over 36.1% in 2024. This dominance can be attributed to the presence of technology providers, such as nVIAsoft Corporation, HID Global, M2SYS Technology, and BioConnect, in the region. Increasing demand for contactless biometrics solutions by payment solution providers to offer secure transactions to their customers in the region is further expected to drive regional growth. For instance, in October 2019, SnapPay, Inc., a provider of payment solutions, announced the availability of facial recognition-based payment technology for merchants in North America.

The rising adoption of contactless biometrics solutions in defense and government applications is also expected to drive the demand for the market in North America. Furthermore, increasing government initiatives to implement contactless biometrics solutions to deal with an increasing number of travelers and to increase security at airport facilities are expected to drive regional demand. For instance, the Canadian Border Services Agency installed kiosks that utilize facial recognition technology at airports. The new technology utilized both facial recognition and fingerprint biometrics to facilitate clearance procedures for travelers at airports in Canada.

U.S. Contactless Biometrics Technology Market Trends

The U.S. contactless biometrics technology market held a dominant position in 2024. The growth is driven by increasing security concerns and the demand for convenient, hygienic authentication methods. Moreover, escalating security needs, technological advancements, and a shift towards hygienic solutions post-pandemic are significantly contributing to market expansion. As industries continue to embrace these innovations, the demand for secure and efficient authentication methods will likely expand across various sectors.

Europe Contactless Biometrics Technology Market Trends

The Europe contactless biometrics technology market is also growing as in Europe, the growth is fueled by increasing initiatives by major players for instance in June 2024, Mastercard is launching its biometric retail payments for the first time in Europe. The company will pilot its Biometric Checkout Program in Poland in partnership with local fintech firm PayEye, which will supply its iris and facial recognition technology.

Asia Pacific Contactless Biometrics Technology Market Trends

The Asia Pacific market for contactless biometric technology is anticipated to grow at significant CAGR over 2025 to 2030. The market is poised for substantial growth driven by technological advancements, heightened security concerns, and increasing adoption across various sectors. As governments and businesses continue to invest in these technologies, the demand for secure and efficient identity verification solutions will likely expand significantly over the forecast year.

Key Contactless Biometrics Technology Company Insights

The market is characterized by strong competition, with a few major worldwide competitors owning a significant market share. The major focus is developing new products and collaborating among the key players.

Fujitsu Limited is a Japanese multinational corporation specializing in information and communications technology (ICT) solutions. The company has grown to become the largest IT services provider in Japan and ranks among the top IT service companies globally. Fujitsu has been actively involved in the development of contactless biometric technology, which leverages advanced sensing capabilities to enhance security and user convenience. This technology allows for biometric identification without the need for direct contact with sensors.

IDEMIA is a prominent French multinational technology company headquartered in Courbevoie, France, specializing in identity-related security services. IDEMIA is at the forefront of contactless biometric technology, which allows for secure identification without physical contact. IDEMIA's commitment to integrating cutting-edge biometric solutions positions it as a leader in the evolving landscape of identity security.

Key Contactless Biometrics Technology Companies:

The following are the leading companies in the contactless biometrics technology market. These companies collectively hold the largest market share and dictate industry trends.

- Aware Inc.

- Fingerprint Cards AB

- Fujitsu Limited

- Gemalto N.V.

- HID Global

- IDEMIA

- M2SYS Technology

- NEC Corporation

- nViaSoft

- Touchless Biometric Systems AG

Recent Developments

-

In July 2024, Fingerprint Cards AB and IN Groupe, through their SPS brand, a leader in contactless and dual-interface cards, announced the launch of a secure component solution for contactless biometric payment cards. This initiative aims to help global card manufacturers scale up production of next-generation payment cards.

-

In September 2023, HID, a global leader in trusted identity solutions, and CERTIFY Health, which provides modern solutions to enhance patient care and experience, announced a new collaboration focused on patient engagement and facial recognition. This offer aims to transform healthcare operations and deliver improved patient service at every touchpoint. This integrated biometric platform will be unveiled at Becker’s HIT Conference from October 3-6 in Chicago and will also be featured at HLTH 2023 and CHIME23.

Contactless Biometrics Technology Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 21.2 billion |

|

Revenue forecast in 2030 |

USD 46.6 billion |

|

Growth rate |

CAGR of 17.1% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Market revenue in USD million/billion and CAGR from 2023 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments Covered |

Component, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; South Korea ; Australia; Brazil; UAE; KSA; South Africa |

|

Key companies profiled |

Aware Inc.; Fingerprint Cards AB; Fujitsu Limited; Gemalto N.V.; HID Global; IDEMIA; M2SYS Technology; NEC Corporation; nViaSoft; Touchless Biometric Systems AG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope. |

Global Contactless Biometrics Technology Market Report Segmentation

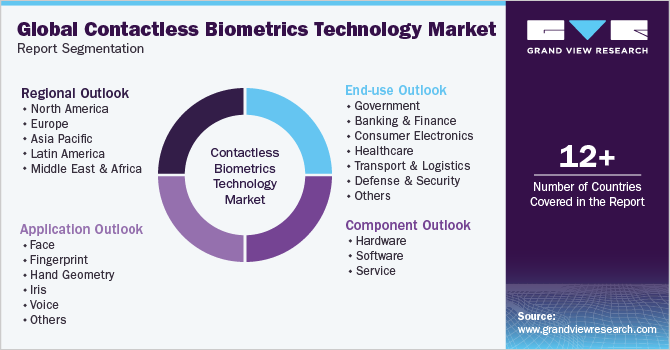

This report forecasts revenue growth on global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global contactless biometrics technology market report based on component, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Service

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Face

-

Fingerprint

-

Hand Geometry

-

Iris

-

Voice

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Government

-

Banking & Finance

-

Consumer Electronics

-

Healthcare

-

Transport & Logistics

-

Defense & Security

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global contactless biometrics market size was estimated at USD 17.5 billion in 2024 and is expected to reach USD 21.2 billion in 2025.

b. The global contactless biometrics market is expected to grow at a compound annual growth rate of 17.1% from 2025 to 2030 to reach USD 46.6 billion by 2030.

b. North America dominated the contactless biometrics market with a share of 36.1% in 2024. This is attributable to the presence of technology providers such as nVIAsoft Corporation, HID Global, M2SYS Technology, and BioConnect, among others, in the region.

b. Some key players operating in the contactless biometrics technology market include Touchless Biometric Systems AG; Fingerprint Cards AB; Fujitsu Limited; IDEMIA; and NEC Corporation.

b. Key factors driving the growth of contactless biometrics technology market growth include growing popularity and the need for more convenient and secure authentication systems and vast advantages of contactless biometrics, including a high level of security in the private, public, and commercial sectors.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."