- Home

- »

- Medical Devices

- »

-

Contact Lens Inspection Market Size And Share Report, 2030GVR Report cover

![Contact Lens Inspection Market Size, Share & Trends Report]()

Contact Lens Inspection Market Size, Share & Trends Analysis Report, By Type (Manual, Semiautomatic, Fully-automatic), By Application (Disposable, Dry Lens In The Shell), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-289-0

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Contact Lens Inspection Market Trends

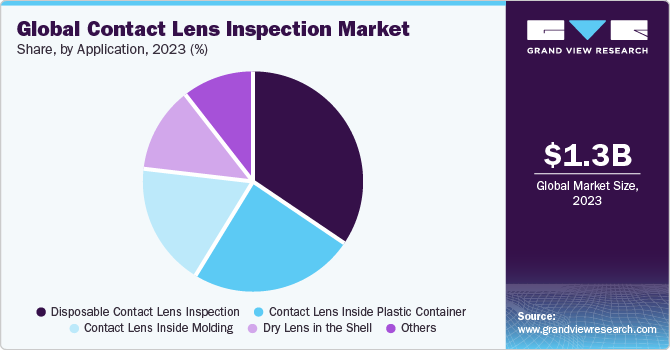

The global contact lens inspection market size was estimated at USD 1.25 billion in 2023 and is projected to grow at a CAGR of 5.1% from 2024 to 2030. Factors driving this growth include rising prevalence of vision disorders, expanding aging population, and growing awareness about eye health. In addition, technological advancements in contact lens manufacturing and inspection methods fuel market expansion. Moreover, stringent regulatory standards and emphasis on product quality and safety are further propelling market growth.

Changes in lifestyle, such as prolonged screen exposure and increased engagement in outdoor activities, have resulted in a rise in vision-related problems. Consequently, more people opt for contact lenses as a convenient solution for correcting their vision. For instance, in February 2024, CooperVision launched a report aimed at aiding eye care professionals in comprehending patients' encounters with digital eye strain. A report based on research involving 750 U.S. adults aged 18-44 needing vision correction emphasizes the potential for practitioners to address device-related habits and symptoms during routine eye care. Nearly 70% of respondents report experiencing symptoms linked to digital eye strain, indicating a demand for solutions such as contact lenses tailored to alleviate these symptoms.

Moreover, the increasing recognition of the aesthetic advantages of contact lenses, including colored or cosmetic options, is anticipated to drive consumer demand from those aiming to improve their appearance. The market also benefits from the growing adoption of disposable and specialty contact lenses, catering to diverse consumer needs and preferences. For instance, in June 2023, Bausch + Lomb expanded its product offerings in the U.S. by launching INFUSE Multifocal Silicone Hydrogel Contact Lenses. Specifically designed as a daily disposable option, these lenses provide a convenient solution for individuals suffering from presbyopia, addressing their vision correction needs effectively and comfortably.

Technological advancements in contact lens manufacturing and inspection methods play a crucial role in driving market expansion. These advancements enable manufacturers to produce high-quality contact lenses, ensuring safety and efficacy. For instance, in August 2023, researchers from NTU Singapore developed a thin, flexible battery resembling a human cornea that stores electricity in saline solution, potentially powering smart contact lenses. This wire-free battery, made from biocompatible materials, utilizes a glucose-based coating to interact with ions in the solution, including those in tears, extending its lifespan. Collaboration with contact lens manufacturers is underway to integrate this technology. Advancements in inspection technologies, such as automated imaging systems and artificial intelligence (AI)-based algorithms, enhance the efficiency and accuracy of contact lens inspection processes, further driving market growth.

Market Concentration & Characteristics

The contact lens inspection industry displays a moderate level of concentration, with several key players dominating the market. Characteristics include stringent regulatory standards ensuring product quality and safety. Moreover, the industry benefits from increasing demand for contact lenses globally due to factors like rising prevalence of vision disorders and expanding aging population. However, challenges like high initial investment costs and complex regulatory requirements impact market entry.

The contact lens inspection industry exhibits notable innovation, with advancements in imaging tech, automation, and AI algorithms. For instance, in March 2024, Menicon, a leading Japanese contact lens manufacturer, revealed its adoption of advanced technology to improve the next generation of contact lens materials and tackle plastic waste recycling.

Regulations significantly influence the contact lens inspection industry, ensuring product quality, safety, and compliance. Compliance with stringent regulatory standards, such as FDA approval in the U.S. and CE marking in Europe, is vital for market entry. Regulations drive innovation and development of inspection technologies, promoting accuracy and efficiency. However, navigating complex regulatory frameworks can lead to delays in product launches and increased costs for manufacturers. In addition, adherence to regulations ensures consumer confidence in contact lens products, fostering market stability and growth.

Mergers and acquisitions in the contact lens inspection industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in November 2023, Oxford Metrics agreed to purchase Industrial Vision Systems Ltd (IVS), known for its machine vision software and technology used in inspection, quality control, and measurement during production processes, in a deal valued at USD 9.9 million.

In the contact lens inspection industry, substitutes like manual visual inspection and traditional quality control lack the precision of automated systems. While technologies like OCT and confocal microscopy offer alternatives, they may not match dedicated inspection systems in speed, accuracy, and defect detection. Overall, while substitutes exist, they often fall short of meeting the rigorous requirements of the contact lens inspection industry.

The contact lens inspection industry is expanding regionally due to rising global demand. Manufacturers are establishing a presence in emerging markets to meet growing needs for vision correction solutions. For instance, in December 2021, Optimec Systems Limited (METROLOGY) collaborated with Aston University in a Knowledge Transfer Partnership (KTP). This collaboration was focused on enhancing the calibration procedures utilized by the company's unique instrument, is830, built to measure contact lenses during the first KTP. This partnership was anticipated to increase the product sales by USD 1.09 million.

Type Insights

The manual contact lens inspection tool segment accounted for the largest market share of 44.58% in 2023 and is expected to grow at the fastest CAGR over the forecast period. A manual contact lens inspection tool is a handheld device inspectors use to visually examine contact lenses for defects. It typically involves human operators using tools like optical comparators, single-lens magnifiers, and microscopes. These aids facilitate the thorough examination of lenses for irregularities. Operators depend on their eyesight and expertise to identify imperfections that could compromise lens quality or wearer comfort. This approach guarantees a comprehensive assessment of each lens, thereby maintaining quality standards throughout the contact lens manufacturing process.

One example of such a tool is a slit lamp biomicroscope, commonly used in ophthalmology clinics. With this tool, an inspector can examine the lens under magnification and adjustable illumination, allowing them to identify scratches, air bubbles, or other imperfections that may affect the lens's quality or comfort. By manually inspecting each lens, the inspector ensures that only high-quality lenses are distributed to consumers, maintaining safety and effectiveness in vision correction.

Application Insights

The disposable contact lens inspection segment accounted for the largest market share of 34.93% in 2023 and is expected to grow at the fastest CAGR over the forecast period. Disposable contact lens inspection involves the examination of disposable contact lenses using specialized machinery to ensure quality and safety. This process typically includes thorough checks for defects, irregularities, and adherence to regulatory standards. Inspection may encompass parameters such as lens clarity, surface smoothness, and dimensional accuracy.

Advanced technologies like automated optical inspection systems and high-resolution imaging are often employed to enhance accuracy and efficiency. Manufacturers can uphold product integrity by conducting rigorous inspections and providing consumers with reliable disposable contact lenses. In addition, the availability of disposable contact lenses from various market players, such as Bausch + Lomb, Alcon, Inc., and SEED Co., Ltd., is anticipated to support the segment growth over the forecast period.

Regional Insights

North America contact lens inspection market dominated the overall global market and was accounted for revenue market share of 37.19% in 2023. The strong need for quality assurance measures for ophthalmic devices arises from the well-established healthcare infrastructure. Moreover, ongoing technological advancements, increasing awareness among end users regarding eye health, and strict regulatory standards are anticipated to drive market expansion in the future.

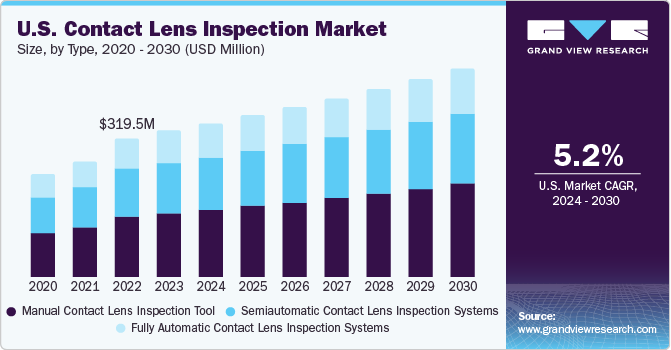

U.S. Contact Lens Inspection Market Trends

The contact lens inspection market in the U.S. held a significant share of North America's market in 2023. The country's growth can be attributed to advancements in contact lens manufacturing and inspection technology, alongside increasing consumer focus on eye health and convenience. With more people choosing contact lenses for vision correction, manufacturers and distributors are upgrading inspection machinery to ensure product quality and safety. For instance, in March 2022, Johnson & Johnson Vision Care, Inc. received approval from the U.S. FDA for its daily disposable contact lenses, ACUVUE Theravision with Ketotifen, designed to alleviate eye itching caused by allergic conjunctivitis while providing vision correction.

Europe Contact Lens Inspection Market Trends

The contact lens inspection market in Europe is witnessing growth fueled by increasing demand for contact lenses, driven by consumers' preference for them as a primary vision correction method. In 2023, Europe accounted for the second-largest revenue share in the global market. Manufacturers and distributors are adopting advanced inspection technology to meet this demand and ensure product quality and safety. Factors contributing to this demand include lifestyle shifts, advancements in lens materials and designs, and a growing emphasis on convenience and aesthetics in eye care.

UK contact lens inspection market is projected to expand owing to its advanced healthcare system, partnerships among major stakeholders, and the launch of novel products. Furthermore, a heightened focus on research and development for contact lenses designed to address diverse conditions is anticipated to drive market growth.

Contact lens inspection market in France is expected to grow over the forecast period. This growth can be attributed to advancements in technology, heightened awareness of eye health, and increased research and development efforts focused on contact lenses within the country.

Germany contact lens inspection market is expected to expand in the foreseeable future as people become more aware of potential issues linked to contact lens use, such as infections or discomfort. This growing awareness has resulted in a stronger focus on ensuring the quality and dependability of vision correction products. As a result, companies manufacturing contact lenses invest in advanced inspection equipment to thoroughly scrutinize lenses for defects or abnormalities.

Asia Pacific Contact Lens Inspection Market Trends

Contact lens inspection market in Asia Pacific region is projected to experience notable expansion driven by increased healthcare investments in various countries, a growing number of companies venturing into contact lens inspection machine manufacturing, and a rising consumer base embracing contact lenses. With the growing preference for contact lenses as a vision correction option, there is heightened emphasis on implementing robust and efficient inspection procedures to uphold product quality and safety standards.

Japan contact lens inspection market is poised for substantial growth, driven by awareness of eye health and the rising adoption of contact lenses. Furthermore, the presence of prominent players in Japan, particularly those focusing on pioneering contact lens technologies, further fuels the expansion of the market.

Contact lens inspection market in China is expected to grow, driven by technological advancements and heightened research and development in the field of contact lenses. The China National Medical Products Administration (NMPA) oversees medical devices, including lens inspection machines, to guarantee their safety, effectiveness, and adherence to regulatory requirements.

India contact lens inspection market is poised for substantial growth, driven by rising contact lens usage and growing awareness of eye health. With an annual growth rate of 15% to 20%, this trend reflects shifting preferences among Indians toward contact lenses for vision correction. Factors like increasing disposable incomes, urbanization, and evolving attitudes toward eyewear contribute to this surge. Consequently, the demand for contact lens inspection machines for quality assurance is projected to increase in India.

Latin America Contact Lens Inspection Market Trends

Contact lens inspection market in Latin America is experiencing significant growth. Increasing research and development efforts and rapid technological advancements are predicted to drive market growth. Domestic firms concentrate on cost-conscious market sectors by delivering economical inspection solutions. Their familiarity with local regulations and business practices could enable them to offer more customized support and services, fueling market growth.

Middle East & Africa Contact Lens Inspection Market Trends

Contact lens inspection market in the Middle East and Africa (MEA) is witnessing steady growth, fueled by increasing demand for corrective eyewear, rising awareness about eye health, and technological advancements. With a growing population and increasing disposable income levels, the region's adoption of contact lenses is rising.

Saudi Arabia contact lens inspection market is anticipated to expand significantly in the forecast period. This is attributed to the government's encouragement of private sector involvement in healthcare, as outlined in the National Transformation Plan (NTP). In addition, the projected rise in disposable income from economic expansion and urban development is expected to generate favorable growth prospects.

Contact lens inspection market in Kuwait is expected to grow lucratively over the forecast period due to rising requirements for precise and dependable inspection testing services. Contact lens inspection control is crucial in guaranteeing the effectiveness and precision of tests in Kuwait, aligning with the nation's emphasis on quality assurance and adherence to standards. Kuwait's dedication to enhancing healthcare services, fostering research and development, and adhering to global quality benchmarks propels the market. Consequently, the growing healthcare focus is forecasted to elevate the adoption of such equipment, thereby stimulating overall market growth.

Key Contact Lens Inspection Company Insights

The market is highly competitive, with key players such as Rotlex; Optikos; and Oxford Metrics. holding significant positions. The major companies are undertaking various organic and inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Contact Lens Inspection Companies:

The following are the leading companies in the contact lens inspection market. These companies collectively hold the largest market share and dictate industry trends.

- Rotlex

- Optimec Systems Limited (METROLOGY)

- NEITZ INSTRUMENTS Co., Ltd.

- Optikos

- Oxford Metrics (Industrial Vision Systems)

- Chernger Technologies Co., Ltd

- AMETEK, Inc. (Zygo Corporation)

- AEA Investors (Excelitas Technologies Corp.)

- ADLINK Technology Inc.

Recent Developments

-

In January 2024, Zygo Corporation, a subsidiary of AMETEK, Inc., launched its newest laser interferometer, Qualifier. This instrument is helpful in metrology applications in various industries, such as semiconductors, space-borne imaging systems, defense, and cutting-edge consumer electronics.

-

In February 2024, XPANCEO, a technology company focusing on smart contact lenses equipped with extended reality (XR) and health monitoring functions, recently demonstrated a successful prototype of what it claims to be the first augmented reality (AR) holographic lens testing system in the world.

-

In May 2023, Excelitas Technologies Corp., owned by AEA investors, launched the latest version of its imaging lens software, MachVis 5.4 Lens Configurator. This software supports the Excelitas LINOS Machine Vision Lenses series, which helps inspect contact lenses.

Contact Lens Inspection Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.3 billion

Revenue forecast in 2030

USD 1.7 billion

Growth rate

CAGR of 5.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Rotlex; Optimec Systems Limited (METROLOGY); NEITZ INSTRUMENTS Co., Ltd.; Optikos; Oxford Metrics (Industrial Vision Systems); Chernger Technologies Co., Ltd.; AMETEK, Inc. (Zygo Corporation); AEA Investors (Excelitas Technologies Corp.); ADLINK Technology, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

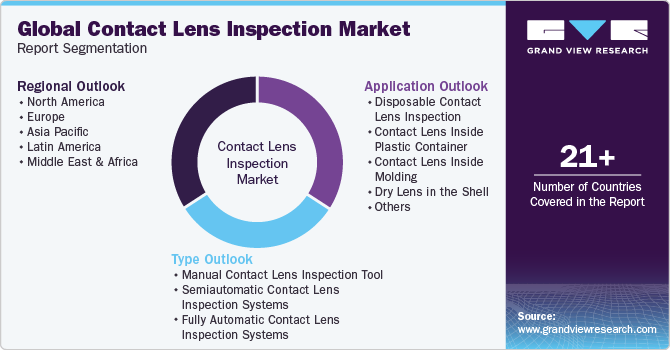

Global Contact Lens Inspection Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the contact lens inspection market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual Contact Lens Inspection Tool

-

Semiautomatic Contact Lens Inspection Systems

-

Fully Automatic Contact Lens Inspection Systems

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable Contact Lens Inspection

-

Contact Lens Inside Plastic Container

-

Contact Lens Inside Molding

-

Dry Lens in the Shell

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global contact lens inspection market size was estimated at USD 1.25 billion in 2023 and is expected to reach USD 1.3 billion in 2024.

b. The global contact lens inspection market is expected to grow at a compound annual growth rate of 5.1% from 2024 to 2030 to reach USD 1.7 billion by 2030.

b. North America dominated the contact lens inspection market with a share of 37.2% in 2023. This is attributable to the rise in the number of visual inaccuracies and rising product innovations.

b. Some key players operating in the contact lens inspection market include Rotlex; OPTIMEC SYSTEMS (METROLOGY); NEITZ INSTRUMENTS Co., Ltd.; Optikos; Oxford Metrics (Industrial Vision Systems); Chernger Technologies Co., Ltd.; AMETEK, Inc. (Zygo Corporation); AEA Investors (Excelitas Technologies Corp.); and ADLINK Technology, Inc.

b. Key factors that are driving the contact lens inspection market growth include rising prevalence of vision disorders, expanding aging population, and growing awareness about eye health. Additionally, technological advancements in contact lens manufacturing and inspection methods are fueling market expansion

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."